Dear reader,

I wrote about Gold blasting through $2,100 and so it continued to $2,200. Will it go higher?

Meanwhile I have reflected on the motley crew of gold shares I covered, after writing about Gold (38% of portfolio) at Royalty co. Trident, earlier today.

Do I have a revised view on Gold miners given gold’s higher price?

Revisiting my top trumps:

Centamin

Centamin’s average price per ounce sold was $1,948. Bearing in mind they have hedged just under 30% of production an average $2,200 gold price would massively boost profits.

A 10% increase would’ve boosted PAT by $86.3m. That’s nearly double the $92.2m 2023 number.

Costs meanwhile announced an eye popping $1,205 AISC in its recent FY23 results and outlook is $1200-$1350/ounce.

Caledonia (CLDN)

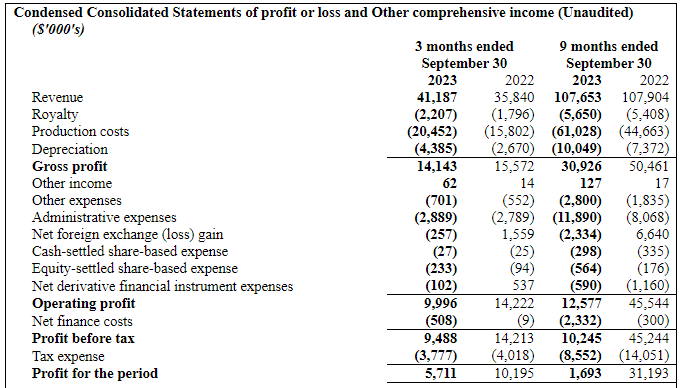

Again an average $1948/oz sale price. Deducting royalty and tax (and extrapolating the 9 months) a $2200 gold price, offset by a higher $1350 AISC ($100/oz higher), but without 2023’s extraordinary costs would likely boost profits by $11m. So an estimated doubling of profit for 2024.

Metal Exploration (MTL)

MTL on a $2,200 gold price working on the lower AISC of $1,000 (Per H&P research) and using a 70Koz (Per H&P) for FY24 production, gets me to $150m revenue, $70m COS, and Admin $10m to arrive at $70m op profit less tax is a 2X performance compared to 2023 but this is the profit that H&P forecast in any case.

Serabi (SRB)

On Tamesis FY24 PAT of $16.2m and assumption of $1,950 gold, $2,200 golf has the estimated effect to boost profits from $16.2m to $23.5m

Pan African (PAF)

Using Edison’s numbers of a $1,940 gold price moving this to $2,200 moves the PAT from $67m to around $91m.

Hochschild (HOC)

Putting $2,220 into my HOC profit model I go from $1,950 to $2,200 per ounce gold. The change in profit is $50m to $113m

Hummingbird (HUM)

An industrial dispute at HUM’s new Kourroussa mine has led this to fall by 75% from its peak nearly a year ago. I’m sure $2,200 gold would have an upside for HUM but I’m not sure I want to go to the effort to calculate it.

Conclusion

It appears CEY, HOC, MTL can all 2X profits from a “$2,200 gold price” (NB I’ve worked on the basis of a 10% increase from the general $1,950 price for $2,145 an ounce, being picky)

This suggests their total costs are 90% of revenue and therefore 110% turns 10% to 20% - doubles.

For SRB and PAF the margin is larger therefore the gain is smaller - costs maybe of 80% to the same 100%, so 110% turns 20% to 30% - a 50% increase rather than a double.

In my last article 35% agreed with me that CEY looked a good option. It’s interesting to see that over a 1 year span higher gold prices have spurred some shares to rerate - but not CEY. Even a strong FY23 result this week had a negligible effect on the share price. I dare say a doubling of profits and 2024 news flow* will awake it from its Egyptian slumber.

*CEY newsflow includes its Eastern desert exploration update, the Cote D’Ivoire Doropo DFS, increase from 450Koz to 470-500Koz production, the accelerated waste-stripping programme, 50MW grid project completion and the solar expansion study.

This is not advice

Oak

Very bullish update from Cobus today on PAF. Some highlights are they expect mintails to start contributing by December, and with the elevated gold price a payback on the entire project in only 3 years.

Gold miners likely to have similar tailwinds but great to hear it from the CEO

Oak look more closely at PAF - when mintails goes live in q3 their p/e drops to 3, Sudan in for nothing. This is insanely cheap imo plus the management is far superior to cey.