Dear reader

(First of all thank you so so so much to everyone who has joined in the Bowel Cancer campaign. If you haven’t yet, please do consider contributing. With gift aid and my employer’s match funding we are at about £2,500 which brings a tear to my eye.

Thank you again and I hope you enjoy today’s Georgia on my mind)

In the country of Georgia an uprising against a “Foreign Agents” law is continuing. Plucky Gen Z’ers are pitted against rubber bullets, tear gas and riot police in scenes reminiscent of “The Hunger Games”. While President Snow, I mean Georgian Prime Minister Irakli Kobakhidze, pictured below, pushed through the law regardless. Stats show 70%-80% of Georgians actually have the EU on their mind (and it appears nearly 100% of younger Georgians do) while the government coalition are made of pragmatists (Georgian Dream) and Soviet hardliners (People’s Power). The “Old School”.

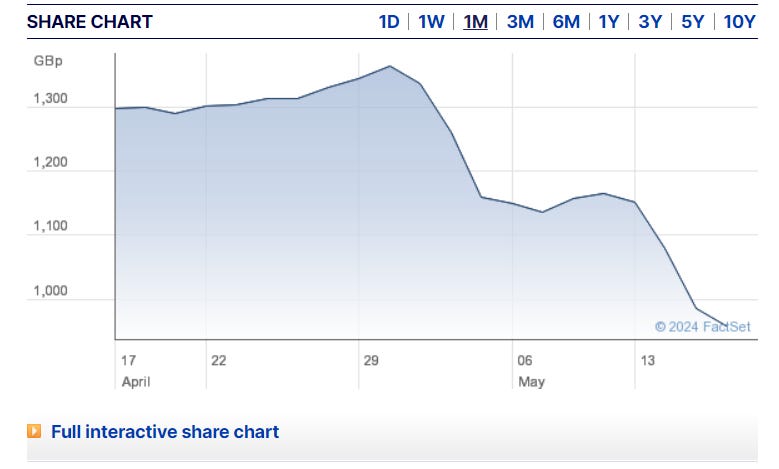

This unrest explains a crash of nearly 30% (£4 a share) in CGEO since May 1st (and 20% in BGEO). Eagle-eyed readers will know I wrote about CGEO on 10th May where I told readers I’d averaged down in to the drop believing the violence will pass. Yesterday’s bounce of 11% in CGEO indicates that the drop has tempted others to join me in that belief.

But where does it go from here? What does this mean for shareholders of CGEO (Capital Georgia) and BGEO (Bank of Georgia)?

I am no political commentator, futurologist or analyst of such political things but what I do know is that pragmatists will always be practical. Their coalition partners, who were obsessed with pushing the controversial law, are 6% of the Parliament. 94% outweighs 6%.

While part of pragmatism is also not to upset the Russians (too much), clearly the nightmare facing Georgia Dream is political anhilation. So I simply think a solution will be found. Gen Z’ers are too large a demographic to ignore and if people are prepared to face beatings, bullets and gas - they’ll presumably also be motivated enough to go out and vote in the national elections too. That vote is just 5 MONTHS AWAY READER. I suspect the riots will soon cease and the electioneering will begin. I wonder what the key issue might be?

Quoting from Eurasia.net’s Excellent Double Think May Backfire:

“Georgia Dream (GD) overreach has awakened a powerful segment of the electorate, one that is capable of effective organisation and messaging.

This transformation of the political process poses a formidable challenge for Georgian Dream. Discrediting youth activists is proving a much more difficult task for GD than outmaneuvering opposition politicians.

In recent years, GD has benefited from voter apathy that has helped keep election participation numbers relatively low. This year, the active engagement of youth in the political process promises higher turnouts, raising the chances of an upset defeat in the parliamentary elections, provided, of course, the vote is free and fair.

The counter argument is that Georgia is doomed to Russian domination. An article in today’s Guardian appears to suggest it’s already happened (although the article fails to say how)

Let’s talk investments - not politics

Apart from my article Hit & Miss I’ve covered FY2023 update in Georia-ous and the original thesis introducing CGEO. The Oak Bloke 20 idea is up 3.2% since I tipped it in late Dec 2023 - despite the recent falls.

