Dear reader,

I couldn’t resist when I learned ICG’s largest holding is called Chewy. Private equity meets a Wookiee? No - Chewy is a listed Pet Food and Medicines company in the US.

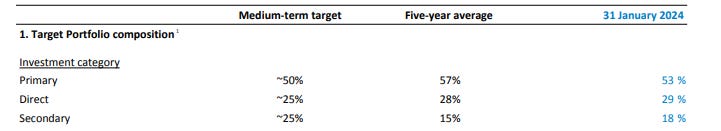

Meanwhile ICG invest in buy outs in Primary, Secondary and Direct investments:

Primary Investments: is where ICG purchase shares (stocks) directly from the fund issuer

Secondary Investments: allows primary private equity (PE) investors (limited partners) to make an early exit, liquidate assets, or rebalance their portfolios, so ICG purchases shares in a fund indirectly from existing PE owners.

Direct Investments: ICG buys stakes directly in companies (operating businesses) rather than through a fund.

Buyouts or acquisitions (Buyout is an Americanism I believe) are typically for much more mature businesses. Narry a start up, a seed, or Series A - E. In fact the word “Series” appeared only once in ICG’s latest annual report as shown below…. can you find another PE/VC listed company who can make that claim?!

ICG invest in a broad range of verticals - it’s fair to say there appears to be no targetting of verticals whatsoever. What matters is the delivery of growing amounts of cold hard cash.

ICG Enterprise Trust is a private equity investor focused on cash-generative European and US private companies and aims to generate defensive growth by focusing on buyouts (i.e. acquisitions). A 10 year view of NAV and stock price immediately reveals a very telling picture. A disconnected NAV.

I see a long-term picture of NAV growth and share price disconnection. I see a small drop in NAV from 3Q24 to 4Q24 (ICG are year ending 31/01/2024), but as is often the case with Q4 updates there’s no Q4 commentary explaining the move from Q3, just a 12 month year on year analysis. But a little digging and it appears Chewy is to blame. This is ICG’s largest listed holding (7.8% of the portfolio are listed) and is a £5.5bn mar.cap that has enormous sales and very tight net margins. The share price has fallen it’s true, but over a longer time period it also delivered a 3X return to ICG so its recent performance should be taken in context.

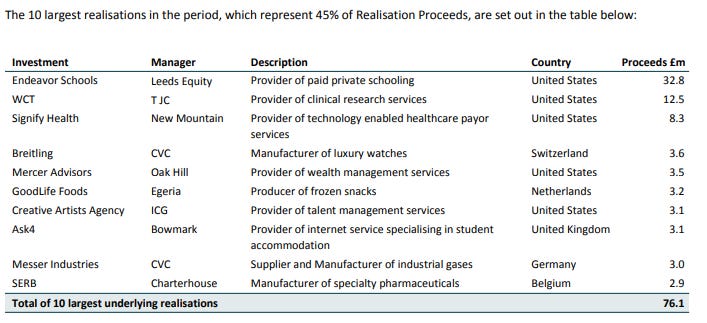

Just like in the original Star Wars where Chewy was the only Wookiee, virtually all investments are Private Equity not publicly listed - they might list whilst in private ownership and in fact 7.8% have done. The largest realisation in FY24 was £32.8m (and checking Ask4 for example this had £1.1m net assets in its last accounts so £3.1m is for 100% of the company). It appears Primary/Secondary focus on mid and large businesses while Direct appear to focus on much smaller businesses.

But size is less important than their characteristics.

ICG’s Y-to-Y numbers look impressive! Its 5 year and 10 year average numbers too!

Total NAV: £1283m

Particularly, I’m drawn to the high level of realisations achieved even through “difficult” years (for everyone else) £239m and £252m in 2023 and 2022 is roughly 20% of the portfolio per year. Looking back these realisations are consistent. Compare that to its PE/VC peers and you will not find another PE investor achieving those volumes - at least not during 2022 and 2023. This is because it is unusual for ICG to IPO its holdings. Also because it avoids growth and venture capital and focuses on defensive sectors and on cash generation and profit.

