Have you got the Mineral & Financial Investments? OB 2025 Idea #5

Does it baffle - that you've not heard of MAFL?

Dear reader

There’s money in them there hills. Lots of money if readers followed the recent idea Condor Gold in article #325 “Musings by the Oak Bloke” up 52% as I write. I hope some readers are celebrating this morning and if you are a MTL owner (or BSRT) then assuming Metals Exploration’s bid wins then it is gaining a great project with great upside.

But for today’s idea which is #5 in the list it is not Condor. Instead I screened for deep value panning amongst some fairly dreadful stocks but then one popped up. Just one caught my eye.

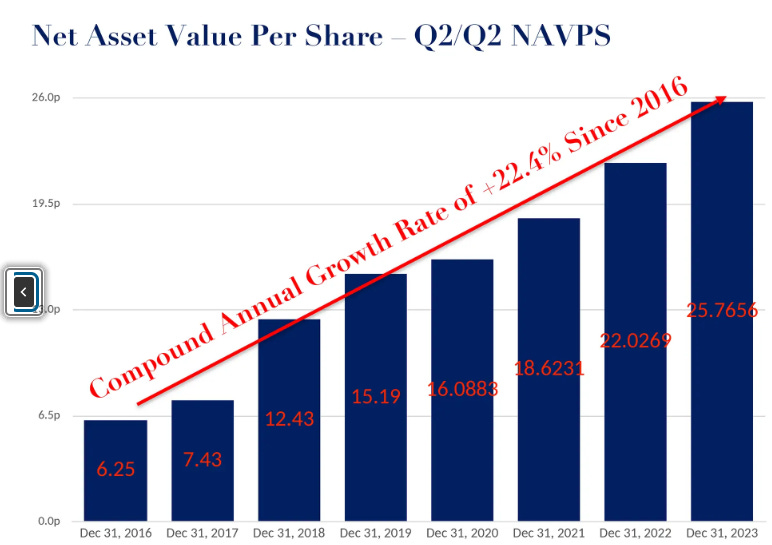

It was a baby + bathwater moment. Its NAV was up in the past year while its price was down - really down.

So was 2024 a flash in the pan in its NAV performance?

No, not when it achieved pan-decade performance of 1857% NAV growth since 2013.

MAFL’s thesis is not unlike my own: Miners are deeply out of favour. The green is the S&P500 while the blue is the commodity index over 50 years. Either the S&P500 is overvalued or miners are undervalued…. or both.

MAFL’s holdings are split into strategic and tactical.

Strategic Holdings - unlisted

MAFL have what they called strategic holdings and what the rest of us would call unlisted holdings.

#1 Digbee

Have you ever “googled” a mine? Or a type of mine? What if there was a better search engine? Digbee offers this. See Digbee’s global index of mines where you can search by mineral, operator, country.

Digbee doesn’t just publish a map of mines. It earns fees for its ESG framework. This can be helpful in gaining in-country approval/compliance, environmental permits, funding, investors and guarding reputation by - you guessed it - ESG reporting. Digbee provides an independent panel of ESG mining experts as part of its service.

#2 Ideon

Imagine you had a new geophysical tomography tool that worked like an x-ray. It uses Muons which are a type of cosmic ray emitted by Supernovae and that can be used to understand an underground space. It would cut down on drilling by up to 90% but also compress the time it took to gather information and interpret that data by over 50%.

But now imagine you had the recent £12m backing from the Canadian government, and the assistance of AI in interpreting the data. At a project called Macpass (sounds like being resolute and driving past those tempting golden arches) Ideon is currently mapping a huge Zinc project and had past success mapping Uranium for the likes of Orano and BHP.

A further funding round is due and could be at a higher valuation.

#3 Golden Sun

This is currently a 400 tonnes per day gold mining operation in Costa Rica (of all places) and is producing but going through commissioning and ramp up (since April). The target production is 20Koz-30Koz per year ($54m-$81m) at 1.4g/t should deliver an AISC at or below $1,300/oz. If so, a $28m annual operating profit translates to a net profit perhaps of £14m. That means this is held at a P/E of about 3 times based on an estimated 5.53% MAFL holding.

