Dear reader

It’s bothered me for a while that Spain wholesale electricity rates have been extremely low. Yesterday 26.11 Euros/MWh. Eage-eyed readers will spot that that’s 2.24p/Kwh.

My own domestic supply is 23.34p/Kwh plus 60p a day standing charge.

An 11X difference (before considering the standing charge). Now it’s fair that UK wholesale electricity yesterday was 6.5p/Kwh, so I’m only being fleeced about 4X by my domestic supplier, but where there’s margin there’s profit, surely?

Eagle eyed readers will also spot that 26 Euros isn’t the lowest price in Spain either. Numerous days in April that electricity was as low as 2 Euros/Mwh.

PV Mag tells us this could continue going forwards too.

Low power prices is a curse for producers. If you own a Spanish solar farm you’re probably weeping into your glass of Rioja. Perhaps as much as northern European power users weep everytime they get their electricity bill. But for every loser there’s a winner. Invert! Munger would have said.

So who wins when supply is low and demand prices are high? Surely someone? Well the obvious answer is the power generators. But I read my power supplier Ovo lost money (due to losses on derivatives) in their latest available accounts. SSE lost money in 2023 too but are forecast to earn £1.7bn on £11bn sales. Not bad but ROCE of 5% hardly shooting out the lights. Much is made about the “waste” of converting electricity into hydrogen and its true the “round trip efficiency” is lower (currently) than other forms (about 60% efficiency) but the point is if you are generating power which is near worthless and can transport it to where power is scarce and prices are high the arbitration outweighs the round trip inefficiency.

The Arbitration Opportunity Outweighs the Round Trip Inefficiency

Hydrogen offers an intriguing possibility. Generating electricity and then storing it for later use. Or transporting it via a national grid for use elsewhere. For a start, H2 is getting enormous state aid and subsidy. $7.4bn State Aid by the EU was recently anouunced, the IRA in the USA whose generous $3/Kg subsidy could drive $30bn per year to Hydrogen by 2030! In total Bloomberg NEF reckon worldwide there’s $280bn of subsidies for Hydrogen. The UK, the Australians, the Chinese, South Korea, Japan, many countries are scrambling to move on hydrogen.

Hydrogen can be considered as a source of power, but hydrogen is also a source of heat (particularly high heat such as for cement or steel making), or as a feedstock for many chemicals, for fertilisers, plastics, steel, glass, metallurgy and food too.

Plans are well underway to build out a European hydrogen pipeline network with connectors from north Africa. The West African Atlantic coast is barren, windy, sunny and virtually empty desert for large areas. The opportunity to build energy farms for export to European consumers opens up new possibility. This is a visualisation for the planned hydrogen network by 2040. Will the sunny south power the cloudy north? Will the windy west power the east? It is an intriguing concept where the commercial reality is driven by scale, and subsidy, but we begin to see scale occur - and certainly see subsidy - read on reader, more on that later!

Hydrogen One invests into different hydrogen holdings and grew its NAV 5.8% in 2023 to £132.7m despite a 6.7p reduction due to the discount rate being driven from 13% to 14.2%. So an underlying performance of 12%-13% return if you strip out the additional DCF discount nonsense.

Meanwhile the share price has fallen off a cliff driving the discount to NAV to 55% as at 3rd May (it was 60% recently). If you’d bought in back in 2021 you’d have lost half your money.

The portfolio is quite small at £132.7m, and it’s true charges are high at 2.6% but does this offer value to new investors?

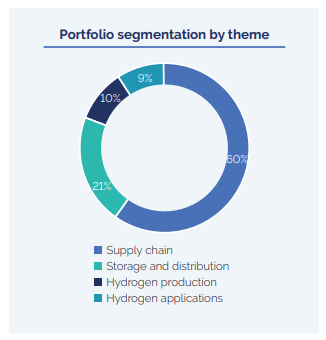

I’ll examine some of these companies further on but it’s fair to say the 80% bulk of its holdings are actually “utility type” holdings in the hydrogen supply chain and storage, with just 10% on production and 9% on hydrogen applications (which could be considered higher risk and more speculative). In 2023 the amount of green hydrogen grew 50% and 400% increases in investment suggest volumes will exponentially grow.

