Farewell Wilson? HAN, OCN, PORT3

Revisiting The complicated value story of Hansa, Ocean Wilson & Wilson Sons

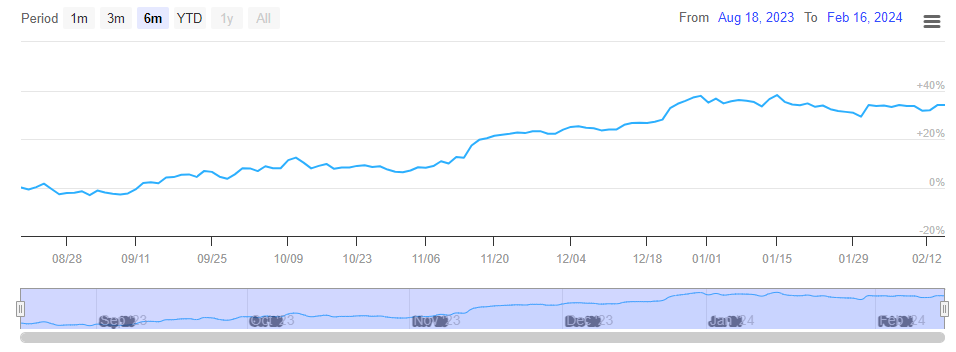

It’s 5 months since I wrote about Hansa. It’s my least read article. Oh dear, reader, did I bore you? The few that listened may have found the insight valuable.

After all since my article, all three of Hansa, OCN and Wilson Sons have increased in value - by quite a bit! What’s happened since and which would I pick today?

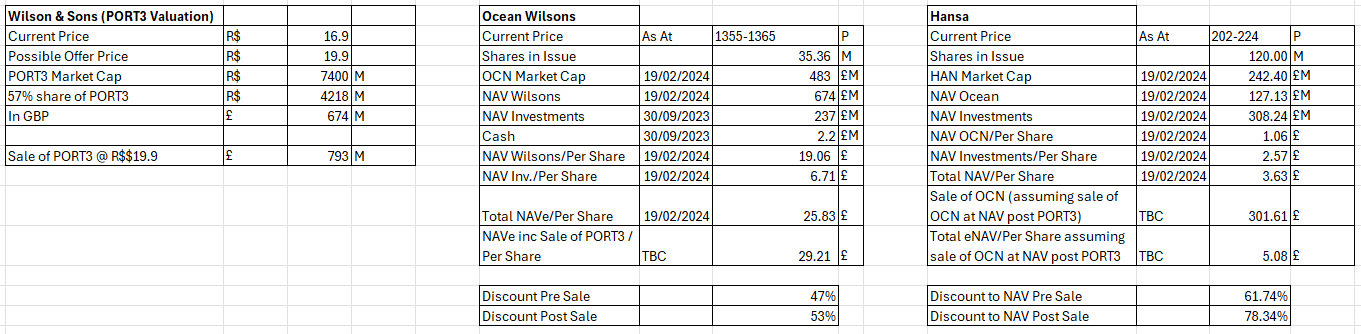

So my original article and diagram sets out the thesis but Wilsons is the grandchild, Ocean is the child and Hansa the parent. Back then HAN was at a 65% discount to NAV on a look through basis, as was OCN, as was Wilsons.

Wilsons is listed in Brazil (so probably not a holding you’d directly want to buy) but is a major port terminal for Southern Brazil but crucially for Uruguay and Argentina too, a and shipping services (towage) firm. This is their Q3 presentation. There is a strategic review going on at its parent, Ocean, and rumours of a bid from Msc, but now further rumours of several bids. In this article I assume the lower bid price of R$19.90 but it could be much higher!

Ocean (OCN)

Since telling readers the complicated story (which hardly anyone read - their loss) OCN is up nearly 50%. Have readers missed the story? Read on reader, you might be surprised!

OCN holds 57% of Wilson’s shares and also holds around $300m investments in various investments hedge funds and technology plays (some of which are on a discount themselves).

Its Q3 update is here. Confusingly the accounts consolidate Wilson’s accounts so there’s mention of debt for example but OCN has no debt - Wilson does!

Hansa

Hansa is also up but only by about 15%, which its NAV is up quite a bit more. It owns just under 30% of OCN so the grandparent has grown as its offspring holdings have grown.

Hansa holds a very similar range of Hedge Funds and investments along with about 30% of Ocean Wilsons. Now here is the bit where you have to take a view. If you believe in the faster “Farewell Wilson” story narrative then OCN is the best share to buy.

If you instead prefer a longer term play, if (when?) OCN sells off Wilson and then if/(when?) HAN sells or merges with OCN and assuming everything happens at NAV then HAN offers a higher discount than buying OCN. But this is less certain, or at least less likely short term. HAN is 57% owned by a HNW family called the Saloman, so would they want this? Not known.

This is not advice.

Oak

https://www.lse.co.uk/rns/OCN/update-on-sale-of-interest-in-wilson-sons-sa-ce0qh4ewe7zlu9d.html