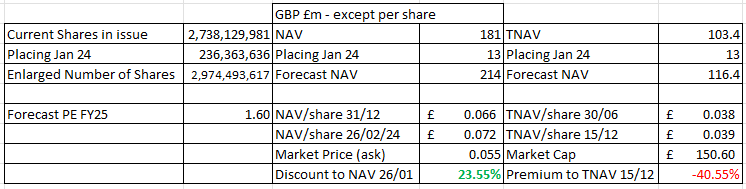

Comparing my model with today’s actuals there are several grounds for optimism at JLP:

The discount to assets has widened despite posting strong Chrome results.

Eagle-eyed readers will spot NAV is down 10%. Yes, but this is purely an FX conversion to GBP. Assets are in ZAR and ZMW (South African Rand and Zambian Kwacha). So NAV is actually up in local currency terms, so the 23.5% discount to NAV is probably higher.

The South African power disruption issue is beginning to ease. This is positive going forwards.

The Chrome price at $90/tonne has generated remarkable revenue which is partly offset by higher costs. The adverse currency movement will have driven this in part (sales are in US$ whereas costs are in ZAR and ZMW).

PGMs at a basket price of $1,021 surely are at a nadir particularly given the inflationary costs are industry wide and not specific to JLP. Anglo have spoken to mothballing production and not all PGM producers are also Chrome producers. See my pricing analysis later on.

Zambian copper production exceeded copper sales by about 500 units. In other words on a revenue basis at $2,109 margin per tonne there’s about £0.8m profit accrued - not in the numbers.

2H24 looks on track to increase net profit by over 30%. This 30% comes from guidance minus H1 production. Looking forwards, and on a run rate basis FY25 looks to increase further still - see my revised model.

Here is my original production/gross profit forecast vs today’s update.

I’ve used the guidance of 42koz PGMs, 1.45mt Chrome and 5850 units of copper to arrive at my calculations which point to a forecast £19m net profit in the second half, and that’s based on PGMs remaining at depressed levels to June.

Forecast £33m net profit for FY24 puts this on a PE of 4.5 at arguably a low point in the cycle for both PGMs and Copper, where investment into Chrome and Copper offer future upside.

PGM Upside:

To illustrate what I mean by PGM upside if you take the average PGM margin over the past 3.5 years you arrive at around $821 albeit changes to reporting make comparison a bit tricky. But a $821 margin would deliver a £25.8m profit (5X profit) or a $191 margin increase would double profits. That’s before any PGM volume expansion due to increased chrome production.

Copper Upside:

Opinions vary, but Fitch think Copper will average $8,800 this year and a lot is being made of China’s housing woes but other economies like India and Indonesia are powering ahead and renewables and grid power in all major enonomies are copper hungry. Even China is expanding its power generation (using Copper) at phenomenal rates. The World Bureau of Metal Statistics (WBMS) confirms copper demand remains robust, particularly in non-OECD countries. Despite all the talk of Chinese economic problems, their copper demand surged 13% year-on-year over the first ten months of 2023. Strong non-OECD copper demand growth was not limited to China. India’s copper demand grew 30% and, although seldom mentioned, Indonesian demand grew an astounding 40% over the same period.

On the supply side First Quantum in Panama and Anglo American in Chile have announced closures and disappointing production accounting for a 0.6mt reduction. It’s hard to see Copper only averaging $8,800 this year.

Meanwhile the upgrades at Roan Concentrator (Capacity 13Kt), and Sable (Capacity 16Kt) both come into effect in 4Q24 (i.e. from around April 2024) and trial feed from Munkoyo too. So from July the run rate in FY2025 will be much higher than FY24. But growth in FY25 will be further supported by feed from Munkoyo (expected 3Q25), as well as the Waste Rock Project and the Mufilira Slag Project.

Any surge in Copper to $10k/tonne or beyond and these projects are compelling; at $8k/tonne they are profitable.

-

This is not advice.

Oak