Moving around the clock from 12 o’clock let’s look at holdings:

#1 Sunfire (45% of mar cap; 20.3% of NAV)

Sunfire in 2023 launched new alkaline electrolysis plant in Solingen, Germany, targeting 500MW capacity. It installed a 2.6MW solid oxide electrolyzer, the world's largest, in Rotterdam. It signed a contract for a 100 MW alkaline electrolyser to a European refinery and received a €169 million grant from IPCEI to support its growth plans. It commenced construction of a €30m Research and Development centre at Dresden, Germany. GET H2 TransHyDE joint project start-up achieved first hydrogen production, using a 250 KW solid oxide electrolyzer from Sunfire. Post period it has raised 500m Euros in a Series E fundraise, probably resulting in an uplift in valuation.

#2 Elcogen (40.2% of mar cap; 18.4% of NAV)

Elcogen is a manufacturer of solid oxide fuel cell and stack (“SOFC”) and solid oxide electrolyser cell and stack (“SOEC”). It is constructing a new 14000 m2 facility in Loovälja Industrial Park as at January 2024, with operations scheduled to commence mid-2025. Developed together with Maru Ehitus AS, the facility will expand the Company’s manufacturing capacity from 10 MW to 360 MW. In 2023 it signed an MOU with Hyundai, one of the world’s largest shipbuilders who invested €45m in 2023.

#3 Strohm (32.4% of mar cap; 14.8% of NAV)

Strohm makes pipes. From TCP. TCP being thermoplastic composite pipes. It is used in Oil & Gas (most recently by Exxon in Guyana) and offers 30 years life, 10,000 PSI pressure capability, is fully recyclable and simpler than steel pipe. But also is used for transporting hydrogen. For example in Belgium a 10MW offshore electrolyser mated with wind turbines will generate green hydrogen transported by Strom TCP.

#4 HiiROC (22.6% of mar cap; 10.3% of NAV)

HiiROC is a UK electrolysis technology which uses plasma torches to electrically separate hydrogen and CO2 from CH4 (methane). The carbon collected is solid carbon black which has multiple commercial applications including tyres, rubbers, plastics, inks and toners. HiiROC are also researching new uses and applications for the carbon produced. These range from environmental remediation filters and soil enhancers through to animal feeds, high-performance materials and construction materials.

#5 Cranfield Aerospace (19.4% of mar cap; 8.9% of NAV)

Finishing on an exciting one, CAes has an order book of 1300 aircraft. The aircraft itself is a Norman-Britten Islander used to carry 9 passengers, or 3 patients in an air ambulance role, or 1.6 tonnes of cargo, or 4 executives in comfort.

CAes is adapting it replacing the Rolls Royce engines with its own and adding 2 large fuel tanks pictured in green. Commercial sales are 2-3 years away.

Eagle-eyed readers will remember I spoke about Bramble - an IP Group holding - a few months back. Since I wrote this, I see Bramble have completed real world testing of a fuel cell powered houseboat. Decarbonising marine transport equates to 12 tonnes of CO2 per vessel. Usually the types inhabiting these boats are ecologically minded. There’s 35,000 house boats in the UK (4,500 in London) and 25% live permanently onboard. That’s a lot of fuel cells just in the UK. Just house boats. Bramble received a UK £12m grant for fuel cells for buses in 0223.

The actual Revenue

HGEN report 2023 revenue growth of 76% - >1000% in its holdings.

Total revenue of £74m puts price to sales at around 1.25 shrinking to well below 1 in 2024 if growth continues in 2024 and beyond.

Penultimate Thought

There are many blue chips backing hydrogen technology. Much is made of Shell’s and BP’s softening or attempted softening of their green energy stance. But they are still large players as are many other Oil & Gas/energy firms as joining the race. But also industrial players and others are joining in too. Everyone has a 2050 commitment to reach and throwing money at that problem. So M&A could well be a way for HGEN to realise gains, as could IPOs. It’s also fair to say most of its publicly listed holdings (1.7% of NAV) like AFC Energy, ITM and Ceres (CWR) are all at bombed out valuations.

Conclusion

By 2050, the global hydrogen market could reach $2.5 trillion, dominated by hydrogen producers, electrolyser and fuel cell manufacturers.

Even just replacing today’s c.$175 billion ‘grey’ hydrogen market with clean hydrogen could mitigate over 0.8 billion tonnes per annum of greenhouse gas emissions.

Worldwide emissions are 50 billion tonnes of CO2. Hydrogen could mitigate some 20 billion tonnes per annum of GHG emissions - about 40% of the problem.

