Dear reader,

Interesting to see BOTG holdings bounce strongly in yesterday’s trading. And up again today. Like an erstwhile T600, it takes more to clobber and terminate this OB25 for 25 idea than a pesky tariff.

“There might be a recession” is the incessant bleat. Many commentators are saying this but where is the evidence? Meanwhile a massive sell off and holdings like NVDA have reduced by a third, although NVDA has bounced strongly too. Japan 1st in line for a deal has bounced the numerous Japanese robotics holdings too.

I decided to follow this idea based on a conviction that Robotics will be recession proof in any case. Why do I believe that?

#1 The USA industrial reshoring will require massive automation - Labour is too pricy

#2 China will require massive automation - they lie about their population, central government tax the population but local government spend the money based on headcount. It is the latter who claim there are 1.3bn Chinese. Sources say the truth is closer to 0.7bn. Regardless, China faces a huge demographic time bomb due to the 1-child policy

#3 Japan will require massive automation due to their demographics and immigration policy. The West will choose automation and robotics above immigration to solve their demographics issue, I believe.

#4 The Rest of the World will have to follow the above nations and embrace robotics or lose competitive advantage.

#5 Robotics in Military Applications will - and is - driving Industrial and Social Applications. Just look at the Russia-Ukraine war. Today’s article explores this theme of holdings serving the Military.

#6 If AI is the brain then the brain will need a body (if you want to do more than just chat with GPT). That body is robotics.

The Top 20 bounced 1.5% today on average.

#1 Keyence

£65bn and £1.88bn earnings puts this at 34.5X. Keyence is an innovative leader in the development and manufacturing of industrial automation and inspection equipment worldwide. Its products consist of code readers, laser markers, machine vision systems, measuring systems, microscopes, sensors, and static eliminators.

#3 NVDA Nvidia

Seems BOTG reducing NVDA was a smart move. But now NVDA is down over a third where does NVDA go from here? What if there is recession? Well evidence of correlation between Data Centre usage and GDP growth rates is weak. In fact during the 2007-2009 downturn IP traffic still grew at 40%-60%, and also grew rapidly during the Covid-19 recession.

If spending on “real experiences” drops (e.g. foreign holidays) will gaming offset this? If spending on employment falls will automation offset this?

Meanwhile a P/E of 41.4X (per my prior article) has collapsed to 27.8X

At #3 NVDA remains a large position for BOTG and the thesis remains that while the numbers are mind boggling (a market cap equal to UK annual GDP) the growth and profitability is rapidly justifying that valuation - in that profitability and growth can continue.

Blackwell grew from zero to $11bn and is “in full gear” with data centre expansion at 93% where essentially that is a contract sale with renewal.

If you value NVDA as though you would a SAAS business and the mathematics are incredible. Let’s ignore gaming, Professional Visualisation and Automotive for a moment. Just Data Centers (90% of revenue). Consider that cumulative sales are $203bn. Consider the FY24 growth was 709% of average FY18-FY23. That FY25 delivered $115.3bn so well over double FY24.

Assuming 70% margin (it’s 73%-75% but with Blackwell it’s forecast to drop a little short term), and a replacement cycle of 5 years. If we further assume that in 7 years Data Centre customers have been through 4 cycles i.e. there are $50bn of chips in use “live” today then with a 5 year cycle we are looking at $10bn per year repeat business. Evidence shows the cycle is much shorter due to the intense power computes of AI and Video. Chips wear out faster.

By including growth of new Data Centers with replacement cycles you can get to a P/E falling to 19 then to 15. Agree the cycle is shorter then the P/E drops potentially to the pre-teens. And of this without considering triple digit growth in Automotive (and vehicle autonomy), Gaming and the Metaverse plus the slower growth of Professional Visualisation. Then there is the robotics segment. All of that is on top of semiconductor chips for data processing in Data Centres.

NVIDIA’s technology has increasingly been adopted for military applications. The company’s AI platforms, like the DGX systems, are used in defence for autonomous systems, simulations, and cybersecurity.

