Gearing up for Touchstone's Programme

TXP is drilling to fill - what will 2025 look like as a result?

Dear reader

Touchstone (LON: TXP, TSE:TXP) the Trinidad O&G producer and explorer has made progress.

Obtained a 80% WI in the Rio Claro licence adjacent to its producing Ortoire block which grows net acres by a fifth. Working acreage is 4X that owned in 2023. Nowhere is that in the price. But then again no new 1P/2P resources have been defined under that land either.

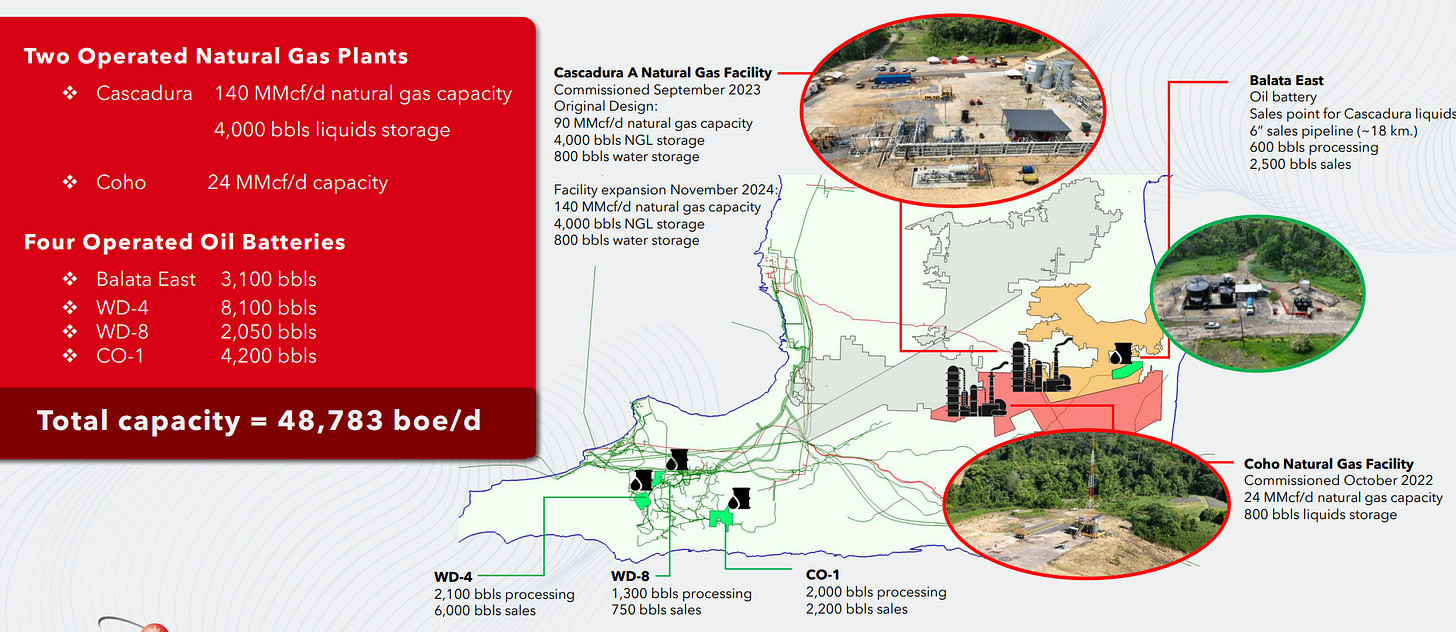

2. The Cascadura C flow line tie-in was completed, which basically connects the wells to the gas facility. In 2023 and 2024 nearly $50m of capex on property, plant & equipment has been invested. This enables processing of 48,783 boe/d. At a $17/boe netback that would be around $300m netback (gross profit) per year. Less DD&A of perhaps $20m, overheads of perhaps $30m, and tax of perhaps $50m that’s a $200m net profit potential. $17/boe netback isn’t the top level achievable either. However with production at just over 10% of that capacity the point here is that TXP is fairly future proofed for expansion.

3. Cascadura-2ST1 and -3ST1 wells are connected. 2ST1 flowing at 3,333/boe gas and 400/bbls of NGLs per day. 3ST1 flowing at 600 bbls/day of oil.

It is interesting to note TXP found an additional unperforated sand with over 24 feet of net hydrocarbon pay. This sand is located at depths between 5,816 to 5,840 feet in the well, uphole of the current production zone. Given the strong flow test results from the well, this interval offers a potential future development opportunity for the Company to pursue.

