Dear reader

WATR released their interim results for 1H25 not that you’d know looking at their web site which show their 2023 Interims as their latest results.

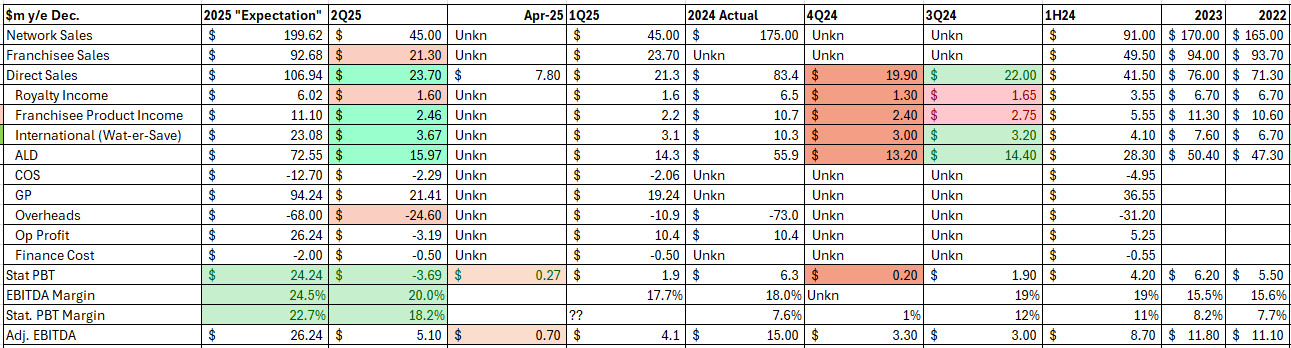

Profit before tax 1H24 to 1H25 are down.

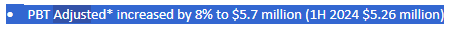

And Operating Profit 1H24 to 1H25 down. But adjusted profits are up. Should you use the adjusted numbers, reader? More on that later.

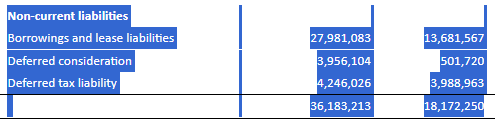

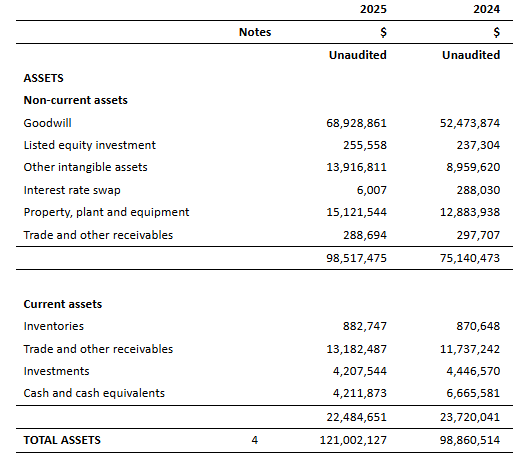

WATR’s debts doubled from 1H24 to 1H25.

What did that debt buy WATR? $2.2m of Property, Plant & Equipment plus $21m of intangible assets. That’s $23.2m more assets balanced by about $18m more liabilities and supported by $5m of 2024 profits that contributed too.

i.e. None of that $5m profit got returned as dividends although a token amount was used for buy backs.

Ask yourself - how much should such acquired intangibles deliver to the business?

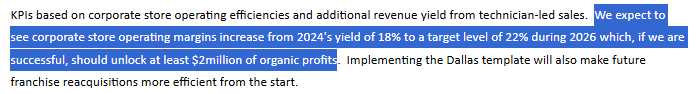

22% we are told is the target level. Tasty returns - if those 22% returns can be achieved. Now or in 2026. Or ever.

On the $18m of extra liabilities acquired in the 12 months to 1H25 that’s £3.96m or £1m per quarter EXTRA operating profit. That’s $18m of EXTRA sales at a 22% operating profit at a £4.5m per quarter or $6.1m. Is that happening?

