Dear reader

"Hustle harder, hustle smarter" famously said 50 Cent the American rapper and entrepreneur. What if he’d been British? Would we today instead know a famous rapper called 50 pence instead? Or would he have named himself “Arf Quid”? Or “Heptagon Coin” maybe?

50p is also the offer price and market price of EMVC as it goes to market to raise £1.5m. Or is that £1.2m - given that insiders are already backing EMVC with £0.3m of that number and £0.58m of subscribers have already committed.

Will Private Investors follow suit?

Read on to find out what I think.

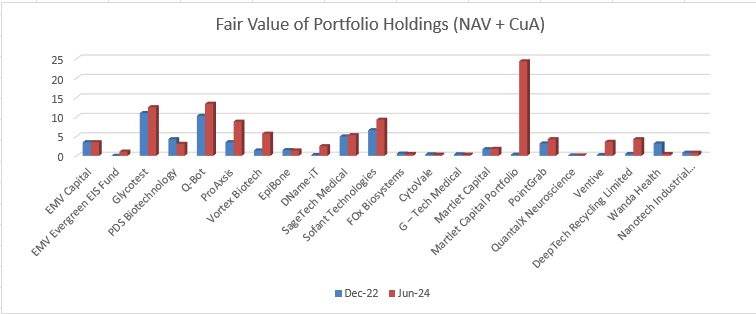

* Wanda Health has generated a 2077% capital return in only six months

* £41.77m directly-held portfolio at fair value

* AuM which were £65.7m as at 30/06/24 funds under management - today more

* 69% share price discount to proforma value of portfolio - even post equity raise

Before I talk about EMV Capital let’s set the scene.

