Georgia on my mind

Louis

I’ve no idea where this picture of a statue to Louis Armstrong stands but I’d love to know if a reader can share. New Orleans would be my guess. One of my favourite Louis Armstrong Jazz duets is “all that meat and no potatoes, ain’t just right like green tomatoes”. So how does CGEO measure up and what does 2024 hold for CGEO? More meat and more potatoes? Or will it be green tomatoes?

Sold at the sound of gunfire

I used to hold CGEO and sold shortly after the Ukraine Invasion (along with Polymetal) and also following a price spike when the Water Company Private Holding was sold so around 2 years ago. I feared (and Putin assumed) Ukraine would quickly fold and an emboldened Russia who, remembering their 2008 conflict with Georgia, would quickly strike Georgia - so crashing CGEO - poof money gone.

The opposite happened.

Ukraine stood and stands. Georgia is doing nicely (thank you) despite the conflict partly through the skills influx as the “creme de la creme” of Russians emigrated to Georgia to avoid the military cannon fodder call up.

So Georgia prospers. Now, the EU are offering prospective future EU membership and that is transformative. The 64% discount even at these higher prices feels wrong given the change in status and the outlook for Georgia in 2024.

The Oak Bloke Top 20

So I’m covering this stock as a candidate for my 2024 Oak Bloke Top 20. Just to remind you, reader, I committed to cover 10 of Oak Bloke’s best ideas for 2024 based on the prior 79 articles written since August which I’ve written for your entertainment.

Alongside these, to then include 10 of the best ideas introduced by my readers. In the interests of disclosure, some ideas from readers are Oak Bloke holdings already. And of course, these existing holdings appeal to my natural bias and are more likely to be covered. The Oak Bloke has in his existing articles a Top 30 and has had to cull 20 ideas to give his readers 10 slots. That’s hard. Really hard. 20 children culled to let 10 survive. 29 out of 30 of which I wouldn’t hesitate to recommend - I don’t buy shorts, I buy longs based either on value or growth.

I intend, if I can, to give the same kindness to my readers’ ideas and to give an obituary “why I didn’t include”. Time - as for all of us - is the enemy so I will do my best in the time before I return to work in early January.

CGEO

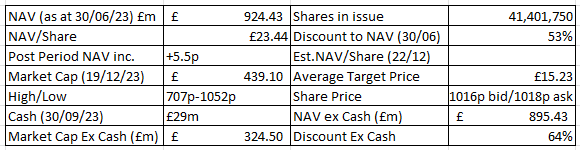

This is the portfolio.

As I began researching for this article, I found another substack - clearly must be an hombre de roble (if you Speak Spanish you’ll get the joke) to have written such a superb article about Georgia Capital. In fact, reader, my work here is nearly done. Just please click on and read his article - and then return here for my further commentary. What can I add to Oscar’s superb job? Well, the key question is this. Noting that I sold and noting, too, Oscar appears to have since sold Georgia Capital is this a buy or sell for 2024?

Defensive

The first thing to say about the CGEO portfolio is that these are defensive holdings. We are not speaking of high tech, high risk ideas. We are speaking about insurance, hospitals, pharmacy, energy, education, housing and hospitality in an economy which has done well despite the Ukraine war, because of the Ukraine war. According to preliminary data, Georgia’s real GDP growth was 6.8% in 9M23.

Where the Water Company was IPO’d at a 30% premium to its holding value. CGEO holds £46.1m in the listed company.

This is CGEO’s balance sheet as at 30/09/23:

Uncool share issuance that’s cool

Oscar raises an concern about uncool share issues from 2018 to 2021, which he goes on to explain was actually accretive as the issuance was to acquire assets (Georgia Healthcare). Smart. More pleasing post Oscar’s article is to see buy backs are now the game in town. Both CGEO and its holding BGEO (Bank of Georgia) have an extensive BB programme. Let’s examine the value there.

Programme value: CGEO $10m (£7.9m) and BGEO GEL62m (£18m).

CGEO has bought back 1.6m shares in 2023 (44,827,862 - 43,200,840)

BGEO has bought back. 0.2m shares since August 2023 (45,914,723 - 45,714,563)

BGEO have authorisation for 0.25m more and CGEO 0.6m more. Assuming a BGEO £39 bb price and £10/share bb CGEO price for these the future uplift to NAV for CGEO is 50p/share - for BGEO as it trades on a premium to NAV the see through impact is subtler.

Bank of Georgia on my mind.

The “usual” way Steve Sedgwick from CNBC taught me to value a bank is to look for ROTE. The return on tangible equity. But BGEO doesn’t share this. They instead use a ROAE (return on average equity) measure which is 30.7% in the latest results. I’ve watched Mr S interview all the UK banks and he would be impressed with 10% and licking his lips at much above this. Other publications like the FT and stockopedia speak of BGEO having a ROE of 40%. This measure has tripled in the past 2 years. It’s on fire. Damn I did consider buying BGEO.

BGEO also yields a 6% dividend so that’s a £20m income each year to CGEO.

The value of the BGEO holding post period (30/09) has increased by £48m.

Here’s my full post period analysis.

Basically I was struggling reconciling the NAV and NAV per share. And this is probably the biggest headache (aka HIDDEN VALUE) with CGEO. Not everything is in GBP.

