Dear reader

EPIC or EPE or ticker ESO is the Oak Bloke latest idea in hidden value.

A £1.50 buy and a NAV of £3.24 as at 31/1/24.

But how real is that NAV?

Well ESO has been buying back its shares. It’s also been paying down its debts. The debt actually caught my eye. ESO’s preference ZDPs:

“Preference shares get a final capital entitlement at maturity on 16 December 2026 of 129.14 pence per ZDP Share.”

So that means a 24.2% return over 2 years and 9 months - an 8.8% return.

Last November you could have bought for 96p so a 34% - and 11.3% return.

If you fancy a nice steady return double what the bank will give then the risk is pretty low. The business has enough cash to cover the ZDPs and a further £96.9m of assets. Every single asset would have to go bust in true Brewster Millions style in order for the Prefs to not get paid. Read on reader, read on. I’m not a betting man but one might say the odds are in your favour!

Back to EPE’s ordinary shares.

Looking at the NAV, this is on a 55% discount at the current 150p buy price. Cash at year end (31/01) was £14.5m so the discount rises to 64% once you strip out cash.

But here’s the thing…. no I’ll tell you later.

Let’s next look at the portfolio. Now, reader, you can’t go to the EPE web site and see any of this - I’ve had to piece it together. The column “Valuation” and “80%” relates to the fact that EPE own 80% of ESO1 & ESO2, so for example ESO2 owns £48.9m of Luceco shares but EPE only owns 80%, i.e. 80% of the 35.6m Luceco shares (worth £48.9m) are £39.12m.

You’ll notice there’s 3 investment vehicles ESO2, 1 and Alt. The only info you get from EPE’s annual report are the subtotals.

Luceco 131p/share

Luceco has been in the news recently with a positive trading update. Stockopedia and Liberum have been waxing lyrical about how bullish they are about Luceco. I do know that the target price according to Liberum is 170p so that’s a 23.7% upside and there’s a 3.5% dividend. Ironic that Luceco gets a “91” score on Stocko while EPE gets a lowly “46” and a “Value Trap” epithet… yet for the price of 1 EPE share you get 0.89 Luceco shares + £1.93 of other stuff. In fact if you believe the 23.7% upside is real then each EPE share is worth 1.1 Luceco shares (£39.12m x 23.7% = £48.4m and the market cap for EPE is only £44m).

The scores on the doors don’t tell you everything, and in this case would mislead you from a better value opportunity.

The holding pays about £1m dividends.

Pharmacy2U 12p/share

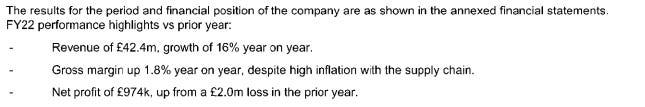

This is a growing prescription delivery co. Its latest accounts speaks to the acquisition of Lloyds Direct, investment & establishment of a 2nd distribution centre in Leicester (£4.4m), also some exceptional costs (£0.8m) post Covid and clawbacks from the NHS. Cost of sale is high and leads to a loss for FY23 but they say the focus is on improving this in FY24 and the acquisition and 2nd distribution centre will be key to that.

I’m assuming negligible profits, but FY25 this would have positive upside.

Rayware 87p/share

The FY22 accounts are the most recent and this “only” made £2.2m net profit in a difficult year (£4.4m) the year before. On £26m of revenue there are tasty net margins. The balance sheet is ok with £6m net assets, no debt except trade creditors but an acid ratio of 0.75X (£9.5 cash/debtors) and £12.5m creditors. More recently EPE tell us that “Financial performance was impacted by customer destocking, acute supply chain costs, depressed consumer confidence and well publicised inflationary cost pressures.” They injected £3.35m, and I would suggest that FY23 will be ugly but this looks a solid business with good profitability in FY24 and beyond.