No. Not yet. Not even close.

We do see some improvement in 2Q25 it’s true, with Direct Sales +$2.4m in 2Q25 vs 1Q25 ($23.7m vs $21.3m), with Franchisee Product Revenue up $0.25m, and International +$0.57m, and ALD +$1.67m. A stronger showing and also against 4Q24. It was two consecutive poor quarters which led me to call time on this former OB25 for 25 idea. This new result covering the 2Q25 quarter is an improvement it’s true.

What if we compare it with the stronger 3Q24 (the basis for WATR’s original inclusion) vs 2Q25 what then? Direct is +$1.7m, Royalty down -$0.05m, Franchisee Product Sales down -$0.3m, International +$0.47m, ALD +$1.57m. So a mixed bag of results with disappointment from product sales and franchisees. A disappointing loss of nearly -$3.7m too.

Do I have regrets for calling time?

No.

We are still not seeing three crucial factors.

1. The ALD/International reacquisition improvement.

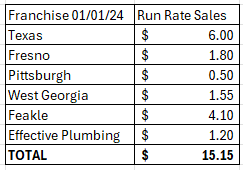

Consider that the prior run rate of sales of acquisitions should be adding $3.75m per quarter of revenue - even only at historic sales rates. It’s true that we see a “doubling” of International since 2022 but strip out the historic Feakle run rate of sales and the actual growth is $3.8m (so a less impressive 50% growth achieved over 30 months). For the ALD segment the difference is starker: $64m minus -$11m of the below acquisitions (ignoring the 2023 acquisitions too) means revenue growth of only $5.7m since 2022. About zero once you factor in 2023 acquisitions.

That’s a poor result. That’s only about 4% growth in underlying revenue per year.

2. Disappointing Product Revenue

Product Revenue. $2.46m in 2Q25 multipled by 4 quarters is just under $10m per annum. That’s 6% less than it achieved in 2022. Poor. Consider, too, that that result includes a quarter when their product sales includes the much-vaunted Chubb Streamlabs product. Revenue which might make very little margin since WATR hold no IP - they just resell. The 1H25 results don’t draw out any clear information about product sales and “ALD” includes both services and products - they don’t separate these so apart from Franchisee product sales we don’t really have any measure. The measure you do have (Franchisee Product Sales) shows declining product sales. The investment thesis for me was the “cross sell and upsell”. But that’s not happening - yet.

No mention of the thrice renamed intelliditch, nor the sewer sensor, nor the water level thingy for swimming pools. Silence. Why?

I remain deeply sceptical on the merits of Chubb’s product vs Ondo Insuretech. Both from a product point of view (the former is not patent protected while ONDO is), plus the business model itself. WATR appear to believe they can earn rich rewards in recurring revenues from well-heeled customers. There are two problems with this. First there is no evidence they are achieving this in practice. We are vaguely told about relationships with Insurers while ONDO specifically name its partnerships and direct growth via those insurers. Second, the ONDO model essentially offers its service for free then charge $60 per year recurring (in the US). WATR offers its implementation service at a charge (of up to $2k - as their product requires a professional plumber installation and pipes to be cut) followed by a large $500 per year annual recurring charge where an unspecified proportion (100%?) goes to Chubb. Remember WATR say they get a “product discount” - no mention of anything else. Chubb acquired the Streamlab product in 2021 and the original team goes back to 2010. Very little traction in 15 years. How will Year 16 suddenly be different?

2a. Who are StreamLab?

There are no stats as to how large or small StreamLabs is today. In Chubb’s latest 2023 Annual Report it gets a brief mention under “Chubb Personal Risk Services” for high-net-worth folks in the US. But there’s no appreciable business unit.

Based on the StreamLab web site’s “community” page it only has “followers” in the single figures. So not very big based on that. Yes it’s owned by big ol’ Chubb and was acquired in 2021 and has been going since 2010 (15 years and over 4 years already under Chubb) and was founded in Australia. Over 4 years, so don’t get too giddy over this being Chubb - it appears there’s limited traction.