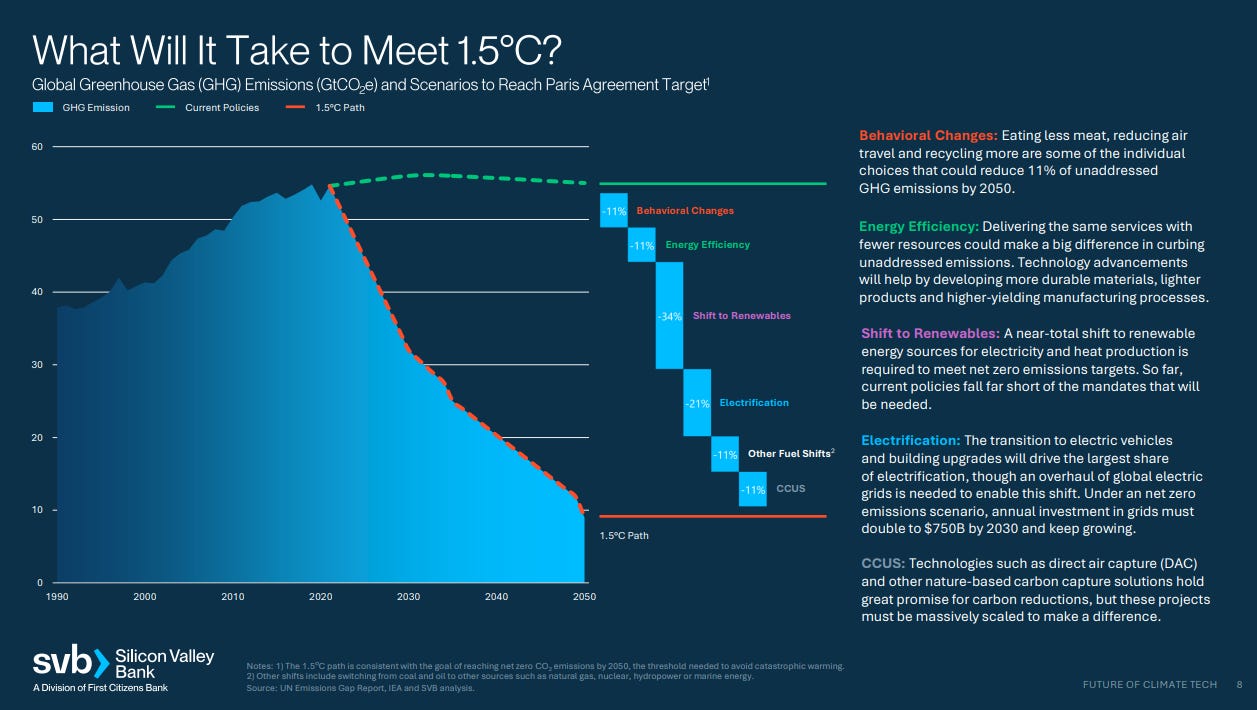

One overarching investment theme to many of my ideas is the inevitability of tackling climate change. I believe it is the challenge of our lifetimes. The song of Ice and Fire. If you disbelieve in grumpkins, ghouls and climate change, great. You and others like you are the reason the value of addressing this problem grows and grows - meaning the value of investments in these areas grow too. The greater the problem increases the value of the cure, sadly. Investments in this area can range from moonshots to smaller more mundane ideas. Today we will speaking of mundane measures not Moonshots. Moonshots are expensive and not the business of nanocaps.

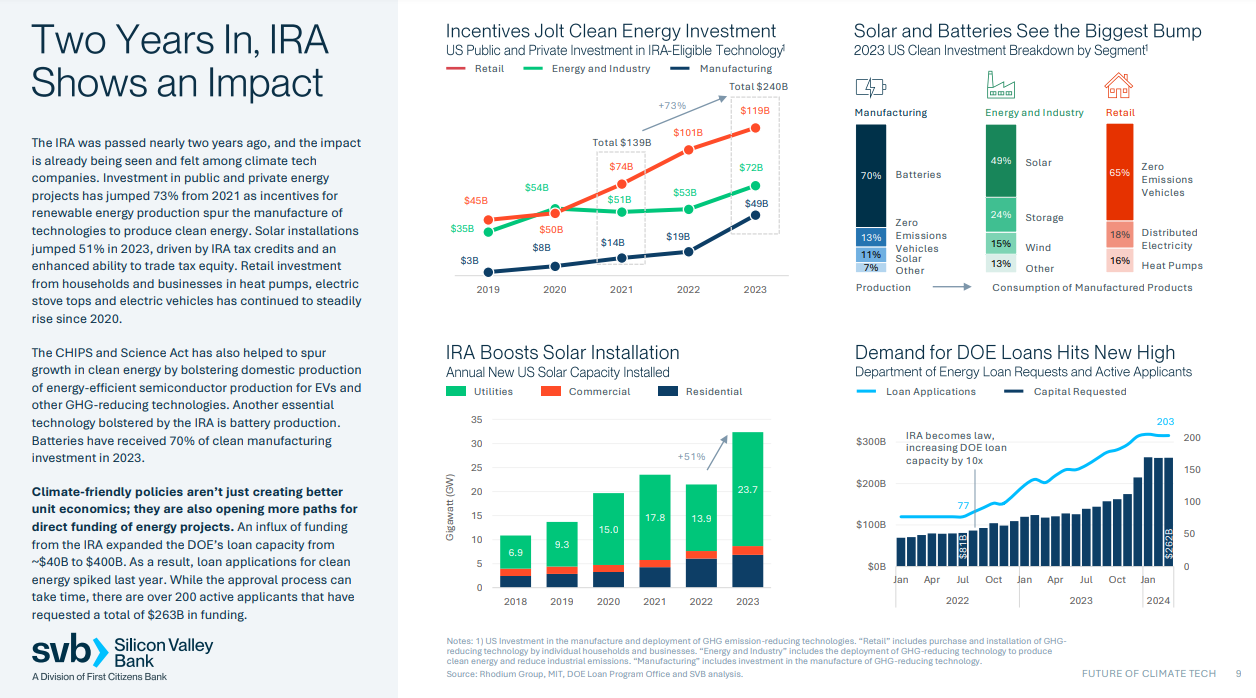

I previously wrote about how Labour largesse will be targeted into government intervention. One major area of investment will be into clean energy and efficiency.

Another investment theme is the application of technology into Health.

EMVC plays into both of these themes.

Preqin’s survey tells us fundraising is steadily getting less difficult for Greentech VC.

