Dear reader,

Chainsaws can cut through nonsense. I had a sense a year back that Milei was someone to watch. Beyond the wild cries of “Afuera!”, “Afuera!”, the chainsaw, the funny hairdo and Elvis convention credentials his determination to turn around Argentina has been an inspiration to others, and a year later it’s difficult to argue with the turnaround success. Albeit not without a cost. Omelettes and eggs perhaps?

Back then I sought ways to invest in Argentina. Sadly no obvious avenues presented themselves….. until now.

Cerrado is a US$31m (£24.5m) market cap listed in Canada with three holdings in Argentina, Portugal anad Canada. Don Nicolas is a producing gold mine in Argentina. Lagoa Salgada is a familiar name to anyone following the OB25 for 25 idea MAFL. The 80% owner (potentially the future 85% owner alongside EDM) is CERT. Finally CERT owns an early stage project for “green iron ore” in Canada suitable for electric arc furnaces to make green steel using hydrogen and avoid using met coal. MAFL own around 0.4% of Cerrado, so should shareholders follow MAFL into this share?

Cerrado is a double bag from 2024 but 75% down from 2022. So choose your horizon to pick your performance. What about 2025? And beyond?

#1 Don Nicholas

This is a producing gold mine in Argentina.

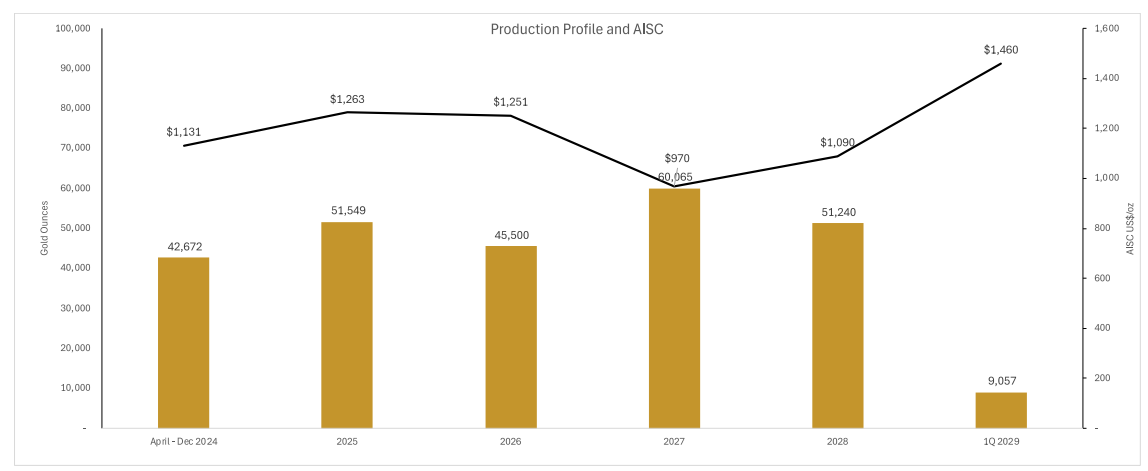

On paper an average AISC of $1144 over the life of mine is highly attractive, and a forecast 51.5Koz of Gold Equivalent Ounces 2025-2028 suggests an $84.4m EBIT in 2025 and over $50m FCF (assuming an average $2,900 gold price per ounce). That would be a £67m operating profit per annum from a £25m market cap! Its AISC is forecast to fall in 2027 and 2028.

But before we get too giddy, actual 2024 financial results are so far less rosy. The AISC for 9m24 is $1,580 per ounce (eq’t) and average revenue $2,192 per ounce so revenue of $91.8m less -$76m operating costs and -$7.8m G&A leaves $8m EBIT. Less some extraordinary costs due to a financing stream we end with a loss of -$4.7m YTD.

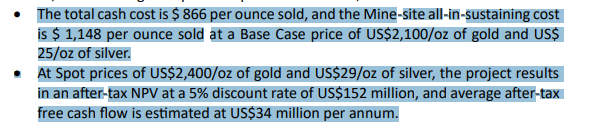

The project had an NPV of $105m back at $2,100/ounce gold, discounted at 8%. This has more than doubled with today’s gold price to an NPV of $207m (at $2,900 gold). Moreover the current mine plan is solely open pit although underground is a possibility and exploration to the fringes too. Cerrado quote three nearby mines as examples of open pit operations which were extended in a similar way. It has land options to extend and explore.

