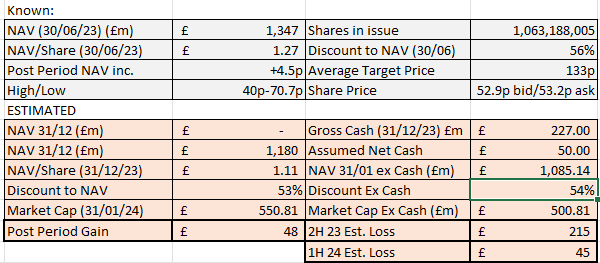

IP Group (Ticker IPO) announced their end of year NAV this week.

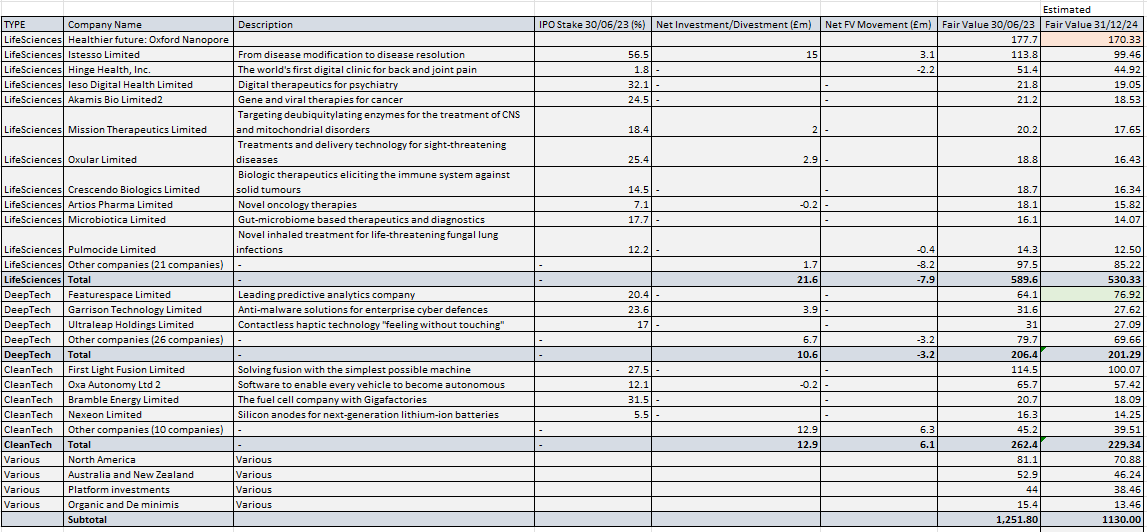

We know from the update that the 31/12/23 NAV per share was 111p-117p. We also know gross cash was £227m. We also know the prior NAV/share was 30/06/23 126.7p. We further know via RNS that Autifony had an uplift of approx 0.5p/share and a “Top 20” holding had a funding round which was a 4p/share uplift. Therefore and assuming worst case 111p/share and assuming that net cash is around the same as 30/06 (we don’t know that for sure) then the portfolio should look something like the above.

I’ve adjusted ONT because we know the closing price was 208p a share so a £7.3m reduction (But post period a further £45m drop). We also know (via CHRY) that Featurespace’s NAV is 20% up period on period. Again, there’s no guarantee that IP Group will value it the same way as CHRY but it’s likely.

Therefore in the absence of news we see a 12.5% drop elsewhere to arrive at a portfolio of £1,130m (plus £50m net cash is £1180m NAV).

Since we do not where this falls I’ve decided to distribute the 12.5% drop equally.

IP Group speak to “some significant inflection points expected in 2024.” Hmm. Let’s explore that.

Today I’d like to explore their Life Science portion (50% of NAV) excluding ONT - for coverage of Oxford Nanopoe ONT see my introducing IPO article

Istesso

According to US regulator they completed their Phase 2b trial 1 month ago. So results are imminent.

Why Istesso? Imagine 45% of death did not occur?

“Nearly every human malady … damages tissues, and 45% of all deaths can be traced to inflammation- and fibrosis- related regenerative failures”. Istesso is focused on how we can coax tissues to regenerate. If we could achieve this goal, we might certainly impact that 45% of deaths and potentially make the quality of those saved lives better.

First steps first and its drug MBS2320 for rheumatoid arthritis is being tested for a >20% improvement for sufferers.

Istesso’s 31/12/2022 accounts are the latest available showing annual cash burn of around £7m and £7m of funds remaining. However a further £10m has been made available by IPO for 2024 and given the Phase 2B results are imminent, this will presumably go to Phase 3 in 2024 and has runway until about mid 2025.

