Tekcapital owns 5.2 million shares in Innovative Eyewear which is ~40% of the total issued share capital. At today’s market price of $0.65 that ownership is worth $3.4m/£2.7m or 1.52p/TEK share (TEK is £21.4m market cap total at today’s 11.5p). Because TEK has a controlling interest there’s a 15% mark up in the books so 1.75p/TEK share.

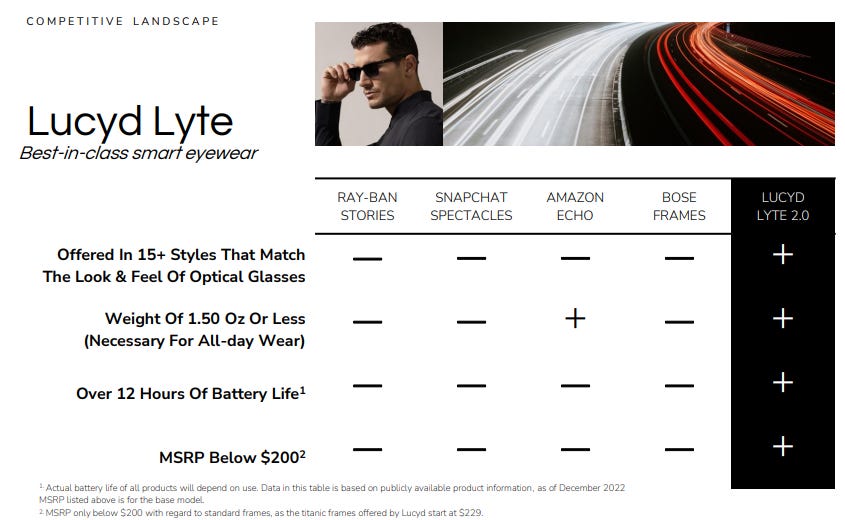

Innovative Eyewear (whose brand name is Lucyd) was founded in Florida in 2019 with the aim of delivering smartglasses which have style, technology and affordability. Lucyd have 63 patents pending/granted including a voice to query Chat GPT interface, the best battery life, lightest weight and an ability to add prescription lenses.

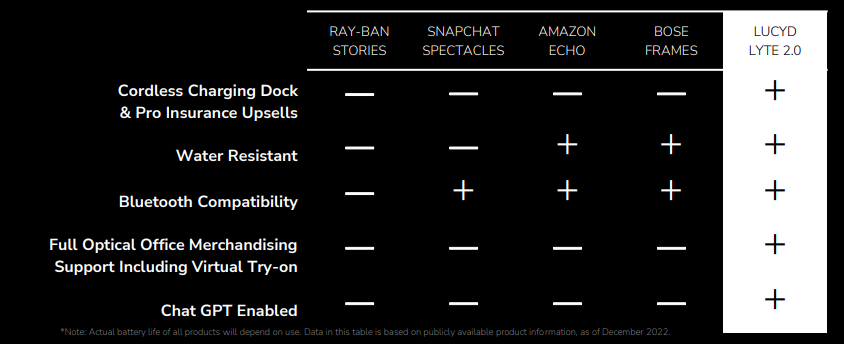

This chart is from their investor guide:

The share price tells another tale. That’s dropped from $7 at IPO to less than a tenth (over 90% destruction). A recent placing raised at $1.05/share raised $4.1m net.

So what happens next? LUCY’s June Q2 report makes interesting reading.

1. Historic quality issues are now resolved. The negative gross profit is largely due to this and the cost of free replacements.

Distribution Mix - with over 300 retail stores selling Lucyd Lyte, primarily located within the United States and Canada more and more Lucyds are being sold via channel. “Based on the existing demand for our products, current distribution, and recently consummated supply agreements, we anticipate that our products will be available in a significant number of new third-party retail locations in 2023.

White Labels - “we expect a more notable increase with the rollout of our Powered by Lucyd branded products over the next year.” The introduction of fashion-branded products from the Authentic Brands partnerships with Nautica, Eddie Bauer, and Reebok are expected to significantly increase retail store presence due to the popularity and built-in following of these brands.

Lucyd released the Summer Collection at Miami Swim Week - the centerpiece of Miami Beach Swimsuit Fashion Show’s festivities. Held every at the Miami Beach Convention Center, SwimShow draws more than 7,500 swimwear buyers, manufacturers, designers, press, bloggers, influencers, fashion consultants, stylists, VIPs and other fashion industry leaders from over 60 countries.

