Dear reader,

I’ve kept an eye on Golden Prospect Precious Metals Trust ticker GPM but never before committed. It was recently at 50p but given the recent market carnage and a drop to a 41.8p ask I decided to put some dry powder to work.

It struck me that Gold remans above $3,000 per ounce and at that level gold producers are fairly immune to economic circumstance, even if I don’t subscribe to the doom narrative. The re-appearance of Dr Doom on Bloomberg predicting you predicted it errr yes doom for the squillionth time. Quelle surprise.

Gold meanwhile remains elevated even if there is a bit of profit taking today. Hardly the expected trajectory in a doom scenario.

I haven’t seen anyone comment on this but if we are facing recession why is the 10 year yield so much above the 2 year and moving further away? The bond market is telling us - very clearly - no recession to see here.

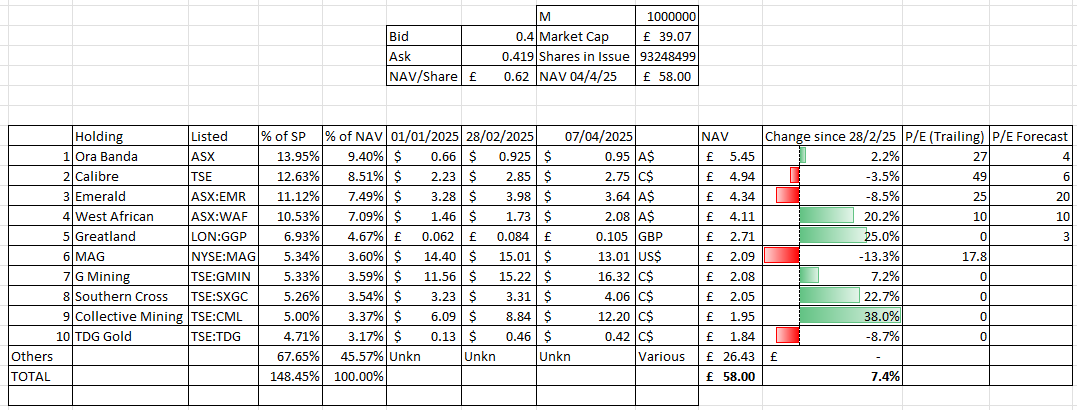

GPM

Coming back to GPM I noticed when reviewing this before Lib Day compared to the 2021 Gold spike when GPM hit 70p even 50p recent highs GPM was still 30% below the peak - also ignoring inflation.

GPM achieved a Net Asset Value (NAV) total return of 20.4%, in 2024, while the share price total return was 20.3%.

In 2025 its NAV has already moved from a 43.1p to a 62.2p NAV (as at 03/04/25) and 56.1p today … a net 30% NAV increase but only an 18% share price rise in 2025 from 35.5p to 42p…and the year is yet young!

Discount to NAV of 24.2%.

At the risk of stating the obvious GPM’s fund managers Keith Watson and Rob Crayfourd observe that the sector remains undervalued, with strong cash generation potentially leading to further outperformance relative to the gold price.

#1 ORA BANDA 9.4% NAV

The fund's top contributor in 2025 and largest holding is Ora Banda (9.4% of NAV), is up 71% YTD. GPM has been top slicing their latest (Feb 25) newsletter tells us.

A US$1,276 AISC and forecast production of 105Koz up 50% on FY24, even more forecast for FY26. At and assuming $3,075 gold that’s $323m and an AISC of $134m so translates to £146.5m PBT. A FY25 P/E of 10. But let’s assume US$3,300 gold in FY26 (come on when am I ever extravagent, it’s not that inconceivable is it?) and A$1840 which is an AISC of US$1160, then we are looking at $495m and -$174m so a $421m PBT so a £245m profit putting Ora Banda on a FY26 P/E of just over 4X.

You can watch the Strewth-inducing presentation of its three mines here.

The managers' strategy focuses on identifying undervalued stocks with catalysts, specifically cash-flow positive producers with development assets and experienced management teams.

#2 Calibre

Located in the 51st State if Trump gets his way (thoroughly recommend this documentary to understand Canadian history and why he won’t)

Calibre was also located at the Master Investor show last weekend too, so it was good to meet the management. It reinforced my thinking on this share since I had begun studying them prior to meeting them.

Calibre is Canadian and given its planned 195k per annum production (first pour 2Q25 so imminent), and $1007 AISC this is a licence to print money. But at what price? C$2.8bn is £1.5bn. Forecast revenue of $600m and a total AISC of -$197m gives US$403m operating profit, so £312m operating profit so an adj.P/E of 6X - not bad!