Military Involvement: NVIDIA has contracts with the U.S. Department of Defense (DoD) and other defence entities. For example, their GPUs power AI-driven systems for military simulations, autonomous drones, and battlefield analytics. In 2023, NVIDIA announced partnerships with defence contractors like Lockheed Martin to integrate AI into military systems. More recently, in 2024, NVIDIA’s Jetson platform (used for edge AI) has been deployed in military robotics and drones.

Revenue from Military Sales: Exact figures for military revenue are not typically broken out in NVIDIA’s financial reports, as they report revenue by segments like Gaming, Data Center, and Automotive. However, as part of the Data Centre segment industry estimates suggest that defence and government contracts (including military) account for approximately 5-10% of NVIDIA’s Data Center revenue, translating to roughly $1.3 billion to $2.7 billion in 2024.

#13 UIPath

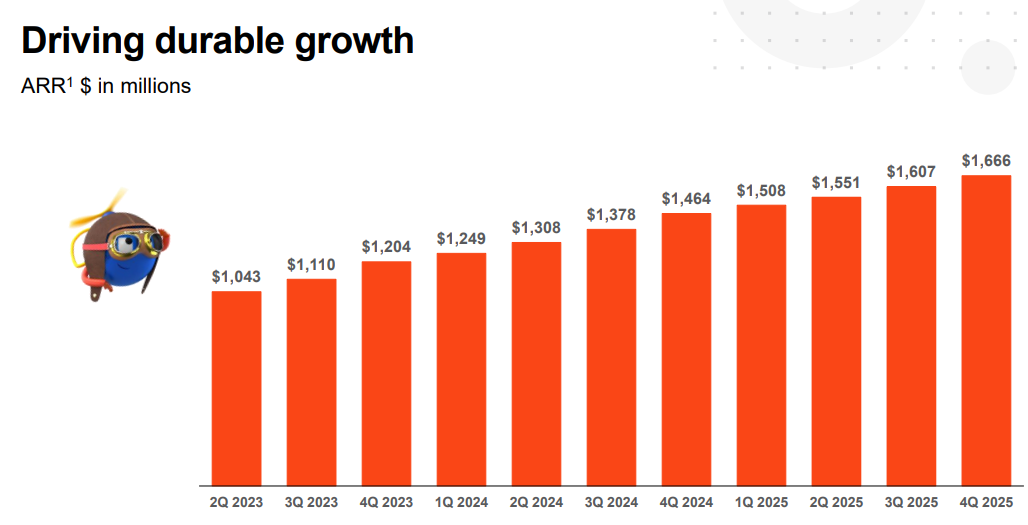

A P/E of 41.6X but forecast to fall to 20.8X inm FY26. UIPATH is on a path of durable growth. This is the application of AI to workflows (so similar to Pegasystems)

It employs Agentic AI.

While both agentic AI and generative AI (GenAI) are pivotal technologies, their focuses differ. Each has its unique strengths and applications.

GenAI is possibly the more familiar. It excels at creating new content across various formats, including text, images, music, and even code. It's adept at brainstorming ideas, crafting compelling narratives, and generating innovative solutions. However, generative AI primarily focuses on creation, relying on human input and guidance to determine the context and goals of its output.

Agentic AI, on the other hand, is action-oriented, going beyond content creation to empower autonomous systems capable of independent decision making and actions.

UIPath claim their customers improve their processes in 90% of cases.

Nothing to do with Military!

#15 Rainbow Robotics

Rainbow Robotics is a South Korean company specialising in humanoid robots and collaborative robotics, with a notable focus on military applications.

Military Involvement: Rainbow Robotics has developed robots for the South Korean military, including humanoid robots for reconnaissance and logistics support. In 2023, they showcased a military-grade humanoid robot at a defence expo in Seoul, designed for tasks like bomb disposal and surveillance. They have contracts with the South Korean Ministry of Defence, and in 2024, they expanded their military portfolio with a quadruped robot for border patrol, similar to Boston Dynamics’ Spot but tailored for defence.