The UK leads Europe with a 32% share of venture capital and tech is up 16% this year compared to 2023 (not a hard achievement you might say) and interestingly Cambridge is up 83% and the Cambridge ecosystem is valued at £150bn….

All good news for EMVC

We’ve seen market sentiment change somewhat in 2024. Just ask Venture Capital firm double bagger GROW.

Ask PE house Oakley up 25% in 2024.

So the VC market is thawing and realisations are growing.

So why is EMVC just on a £10.5m Market Cap?

Why is its share price down a 1/3rd from June highs?

EMVC announced in June it grew its fair value NAV to £41m with £1.25m of further gains post period due to Wanda offset by losses at PDSB. Total AuM have grown to >£65m where there’s fund fees earned as well as a 15% carried interest. Today’s article attempts to answer that.

A Growing Opportunity

Let’s consider the fair value of directly owned EMVC assets on the left hand chart, which has grown period to period, alongside fund management (capital under advisory) increases too.

If we add these two numbers to show them by portfolio company we see a growing fair valuation at many companies. This illustrates how portfolio companies are getting the capital they thirst and require to growth. How? Are they sucking EMV dry of cash and soon it will pass the begging bowl diluting its shareholders? Nope.

Dilute and Anti Dilute

EMV Capital has spoken over some years of running a “capital light” approach to funding its portfolio. I’m not sure the market has understood what this means.

Imagine what happens on Dragon’s Den on BBC2. But then imagine that, yes, the business person “gives up” a percentage (in EMVC’s case it dilutes its holding of one of its portfolio) or perhaps has zero direct holding of its own. But the key difference is that EMV Capital turns the table by charging the “Dragons” a management fee typically 2%, as well as a success fee, typically 15%.

But more than that, it’s usually the Dragons that charge businesses for help and advice after the show (not sure if you’re aware of that). But in EMVC’s case they provide advisory services and so some money which flows in via that dilution then flows to EMV capital through fees earned from portfolio companies. That can be cash, but also can be where EMV receives payment in shares i.e. it dilutes then anti-dilutes through delivering its time and expertise!

EMV says thank you Rachel Reeves?

We now know from today’s RNS that the core EMV business is generating a £2.4m annualised income (as at 31/10/24) and that this has doubled year-on-year (from £1.2m) and grown 20% since June 2024 (£0.988m income in the interim results for 6 months). Based on £3.4m EMV business costs there is a £1m per annum burn rate closing to £0.5m per annum or less by June 2025.

But there’s another side to these numbers. The income grows as the assets under management grow, right? Have a think? AuM fees must have grown 20% since June. Based on £63m AuM that’s up to £12m growth already. I say already because VCT/EIS was not touched in the budget. That’s a further positive for the growing number of people now scratching around to avoid punitive tax.

EIS if held for 2 years is useful for INHERITANCE TAX planning as well as Capital Gains exempt. The IH tax relief applies for estates up to a certain size post Reeves’ budget. Previously, it appeared to have been a blanket relief. The problem is the change to Business Property Relief (BPR). Assuming this changes is fully implemented EIS/SEIS assets in common with other relevant private assets not quoted on a 'recognised' exchange will attract only 50% IHT relief. More information here: https://philiphareassociates.tax/wp-content/uploads/Budget-Statement-30-October-2024.pdf

Plus losses if (when) they occur can be set against income tax or capital gains tax. In other words it’s a bit of a no brainer for high net worth “Dragons” with upside and relatively little apparent downside (make your own investment decisions and take your own tax advice - this is a complicated area). The point for those reading this who aren’t High Net Worth folk the services of EMVC and others like EMVC are going to be more in demand in 2025.

EMVC has been able to live on a thin gruel to avoid starvation but found ways to grow the gross assets pie from £58.7m to an estimated £115.9m in 18 months which is an admirable feat!