What type of customer would pay up to $2k (including est. fitting services) plus $0.5k a year? This is a high-end product isn’t it, for high-net-worth folk? For folks with not just a swimming pool, but a larger swimming pool. Even if there’s an insurance discount involved (and we don’t know that there is), I suspect that discount won’t appreciably cover the initial and ongoing costs.

Or perhaps I’m misunderstanding the value and people’s propensity to spend on yet another gadget/service? Perhaps plenty will shell out the thousands for this having suffered the cost of leaks, even if it doesn’t appear they have until now. Given the small number of people on the StreamLab community this hasn’t rolled out extensively. At WATR or elsewhere.

Besides would they pay these sums of $500 a year to Chubb vs paying $60 a year with ONDO? Makes no sense.

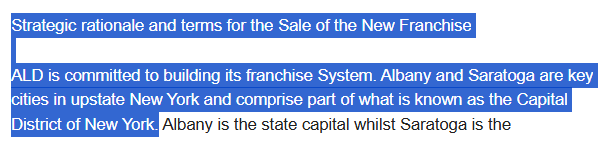

3. Franchisee Growth

No Franchisee growth. Crucially, too, taking the 2023 number of $94m (this is what Franchisees earn in revenue) and deducting -$9.9m of run rate of Francises as above (i.e. ignoring Feakle and Effective since they were not Franchisees) then using the latest $21.3m Franchisee revenue in 2Q25 x 4 = $85.2m annualised vs $84m in 2023. Franchisees are barely growing. Eagle eyed readers will further point out that a new franchise in Albany and Saratoga was added in that time too, so declining revenue is probably more accurate. Back in 2022 Franchisees were 57% of the network sales vs 47% today (in 2Q25). That’s still a large proportion and to “reinvigorate” and apply the Texas template (per the strategy) would require plenty more debt, more reacquisitions and more goodwill to buy out those remaining franchises accounting for 47% of the network still. Years and years of zero dividends to support the “growth” and you end up with whopping amounts of goodwill, debt and little else to show.

The lesson I draw from all of the above is that the model is not working.

Although they talk a good game, it’s true.

But what about “Adjusted” Profit?

Of course recent interviews of WATR presented the business very positively. Up, up, up go the adjusted profits, and sales and stats are carefully curated. So is the Oak Bloke being unfair by using statutory numbers instead of “adjusted” ones?

Let’s try to unpick their adjustments.

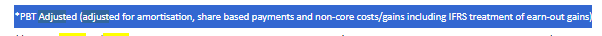

1.Amortisation

It might shock you to learn that while WATR carry out an impairment review annually the “cost” of acquiring franchises remains on the balance sheet forever. There is no other mechanism for recognising the cost. Well the cost of interest payments for taking on debt to buy them, I suppose. That debt is now costing WATR -$2.5m a year.

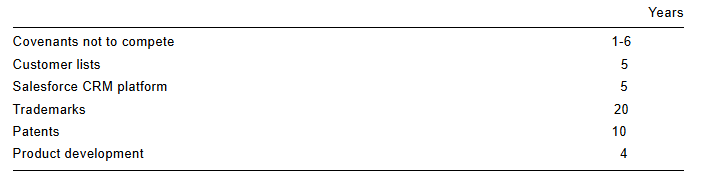

The amortisation cost therefore (unless there is impairment) are costs of the below actual intangible assets. Doesn’t feel fair to exclude these in any kind of adjusted profit - the declining value of lists, software, trademarks and patents are all very real aren’t they? Those are real costs of doing business aren’t they?

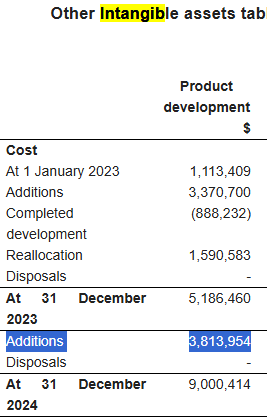

The picture is further muddied when amounts paid for franchises get posted as a $3.8m product development investment. So while most acquisition costs remain stuck on the balance sheet for some unspecified reason $3.8m of Goodwill will get amortised at $0.95m per year for 4 years. Whatever the unspecified reason for this treatment, this feels like it is a real cost too. Otherwise it would sit on the balance sheet forever like its fellow goodwill costs.