#4 Red Corp

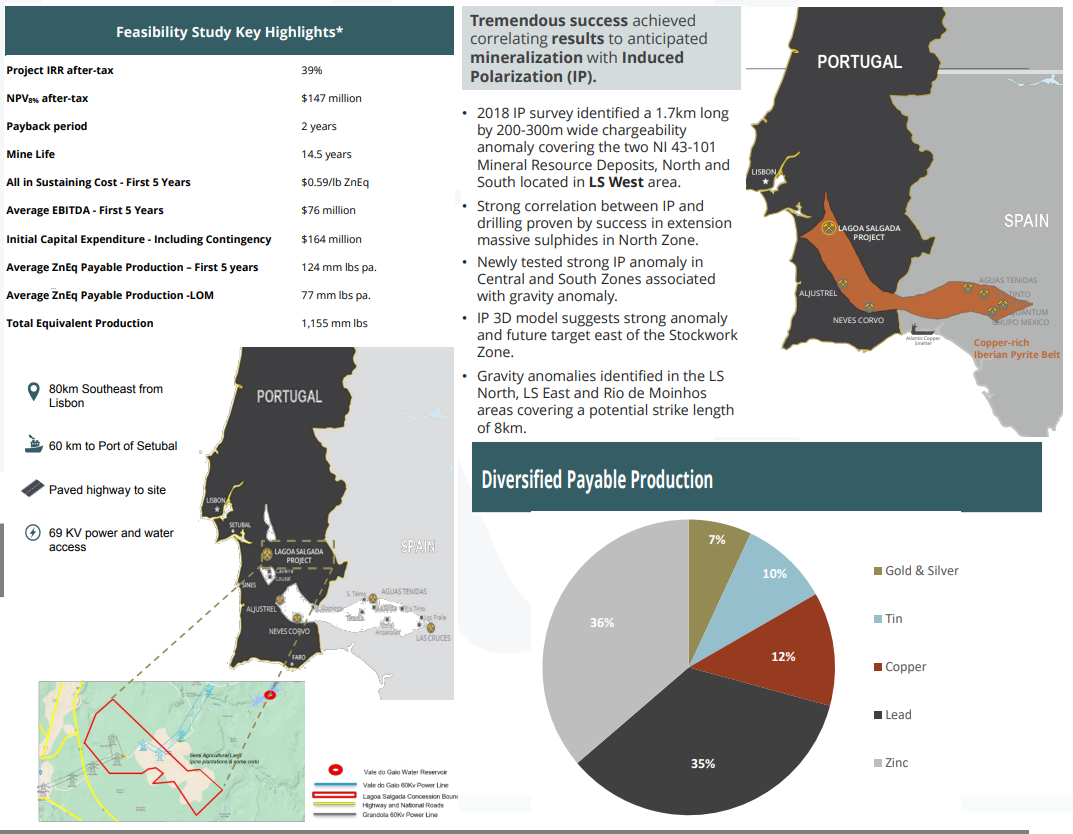

This is a polymetal project with an IRR of 39% and NPV10 of $147m. 80% of the project has been sold and the remaining 20% may be sold based on the value. The potential buyer has a contingent liability of $6.2m in their books while MAFL have it as a $3m asset in theirs. In other words if that’s the price then there’s a nearly certain upside for MAFL of about 7p per MAFL share. If it doesn’t sell then it holds part of a project with a 39% IRR at some highly conservative prices.

#5 Terrasun

Terrasun was spun out to the shareholders of Golden Sun Resources. MAFL own a little over 5%. Terrasun separates the exploration portfolio from the production portfolio. It holds the largest portfolio of exploration properties in Costa Rica. It has 21 exploration permits covering 22,200 hectares. Seven of the 21 exploration licenses cover former historical producing mines with historical resources. Additionally, Terrasun owns 6 exploration diamond drill rigs to conduct its own exploration activities and can develop a contract drilling business in Central America. Lastly, Terrasun also owns a 500 tonnes per day continuous VAT Leaching (CVL) modular gold processing plant. When the market is more buoyant for junior exploration companies, such as Terrasun, MAFL believe they will be attractive investments – particularly one that has such a dominant position in an underexplored jurisdiction such as Costa Rica.

#6 Toburn

This is a 2% NSR over the Golden Sun mine (in Costa Rica).

MAFL apply a 12.5% discount rate to asset the value of this income stream as being $389k. My own calculation using today’s $2,700/oz gold price and just 27% of the 1.1moz resource (as MAFL do) arrives at $887k (undiscounted)

The Tactical Portfolio

Most of the holdings need little introduction. Agnico-Eagle and Barrick are pretty well known Canadian gold majors (Barrick is diversifying into Copper now too). Cerrado is an Argentinian mine and has prospered under Milei the past 12 months, but prior to this suffered while inflation spiked to 450% per annum. Eagle-eyed readers will spot that Cerrado sold Monte Do Carmo in Brazil to Hochschild Mining so has done very well in the past year too.