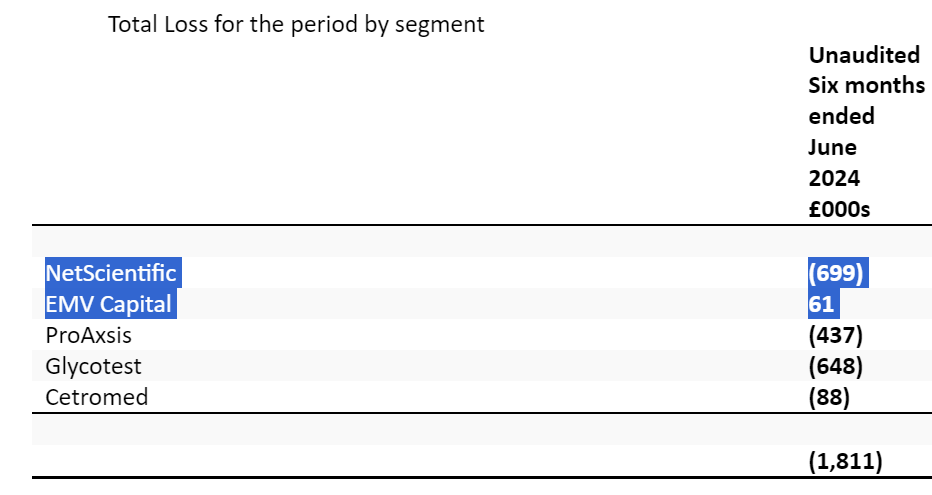

Part of the strategy is for losses at subsidiaries (ProAxsis and Glycotest) to be met with dilutive fund raises through its fund management. EMVC gets diluted get the pie gets bigger so not necessarily a losing strategy - and also means the pie doesn’t fail and drop to zero too.

Therefore the true “loss” for the prior period to June was actually a far smaller £0.6m since the £1.1m loss for ProAxsis and Glycotest corresponds to the £1.1m funds raised for ProAxsis and Glycotest!

EMV plan to grow the VCT/EIS arm. It has had astonishing success so far. Taking on the Martlet portfolio is an example of that. I’ve analysed the Martlet portfolio over three different prior articles (and these are worth a read). There are some incredibly interesting and high potential holdings in there among some potential dross to be fair. In fact, based on latest companies house records, the Martlet portfolio companies have a collective NAV of over £226m of which about 10% or £24.1m is owned by Martlet investees (via the VCT/EIS).

Future Progress and Exits

In the diagram below the black line is today’s share price, while the orange is the fair value of directly held assets (estimated for October 2024 and future). The estimated discount to fair value is an astonishing 74% before today’s fundraise. Once you consider the CuA and potential for returns both from fees but also from upsides through realisations and uprounds, you realise how underpriced this is.

Today’s RNS affirms the “Future” as the strategic plan.

This is that plan visualised.

What’s more, the final column in the chart above is what I anticipate the picture by the end of 2025 looks like going into 2026. In that future I forecast NSCI fair value has grown at the same pace as the past 12 months so reaches £50m. I forecast the same 20% growth in the EMV Capital CuA as seen in the past 12 months. The same past growth at Martlet. I factor in a further EIS fund launch at an assumed £60m. Finally I believe PDS will revert to its valuation 12 months ago. I don’t believe those forecasts are unreasonable, but of course are not certain. I mean, it’s not as though the past 12-18 months have been kind months for Venture Capital and growth companies, have they? A more reasonable set of assumptions could be for faster growth in the future where lower interest rates and perhaps a growing interest in EIS/VCT drives a faster growth than even I predict?

Yes but what about the Exits?

2025 should begin to see exits. EMVC has required some patience it’s true.

Let’s consider the candidates:

Clean Energy #1 VENTIVE

Labour have stated they will support Heat Pumps to the tune of £7,500 each. £3.4bn in investment towards a “warm homes plan” for heat decarbonisation and household energy efficiency over the next three years. In its manifesto, Labour committed to £13.2bn of funding for these issues over the course of this parliament and the budget describes the £3.4bn investment as “the first step”.

The government says this money includes £1.8bn to support fuel-poverty schemes. It adds that it will increase funding for the “boiler upgrade scheme” – which supports the rollout of heat pumps in England and Wales – this year and next.

Good news for Ventive whose new Heat Pump and Heat Recovery is one of the best on the market.

Leaky houses. Leaky buildings. Part of net zero is tackling the 16% of CO2 emissions through our buildings - which in the UK are some of the oldest in the world.