Whittard 3p/share

Whittard’s of Chelsea is the eponymous tea (and another cucumber sandwich Vicar?) English brand to die for. Yet EPE bought it for an undisclosed sum out of administration thought to be below £1m (according to the FT). Notice in my list of holdings there is £19.9m unaccounted for. I suspect most of that is Whittard. And to be fair it’s fair value is surely more than £1m. It made that much in its latest accounts.

As of Jan 2024 ESE tell us Whittard delivered a strong performance in the period led by growth in its UK retail channel, due to strengthening domestic and tourist footfall, further enhanced by a new pop-up store in London Paddington station over the Christmas period. Whittard has continued to progress its international strategy, with the business entering a strategic partnership with Rayware to develop its overseas presence and with its South Korean franchise partner opening a new store in Samsung Town in April 2023.

So possibly close to £50m revenue and profits of £2m?

David Phillips 12p/share

£11m t/o and £0.8m net profit, although I read that EPE is extending a line of credit to support working capital.

Encouragingly EPE tell us that “David Phillips has continued to develop its built-to-rent and project-based divisions, delivering year-on-year sales growth. Profitability has improved from better product sourcing, pricing and a focus on recurring sales channels. Efficiency has been further enhanced through prudent actions taken to reduce the cost base.”

So possibly £1m-£2m profit

Denzel’s 7p/share

The £2m appears to be for 25% of Denzel’s but I don’t know that for sure, just going by the new shares issued in FY23 (Preference shares). The business was loss making but clearly is fast growing and get lots of happy Woofs 4.5 out of 5 times. They are sold through Pets At Home, Amazon and independent sites.

Last one reader!

The SPAC “EAC” was liquidated and £5.3m returned to ESE post period. Now this means cash is now £19.8m.

Here’s the bit I’ve been waiting to show you!

If you strip out cash inc. post period cash the discount jumps to 69%. But if you took out cash, post period cash and liquidated the Luceco position then you arrive to a 139% discount (or 184% if you liquidated at the Luceco target price of 170p).

In other words I pay £1.50 for an EPE share. I get cash worth £0.66. I also get 0.89 shares in Luceco worth £1.30. I sell it, so I have £1.96 back.

So net 46p cash back plus I own part of Whittards, Rayware, Denzel’s, David Phillips and Pharmacy2U worth a net £1.28 for free.

Businesses that are earning about £5m net profit a year (and growing) which is a further 16p per share, and a PE of 9. Even without profits growing you can think a PE of 15-20 not being impossible suggest there’s 100% upside in the “free” £1.28 of holdings. Or more if profits can grow from here.

Conclusion

I’ve held EPE for a while and it’s been tucked away at the back of the cupboard. I’d dusted it off this week to decide whether to keep it or cull it.

Do you know what I decided to do reader? It starts with Top and as Yazz once sang “the only way is…..”

This is not advice

Oak

Hi OB; nice write up, and as a commentator before has side, rare analysis of small caps. And my you do like your small small caps!

Some thoughts: gut feeling, thanks for highlighting this, as yes Luceco pretty much covers your purchase price. Cash generative, profitable and yielding a dividend back of about 3% of EPE. I particularly like the Whittards holding, which has a panache, and must be able to yield high margins if managed/positioned well.

My only concern is the fees - managed and owned by the partners, the structure is generous/expensive proportionately. Yes, if you are outperforming, I'm happy to give up a chunk of my notable gains, but 8%ish return is hardly blowing (Luceco's) lights out. The feel structure almost seems such that they are more interested in maintaining NAV at at £100m+ than returning that to shareholders. Ditto, the large cash holding, which generates additional fees.

I do like this stock, but I'm mixed on whenever progress is being funnelled/stymied be the mgmt fee structure.

Minor point, their holding in Denzel is 18%

Great analysis!. But: AIM-listed, Bermuda-domiciled (good luck minority shareholders!). No idea how you'll realise the upside in the ords....