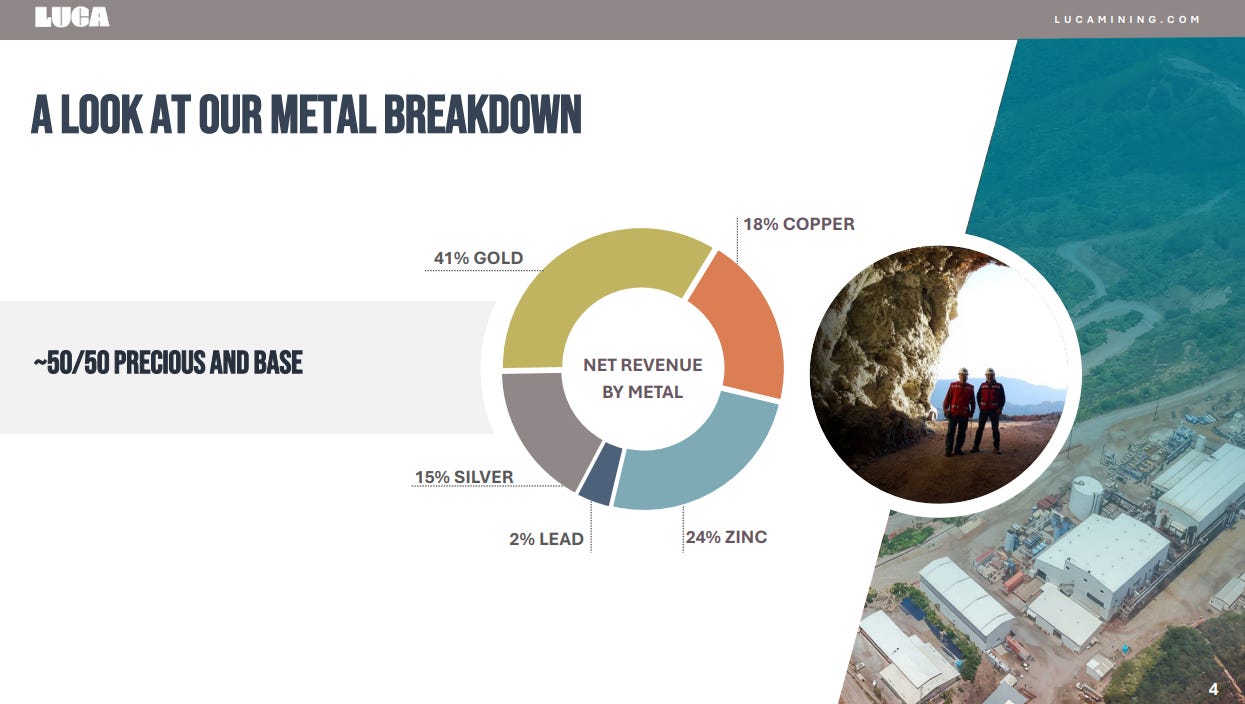

Capstone and Hudbay are copper producers. Luca is a Mexican polymetal Zinc-Copper-Lead-Gold-Silver miner.

Post Period the listed holdings are up on average up 19.6% post period. I’ve used the splits from 2023 (they are not disclosed in FY24’s results) to estimate the make up of the £2.45m of holdings. The -£130k fall at Luca offsets a £330k gain elsewhere post period.

The fall in Luca is due to a H2 fundraise and the CEO explains why that 8.8% fall might reverse (in a large way) in 2025.

A prior period AISC of US$1,633/oz is a bit painful. So the C$11.3m raised ($8m) pays for optimisation, upgrades and spare parts to drive that number downwards.

Production is forecast at 100Koz Au Eq in 2025 and targeting 200Koz Au Eq mid term. But success is not just about producing more. Better separation and better recovery have also been key turnaround measures at Luca.

Au Eq or gold equivalent hides that this is 59% not gold and both Silver and Zinc are up in price 26% YTD alongside Gold’s 30% YTD

The Strategic Portfolio (again) with estimated values

The noticeable elements here is the potential for a value event (IPO) at Golden Sun and a value event (BuyOut) at RedCorp. At the book value we are talking 17.5p (1.5X today’s share price) and at the potential market price you could more than double that to 35p (~£14m).

Those £14m proceeds could be used in all manner of interesting ways. Fast tracking a Terrasun project for example, or perhaps buying a larger stake in Terrasun itself.

Summing it up

I was astonished when I did the maths. You are obtaining assets at a 64.9% discount as at 30/06 before considering upside.

But then strip out the cash, gold bullion and listed holdings and that grows to over 95% (post period). After all the listed holding have increased by about 0.5p a share post period.

Meanwhile the unlisted “strategic” holdings contain a 17.5p per share upside in two near term unlisted opportunities.

A track record of 1857% suggests this is more than just fanciful thinking on the part of the Oak Bloke. When these chaps state nearside opportunity it appears they do have their finger on the pulse.

I commend to you what will be the second of my Oak Bloke Ideas for 2025: MAFL.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I generally avoid small mining companies. My experience over the last 10 years is losing about 99% of value in a bunch of these stocks. I've been holding Condor Gold for 10 years too so I'm still in a loss. I bought JLP at 18p...lol!

The valuation of the Lagoa Salgada VMS deposit is based on the PEA done on older resource knowledge and lower commodity prices in place when the PEA was done. There has been more drilling since then, and more is currently being done. Commodity prices have improved since then, especially gold and silver. It is worth noting that the mine plan currently envisages initially targetting areas in the deposit with the highest payback. The next economic assessment should be higher, and the new figure will be used to calculate MAFL's 5% put option.

The board have always used conservative valuations and never ramped the stock [little history of placings]. There is significant upside for those who are patient; there is even upside for traders whilst the 60% NAV discount prevails.