2.Share-Based Payments

These are payments of $0.3m-$0.4m per year. Issuing shares to Directors and other WATR staff.

These are real costs and part of wages and salaries. I always add them back in and consider it unfair to exclude them.

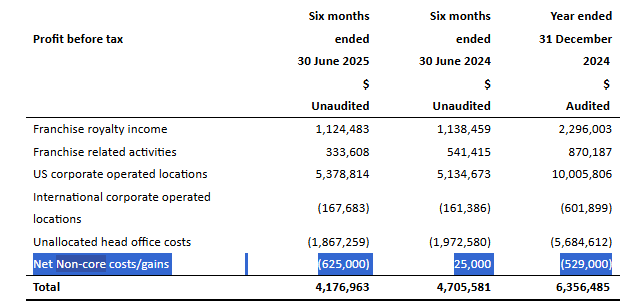

3.Non-Core Costs

These are arguably extraordinary costs and were -$0.63m PBT in 1H25 so about $0.5m post tax. So you can add $1m of annualised net profits to the statutory ones to get a run rate based on the 1H25 results.

We get absolutely no explanation as to what the -$625k costs actually are so this is blindly taken on trust.

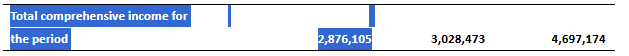

So add that number to comprehensive income and you arrive at a $3.38m underlying net profit in 1H25 vs $3.03m in 1H24 is a +$0.35m underlying improvement….

That’s a $6.75m annualised net profit on an EV of $97.8m. That’s a 7% ROCE based on the STRONG and ADJUSTED 1H25 numbers even after adding back in exceptional costs. Sorry but it’s not very impressive. ROCE or return on capital employed feels like the right measure to take on the business.

If you use the statutory number, instead, you get to an around 5% ROCE.

Conclusion

You can dress up the results and WATR use words like “in-line with market expectations” and “momentum” and “accelerated organic revenue growth”.

The above are actually the words used by WATR in their opening paragraph of their Interim Report.

Meanwhile initiatives like a token non-accretive buy back, since there is no discount to assets and carefully curated stats make the story appear exciting. The results are far more prosaic. Disappointing product revenue, disappointing franchise performance, disappointing synergy benefits thus far. Will the Texas template turn things around? Debt is being loaded up countered by goodwill and largely not by real assets.

Costs continue to go up and it feels like the beneficiaries here will not be the shareholders least not for very many years, if ever. Employees shall. Debt holders shall. Franchisees shall.

I say “it feels”. But it’s more than just a feeling… it’s the numbers.

Regards

The Oak Bloke.

Disclaimers:

This is not advice; you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”. I have no commercial connection nor receive any remuneration from any company I write about.

OB, great analysis thank you. It’s on my buy the dip list - but you’ve given me pause for thought. I wish i had your analytical skills! Really appreciate your hard work.

Thanks for your analysis. Very detailed, clear and evidence-backed. I relatively briefly held WATR this year thanks to the story (e.g. one-stop shop for all things water infrastructure, the marco theme of aging infrastructure + challenges posed by climate change etc.) and what look like deep value metrics. However, I decided to sell for no better reason than something didn't feel quite right.

I think WATR could and should be quite a simple to understand business, but the management make it really challenging. The acquisition of franchises causes a bit of P&L adjusting havoc. Nothing is split out in a particularly easy to understand way, and they describe things in an OTT fashion e.g. the constant reference to salesforce - probably one of the most commonly used platforms within PLCs - is a bit bizarre, and contributes to a feeling of desperate overselling. I think it'd be easier to get more comfortable if you lived and worked in the US so you could get a sense of brand awareness etc. but it's difficult to judge.

Anyway, will keep an eye on it though, as I think that simple to understand, nicely cash generative business is in there somewhere! Thanks again for sharing your analysis.