Clippity clop, Clippity clop - it’s not a stealth robot - that’s for sure.

And meet South Korea’s Johnny 5 - needs no input.

Revenue from Military Sales: Rainbow Robotics is a smaller company, and detailed financials are less accessible - and in Korean!

In 2023, their total revenue was approximately 50 billion KRW (about £30 million) Military contracts accounted for roughly 30% of revenue. In 2024, with expanded military projects, this proportion likely grew to 35-40%, or approximately $13 million to $15 million USD, though exact 2024 figures aren’t publicly available as of my last update.

#16 UBTECH

Jim Mellon called out this Chinese stock at the Master Investor show as an investment in “Humanoids”. If you don’t fancy investing in Hong Kong directly then BOTG is a UK-listed way to access this share.

YouYou is a Panda, pictured below. Powered by 41 servo joints it can perform Tai Chi and Yoga. It is a human companion robot. Not sure what else it does. Could it have military purposes? Or are Pandas just a demonstration of Soft Power?

There are a plethora of products. This one caught my eye.

Mobility Scooters meet Robotics. This chair sees obstacles through its Lidar and can be summoned by its user so has autonomous driving complete with app.

They are selling £140m of stuff in 2024 up 30%: £35m education robots, £35m of Logistics robots and £50m of Consumer robots with £20m of other stuff.

They lost -£115m in 2024, and it’s a only got £250m net assets. Yet it raised new capital 4 times throughout 2024 and “magicked” a Capital Surplus to its accounts of over £100m with no explanation (it doesn’t appear connected with the new capital raises). It is my first time reading a Mainland China accounts and there is no cash flow statement so I am not entirely comfortable with the opacity (is the Capital Surplus government funded maybe?). There is no auditor report. The auditor is PWC and the annual report says that PWC “the figures have been agreed” but nothing more.

UBTECH has also ventured into military applications:

Robots for military logistics, surveillance, and support roles. In 2022, they partnered with the Chinese People’s Liberation Army (PLA) to deploy robots for border surveillance and disaster response in military contexts. By 2024, UBTECH’s Walker robot was adapted for military use, including carrying supplies in rugged terrain. They’ve also collaborated with Chinese defence firms to integrate AI into military robotics. Military contracts are estimated to make up 15-20% of revenue.

Beyond this UBTECH are clearly selling a lot of stuff to someone so you can only conclude there is something there. But the lack of transparency (or is it just a lack of familiarity?) make me unsure about this one.

But where the numbers don’t tell a story this video explaining “Brain Net” Swarm Intelligence makes me rethink my scepticism…. the industrial and military applications are obvious assuming this video is not just conceptual smoke and mirrors.

#18 Aerovironment

AeroVironment is a U.S.-based company specialising in unmanned aerial vehicles (UAVs) and drones, with a strong focus on military applications.

AeroVironment is a major supplier to the U.S. military, particularly known for its Switchblade loitering munitions (often called “kamikaze drones”) and small UAVs like the Puma and Raven. They have significant contracts with the U.S. DoD, including a $990 million contract awarded in 2023 for Switchblade systems, to be fulfilled over several years. In 2024, AeroVironment also secured contracts to supply drones to Ukraine via U.S. aid packages, further boosting their military sales.

Revenue from Military Sales: AeroVironment’s financials are more transparent about military revenue, as defence is their primary market. In their fiscal year 2024 (ended April 30, 2024), AeroVironment reported total revenue of $717 million, according to their annual report. Approximately 85% of this revenue came from U.S. government contracts, predominantly military, which amounts to about $610 million. International military sales, including to Ukraine, made up another 5-10%, or $36 million to $72 million, bringing their total military-related revenue to roughly $646 million to $682 million in 2024.

SMALL HOLDINGS (below Top 20) and their Military Robotics

These make up less than 20% but many have military customers and applications. They are discussed briefly.