How? Better manage the inputs and minimise the outputs is the obvious solution.

Where better to turn if you wanted "best practice” than to use a tried and tested - and patented - approach featured on Grand Designs?

How effective is a Passive Ventilation with Heat Recovery (PVHR) system?

Real-life performance data from Horniman Primary School in Lewisham that was presented at the CIBSE Technical Symposium in 2017 has shown a Ventive PVHR unit achieving heat recovery with an efficiency of 94% across a nine-month period.

Longer-term testing has shown 72% thermal efficiency is regularly achieved, at a saving of 1,500kWh per year.

Presumably, reader, you know exactly how much a pint of milk costs and you know too, that a KWH is about 35p right now. So 1500KWh savings is in excess of £500 a year per household. Or much more for larger Commercial or Public buildings.

Ventive marries this proven and patented technology with sensors and with an integrated heat pump which will not only ventilate and heat a home but cool it also. This is a major USP which other heat pump providers don’t appear to be thinking about….. remember reader what I said at the beginning if you control the inputs and the outputs…. I know a few people who’ve installed airconditioning and bemoan the cost.

In other words they are bringing partners to reduce risk, and not reinvent the wheel.

NetScientific holds 11.0% of Ventive on a fully diluted basis, which equates to a post-investment fair value of £893,000, a substantial increase of 1,617% from the £52,000 31/12/2022 valuation (MOIC 16x). In addition, through EMV’s capital under advisory NSCI gets a potential upside (fees) with the 23.8% of the fully diluted share capital as managed capital.

Cleantech #2 - Q-Bot

Q-Bot raises a further £1.3m today in a pivot towards a focus on partnerships and distributors rather than trying to deliver directly.

Labour’s £3.4bn a year warm homes plan also applies to an insulation subsidy offers its UK distributors making the cost either free for eligible low-income households or a 50%-75% reudced cost.

Meanwhile Q-Bot’s US distributors are tapping into subsidies available via the Inflation Reduction Act (IRA) also. Low income folk get 80% of the cost up to $8k while others get 50% up to $4k. Serious amounts of cash to encourage the uptake of Q-Bot’s unique spray insulation as it penetrates the US market.

Cleantech #3 - DeepTech Recycling (DTR)

Plastic is made from oil, right? So what if you could turn plastic back into oil? That’s the patented technology on offer here and NSCI own 30% of it.

NSCI stepped in and acquired this without paying any cash simply providing advice and services in exchange for 30%. EMV’s value creation team, has focused on consolidating assets and intellectual property, further R&D, assessing market opportunities, and starting the company’s commercial roadmap.

DTR was an aborted IPO due to be floated at £60m (making the NSCI stake potentially worth £18m or 1.3X the market cap of the whole of NSCI) and if you look at the insolvency practitioner’s documents the book value of equipment and fixed assets were worth £10m before considering the value of the patents.

DTR developed advanced and environmentally sound technologies for recycling mixed plastic waste, generating valuable naptha, lubricants, and feedstock for the plastics industry.

Next step is a proof of concept and discussions for funding this with UK and EU parties - after all morally - and now commercially we can’t keep sending plastic in the 3rd world can we? NSCI has a solution and this cost EMVC zero to acquire.

DeepTech Recycling is valued at £1.8m based on a funding round. That funding is to invest into:

1.An MoU to develop a commercial plastics recycling facility in the UK, with a purchase order already received for the 1st stage of the project.

2.A 2nd project, for a 7,000-tonne per annum pilot project.

3.Negotiations to appoint a FEED/EPC contractor.

4.The appointment of Jonathan Seville, previously President of the Institution of Chemical Engineers and Executive Dean of Engineering and Physical Sciences at the University of Surrey, as a Technical Adviser.

5. New Oxfordshire premises secured and set up with labs and a testing plant for further technology development.

For years the UK has sent Plastic to China and other places. They no longer want our plastic. This Greenpeace report speaks to the extent of the problem of plastic.

DeepTech converts plastics into petrochemical feedstocks, which is a radically different approach to making more plastic from existing plastic.

