Dear reader,

The smell of metaphorical rotten vegetables remains. The echoes of boos, hisses and jeers from 5 years past. A lot of angry folk who’d followed a star investor who fell spectacularly from grace in 2019.

Despite being managed by Schroders for nearly five years since and having gone through two name changes to the current moniker: “Schroders Capital Global Innovation Trust” (Ticker INOV) it still carries a certain whiff. The majority of “global” objects surrounding it are rotten tomatoes one might suppose.

At the risk of mixing metaphors (and barge poles) most investors simply won’t touch it with a barge pole - but come armed with colourful metaphors. Any investors that have stayed on board waiting for a turnaround are likely sitting on losses growing each year, as the 5 year view shows, harrumphing loudly at their ill fortune, and how awful Schroders have been.

So when a reader asked me to look at this I was dubious. I felt that INOV had started selling ONT in 2024 at exactly the wrong time - and given its recent rerate I was correct to think so. I also knew the ghost of Woodford’s “patient capital” (a sickly patient indeed) holdings remained in the portfolio although not by precisely how much.

Was there any point analysing this stock? Surely I should just lob some rotten tomatoes and generally harrumph and perhaps make some snide comments on Schroders incapability. After all that’s the fashionable approach in the chattersphere, isn’t it?

And given the -17.1% NAV 1H24 performance and -11.2% NAV performance in the latest results FY23 it wouldn’t be hard to dig some dirt, and say it was just rubbish.

But I also knew there were some really good holdings in INOV. I refer to Atom Bank and Revolut, particularly. Regardless of whether you consider Oxford Nano good or bad (OB readers know I believe it’s the former and I’ve set out detailed reasoning why), it is LISTED, therefore has a realisable value - and there are other listed holdings too. So let’s consider those as liquid funds.

What do we see when we start to look at the wheat and chaff?

Is there enough wheat here to make even a 57.5% discount seem good value?

What about Schroder’s newer picks - are they any good? (Here’s an elevator pitch to get you started)

Read on reader, read on!

The quick version is that if you accept what is the apparent fact that INOV’s current market cap minus its listed holdings (shares and funds), minus its cash, minus Atom and Revolut at their book values adds to £80.7m and that’s £1.7m more than the market cap.

That’s an Ah Hah moment, isn’t it?

But then consider there are £98.5m of other investments too.

Does an “Ah Hah” moment become an “Oh Wow” moment? (Hint: You might need to repeat this phrase again later in this article)

Also consider there’s a continuation vote due in 2025. Do you add an “Oh Ho” moment too?

Before I discuss other investments let’s substantiate the above statement that the market cap is covered.

Statement 1 - Atom Bank is worth (at least) £23.1m.

Atom Bank is the UK’s first bank built exclusively for mobile. It aims to redefine what a bank should be, making things easier, more transparent, and better value. Atom Bank currently offers savings accounts, mortgages and business loans.

Atom Bank published its full year 2024 annual report for the year ending 31 March 2024 detailing:

32% growth in net interest income (from £76 million to £100 million)

Net interest margin remained stable at 2.8% despite pressure on spreads within the residential mortgage market

Deposits grew by 14% from £5.7 billion to £6.6 billion

Loan book grew by 39% from £3.0 billion to £4.1billion

Operating profit grew by 575% from £4 million to £27 million, primarily due to the loan book growth

The valuation of Atom Bank based on a £100m fund raise in November 2023 with ToscaFund and Spanish bank BBVA at a valuation reduced from £435m to £362m. INOV owned 7.28% following this and marked down its valuation by £8.6m. Eagle Eyed readers will spot that 7.28% of £362m is actually £26.4m.

So this is held at a £3.3m discount to its last valuation.

Or considering Atom Bank’s balance sheet (a nefarious thing to do for a bank I know) £402.4m Equity at 7.28% ownership equates to £29.3m, so INOV’s valuation is at a £6.2m discount to its NAV. Or excluding intangibles of £41.6m then £360.8m NTAV is £26.3 so a £3.2m discount.

Intangibles are probably worth worth than £41.6m by the way - in my opinion. To evidence that statement what price should you put on a +88% NPS? The next best “big bank” is First Direct which has a +63% NPS? Look at their brand credentials - £41.6m is a bargain for that level of satisfaction and feedback.

Bain & Co have some ground breaking research that a bank with a high NPS means customers tend to buy more stuff, are less likely to defect and more likely to recommend. Well I never?!