SOUNDHOUND AI INC-A

SoundHound AI focuses on voice AI for industries like automotive, restaurants, and retail. Despite having a board member with military ties (Steve Bigari, a West Point graduate), there’s no evidence of direct military contracts or sales. Their revenue comes from commercial sectors, not defence.

Military sales: NoC3.AI INC-A

C3.ai provides enterprise AI software, and they have a significant presence in the defence sector. They’ve secured contracts with the U.S. Department of Defense (DoD), including a $500 million agreement in 2022 to provide AI solutions for military applications like predictive maintenance and logistics. In 2024, they expanded their work with the U.S. Air Force. Defence is a key vertical for C3.ai, with military sales likely contributing a notable portion of their revenue.

Military sales: YesAUTOSTORE HOLDINGS LTD

AutoStore develops automated storage and retrieval systems for warehouses. Their focus is on commercial logistics (e.g., e-commerce, retail).

Military sales: NoHIAB OYJ

HIAB, a part of Cargotec, manufactures load-handling equipment like truck-mounted cranes and forklifts. They have a history of supplying equipment to military forces, including the Swedish and Finnish armies, for logistics and transport. In 2023, HIAB secured a contract to provide loader cranes for military vehicles in Europe. While not their primary market, military sales are part of their business.

Military sales: YesATS CORP

ATS Corporation provides automation solutions for industries like automotive, life sciences, and energy.

Military sales: NoTECAN GROUP AG-REG

Tecan develops laboratory automation and liquid handling systems for life sciences, primarily in healthcare and research.

Military sales: NoROBOSENSE

RoboSense (also known as Suteng Innovation Technology) is a Chinese company specializing in LiDAR sensors for autonomous vehicles. While their primary market is civilian (e.g., self-driving cars), LiDAR technology has military applications, such as in autonomous military vehicles or surveillance. In 2023, RoboSense was linked to Chinese military research programs, suggesting potential military sales, though exact details are limited.

Military sales: YesRENISHAW PLC

Renishaw manufactures precision measurement and 3D printing systems for industries like aerospace and automotive. They supply components to defence contractors (e.g., for military aircraft), and in 2022, their annual report noted sales to the aerospace and defence sector. While not a primary focus, military sales are part of their revenue stream.

Military sales: YesDOOSAN ROBOTICS INC

Doosan Robotics, a South Korean company, produces collaborative robots for industrial automation. They’ve developed robots for the South Korean military, including a 2023 project for logistics robots used in military bases. Military sales are a small but confirmed part of their business.

Military sales: YesSYMBOTIC INC

Symbotic provides AI-driven warehouse automation for retail and logistics (e.g., for Walmart). Their focus is entirely on commercial supply chains.

Military sales: NoKALMAR OYJ-B SHARE

Kalmar, another Cargotec division, supplies cargo-handling equipment like reachstackers and terminal tractors. They have a history of military contracts, including a 2024 deal to provide container handlers to the U.S. Army for port operations. Military sales are a small but present part of their revenue.

Military sales: YesOMNICELL INC

Omnicell develops automated medication management systems for healthcare.

Military sales: NoHESAI GROUP

Hesai is a Chinese LiDAR company, similar to RoboSense, focused on autonomous vehicles. They’ve been linked to Chinese military projects, including a 2023 U.S. DoD report listing Hesai as a company supporting China’s military-civil fusion strategy. While their primary market is civilian, military sales are likely.

Military sales: YesAPPIAN CORP-A

Appian provides a low-code software platform for business process automation. They’ve worked with government clients, including the U.S. Air Force, on projects like logistics management (e.g., a 2023 contract for workflow automation). While not a traditional defence contractor, they do earn from military-related government contracts.

Military sales: YesHELIX ENERGY SOL

Helix Energy Solutions provides offshore energy services, including robotics for subsea operations. They’ve supported military projects, such as a 2022 contract with the U.S. Navy for underwater inspection using their remotely operated vehicles (ROVs). Military sales are a small part of their business.

