Dear reader,

Ah, Desert Shield Memorabilia. Those were the days when the world led by Bush Senior, helped out little Kuwait against the Iraq invasion. Kuwait has not been in the news ever since. Nor have camels, particularly. So spare Camels a thought as wild camels are critically endangered and the 8th most endangered large mammal. No A-10 Warthog aggression please.

Central Asia Metals, meanwhile, is barely in the news but perhaps should be. It is not Kuwaiti nor do they employ either Warthogs or Camels. They are a miner based in Kazakhstan (thankyou please) but also based in Macedonia, Eastern Europe.

Production in 2024 (in Tonnes) looked like this. Their 2025 outlook guidance is fairly identical to 2024 in terms of volume.

If we apply today’s metals prices to 1H25 and the forecast prices to 2H25 to look at what a 2025 out turn could look like we see profits increase.

If CAML achieve a net profit of $84.4m in 2025 that would be on a par with what CAML achieved in 2021. The share price back then was 40%-90% higher than now in 2025.

However the consensus view of 5 brokers is profit will be $50.76m in 2025. So why do I think it could be so much higher than the “experts”?

What about the “Contained Metal Factor”?

A reader pointed out that I’d missed the concentrates are not 100% but 84% for Zinc and 95% for Lead. Also while the Per Lb Price is accurate at $4.98 (today $5.01) the per tonne price is lower. Discounting for those factors we see a lower result than $84m at $67.4m. But above the consensus guess-timates and a 4.3X price earnings ex cash.

Whichever set of numbers you use it’s merely plugging in the following assumptions given to us from the company:

Metals production in 2025 will be broadly the same as 2024.

In the 2nd discounted scenario factoring in the same level of contained metal ratios.

Cost of production may increase somewhat through inflation but there are capex improvements underway (like the automation at the DST plant going live 1Q25) that will reduce cost so I’ve assumed a flat cost in 2025 relative to 2024. Seems a reasonable assumption to be making.

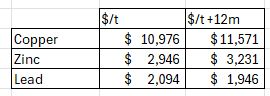

I’ve assumed today’s price as the average 1H25 price and the forecast price as the 2H25 price. Technically the forecast is 12 months ahead, but they aren’t aggressive numbers. Copper will go up 5%, Zinc 8%, lead falls like er lead by -7%. You might think Copper increasing just 5% a bit low. Citi think $12k, BoA $10.75k, Bloomberg $9.7k. Take your pick.

I wonder how accurate the analyst forecasts are? Are they plugging in metal prices form last year maybe? There is no proper research on research tree to explain their assumptions. I’m using the Stocko data, but then I go back using their history function and see the analysts were forecasting a $53.4m profit for 2025 11 months ago - back when copper was $4.10/lb not $5/lb. So to summarise, the experts believc today 2025 net profits will be $3m less than they forecast 11 months ago given today’s much higher prices than 11 months ago? I don’t think they have it right.

Moreover I’ve assumed nothing for the following:

A cash pile of $67.6m as at 31/12/24. (18.9% of the market cap)

Income from the above (at 5% interest rate that’s worth +$3.3m PBT finance income)

The potential value of the 28.6% holding in Aberdeen and its imminent news from drill results: “Drilling commenced at the Arthrath project in northeast Scotland post period-end, and initial indications based on visual core logging are positive. The exploration target is high-grade copper and nickel mineralisation, and the drilling is testing deeper targets”

The potential value of CAML X - “the Company’s 80%-owned exploration subsidiary in Kazakhstan, ramped up its activities during H1 2024, focusing on target generation and licence applications. These activities represent potential long-term growth, and are complementary to the Company’s continued search for an existing or near-term cash-flowing opportunity that would transform the business in the immediate future.”

Its two mines have resources lifetimes stretching to 2034 for Copper and 2039 for Lead/Zinc.

I’m assuming nothing for its Silver Stream. There is some sort of weird agreement to surrender all the silver for a peppercorn or two. This is what put me off CAML in the past. At a 153p share price I can forgive their Silver transgression.

Chain Smoke those Camels

Did I mention that you’re in danger of receiving a 9p dividend twice a year? That’s a 11.8% yield the company coughs up, and those divvies would be twice covered by forecast $84m earnings (ignoring that cashflow could be higher than $84m since net profit includes depreciation which is non-cash).