Some stuff is in GEL, some in USD, some in GBP. Of course you have FX risk with CGEO. Once I considered that, it reconciled beautifully. As I often say around transient factors, today’s “loss” is tomorrow’s gain as these things unwind and therefore today’s loss is today’s hidden value. Saying that I expect GBP will weaken in 2024 and GEL will strengthen. So there’ll be continuing FX losses - just bear this in mind.

Income

Oscar rightly points out positive income in his article, but reader, look at the next part. I gasped.

Comparably for 9M23 income has increased 10X. WOW! Now some of that is BGEO isn’t it - dividend income is up a third.

CGEO then speaks of a “buyback dividend” (BGEO doesn’t mention this term in its report). So what the ‘eck is that? I’ve concluded it’s Georgian language for what the British call a special or one-off dividend. Readers, I’m sure you’ll correct me if I’m wrong. Oscar speaks to trimming the 20.24% gradually down to 19.9% so it might be sale of shares - but if that’s what it is that should be in the P&L as a gain or loss on disposal.

So even stripping one offs out we are still talking a 5X result compared to 2022….

Wait and I am comparing the 12M 2022 vs 9M 2023. So at year end this is likely to be 7X, or 12X including specials.

Right now I feel like a right wally for selling CGEO. I can now see why my reader urged me to cover this.

Let’s continue….

Portfolio

Oscar covers this well so I’m interested in 9m 2023 changes.

What I observe is are:

Impressive ROIC from inception (Return on Invested Capital)

Generally stability in EV (Enterprise Value)

Shrinkage in most implied EV/EBITDA multiples - this is a common theme in many Investment Trusts in 2023 reflecting the higher interest rate environment.

The Insurance Segment shows an impressive performance in 9m 23.

Continuing development and success in their business plans

Deleveraging

Oscar speaks to the paying down of debt as a further means to enhance the NAV which puzzles me. Unless debt is being bought back at a discount I can’t see that’s the case but I do agree deleveraging is reducing interest payments. Since Oscar’s coverage of FY2022, CGEO has gone much further. Its gross debt in 9M23 is now less than half (GEL 819m to GEL403).

Calculator

Cor. If every company had one of these, the Oak Bloke would spend much less time tapping away for hours discovering hidden value. Perhaps share prices would be aligned with their value. But if that’s true it begs the question how people are blind to the value at CGEO when that calculator is automating showing today’s share price for BGEO, and the up to date number of shares. I can only echo Oscar’s urging to click on the link and play around with it, if you are considering the hidden value at CGEO.

Conclusion

Well I think my earlier wally comment sums it up. I’m 100% invested but now pondering which of my holdings is up for a cull to get back in at CGEO.

Is this candidate in the Oak Bloke Top 20 for 2024? Well you’ll just have to wait to find out!

PS I’m going to reach out to Oscar at his substack as I would be fascinated to get his take on why he sold and like me does he regret it?

This is not advice

Oak

Christmas Appeal

I hope you enjoy my articles published for entertainment and interest. But I’d like to ask for your help this Christmas.

The Salvation Army do a huge amount of great work supporting over 3,000 homeless including veterans and people who’ve fallen on hard times. Some people escaping their unsafe home. It’s not just for the homeless the Salvo’s serve a Christmas meal to lonely elderly people too. Please, please, please would you join me in helping the Salvo’s by donating something, even a small amount. DONATE LINK. Click my poll to let me know you’ve done that. And thank you. Merry Christmas.

Hi! Nice writeup, thanks for referencing mine, glad you liked it!

The reason why I sold (at 1025 GBX, around current price) is not fully related to valuation. With countries where geopolitical risk is high and I could get zeroed at some point in time (such as if Russia attacks Georgia or any other black swan event, not saying this will happen) sometimes I sleep bad holding the positions, it might be irrational, but it was getting me increasingly concerned and I sold and added to PAGS. When I sold at the end of September, PAGS (another of my writeups) was trading at depressed prices with huge tailwinds. Additionally, in my opinion, Brazil has less geopolitical risk than Georgia, so I made the change.

Regarding the valuation of CGEO:

>Most of the NAV increase was due to the BGEO re-rating, and I am not sure how BGEO will do with lower interest rates. I think it will do good, but ROE is probably inflated

>Initially I thought that a 0.6x price to book would be more appropriate than current 0.45x, which would mean that CGEO still has 35% multiple expansion plus buybacks plus NAV growth. I am not so sure about price to book though, I think that the multiples that the valuation agency assigns to their portfolio companies might be a bit inflated, so maybe it's not so undervalued.

>I still think CGEO is a bargain, but it's the geopolitical risk that troubles me. I like the deleveraging (new cash from ops and dividends reduces debt, which increases equity and lowers interest payments) and the buyback strategy. For some reason, I cannot get myself to buy it back right now.

When I started investing I was comfortable investing in countries with high geopolitical risk, but, as time goes buy, I think this risk is not so worth it, you can get good returns without this risk investing elsewhere, but it's harder to get bargains. CGEO capital allocation has been great though and if this risk does not materialize Im sure they will do great, but who knows, maybe Russia one day goes for Georgia as they went for Ukraine (hope not!).

Feel free to DM me on twitter so I can follow you @oscar100_x

I believe CGEO use the inaccurate term 'buyback dividend' because they include the receipt of sales (of BGEO stock) within their income from dividends, rather than suggesting their will be a special or dividend payment imminent to stock holders. Missed your usual opening price/spread/NAV header - I find that most useful.