When I reiterated the idea on May 10th it was that there was a 56% discount to NAV - when that NAV is growing 9% quarter to quarter?!!”

Well reader, that discount to NAV has grown to 60% (due to the share price falling and even taking account today’s 11% rise - it was 64% yesterday afternoon)

Let’s look at what drove that 9% NAV increase in just 3 months - and what we might expect in the remaining 9 months of 2024.

A large reason for CGEO’s NAV was the continued rally of BoG's share price, which saw a 25.9% “observable increase” in 1Q24 and reflects the strong growth in BoG's earnings, as well as the impact of its expansion into the Armenian market (through the acquisition of Ameriabank CJSC). The Water Co holding increased 1.9% too.

This summarises the increases/decreases in NAV for 1Q24:

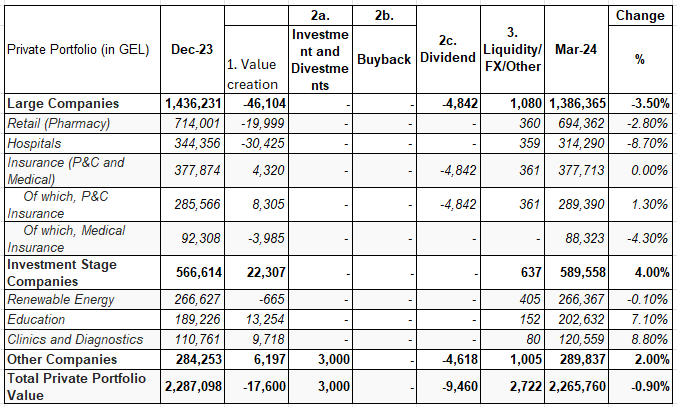

The below gives a more granular view of just the private holdings (NB above is in GBP while below is Lari - GEL so that’s why it’s -0.5% above and -0.9% below.

Let’s examine the private portfolio to understand gains and losses:

Pharmacy -2.8% fall in NAV. (17.5% of NAV)

Gross profits grew despite government price controls introduced on some medicines. In fact the retail footprint grew 10% with 40 new pharmacies and 13 franchise stores in 2023.

A sharp rise in operating expenses (21.4%) meant earnings fell sharply. These are mainly associated with one-off initial costs of the above growth, but also capacity costs where activity and revenue hasn’t yet caught up.

So it appears this holding should see revenue and profit growth as we move through 2024.

Hospitals -8.7% fall in NAV. (7.9% of NAV)

Part of this reduction follows a 4Q23 divestment of a hospital, impacting Q-to-Q value. The remainder is due to a change in sales mix to accept more private hospital clients and to factor the higher risk of bad debt and impairments to receivables, so a prudent anticipation of loss rather than any actual performance change.

Education 7.1% rise in NAV (5.1% of NAV)

A strong performance following two new campuses being opened in 2023, with revenue up 39.9% year on year in Q1 and EBITDA up 10%. Strong cash generation meant debt fell 25% in the quarter. There is an uplift despite a lower valuation multiple being applied.

Renewable Energy 8.8% rise in NAV (6.7% of total portfolio value)

The resumption of two power-generating unit of Hydrolea HPPs following rehabilitation work meant revenue up 46.5% in 1Q24, with costs down 4% EBITDA y-o-y was up 97.7% - and again a lower multiple applied.

You’ve seen the words “lower multiple” a number of times.

Overall the private portfolio achieved in 1Q24 a £7.5m increase in operating performance (this being defined as the “Change in the fair value attributable to the change in actual or expected earnings of the business, as well as the change in net debt”). And a £12.6m reduction through lower multiples. Multiples wax and wane while the operating performance, BGEO performance and the investments into growth which CGEO are making appear to explain the trajectory of this holding.