That level of earnings would put this at a 4.2X-5.3X price/earnings, or 3.4X-4.3X if you strip out the cash (as it was at 31/12/24).

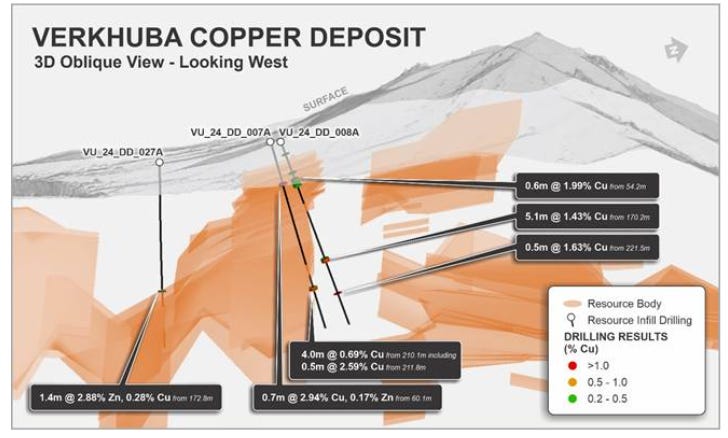

If they can establish a 3rd project in Aberdeen or Kazakhstan then there’s upside there too. They still have time given their long-term resources. I also wonder whether fellow Kazakh explorer EST (East Star Resources) might get swallowed up by CAML? EST is at a £3.5m market cap, and could be bought up with CAML spare change at a premium to today’s share price. It’s on their doorstep (well not 10,000 miles). EST’s Verkhuba project contains attractive amounts of Copper and Zinc.

Valuation

Even if you consider CAML at just 5X my forecast earnings ex cash you get to a 15%-50% higher share price, so 153p seems a tempting price to me.

If you think I’m wrong and the experts have it right it’s still a fully covered dividend of 11.8% with room to get there in 2026 or beyond. The experts forecast a 50% upside price in any case.

For a reliable, quality miner delivering steady results with several early stage project prospects and a warchest to direct at acquisitions, development of projects, or perhaps even buy backs or a higher dividend then even a 5X earnings valuation is rather mean.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

"or perhaps even buy backs"

Well you can rule that one out. I'm a CAML shareholder. I've written to Richard Morgan (IR) expressing my concern about incremental shareholder dilution.

Mr. Morgan said: "If we look at the past two and a half years, we see an increase in the average number of shares in issue (used to calculate earnings per share) of 0.83% in FY2022, 2.22% in FY2023 and 0.0% in H12024. These are extremely small increases"

Yes, but if you're a coffee canner instead of a stock flipper, still, over time, you see your shareholding nibbled at - and without need. Ok, call me fuzzy and having the wrong investment style and whatever.

In my answer I brought out the question of buy-backs - though fully knowing that at a recent presentation of results, when management was asked about buy-backs, they said sth. like: "Well, we pay a dividend"; specifically, I alluded to the positive effect of buy-backs: "This has been seen in coal mining in recent years, where, due to singular circumstances, the management teams could dramatically reduce the share count, leading to a corresponding significant increase in shareholder wealth".

But, again knowing about their dismissive answer about buy-backs, I didn't want to belabour the point and hence was only aiming for a stable share count: "my question would be, and not even envisaging buybacks to reduce the share count, would management contemplate buying back the shares they offer in employee incentives, to keep the share count stable? As I mentioned and you confirmed, it is not the cash that is lacking."

A reasonable question kindly worded, I daresay. No answer. One month later, I re-sent the question. Again, no answer.

As a minority shareholder I tend to judge the quality of management by the quality of IR (because by what else I could judge it with).

Thank you for the analysis, from a long-term holder of CAML, underwater at the moment, wondering whether to top up. I think I will wait till next week's results. Geopolitics is a handy excuse not to buy, but the management has been serious and solid and perhaps too secure to go for the blue-sky deals PIs love, but which nearly all fail. But this price does seem a bottom. I don't expect div to increase, but neither should it decrease. The latter would be a sell signal.