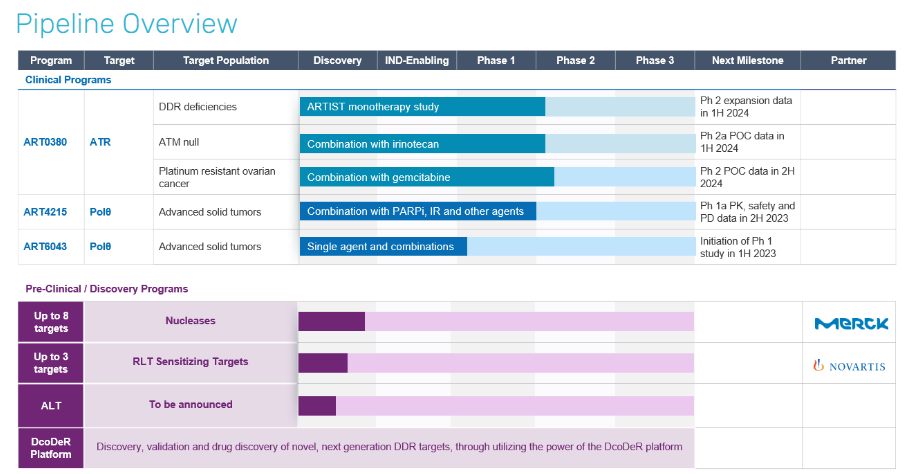

Artios

Artios accounts show cash of £120m and cash burn of £40m per annum. However there are two phase 2 studies for its cancer therary completing in 1H 24 and a 3rd in 2H 24, basically on its own and in combination with two standard treatments. For a big pharma this Oncology play would be an attractive asset.

Both Merck and Novartis are already shareholders in Artios and this appears a candidate for a takeover. As I pointed out recently Big Pharma are busy acquiring and Merck needs to move or face a patent cliff risk:

Crescendo Biologics

Crescendo is working on developing novel, targeted T cell enhancing Humabody® therapeutics and has a phase 1b due in 2024. It’s working with Biontech and Takeda (large pharma), but also in combination with Pfizer’s Keytruda anti-cancer therapy.

Its accounts say £44m cash at end of 2022, £6m cash burn and £25m raised in 2023 so appears to have a long runway.

Mission Therapeutics

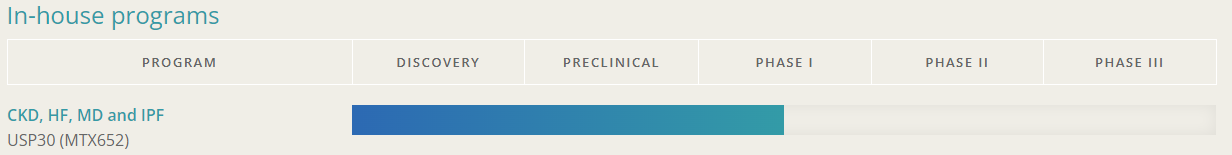

Recent reports suggest that up to 50% of high-risk patients suffer acute kidney injury following heart surgery. An FDA approved phase 2 trial began December 2023 to study candidate MTX652.

Results in late 2024 or early 2025.