Portfolio Returns

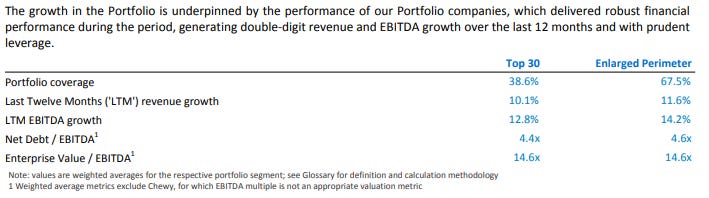

Based on 2/3 of the portfolio revenue and profit growth is a very reasonable 11.6% and 14.2%. 14.6x EV/EBITDA

Shareholder Returns

ICG pays a dividend of 2.7%; but this has grown each year at 9.4% CAGR. Factoring in buy backs adds another 1.3% shareholder return in FY24 (i.e. y/e 31/01/24). Given the discount it is good to see, and even better an “opportunistic buyback” has been added for the current year of £25m. This will triple buy backs potentially hoovering up shares on days when the price falls.

Especially as the discount is so large (37.6% currently) along with the consistent uplifts on realisations (around 30% in 2023 and 35% average over 10 years) that puts the implied NAV/share on 2475p which compared to the ask is 1216p so buy backs are at over 50% discount.

On the current approx. 66m shares, a buy back of £38m at 1216p would equate to 3.1m shares. NAV is £1,283m deducting £38m gets to £1,245m which over 62.9m shares equals 1980p - a 71p increase in NAV (equal to 5.8% of the share price) even if there’s zero performance in FY25.

So 2.7% dividend + 5.8% buy backs = 8.5% shareholder return in FY25

Plus any actual positive (or theoretical negative) performance (which on a 5 average is 17.4%… positive).

Or using the lowest/highest annual portfolio return numbers equates to 8.5% + 3.2% = 11.7% FY25 total shareholder return….. or 8.5% + 27.6% = 36.1% total return.

11.7%-36.1% per annum are compelling numbers.

Negatives / Bear Case

Fees are high at 2.81% (around $16m) a year. Compared to other investment trusts doing the same job for less than £2m. Its fees have reduced for FY24, capping the management fee at 1.25% and transferring responsibility of costs to the manager (why should shareholders pay for the promotion costs of the manager to attract new shareholders?). It has been devilishly hard to find the basis for fees. That was a frustrating red flag but I persisted.

In a Stocko discussion forum it is claimed ICG has “Carried Interest: 0.7% if performance +8% p.a.” but I haven’t been able to validate that. In fact I only can find a tiered flat percentage arrangement.

Since a great many investments are into funds I wonder (aloud) whether some of the balance of the 2.81% minus 1.25% is taking into account the fund fees and costs. ICGT Director fees are modest at £0.3m. The auditor costs more at £0.4m! Also interesting to see bank fees on revenue are about half the 2.81%. If you exclude these the fees reduce back to about 1.4%. Harumphing prospective shareholders excluding ICG on grounds of its 2.81% costs should consider whether bank costs are a fair inclusion (even if AIC rules say they are)

ICG’s over commitment strategy means it commits to fund things in excess of its assets. These commitments are theoretically some way in the future but you know the saying about buses don’t you? ICG relies on cash distributions to meet capital calls as they come in, allowing it to put as much capital to work as possible and minimise the negative impact of cash drag on returns.

If distributions suddenly dried up ICG could get caught short. Overcommitments look a bit scary at £552m as at 31/01/24.

It is also worth pointing out that for primary/secondary (non direct) the Investment Manager does not control when exits occur - this is controlled by the Fund. This doesn’t appear to have been an issue historically, but again buses coming at once or not at all - it’s something to think about.

Conclusion

I don’t hold ICG but I should. A reader flagged it up to me and I’m glad they did.

I particularly like its defensive nature. While the over commitment aspect is something to keep an eye on these folks have been operating for 40 years - optimising capital and behaving foolishly both come under the title “over commitment” so you have consider that.

The yield is “low” on the face of it, but dig in to the actual shareholder returns (I love the 2nd “opportunistic” buy back!) and its performance over many years is deeply impressive. Particularly combined with the level of realisations they achieve and the consistency of the above book returns. You could opt for a higher dividend but get lower or less consistent shareholder returns. You could opt for a higher discount to NAV but get slower realisations.

ICG feels like an understated steady eddie in the world of private equity. Not glamourous, doesn’t hold sexy IPO holdings, no 100% growth stories, but 10%-15% steady progress is the Tortoise that wins the race without the Hare’s ups and downs. ICG will take you further, steadier and more reliably. Looking at its good years where >30% returns were achieved do you think FY2025 might be one of those years? Y/E FY2024 wasn’t one of those years where ICG achieved just a 2.3% return….. but consider how many PE funds returned a negative return last year? 2.3% is good!

If a >30% elevated return is achieved and that’s combined with a closing of the discount, theoretically this could return >60% in the year to 31/01/25.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings including those held in a Trust might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"