Readers would be right to be concerned about post period falls in Bank of Georgia. My calculation is as at 31/3/24 the BGEO share price was £50.50 and 17/05 was £41.60 per share. That’s a 17.6% fall. That translates to a fall in value of £78m, in the value of CGEO’s holding of BGEO. That equates to 7.2% of the £26.48 per share NAV so £1.92 NAV per share, although at a 60% discount to NAV that actually “should” be a 77p downward movement in the share price. Public is 43% of the portfolio while private is 57%, so pro rata compared to 77p that is a £1.02 downward movement for private so £1.80 in total. (Unless you can think of a reason why Pharmacies are more risky than Banks? I know BGEO has Armenia ops but so do CGEO’s private businesses also)

Actually we have seen a near £4.00 fall at CGEO. So CGEO relative to BGEO appears OVERSOLD.

Also of note post period, buy backs have recommenced too with a £20m programme. If shares can be bought at £10 a share or at a 60% discount £20m will increase the NAV by 5% - so that means £1.32 extra NAV for each shareholder.

FX risk

It’s true that some of the rise in the NAV (in GBP terms) is due to the strengthening of the Lari, and that the recent trend is weaker. Whether you worry about this also rather depends on whether you see CGEO as a short-term trade or longer-term holding. For either FX probably doesn’t matter, but there might be medium term head winds, it’s true.

BGEO relative to CGEO

Comparing CGEO with BGEO you will notice the price has recently dropped further relative to Bank of Georgia. BGEO is a cyclical stock so would be far more affected than CGEO (which has more defensive holdings). This comparison provide a clear visualisation of the disconnect - short and long term.

Conclusion

Will Georgia fall into a vassal state to Russia? Will pragmatism combined with democracy lead to a settlement and a muddle?

For us investors what does either outcome mean for investing in CGEO? The EU accounts for 20.5% of international trade while Russia is just 12.1%. Much of its trade is with countres in the Caucous and the CIS. It seems some kind of Russia take over could be economic as well as political suicide. Remember, too, many if not hearly all ethnic Russians within Georgia do not want closer ties to Moscow. Many of the Russian elite have relocated to Georgia to avoid conscription.

Even if Russia “takes control”, Georgia’s pharmacies, hospitals, schools, energy, insurance will continue regardless. We remain a long way from any sign of expropriation of Western assets. So I’m minded to quote what I feel is an appropriate way to end the article, even if I’m extending its use to the water cannons sadly blasting Georgian Youth.

"Buy to the sound of cannons, sell to the sound of trumpets."

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings including those held in Investment Vehicles covering Georgia might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Hi there! Read through all of your articles on GCEO, and I had a few thoughts.

1. How did you value NAV? Did you use the investor toolkit on the website? If so, how do you feel about the multiples the businesses were rated?

I personally think their NAV is inflated, and many of their multiple ratings were unfair. I've been through a couple of their annual reports, and find that their peer comp group is invalid. For example, a 16x multiple on an education business, or 14x on a hospital business. One example would be, Overseas Education Limited in Singapore being used as a comp set. Firstly, comparing schools in Singapore to Georgia is a large stretch IMO. Secondly, Overseas Education Limited trades at around a 10 PE range for a public business - How does a private education business in Georgia get 16x?

2. I believe that there's a non-zero chance of this investment going bust if any geopolitical risk rises. Alongside Moldova, and the Baltic states(less so), I believe that Georgia is next on their mind, and Russia has clearly proven so in recent events.

I've done a DDM, and worked on my model, and am looking at a base case 50% upside on this. What's your target price? Do you have an excel sheet/pdf write up? Would love to see it.

Overall, love the work that you've done. I think this is a great pitch aside from my second point (which I believe the risks to be relatively negligible).

The Georgian currency is a very big risk here and if the GEL was to return to the same average exchange rate against the USD and GBP as in 2021 then these shares would fall by about 30%

In May 2021 the USD bought 3.45 GEL but it only buys about 2.75 now

And in May 2021 the GBP bought about 4.80 GEL but it only buys about 3.50 now

There does not seem to be any good reason for this huge rise in the GEL against the USD and GBP in the last 3 years and so it is likely that the GEL will return to a more normal level against these currencies

This would mean a fall of about 30% in the shares