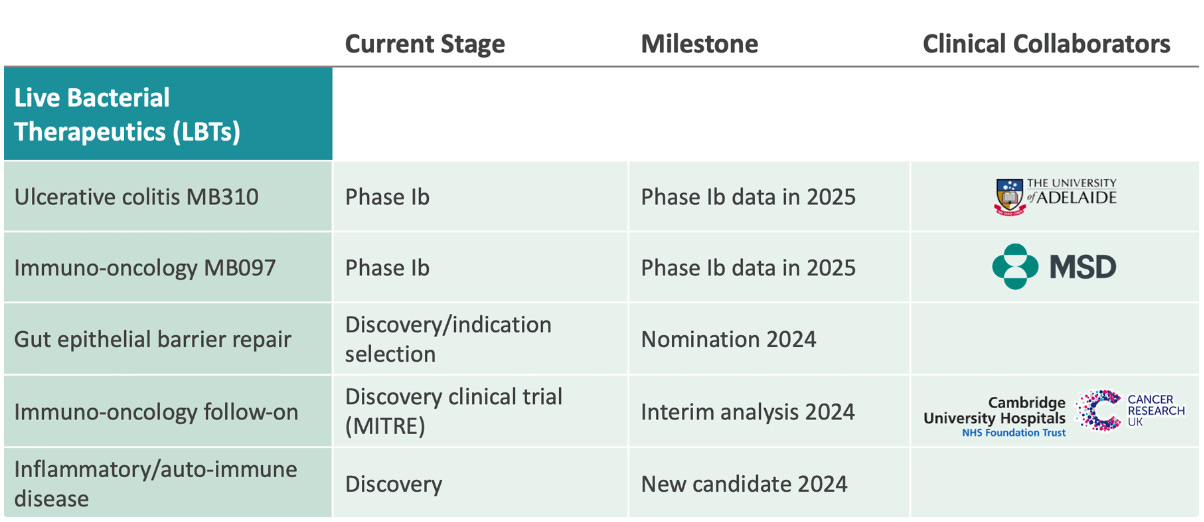

Microbiotica

Imagine using friendly bacteria to heal your body. Many swear by their probiotics and prebiotics. A family member swears by the Chuckling Goat and its 27 cultures - if you have issues with IBS, gut, Ulcerative Colitus etc then it may be worth trying. This is essentially a farm in Ceredigion, West Wales, who sell Kefir from Goats Milk as a specialist product by post.

Microbiotica meanwhile is addressing that huge and largely unserved market and could help open up a whole area of therapeutics, by elevating the food to a medicine.

Again, a number of milestones this and next year.

In 2022 £33m cash and an approximate £8m cash burn puts this with 3 years runway.

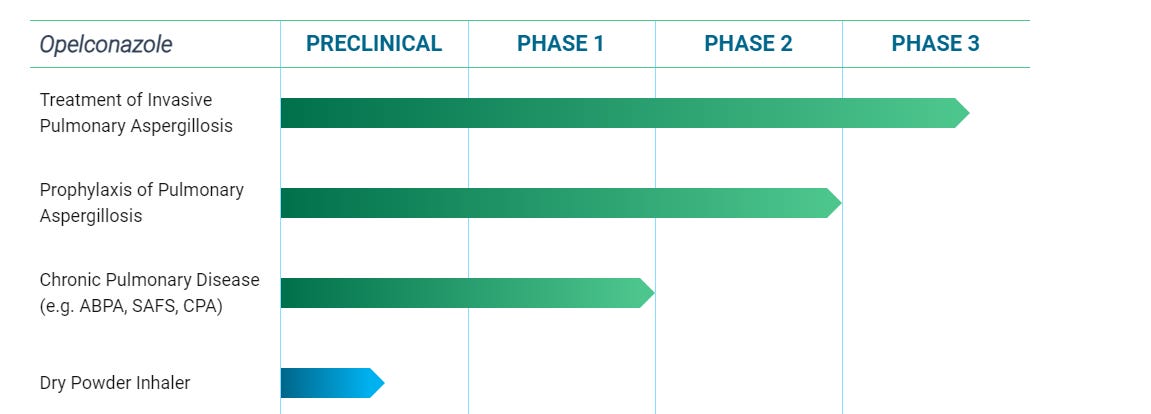

Pulmocide

I’d not heard of Pulmonary Aspergillosis but I’d certainly watched HBO’s “The last of us”. Pulmocide seek to tackle fungal infection of the lungs.

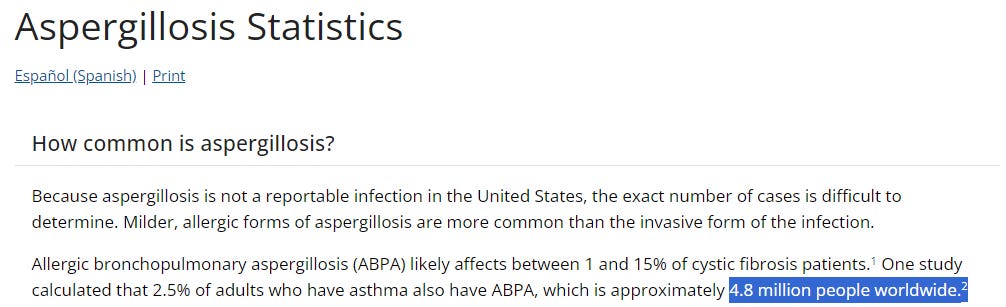

The CDC in the US estimate 4.8m sufferers and that treating (the symptoms) costs the US $1.2bn a year. So about $4bn-$5bn worldwide.

They have a P3 trial reporting this month.

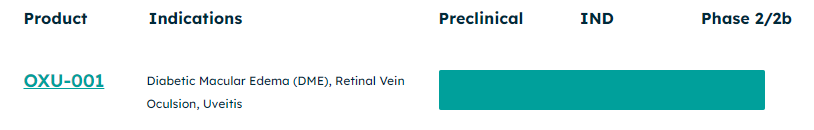

It’s do or die, as £12.1m of funding is dependent on completing the milestone by March. Stay tuned for the action-packed finale.