Health Tech #1 - PDS

I’ve written positively about this biotech firm in the past and its chances of being bought by Merck (most likely). Its Phase 3 trial begins this quarter and results are expected Q1 2026 at the earliest. The immunotherapy appears both effective and well tolerated in conjunction with Merck’s Keytruda and survival data and disease control improved for HPV cancers.

In a separate program (studying Cervical cancer) this week it announced an overall survival rate of 84.4% vs 64% via chemo.

Health Tech #2 - Glycotest

Up to 938m patients globally could benefit from regular testing for liver cancers and fibrosis–cirrhosis. This is because they have fatty liver disease that can transition to non-alcoholic steatohepatitis (NASH), or suffer viral hepatitis B or C. The numbers grow as we grow fatter and as the population grows.

Glycotest plans to offer a hepatocellular carcinoma surveillance test (HCC Panel) as a clinical testing service, a market estimated to be worth $800m in the US. The clinical evidence for its product “HCC Panel” is very strong. They say prevention is better than cure, well the value of Glycotest is an early cure is much better than later when there is no cure.

In China, where serious liver disease, especially hepatitis B, results in more than 500,000 deaths annually, there is a potential multi-billion-dollar market opportunity for Glycotest’s products that are being developed in partnership with Fosun Pharma.

Beyond the US and China, Glycotest is evaluating options to harness the best return on the investment. WH Ireland models suggest the company could be making sales of $47m and 14 operating profit of $14m by 2030. That puts the current £11m valuation on a future PE of 0.64 (62.5% stake of £11m earnings divided by £11m at a current 60% discount to NAV). Applying a PE of 15 to Glycotest, suggests an uplift of 23X or £103m.

Health Tech #3 - Wanda Health

The intelligent platform for Remote Patient Monitoring is close to commercial roll out:

The software, the hardware and the AI engine are all built - see below. I presume these will be manufactured under contract.

The Platform has achieved ISO27001 certification - Info Security

It’s achieved ISO13485:2016 certification - Medical Device QMS

It is undergoing FDA approval for their congestive heart failure readmission risk models powered by AI. These models aim to predict patient exacerbations and hospital admissions up to seven days in advance, providing healthcare providers with crucial data for early intervention.

The 2nd area of focus is COPD and respiratory (per CEO Tom Smith’s interview) - see my ProAxsis comments further on.

Once FDA approval is given the next step is to drive commercial sales (a Head of Sales has been appointed in anticipation of this).

Wanda Products

The Wanda Teleheath system is made up of 4 gadgets (for now) - a glucose monitor, an oxygen monitor, scales and a blood pressure monitor. All four of these talk to the “Virtual Care” app.

Wanda App

This is the App - or screenshots from the App.

Synergies to other NSCI holdings

Eagle-eyed readers will spot that in NSCI-nicey I spoke of how ProAxsis have announced they are adapting their NeatStik test to build out a remote monitoring capability. Innovate UK have awarded a £491k grant. Could Wanda Health’s Virtual Care with its App and AI be part of that plan? (How could it not?)

NeatStik is currently a disposable test measuring Neutrophil Elastase (NE) and Proteinase 3, as biomarkers of lung infection and inflammation in chronic respiratory diseases such as COPD, cystic fibrosis and bronchiectasis.

The grant is to build out a remote patient monitoring tool so to proactively catch exacerbations before they actually occur.

It’s not such a stretch to think I’m right…. further proof is ProAxsis is actually listed as a client/partner at Wanda’s web site:

Health Tech #4 - CytoVale

Cytovale, despite being listed as late clinical, now appears to be at a Commercial stage. Its IntelliSep test is the only test of its kind that is U.S. Food and Drug Administration (FDA)-cleared for detecting sepsis in an adult population that presents with signs and symptoms of infection to the Emergency Department (A&E). The test provides critical new information about immune activation and sepsis risk stratification through a simple blood draw in about 8 minutes.

Recent research showed IntelliSep demonstrated impressive 'rule-out' performance related to sepsis, with a Negative Predictive Value of 97.5%. These findings spotlight how IntelliSep enables clinicians to detect sepsis earlier in patients for whom the condition wasn't otherwise suspected. Conversely, IntelliSep also provides an objective tool for clinicians to rule out sepsis and move onto an alternative diagnosis," said Dr. O'Neal.