#3 Emerald Resources NL

Back to Oz (and Cambodia) and an AISC of $818/oz! 114koz. Delivered £30m PAT in 1H25 to 31/12/24 so a P/E of 20X.

The attraction here is its two near term prospects the Dingo project and Memot. Both have active exploration and development programs that could propel this and compress the Price Earnings going into 2025 and beyond.

#4 West African Resources

This Australian-listed miner is in Burkina Faso and is ratcheting up production. Up 60% this year putting it at a £1.3bn market cap and a P/E of 11.6X

Geographically, Australian companies are GPM’s primary contributors, and largest allocation. With the Aussie Dollar at 2.06 to the pound there is an opportunity to buy Australia cheaply. Labor costs also have eased, improving profitability. GPM’s gearing contributed 3.5% to returns, giving a further boost.

#5 Greatland Gold

An Australian miner based in the Paterson region in the NW. It has an initial MRE at its Havieron project of 8.4Moz eq’t inc. 270Kt of copper while Telfer is 45km away and has an MRE of 3.2Moz eq’t including 117Kt Cu. Telfer has been operating since 1977 and produced over 15Moz already. GGP bought Telfer and also became 100% owner of Havieron in December 2024.

These are the near term upsides from upcoming milestones

Telfer is producing around 1250 ounces of Gold Equivalent per day at US$1,454/oz and the above is to extend its life while Havieron will be a new mine and is a GGP discovery being developed. The mine plan will be where Havieron will add a forecast further 700 ounces a day to production with a stunning AISC of just $818/oz from first gold 2H27.

Even at 1250 oz/day at $3k/oz (-$1454/oz AISC) equates to $1.37bn revenue and -$0.66bn AISC so a $0.7bn operating margin.

Add in Havieron equates to a further $766m revenue (-$209mAISC) is $0.56 op.margin. Post tax even you easily get to a P/E below 3X.

But the plan doesn’t stop there and that’s where the Feasibility study comes in.

#6 Positioning & Outlook

GPM maintains a positive outlook for the gold price, citing geopolitical tensions, central bank demand, and potential inflationary pressures from US trade policy. Concerns regarding US national debt sustainability also support gold's role as a safe-haven asset.

From an equity perspective, the sector remains relatively cheap, having lagged the gold price. Cost pressures have eased, enhancing profits and free cash flow. GPM focuses on companies that can convert improved cash flow into profits, particularly those with near-term catalysts for re-rating. This strategy has resulted in over 50% of the portfolio being invested in producers with development assets, including Ora Banda and Calibre Mining.

Recent additions include New Gold and Eldorado, based on anticipated de-risking catalysts in 2025. GPM believe easing construction costs and a weaker Australian dollar support project delivery on time and within budget, justifying the high weighting in Australian stocks. While tariffs have created concerns in some sectors, GPM believe resulting currency weakness in Mexico and Canada could benefit their precious metals producers. Previously exposure to Mexico was reduced but the new Presidente Pardo is much more mining friendly.

#7 Discounted Annual Fund Raise

I have to add the fact that you get the option to subscribe at a discount. Anyone who held shares at 29th November each year has a right to subscribe for one new ordinary share of GPM in respect of every five ordinary shares based on last year’s NAV. This year the price is 48p since the NAV was 48p on the 29/11/2024.

Shareholders are not obliged to exercise their subscription rights and if they do not exercise their rights a subscription trustee appointed by the company, may, subject to its evaluation of market demand, attempt to place or sell unexercised subscription rights and return any proceeds, net of costs, within 14 days to shareholders who have not exercised their rights. The total cannot exceed €8m.

#8 Conclusion

The gold market has experienced significant gains, with the metal breaking through multiple all-time highs. While it’s dangerous to get giddy and over excited the outlook for gold and silver appears strong. Geopolitical factors are not reducing, are they?

And we haven’t even spoken about central bank demand (including notably among the BRICS countries) being another key driver. Particularly post “Liberation” day.

These Miners appear attractive at current valuations, comining favourable cost trends with a strong gold price.

Yes gold miners have increased during 2025 a bit but remember when prices double profits more than double. It is just mathematics of margin. GPM offers a distinct approach of targetting producers and soon-to-be producers.

As a Trump tariff avoidance strategy could this be a way to hide out? Seems to me the pull back to a 42p ask is an opportunity to buy into a series of holdings that are going to be busily printing cash, even if we see a recession.

But also if we don’t!

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Calibre is has a merger agreement with Equinox, awaiting shareholder vote. Not sure if this has any real effect to the valuation. But it looks good!

I prefer less risky miners so I bought GDGB ETF (GDX in sterling) as the market fell. It doesn't have the advantage of a discount but it has larger miners.