4. Existing Production is reduced by 4% Q-to-Q so declines have flattened. Netback at Cascadura ($28.9m) now exceeds the capex ($26m) which is good to see.

5. TXP own their own Drill Rig and have sent it to Cascadura B and a further well is being drilled next month, and a second in early 2025.

6. Between an LNG export facility, a potash, petrochemical, methanol and steel works there are plenty of willing buyers for TXP products and slight inflation increase on our gas income.

Paul R. Baay, President and Chief Executive Officer, commented:

"These encouraging well test results not only validate our geological models but also underscore the potential of the Cascadura field. With critical infrastructure in place between the wells, we are well-positioned to drill additional wells to further develop the field.

Valuation

Appreciating that my prior article on TXP was back in June and in that article the focus was on the synergy with Trinity (who reneged on the deal and found a different suitor), but I was interested that in that article I’d set out some profit estimates for 2025.

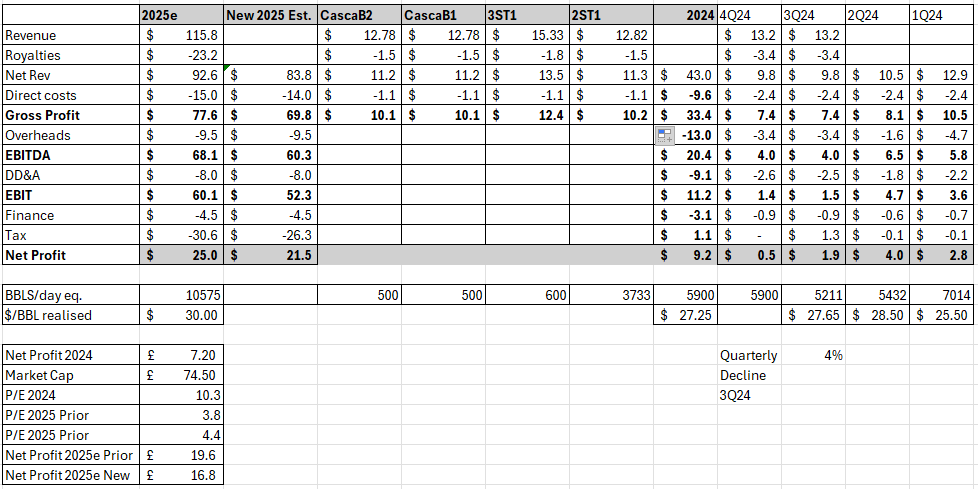

Of course delays and other aspects have also made a difference but when I thought hmm, let’s assume Q4 is identical with Q3 apart from there’s no tax benefit and depreciation increases slightly. The result? A $33.4m netback and forecast $9.2m net profit from the year (£7.2m) which is a reasonable 10.3 Price Earnings.

But how does the 2024 $33.4m netback “magically” become $77m in 2025. A leap of Oak Bloke imagination? Or something else?

Of course if you’ve read and absorbed the news on the new wells in November 2024 and others planned for December and January you might be thinking well what does that do to profits?

Well if I map the production and assume a $67/bbl NGL revenue, $15/boe Gas, and $70/bbl oil, if I further assume modest success at the two Casca-B wells of 500/bbls each, and assume a 15% reduction due to decline from 2024 production then I arrive to $83.8m of net revenue (post royalty). The impact on profit vs my model 5 months back is $3.5m lower profit. Given I’d assumed synergies with Trinity that shouldn’t come as any kind of surprise.

We see 2025 net profit drops £2.8m to £16.8m which is an attractive P/E of 4.4.

I assume *NO* further growth in 2025 production beyond wells drilled in January 2025. The 15% reduction may be quite harsh too. The other noticeable aspect is that if a $3.5m drill cost is typical and the $10m year one netback is also typical then the simple payback is 4 months. If TXP can prove they are dealing with a fairly fixed overhead (“G&A”) cost, and that filling the 90% of capacity through its “Drill to Fill” programme is on average 33% successful at striking O&G then what does a drill programme look like anyway?

If we assume only 33% success (again you might think this quite harsh) and only modest success worth $10m netback (1 out of 3 times) with a 16% decline, and an average $3.5m drill cost per well, the cumulative profit is quite hard to see at first. The company appears to be losing money. Sound familiar?

