I bought Augmentum when I heard it owned part of InteractiveInvestor. Big fan of “ii”, way better than HL or the bell ringing mob, and usually much cheaper too. Then they sold II to Aberdeen for a tidy sum. AUGM also held Cushon which Lloyds Bank bought… for a tidy sum. (a 46.2% premium worth +3.1p to AUGM’s NAV)

AUGM was on a premium for such a long time that its current discount to NAV following such recent succesful trade sales baffles me. The downside protection is has, its rewards structure I could get quite uber geeky about what I like about AUGM. So when a reader asked for its inclusion in the OB Top 20 I readily agreed it should be considered.

Here are the 24 holdings as at the Interim Report 30/09/23:

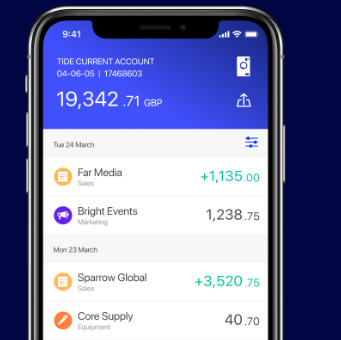

Tide

Tide announced on 20 September that it has reached 10% market share of all UK small businesses, with more than 550,000 customers. It bought the UK’s leading business credit marketplace Funding Options in November 2022, with regulatory approval from the FCA in February 2023. The acquisition fast-tracked the company’s credit offering by providing existing and new members access to over 120 lenders.

The past year also saw Tide realise the first steps in its international ambitions, as it officially launched in India in December 2022, expanding throughout 2023. Tide now has more than 150,000 members in India.

Grover

Is a pioneer in the circular economy: Its business model of renting out and refurbishing tech products contributes to devices being used more frequently and for a longer period. This increases the potential to avoid e-waste. To date, Grover has circulated over 1.2 million devices, employs over 400 people, and stands as one of the fastest-growing scale-ups in Europe.

Zopa

Since launching in 2020, Zopa Bank has attracted £3.5bn in deposits, more than £2bn of loans on balance sheet, and issued 470,000 credit cards. Building on its profitable foundations, today Zopa Bank has 1 million customers generating an annualised revenue run rate of £250m. It is expected to serve 5 million customers by 2027. It’s almost certain to IPO in 2024.

Volt

This one seems exciting. Visa and Mastercard control pretty much all payments don’t they? Don’t they? Well Amex exists too, but it’s an oligopoly of what’s called “Payment Rails”

Now, you might, consider crypto might be the death of payment rails but I’m not seeing that happen. Crypto is just a greater fool investment. Buy it to sell to a greater fool. Like a ponzi. My pessimism towards crypto might jar with some readers, but I’m sure there were some big Tulip and South Sea fans back in the day also.

Anyway, Volt plans to replace payment rails with account-to-account payments connectivity for international merchants and payment service providers (PSPs). Using Open Banking Volt provides account-to-account payments where funds are moved directly from one bank account to another. A very disruptive fintech with enormous opportunity to disrupt the long-held status quo. Do you think the oligopoly would look to buy Volt at some point? Or would the likes of the Magnificent Seven look to buy it to “cut out” Visa/Mastercard?

Six months ago Volt’s Series B funding round was 2.7x the prior valuation and provided a £11.4m uplift (6.3p a share) to AUGM. It also meant Volt has a $60m warchest too. Volt also announced partnerships with Shopify and Worldpay.

Conclusion

All of these are funded to profitability and in fact in the interims AUGM announced its portfolio have an average 29 months runway. Let alone that AUGM holds £50m cash (18% of NAV)

Digging into some of AUGM’s holdings there are disruptive fintechs able to grow and grow. Potentially worth a great deal to the right buyer. Others ripe for an IPO in 2024.

A 52% discount (ex cash) is superb value in my opinion.

AUGM is part of the Oak Bloke Top 20 provided for your entertainment and interest.

This is not advice.

Oak.