Lucyd announces a partnership with Privato who operate 105 stores in Fixed Based Operators terminals FBO – It’s a terminal for Private Jets and their passengers. These FBO locations average 9,000 flights Annually with an average of 8.2 passengers per flight. FBO passengers are Ultra high net worth Individuals accounting for top .5% income earners globally

Q3/Q4 2023 planned features include XL glasses, the ability to access AI other than ChatGPT from the Lucyd app, the addition of an audio content library for users to enjoy, and further enhancements to the core AI functionality. In terms of the Vyrb app, LUCY is launching a full peer-to-peer content marketplace in the style of Patreon, but with a focus on audio and content designed on and for wearables. Additionally, the Company hired a new full-time software engineer, and spent significant amounts on new product moulds to enhance its core product offering.

The Lucyd Lyte version 2.0 product is receiving significantly higher ratings online compared to our previous products, indicating that customers are appreciative of improvements in product design, functionality and build quality. 11 out of 15 of the sunglass styles on Amazon carry a 4.1/5 rating or higher, compared to most products with an approximate 3.5/5 rating from our previous collection. This is a very strong signal of early positive feedback on our products that indicates our ability to grow and scale with America’s largest online retailer and other platforms.

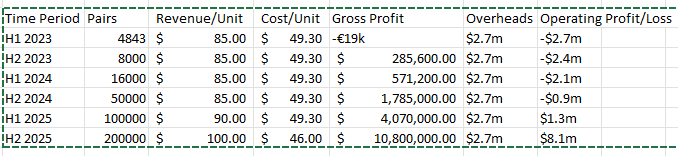

So show me the money!

Rationale: Lucy’s Q2 data shows 15,422 cumulative online orders since 2019, so about 900 pairs of glasses a quarter on average. We also know approximately 33% of sales were processed on our online store (Lucyd.co), 34% on Amazon, and 33% with reseller partners. So we can deduce that using a $65 price (heavily discounted sales and wholesale discounts) that sales in H1 2023 of $314k must equate to 4,843 set of glasses (I’m ignoring accessories sales).

I’m assuming a 40% of glasses needed replacement so cost of sale would otherwise have been $238k meaning that gross margin on Lucyd’s must be 32.3% average. But with Lucy'd 2.0 we know that there have also been price rises. So I’m using an $85 average revenue/unit going forwards.

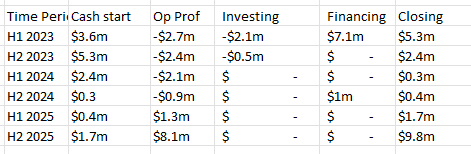

Based on the growth projections we’ve already seen I arrive at a model which turns margin positive in ‘23, and cash positive in 15 months - and net profitable.

Notice I’m assuming $1m of warrants converting next year…. assuming this is at the $1.05 rate then that’s 0.95m shares so a 6% dilution (reducing TEK to 37.3% ownership). Or assuming warrants for 65c (current price) then dilution to 35.8%.

What’s it worth?

On a forward FY2025 PE of 1, the current share price is actually ridiculously cheap. A PE of 15-20 wouldn’t be unreasonable, and a take out price of 25 times isn’t impossible. A 25x sale if they were taken out by Amazon for example would mean 38p of cash per TEK share.

Where’s the downside?

Can they rein in their spending? There’s very little leeway in the numbers. Notice I’m working on overheads remaining static.

What if there’s more disappointment with quality? Q2 report says it’s 100% resolved but what if something else happens.

Competitors - competing with Bose and Amazon etc isn’t the most comfortable place to be - real David and Goliath stuff.

Where’s the upside?

App Store Type Sales - this is spoken about in their Q2 results. Apple make 10% of revenue this way.

Licencing of patented technology - 65 patents including AI interfaces.

Industrial Application of Lucyd - Safety Glasses market is worth $3.7bn/year

Warrants outstanding are worth $11.7m so $1m is conservative. TEK would own 26.8% of LUCY if all warrants were exercised. Will TEK inject more cash in e.g. following a sale of another portfolio member? Harrison (CEO of LUCY) is Clifford’s (CEO of TEK) son remember.

How does LUCY compare?

A dude compares: 1/ Amazon Echo Frames, 2/ Ray-Ban Stories, 3/ Lucyd Stratus, 4/ Razer Anzu, 5/ Ampere Dusk and 6/ Bose Frames Tempo glasses

What Lucyd does (uniquely):

> Widest range of style and Lens

> Chap GPT

> Near 1st place audio quality

>1st place Microphone/call quality

> Best Battery Life

Vs: What the competition can do:

> Built-in Cameras

> Carry cases with charging facilities in the case

> Swappable lenses

> Auto volume (changes the volume according to ambient noise)

> Change the tint through the app

> Find my glasses alarm through the app

> Alexa Integration

What’s great however is these brands are opening up the consideration for “Smart Glasses” and then people will watch videos like this one and potentially decide on LUCY.

My posts are written for my benefit, you see, to set out my investment rationale to myself. I hope you enjoy what I write and find it entertaining but also useful in forming your own rationale.

Good luck.