Dear reader,

Alright stop. Collaborate and listen.

i3 reported a reasonably strong operational performance from its oil (22%), NGL (25%) and Natural Gas (53%) in 2Q24 and significant growth compared to the previous year. Average production increased to 6,223 boe/d, a 214% rise from 2023. Free funds flow from operations reached $10.1 million in H1, up from $809,000 in H1 last year.

The company faced steeper production declines than expected, reducing its 2024 average production forecast from ~9,400 boe/d to ~8,000 boe/d and are projecting $28 million in funds flow. They are focusing on developing their acreage and have revised their capital budget to $35 million. Net earnings for the first half of 2024 totaled £4.7m, marking a positive shift from a loss in 2023. The company ended Q2 with a cash balance of £8.8m and shareholder equity of £162m. This compares to a market cap of £112m.

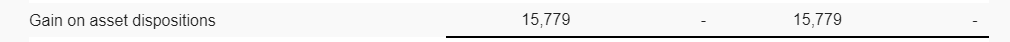

What caught my eye was the substantial gain on asset disposals. Over at DEC yesterday a slide spoke of Oklahoma land being worth $800m so it’s interesting that other companies are selling acreage too.

This also caught my eye: USD $64k per flowing BOEPD is a really, really healthy number! No wonder they recorded a £15.8m gain on disposal! The book value was £4.9m and proceeds were £20.7m. The share price reacted this week by increasing by about £4m to a £15.8m gain outside of the expected. That’s a £11.8m gain not in the price.

They bought those assets for less than $4,350/boepd; so that’s roughly a ROIC of 18X!!!

Production decreased 3% compared to Q1 to 18.3kboe/d, generating $36.5m revenues, $15.7m net operating income and $15.8m adj.EBITDA for the 3 months to June 30th.

At i3e Production in late July averaged 18.4kboe/d, with an additional 310boe/d of production voluntarily shut-in due to depressed natural gas pricing. As such, the Company remains in-line with expectations and on track to meet its FY24 average guidance of 18-19kboe/d and exit rate guidance of 20.25-21.25kboe/d.

Incredibly, however, natural gas prices in Canada in Q2 hit silly levels. CAD$1.25/mcf average is the equivalent to US$5.47/BOE! Fancy a 93% discount on energy anyone? Canadian natural gas is practically free compared to the price of an actual barrel of oil.

For now.

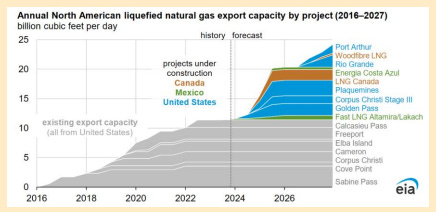

LNG Canada will change that from mid 2025 processing 2bn cubic feet of gas per day or 11% of output, and by 2028 this number will grow further perhaps to 25%. Much of the Canadian gas is currently exported to the US so this will also impact future US gas prices.

Moreover around 1/3 of production is hedged at much higher prices so the record low prices are somewhat insulated through hedges.

Forecast

Brokers forecasting a US$90 Brent oil price, and average near doubling of gas to C$/mcf of C$4 so also see a rebound in revenue and while Opex grows by around $10m, a near doubling of revenue against relatively fixed costs boosts net profit from $3.2m to $50.9m in FY25. This puts P/E on 2.7.

This is also based on the $51m capex programme where current year 18-19kboepd guidance meets an exit rate in excess of 20kboepd.

Net Present Value Vs Peers

i3e with a £112.3m market cap vs a DEC £480m market cap is 4.3X less expensive to buy.

At a PDP NPV10 of US$303m i3e is 11.7X less than the PDP NPV10 of DEC. That makes DEC about 2.5X times cheaper.

But if we factor in i3e’s PDP + 1P + 2P (assuming the probable is proven) the ratio is 1.94X. i3e is better value.

But if we assign a 50% uncertainty to i3e’s 2P then it’s 2.7X difference.

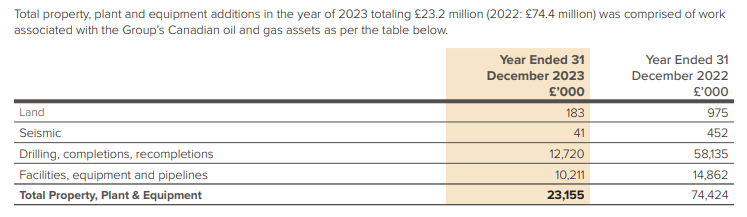

We must further consider the capital intensity. Over the past 2 years i3e has spent £97.5m on PP&E which is mainly drilling, with some infrastructure. DEC spends much less than this because it doesn’t drill. I strongly suspect over years and decades that DEC wins out in the end due to lower capital intensity and due to reduced risk (of the 2P “probables” particularly.

But i3 certainly offers a cheap price, a good dividend and smart management.

With sale of acreage a further bonus, and a top drawer royalty sale too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Gran Tierra approach!!

Not a huge offer - 13.92p ~ £174m

On a more northerly latitude, I3E lost some production to

A brief cold snap in January caused temporary disruptions to operations….. primarily due to cold temperatures in mid- January……..of cold temperatures that temporarily shut-in production, caused a spike in electricity demand usage and generated additional costs associated with getting wells back online

I don’t think that’s a consideration for DEC