Military sales: YesPROS HOLDINGS INC

PROS Holdings develops AI-driven pricing and revenue management software for industries like airlines and manufacturing.

Military sales: NoPKSHA TECHNOLOGY INC

PKSHA Technology, a Japanese AI company, focuses on natural language processing and machine learning for commercial applications (e.g., customer service).

Military sales: NoSHIBAURA MACHINE

Shibaura Seiki (Shibaura Machine) manufactures precision machinery, including machine tools and injection molding machines. They supply components to defence contractors, particularly in Japan, for military vehicles and equipment, as noted in a 2023 industry report. Military sales are a minor part of their business.

Military sales: YesFARO TECHNOLOGIES INC

FARO develops 3D measurement and imaging solutions for industries like manufacturing and construction. They’ve supplied laser scanning technology to the U.S. military for applications like reverse engineering and quality control, with a 2023 contract for the U.S. Army. Military sales are a small portion of their revenue.

Military sales: YesIMOTION AUTOMOTIVE

Chinese company focused on autonomous driving systems. While their primary market is civilian, autonomous driving tech has military applications, and iMotion has been linked to Chinese military research in a 2024 report. Military sales are probable but not their main focus.

Military sales: YesROBOTIS CO LTD

ROBOTIS, a South Korean company, produces servo motors and educational robots. They’ve developed robots for the South Korean military, including a 2023 project for small reconnaissance robots. Military sales are a small but confirmed part of their business.

Military sales: YesCERENCE INC

Cerence provides AI-driven voice assistants, primarily for the automotive industry. While they’ve explored government applications, there’s no clear evidence of military contracts or sales.

Military sales: NoAINNOVATION TECH

Likely referring to AInnovation (also known as Sinovation Ventures’ AI arm), a Chinese AI company. They focus on commercial AI solutions (e.g., retail, manufacturing), but they’ve been involved in Chinese military projects, including a 2023 collaboration for AI-based surveillance systems. Military sales are likely.

Military sales: YesHIRATA CORP

Hirata Corporation, a Japanese company, manufactures industrial automation equipment. They supply assembly lines to defence contractors, including for military vehicles, as noted in a 2022 Japanese defence industry report.

Military sales: YesSERVE ROBOTICS INC

Serve Robotics develops autonomous delivery robots for commercial use (e.g., food delivery).

Military sales: NoANGEL ROBOTICS CO LTD

Angel Robotics, a South Korean company, focuses on wearable robotics for rehabilitation. They’ve developed exoskeletons for the South Korean military, including a 2024 project for soldier assistance systems. Military sales are a small but confirmed part of their business.

Military sales: YesRICHTECH ROBOT-B

Richtech Robotics develops service robots for hospitality and healthcare.

Military sales: NoIROBOT CORP

iRobot is known for consumer products like Roomba. They do have a history in military robotics and developed the PackBot for the U.S. military, used for bomb disposal in the early 2010s. However, iRobot exited the military market in 2016 to focus on consumer products.

Military sales: No

Conclusion

A popular theme right now is defence stocks. The likes of BAE trades on 20X.

Robotics offers another route and potentially an extremely lucrative one.

Quite a number of holdings have links to the military and are involved in programs. Military development will likely drive civilian applications and uses.

Regardless of military use what about the demographic timebomb? Could that be disarmed through robotics, perhaps? An ageing population cared for by robots.

A shrinking workforce becomes an unlimited workforce, limited only by electrical power and energy storage, rather than by births and deaths.

Such a world could be a utopia but would bring other challenges. Regardless of whether that utopia is possible, the rewards for investors into one of the largest macro forces of today’s world - robotics - is less loved than AI stocks but just as profound. Just as a human is a mind, body and soul, robotics is the body to the AI mind.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, you make your own investment decisions.

Micro cap and Nano cap holdings including those held in an ETF might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Aerovironment up significantly this week.

https://theoakbloke.substack.com/i/160838162/aerovironment

Definitely an area to have some exposure to I reckon.