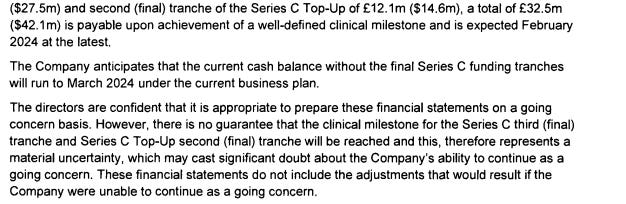

Akamis Bio

Cancer is tricky. Tumors use multiple mechanisms to evade immune recognition and attack. Akamis Bio’s T-SIGn® therapeutics are viral vector, tumor gene therapies capable of homing specifically to primary and metastatic solid tumors following intravenous delivery triggering robust antitumor immune responses.

Cash burn is £16m and runway to end of 2024, further Phase 1 news and a funding round is slated for 2024.

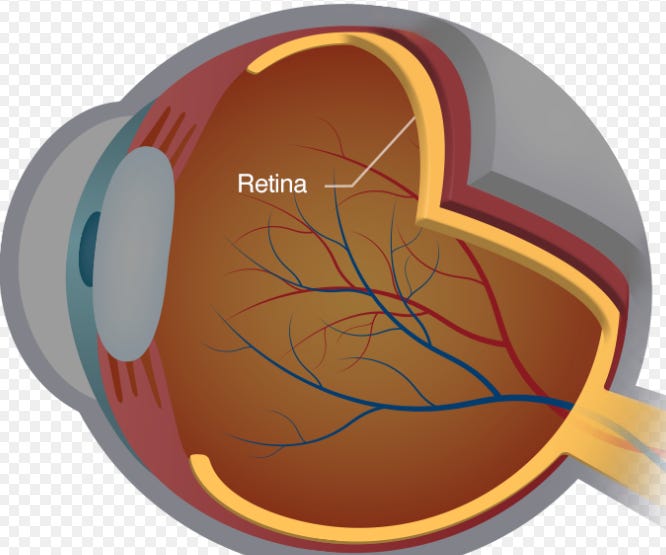

Oxular

Oxular a clever pun on occular (presumably) it all about retina disorders.

Phase 2 reporting in 2024, but £9.9m cash in the last accounts and a £5.6m cash burn means a further funding round in 2024.

Enterprise Therapeutics.

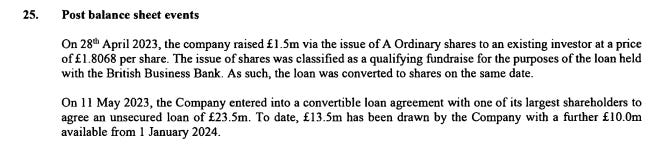

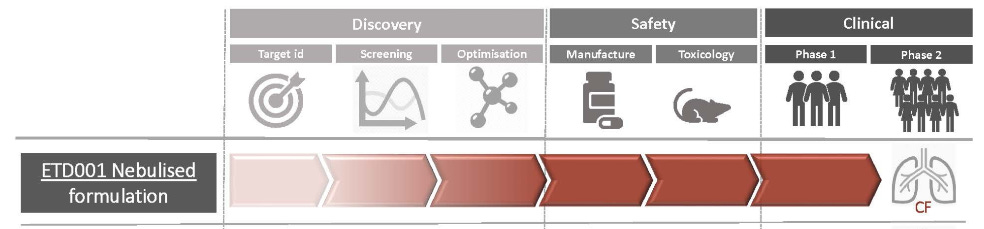

Enterprise Therapeutics has recent news - a fund raise where IPO participated to further a Phase 2 study.

Conclusion

Studying each major life science holding there are five studies which themselves could prove transformational inflection points for valuation. Beyond this, the skills, capabilities and IP these companies hold appear to be highly attractive for big pharma.

Some do show limited runways for cash (albeit I’m exprapolating from last Companies House returns for late 2022 so my estimates are subject to cost cutting or expansion).

There appears to be potential for at least 5 exciting inflection events during 2024 - just in life sciences. For further reading last year’s Edison Deep Dive into IP Group is interesting too, but I hope this article provides some additional insight too.

Trading at an estimated 54% discount ex-cash, post period (ONT has fallen around 25% in January), there appears to be a harsh discount to IPO.

This is not advice.

Oak