But once you’ve built momentum then the resulting ADDITIONAL profit is greater than the TXP market cap. That gross profit growth translates to growth in net profit too because it’s simply sweating the assets harder.

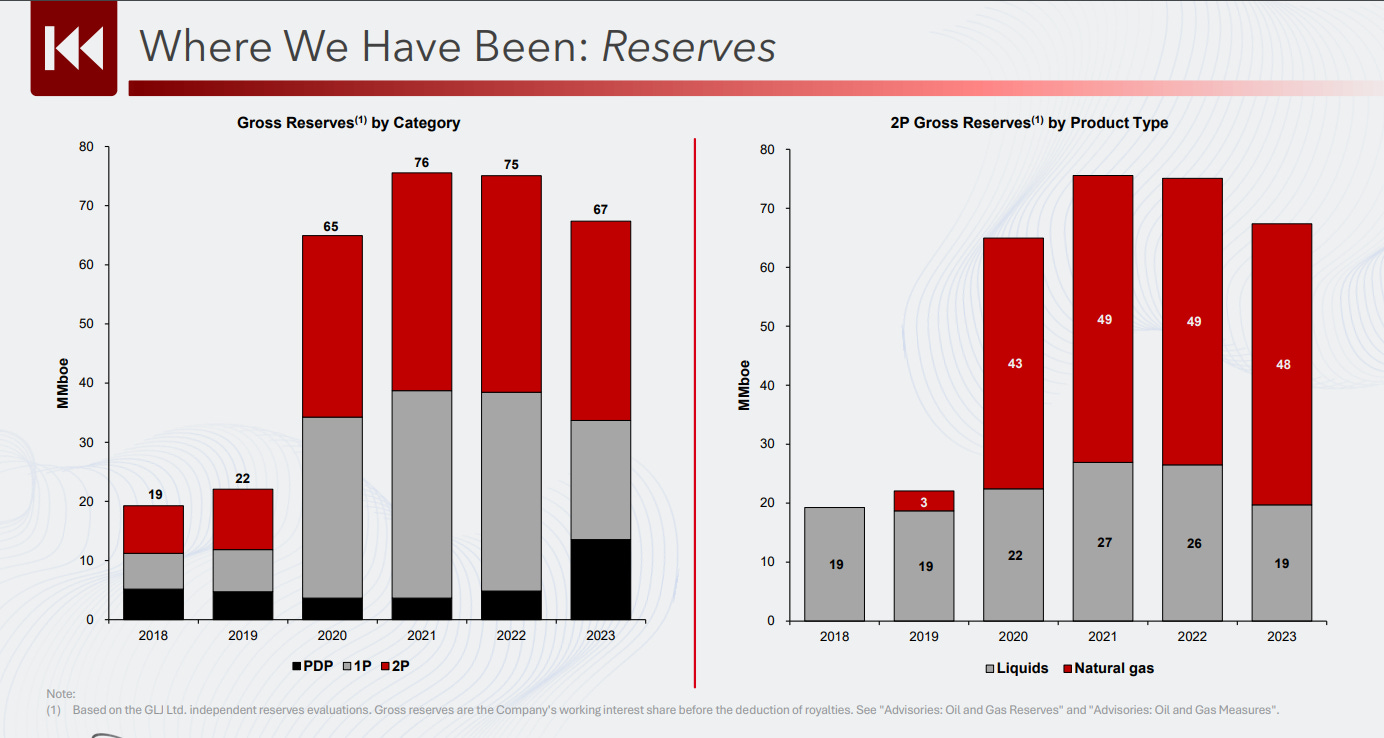

Some investors have decided to shut down the Touchstone programme. It has borne delays and disappointment, it’s true. I don’t think the market has understood its capability to expand production at low marginal cost, not understood its capacity increases, not understood its attractive acreage. Not understood the growing level of PDP which by the way will be at $9,250 per flowing BOE (with zero value placed on the 77mboe of 1P and 2P). Or $1.10 per BOE is another way to look at the reserves.

What do I think TXP is worth? A P/E of 6.6 would imply a 50% upside to the 2025 forecast so a 45p target based on the 2025 forecast view. Longer term if TXP can build from here and “drill to fill” its 48Kboe processing capacity to 100% that places it at a $1bn valuation (based on 6.6x).

I believe 2025 is an opportunity to clear its name and we will yet see a successful sequel featuring TXP.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".