Cytovale is currently working with early access partners to integrate the IntelliSep test into their A&E screening. Recent data from Our Lady of the Lake Regional Medical Center, a large academic medical center in Baton Rouge, La. found that when IntelliSep was integrated early in an ED sepsis diagnosis protocol it significantly reduces length of stay for IntelliSep tested patients, resulting in a savings of $1,429 per patient.

$1,429 saving and a million cases a year in the USA alone. That’s a $1.4bn of savings if the US healthcare adopted Cytovale. Is that a no brainer? Meanwhile in NSCI’s books Cytovale is valued at £40m ($50m) and NSCI own 1%. Do you think a $50m valuation might be a little on the cheap side, reader?

Health Tech #5 - Proaxsis

EMVC reported a cool £4.5m uplift to its NAV earlier this year based on an upround at Proaxsis. That’s equivalent to 40% of the EMVC market cap. Was it up 40% on the news? More like 0%. The market is blind to the blindingly obvious!

This is due to an upround of funding. The new investment is being used to turn what is now a Lateral Flow test (remember those reader) and as pictured below - called the NEATstik into a reusable device which can be used at home by those with elevated risk of Exacerbation - those with COPD, or Cystic Fibrosis (CF) etc. There are 11k sufferers in the UK with CF and 100k worldwide. CF is a northern European disease. A shocking fact is life expectancy for someone with CF in the 1950s was 6 months and today it’s 47 years.

At home monitoring might help extend that 47 number higher - at least I hope so.

Valuation

For an investor looking at ideas for a medium term pay off, or sooner if the market wakes up, EMVC contains a number of holdings which could deliver.

We haven’t even considered the 5-6 truly exciting ideas within Martlet in this article. Participating in the fund raise totally makes sense - you are obtaining £1.602 of assets for each 50p, arf quid or heptagon coin that you spend.

That’s a discount to 68.8%. Into a fund which is heading towards cash generative and self sustaining and whose holdings are going to benefit from the tailwinds of:

a/ Labour largesse.

b/ Avoidance of Labour largesse by taxpayers into EIS and VCT schemes. Growth of funds into those schemes offered by EMV Capital should speed the growth and progress of holdings.

c/ The Energy efficiency theme and subsidies which underpin the growth of Q-Bot and Ventive.

d/ The plastic waste problem is a high-profile problem and DeepTech Recycling offer a means to convert plastic into petrochemical feedstock.

e/ Healthtech holdings which address large markets and needs and which are at an early stage of commercialisation

Items in green show my best estimation of growth in fair value or assets under management.

Dilution and anti-dilution, and a win-win-win for all involved in the growing of potential winners of tomorrow, and with deep links into the brightest and best coming out of Cambridge, is a clever way to invest in UK talent.

Increasing levels of funding through a focused growth of the EMV Capital EIS/VCT fund, the Martlet Fund plus others potentially.

Dilution will follow as managed funds take a share of these and other holdings but by growing the pie and supporting business move towards commercialisation, trade sale or IPO then it’s a win-win for EMVC-ers.

Investing into EMVC of course carries risk but balanced with the fee management gives some important de-risks, and not least a 69% discount to book value too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thank you to the 24 folks who have contributed to the Oak Bloke’s 2025 Fundraiser for Emmaus.

Emmaus gives people a hand up and not a hand out - and that’s why I ask you to help me support them.

Thank you!

Impressive analysis as always. Just one point of clarification. Sadly, I believe that your comment ''EIS if held for 2 years is NOT PART OF INHERITANCE TAX OR CAPITAL GAINS'' is only valid for estates up to a certain size post the budget. Previously, it appeared to have been a blanket relief. The problem is the change to Business Propery Relief (BPR). Assuming this changes is fully implemented EIS/SEIS assets in common with other relevant private assets not quoted on a 'recognised' exchange will attract only 50% IHT relief. More information here: https://philiphareassociates.tax/wp-content/uploads/Budget-Statement-30-October-2024.pdf

As usual tax changes have complicated the tax code and the narrative. No shame in omitting that nuance. Keep up the good work.