Dear reader,

Goldplat (ticker GDP) is a precious metal recovery specialist operating for over 20 years which mines nothing but works with miners to recover metals from their waste streams. A “Freddie Dodge” specialist but rather than turning up with his mate Juan (oh), advising on and improving their operation instead Goldplat ships the materials back to its recovery plants in South Africa and Ghana for processing. Its future plan is to add a third plant in Brazil.

Its approach is not dissimilar to Jubilee in some ways, although it is interesting that GDP appears to achieve something similar without vast levels of investment, and of course focuses solely on gold. The reason for this is GDP’s annual production of 37,466 ounces is 1.06 tonnes of gold. Jubilee are processing around 2 million tonnes of chrome concentrate per year by comparison.

GDP works with a wide variety of “wastes” ranging from wood chips to machine grease and uses a tailored processing approach to each feed, and uses a series of interconnected recovery circuits to recover further precious metal from the wastes.

Top Line:

A reader strongly recommended I look at GDP, and for sure it is cheap.

What struck me though when I looked at GDP was its forecast slow growth according to the broker. A P/E of just 2.8 and discount to NAV of ~25% but its profits would stagnate in FY25 (to June 2025). Hmmm. When gold prices are rising? Why might that be? And how accurate is that? That slow growth especially in rising gold prices takes the shine off things - potentially.

Customer (Suppliers of Feed) & Growth

GDP have an expanding breadth of customers across Southern and West Africa, plus are expanding into Brazil. This reduces risk of dependence of too few customers and lumpiness of flow.

It also diversifies from the challenges of power intermittency which has plagued South Africa and associated rising energy costs.

Gold Operations

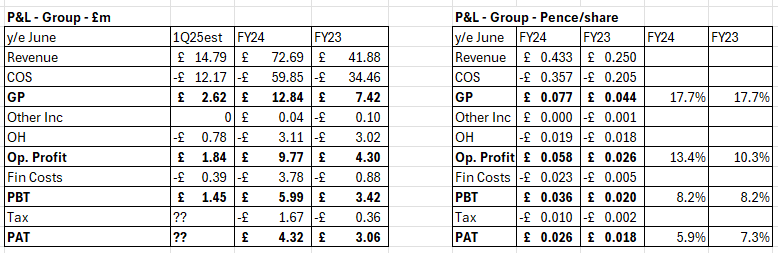

Ounces. Usually you would head straight to production info and see how many ounces were produced. Very strangely GDP only reveal this in the latest annual report (37,466 ounces for the year) whereas we have to assume perhaps 24,000 ounces (taking the midway of “operations recover between 1,500 ounces and 2,500 ounces monthly) the year before (FY23) and perhaps 28,800 ounces in FY22. This must mean a realised price per ounce of $1,940 and an AISC of $1,597 in 2024, $1,745 and an AISC of $1,436. Explains why GP margin is only 17.7% and hasn’t increased in 2024/2025.

So there not nearly as much margin, since the revenue is shared with the customer (who provided the feed) and costs are high because of the processing involved.

There is potential for GDP to expand its PGM recovery (it’s unclear whether there are any since they only announce gold ounces) and it also has a know how for a fine coal recovery process where it says it is not currently the best time to pursue these ideas.

Since mine materials have to transported to either Ghana or South Africa, new sources of feed need to be approved for export, and licences to operate expire - some yearly. GDP’s operations tends to tie up working capital since customers want to be paid far faster than smelters are prepared to pay GDP. You can see working capital getting swallowed up as operations have grown.

It’s also noticeable that margins are declining since 2021 due to higher energy and people costs.

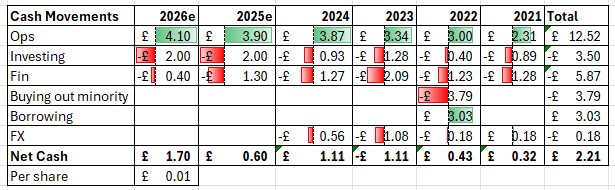

Cashflow:

+ Strong cash generation: GDP generated strong cashflows in FY24 - its P/OCF (price to operating cash flow) is 2.5x and FCF 6x.

Capex:

Ongoing investment appears set to continue via further investment in Ghana and then Brazil. There’s always something to spend the money on. It’s fair to say that GDP appears close to being debt free and there is talk about dividends in 2025 but my assumption is there’s more capex (perhaps £2m a year) to upgrade Ghana to produce Dore Gold and to establish an operation in Brazil.

Compensation & Management:

Director compensation seems reasonable at £420k (inc fees). Management has been delivering on its promises and has a clear and achievable strategy.

Sales:

The 2024 revenue performance is far higher than 2023. This is in part to fewer blackouts in South Africa (aka load shedding), but also due to improved gold prices and growth in the Ghanian operation.