The question investors must ask is has the opportunity now ripened?

Do high and low prices for energy across Europe illustrate an opportunity?

Does the new need and priority for energy security provide an enormous tailwind evidenced by rapid work in Germany and many other countries?

Does COP28’s commitment to phasing down fossil fuels and substantial government subsidies provide a strong tailwind to hydrogen and the pace of progress is far stronger than perhaps people realise?

Is power demand itself not increasing rapidly and it’s not even just a substitution of dirty fossil fuels vs clean ones argument but just addressing burgeoning demand as climate change increases demand and applications like AI increases it too? In transport there are 814 hydrogen refuelling stations and plans to rapidly grow that number. Some car manufacturers noticeably Honda and Toyota plan to build FCEV with less emphasis on EVs. (Hydrogen powered electric vehicles use a fuel tank and refuelling takes minutes not hours)

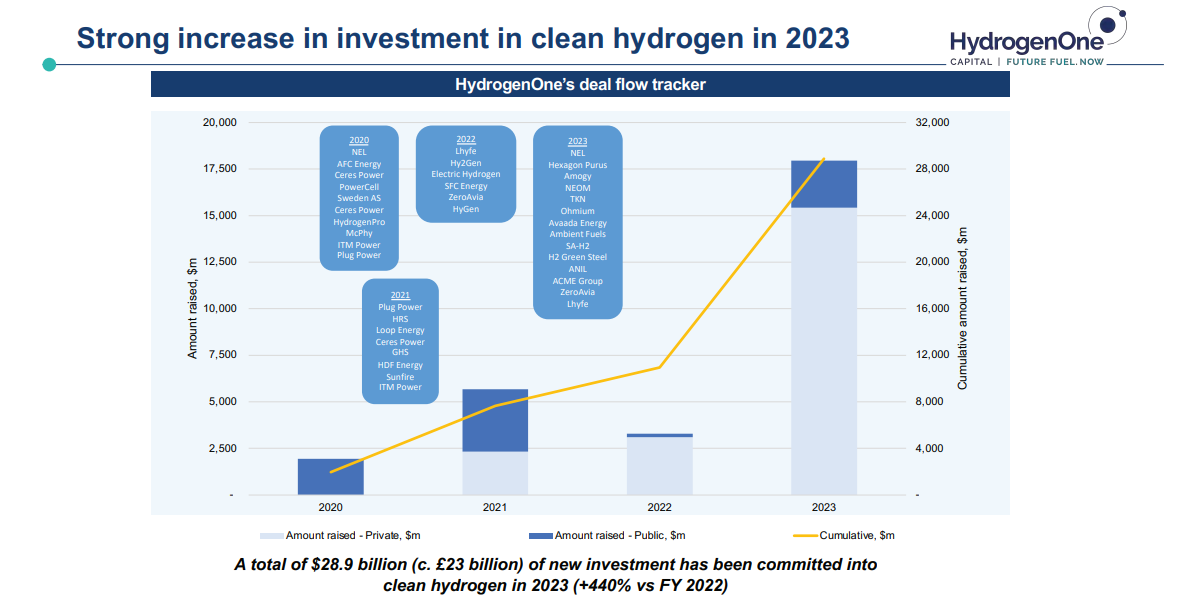

What is the reason that cumulative investment in clean hydrogen more than doubled in 2023? And jumped 440% year on year? That much is being said of the potential for South America and Africa to become energy exporters?

The 55% discount appears incredibly tempting considering the pace the holdings are going at, but also if, like me, you believe a 14.2% discount to future cash flows represents a very pessimistic view, and the NAV is probably higher at a fair price or realisable basis.

Next Wednesday on May 8th HGEN provide a Q1 Trading update. Judging by the newsflow and further investment announcements, this should provide a further boost to the NAV especially for HGEN’s largest holdings like Sunfire and Strohm. I suspect some readers will be watching out for the truth of a NAV change on news and progress so far in 2024.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Interesting article but i worry that hydrogen is over dependant on subsidies at the moment and also that batteries are now battle proven so are the choice for transportation. So with domestic heating looking likely to be heat pumps where will the big demand come from (steel and cement are niche)? I'd say this is as much govts and policy makers hedging their bets having already ceded solar panels and batteries to the Chinese this is the last throw of the dice to come up with something that can be claimed as a global lead.