Statement 2 - Revolut is worth (at least) £8.7m.

Revolut annual report for the year ending 31 December 2023 detailed 46% customer growth (from 26 million to 38 million), 95% group revenue growth (from £0.9 billion to £1.8 billion) and a profit before tax of £438 million.

The £8.7m valuation today is reduced from £11.75m back in April 2023 and is based on a $24.4bn valuation of Revolut. The original £11.75m or $15.25m holding itself was based on a $33bn valuation which is a 0.046% holding so of course tiny. But consider the recent secondary share sale which provided liquidity for Revolut employees to sell (successfully) at a $45 billion valuation.

At a $33bn valuation there is £3m hidden in INOV’s £8.7m valuation. At $45bn there’s a further £4.3m hidden (so £7.3m hidden total)

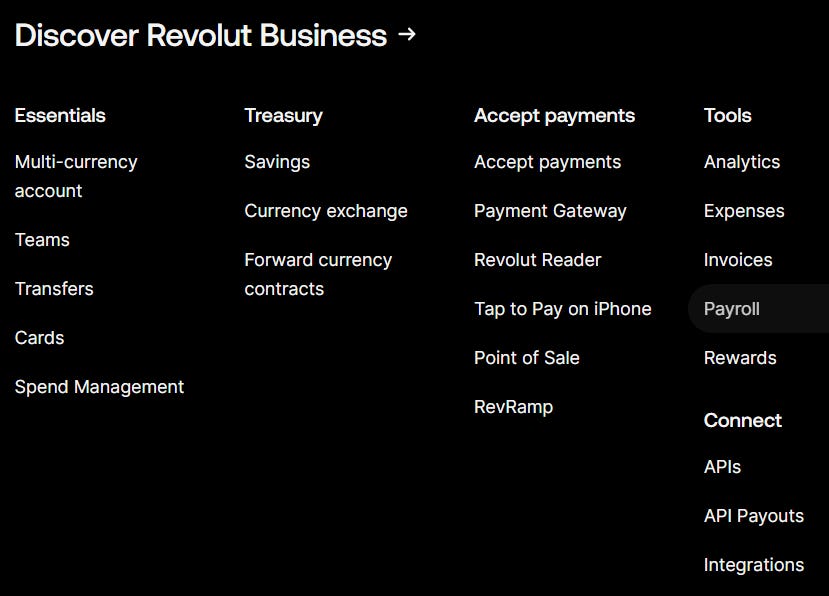

It doesn’t even seem fair to call Revolut a challenger bank when their portfolio of services rivals and exceeds that of the traditional UK banks and continues to grow.

Revolut has finally received its UK banking licence in July so is engaged in its build out of UK banking operations. Revolut recently did a deal with CMC markets on stocks (for the UK) and has a similar arrangement in the US.

Statement 3 - Listed holdings and cash is worth at least £49m

While I’ve not forensically checked each listed holding there is cash (£6m) which is err liquid, and a large holding in a listed Schroders Fund (£25.2m) which is large and liquid and ONT is liquid (£12m). ONT’s recent news of it changing its listing type which will very likely join the FTSE250 (towards the top end) in the next quarter is positive. That and ONT’s continued successful commercialisation and growth bodes well.

So to conclude on the value of the holdings covering the market cap (plus £1.7m) itself, seems pretty solid. In fact the £7.3m hidden in Revolut and £6.2m in Atom (£13.5m) potential upside seems quite reasonable to include in a valuation.

“Other Investments” £98.5m

One simple fact is that about 60% of the holdings in the price for ZERO are Schroders and NOT ex-Woodford.

£58.9m Schroders and £38.6m ex-Woodford.

I bet that comes as a surprise to folks.

However there are numerous ex-Woodford zero value holdings which lost 100% of their value - including some which failed in 2024 like OcuTerra.

Woodford £38.6m

Checking back 24 months I can also see a sea of red where only HP Env’t Tech Fund has made a £0.5m gain. £29m of holdings meanwhile have lost £40.5m - so were worth £69.5m 2 years ago.

Some of these downward valuations are simply growth stocks struggling to raise follow on funds in a harsh world. Technologically they have merit but merit doesn’t pay the bills.