The broker’s view that sales will drop in the year to June 2025 (FY25) to just £48m (from £72.7m) has spooked me somewhat. Why? No explanation is given for this contraction? The gold price is now higher than it was in the year to June 2024. The 1Q25 result appears to show a £14.8m revenue till 30th September by working backwards from the disclosed operating profit. Annualised that would be around £60m turnover. So do they believe the remaining 9 months will deliver just £33.2m? Their guess is in a report dated the 20th December 2024 so a full month after the 1Q25 results so it appears they believe sales will contract by about a 1/3rd in the remaining 9 months (£48m - £14.8m = £33.2m).

Another aspect I’m not comfortable with is sales were £72.69m and 37,466 ounces were produced and sold at $2,076 per ounce. But this doesn’t add up. 37,466 ounces over £72.69m is $1,940 an ounce - $136 per ounce less, or if an average $2,076/ounce is accurate then production must have been 35,014 ounces. I suspect the answer is tied up in minority interests and the like (the Ghana operation is 91% owned by GDP), and/or the reconciliation between their “group” and “company” reporting. I’m struggling to understand their disclosures, and ultimately why obfuscate your performance?

Cash:

Analysing their cash flows debt is or will be paid down now or in the coming months, leaving just lease liabilities. There is clearly growing operational cash flow, which is a positive sign and despite the forecast drop in sales I’ve made some estimates on what cash flows could look like, assuming a £4m budget to address capex for Ghana and Brazil’s operations.

I suspect that any dividend will not be until later in 2025 but a prospective £1.7m would equate to 1p per share. Assuming a 40% of FCF dividend i.e 0.4p equates to a very decent 5.4% yield. That could grow to a 10%+ yield with rising cash flows in time.

Balance Sheet

The nature of the business, and one to get your head around is that your customers (mine owners) are the suppliers and want generous payment terms for their materials.

The smelters are a supplier but you supply the processed ore for smelting and they offer slow payment terms.

So the nature of this business is lots of working capital gets tied up and there’s not an easy solution here where customers are typically very large, smelters are also large and GDP is the piggy in the middle.

Having said that the group balance sheet is solid, and feeds in to the company balance sheet where net assets are 9.6p per share (so at a discount to the share price by 2.2p).

Other upsides:

A final aspect is the MRE from 2016 where today about 2.3 million tonnes of tailings contain 82koz plus an estimated 50% more? of gold plus silver and uranium at 1.5g/t (?). GDP have built a second tailings storage which now is complete and is a stepping stone towards processing the older tailings.

Conclusion:

A £12m market cap at a discount and delivering a £4.3m profit after tax should be a dream come true. But how much could and one day will translate into returns for its owners? After you strip out minority interests, and try to account for production that doesn’t appear to quite add up to the revenue, a high AISC, a fairly heavily discounted gold price (so a limited net margin and upside to gold prices), ongoing capex requirements, quite a bit of past bad luck, a PEG of 2.66, geographic risk and crucially the prospect of a FY25 33% sales drop according to the broker’s estimate for absolutely no apparent reason…. an uneasy feeling prevails.

Perhaps I’m overthinking this one and just need to get comfortable. I’ll be paying close attention to the interims and the truth of the broker forecast.

Regards

The Oak Bloke.

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

A few additional observations that come to mind at this point (please correct if mistaken)

- GDP doesn't recover metals from tailings but all other waste. This is presumably too costly and time consuming for miners to do. Also, it's a problem for governments too.

Thus, we could consider this more as a 'moat' for the business, not so much piggy in the middle but more like one of those cleaner fish, or like an environmentally friendly rentokil for miners.

- Likewise I can't find information about FY25 revenue drop. Perhaps it's more that 2024 numbers were a surprise to the upside? Will do some more digging.

- Some acute observations by Oak on other figures. Needs investigation. However, one of the Directors owns nearly 1/3 of GDP and this kind of skin in the game might serve to allay fears. Also, the cash generation and earnings visibility are reassuring imo.

- Valuation. I have as follows:

:: NAV £20.5m, so a c. 60% discount to NAV

:: PEG 0.1, admittedly rising to 0.6 by FY26

(from Sharescope)

But the main valuation metric, as agreed on by both Zeus and WH Ireland, is that GDP should be trading in line with its peer average of 3.5x of EBITDA.

Yet GDP is currently trading on a miserly shade above 1x EBITDA.

On this metric fair value then would be 3x from where the sp is currently, or a conservative 2x simply to come into line with 1x 2025 NAV.

For a reasonably safe, environmentally friendly business due to implement dividends shortly this is too cheap by any metric imo. But ofc DYOR

Excellent write up Oak. Sharing for your readers the Zeus Capital analyst interview

https://youtu.be/1D9uegPvURI?si=ZqjvG1xLN52eVEcR