IP Group Results Part 1 of 2

More to explore with Oxford Nanopore (LON: ONT)

Dear reader

I covered some IP Group updates Jan 9th. Since then ONT released its FY23 results.

How did my forecast hold up? Pretty well actually, for 2023. Gross profit within £1m, but I did not forecast the growth in costs.

So ONT finds itself with £50m less cash at the end of FY23, albeit over half of that was investment. It is also the case that while “Cash & Cash Equivalents” moved from £356.8m to “just” £222.40m (as reported by a popular shorting website) this overlooks Investment Bonds which add a cool £256.5m. So £478.9m liquidity.

ONT also see scope to reduce inventory over the next few years and this stands at £101.5m.

I have reworked the forecast based upon ONT’s “conservative” 31% growth after this year and used their revenue guidance for 2024. (Despite average underlying growth being 46% over the past 4 years). I’ve revised down margin, in accordance with their guidance too. I’ve assumed steady state R&D and 5% growth in overheads. ONT tell us that break even is pushed back a year to FY2027 and that is what we see in my model. Crucially we see a cushion of well over £200m even at the lowest point, given the investment bonds in addition to cash reserves.

Interesting, too, is that at today’s £1.33 per ONT share this buys you £0.75 of net assets, or £0.67 a share of tangible assets. These assets include >2,500 patents, 7,300 repeat customers and an evolving product set called the 'Q line' platform that will accelerate nanopore sequencing adoption in regulated applied markets such a clinical labs and biopharma QC/QA labs. The “Applied” market is where the bulk of future opportunity lies and ONT are tapping into this during 2024.

It is also the case that ONT guide that this is the base case and speak to upsides of margin, of growth, or a number of “higher value, pioneering projects opportunities”. Past growth was far faster than 30% as can be seen below.

Shorts vs Longs

In genomics you can do a short read or you can do a long read. Each approach has advantages and disadvantages. Long read tends to be much faster (therefore cheaper) but potentially at a slight cost of accuracy. ONT has been working on multiple reads to remove this error factor.

Emirati

The decline of the Emirati Genome Program used to be a major part of revenue but has been falling (as other revenue is growing) so proportionately is now less than 7% of ONT’s revenue. Underlying revenue growth at ONT was 32% and the positive news for the Emirati Genome Program was a contract extension of a further 3 years.

Tech Progress

The thing “the market” seems not to understand is the remarkable progress being made by ONT. Speeds in 2024 are 5-6x faster (33x faster than 2019), and accuracy is higher than 99.8%. Sequencing DNA, RNA and Proteins is a wildly memory intensive process so if you can do this faster then the cost per scan drops. It's also notable that 75% of ONT’s revenue are consumables. In other words if you can get new footprint then you will get growth. The 'Q line' platform addresses the “Applied” market is where £144bn of the future £150bn market size (or $300bn according to Ark Invest) lies.

ONT has also signed a partnership with artificial intelligence developer SeqOne to support its next-generation sequencing approach in clinical diagnostic testing. The goal will be to provide an end-to-end platform that applies extra-long nanopore sequencing reads to whole genomes—initially in order to help identify variants associated with rare diseases, before expanding the project’s scope into cancer testing.

When the cost mapping a genome has already fallen from $3bn to $345 but equally as importantly is able to combine speed and new areas of science known as “the dark genome” it is clear the market potential is going to rapidly grow.

Growth opportunities & Partnerships

ONT added strategic collaborations to develop and access new growth markets in clinical and industrial applications, including collaborations with the Mayo Clinic to advance research in cancer and bioMérieux to develop products that serve the infectious disease diagnostics market.

These partnerships are important because it moves ONT away from research labs and into clinics and hospitals i.e. into applied. The market size for the latter is 20x larger. If testing can occur out in the field this has a wider applicability too.

Infectious disease testing is highly regulated and bioMérieux’s endorsement of ONT’s technology platform shows a confidence in the technology. Jumping to ONT wasn’t done lightly and putting £70m to own 7% represents about 70% of bioMérieux’s FCF for 2023.

ARKG’s fact sheet forecasts a much more rapid multi-omics growth to $300bn as opposed to ONT’s own £150bn market size estimate. particularly the rapid growth of RNA-based medicine….

What does the smart money think?

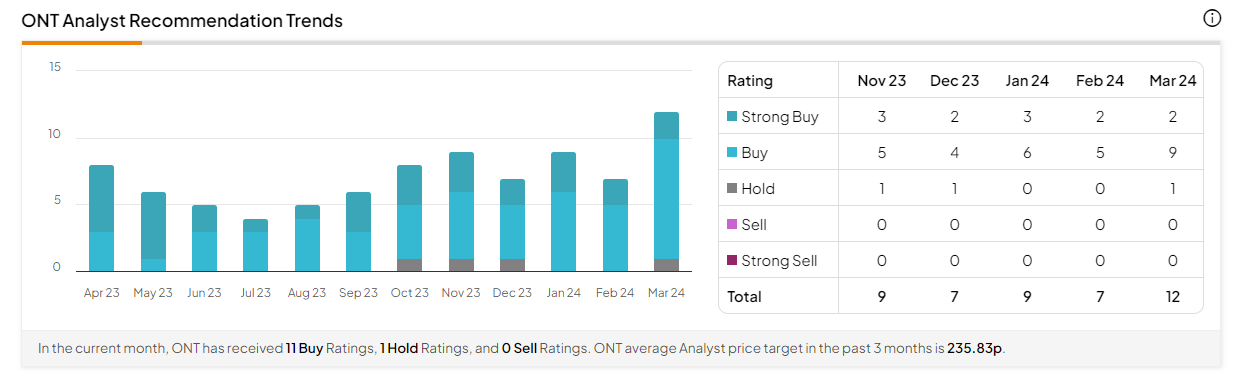

Berenberg, HSBC, Barclays, JPM, Cazenove all see the share price as too low.

A growing number of analysts agree…. and also forecast much higher FY2024 revenue numbers for ONT too.

Competitors

PacBio and Illumina are ONT’s two main competitors.

This research article showed ONT was more cost effective and that both ONT and PacBio were effective.

This article suggests different use-case Scenarios. Each of the three tools have different strengths depending on what you want to achieve.

Illumina: Due to short read lengths, might not always be the best for resolving large structural variations or repetitive regions. However, paired-end sequencing and increased read lengths in newer platforms can help.

PacBio: Excellent for large genomes and resolving structural variations and repeats due to long read lengths. Ideal for de novo genome assembly and phasing.

Nanopore (ONT): The ultra-long reads can span large structural variants and repetitive regions, making it ideal for such challenges. Also excellent for direct RNA sequencing to understand isoforms.

Conclusion

While the FY23 results and can make one feel IP Group is a continual slide downwards, it would be unwise to assume past performance determines future results.

To put the value in context IP Group’s 9.8% holding in ONT has a market price of £116.6m (at today’s £1.397 share price for ONT and 47.7p for IPO) so a £116.6m holding which you can buy for £50.7m (due to the current IP Group discount) but that, on consensus, has a fair value of £194.5m

That’s 383% upside once the discount on IPO is removed, and fair price for ONT is reached.

This is not advice

Oak

Any thoughts about the competition for ONT from the likes of Illumina etc?