The cash flow from Don Nicolas is supplemented by $15m still owed by Hochschild for the purchase of Monte De Carmo. $10m due in 13 months and $5m a year later. In its last accounts it has $21m cash and receivables too.

#2 Lagoa Salgada

At a 8% discount rate currently Lagoa Salgada (LS) is an $147m NPV (based on 80% ownership) and a 39% IRR based on the current Feasibility Study.

Cerrado has bought Ascendant in all all-shares deal, and this has diluted shares from 106m to 131m shares.

MAFL-ers know there’s an upside likely coming at LS later in 2025. Moreover they know that Cerrado can acquire a further 5% ownership from MAFL at a 10.5% discount rate i.e. $6.16m. This cost might increase if the NPV increases. It’s likely to increase - the assumptions of pricing are wildly out of date - $1,700 gold for example. If the NPV isn’t updated to reflect more accurate prices then the main beneficiary to that is Cerrado since they still only pay $6.2m to MAFL.

The LS project adds substantial precious and critical metals exposure (34% Silver & gold, 30% zinc, 15% copper, 7% tin and is expected to have a lowest cost quartile producer with zinc equivalent production of US$0.59/ lb for first 5 years

Next Steps:

EIA approval expected in Q2

Optimised feasibility in Q3

EDM decide whether they want to take 15%; Cerrado buys the remaining 5% holding from MAFL.

Construction decision in Q4 2025

First production H2 2027

Limited equity anticipated to bring project to production

Lagoa Salgada is 70% financed by Santander/TD Bank and supported by the UK Export Finance guarantee. This leaves 30% funding for the $164m construction about $50m. Potentially half - 15% will be via the Portuguese government via its EDM entity, leaving $25m for either Cerrado directly, or Sprott via an additional stream or another new investor to step in.

#3 Mont Sorcier

In March 2023 Cerrado announced the acquisition of Voyager Metals and its principal asset the Mont Sorcier magnetite iron project. Mont Sorcier is a well advanced, large, long-life and economically robust Project in a tier one mining jurisdiction where metallurgical test results demonstrated the ability to produce high purity 67% iron concentrates.

Its Preliminary Economic Assessment (the “PEA”) on Mont Sorcier outlines a project with an after-tax NPV of US$1.6 billion and IRR of 43% producing 5 million tonnes per annum of iron concentrates grading 65% iron over a mine life of 21 years with annual free cash flow of US$235 million. The project is currently advancing towards completion of a Bankable Feasibility Study expected in 2026 and FID in 2028.

Future Earnings Potential

There are official earning estimates for the 3 projects and then there’s potential estimates. In the case of Don Nicolas I’ve used the spot price of Gold ($2900) to arrive at $87.5m (and this is in Cerrado’s presentation in any case).

I arrive at a $26.6m higher potential EBITDA at Lagoa Salgada based on the prices in the feasibility study vs prices as at 1st March 2025 per Tonne or per Ounce (for Au/Ag). I then extrapolated by annual production. This takes no account for the resource expansion ongoing or the optimisation studies ongoing.

Finally in the case of Mont Sorcier this is based on $100/tonne Iron Ore (plus $20/tonne premium for high-purity 67%+) whereas today’s price is $107/tonne.

Conclusion

The cash and cash flow from Don Nicolas lubricates the flow of this share and its plans to proceed with construction at Lagoa Salgada later in 2025 and later Mont Sorcier in 2028.

To evolve from an $80m EBITDA to a $500m EBITDA producer will take quite a number of years (assuming Mont Sorcier doesn’t get sold to a Tier 1 producer, like Anglo American)

What I do know is that a US$34.4m market cap is incredibly cheap and its three projects which have a $2bn NPV based on some pretty conservative assumptions.

If this had no cash flow and was diluting itself to progress its projects that would explain the market cap. But it has cash generation and optionality. It has 2 projects in safe jurisdictions. Or should that be three safe jurisdictions?

The hope is you no longer have to fear inflation or expropriation if you invest in Argentina. But beware all you Aichmophobics: Argentina is on Chainsaw alert!

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thaks for the article. I started buying shares Dec. 2024.

What about the cash flow from the mine in Argentina being limited by currency controls and having to stay within Argentina?