A downwards revaluation to Reaction Engines, an Oxfordshirebased firm developing innovative thermal management solutions for aerospace and other industries, suffered slower than anticipated revenue growth and required further financing and time to become cash positive - so a subsequent downround reduced INOV’s holding.

Meanwhile even though Nexeon is down over 2 years it fell and has been increasing during in the two years and in the 1H24 update announced the start of construction for its first commercial-scale plant to deliver silicon anode material starting in 2025, fulfilling a binding supply agreement with Panasonic. So £8.2m appears fairly solid to me.

Federated Wireless offers Wireless As A Service to US government agencies and businesses providing secure and high speed access. It is continuing to commercialise its offering.

Genomics was also a downround but is expanding its offering and offers an interesting data service to help overstretched health services profile patients according to risk scores (aka a stitch in time saves nine).

So while you could pessimistically write off a further £10m worth of ex-Woodfords that might not make it, the other £30m seems to have a fighting chance of achieving at least a 1X return.

Schroders £58.9m

It might interest you reader to know that taking the 1H22, the 1H23 or 2H23 (i.e. whenever they were added) compared to today, that Schroder’s picks were bought for £51.5m and today are now worth £58.9m? Schroders picks delivered a £7.4m gain. Bet you didn’t see that coming?

Also notice a sea of green with 4 reds (lost money) and of those 4 losing money one of those losses is a fairly irrelevant £6,000 loss. And it’s an AI company, no less.

Consider not only are they “green” as in growing in value, but they are ripening towards potential acquisition, or proof of concept - which would be a rapid jump in value.

Artificial Intelligence

Would you credit INOV with having some exciting AI investments?! Well £11.5m of the £89.5m that’s in the price for free are 3 AI holdings. So secret that two of the three are only known by their Roman Numerals.

a/ Securiti – the pioneer of a centralised platform that enables the safe use of data with generative AI covering security, privacy, governance and compliance.

b/ “AI Company I” (MMC SPV3) - an early leader in an emerging segment of AI software.

c/ “AI Company II” – a privately held company that provides high-quality data curation services for generative AI models and application developers.

Can you usually acquire £11.5m worth of AI companies for free, reader?

A 320% Return

Finally, let’s also not forget Schroders additions and subsequent disposals. It achieved a 3.2X in 1 year on Carmot, for example. That’s pretty impressive!!

Conclusion

Writing this article has led me to form the following opinions:

The cash/listed/Atom/Revolut equals 10.4p a share price and is pretty solid.

There’s 1.6p a share potential upside on Atom and Revolut

Even writing off £10m (not based on anything other than past record) the remaining £28.6m of ex-Woodford is reasonably solid. That’s 3.5p a share.

All of Schroders £58.9m or 7.2p per share is pretty solid and has a good overall track record so far where gains exceed losses.

ONT is at £1.39 per share. Its target price is at least double that. If you agree with that statement then that’s £12m or 1.5p upside per INOV share.

Depending on whether you agree with point 5 you arrive at 22.7p or 24.2p per share. And that’s pretty much before you consider any kind of further and future upside to the holdings.

Will INOV lose its continuation vote next year? Well, as a shareholder to INOV I’ll be voting please continue! But are other shareholders willing to put down their rotten fruit? For INOV to emerge out of purgatory and into a brighter future? I can only hope so.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks for the write up I went through it a few weeks ago but held off buying as don’t love the top stock Atom bank and I’m already full of challenger banks (although I do love the sector) with direct holdings in Monzo and Revolut.

However, an article I came across today made me give it a second look.

https://news.sky.com/story/former-chase-uk-boss-swoops-on-atom-bank-stake-13253048

This shows there is firm interest in the stock at the most recent valuation. Possibly even an opportunity for INOV to offload. That gives me comfort on this name.

Revolut is 100% worth the 45bn with GS negotiating more stock sales to their private clients at this price post the secondary employee sale.

My biggest concern is the continuation vote. I just don’t have any idea how this plays out in practice if shareholders vote for wind up. Does this leave shareholders in a Woodford style situation where holdings will be fire sale’d and fees will be charged to handle the process. This just doesn’t seem like it will end well if that’s the case (even if the holdings are sound). Can anyone provide insight into what a failed continuation vote looks like in practice for a fund like this?

Many thanks as always!

How about the most unloved share? Probably better choices but potentially Nanoco, it’s mcap is around its cash position last I checked, so its IP is essentially free. The accounts are held back this year, but expecting EBITDA of £0.6m