Dear reader,

$90m would buy a lot of family silver. JLP has a buyer for its 4 Chrome and PGM operations in the Western Limb.

Chrome-PGM assets proposed sale

The assets include the toll milling chrome recovery plants at Inyoni, Windsor and Windsor 8 along with the chrome plants at Thutse.

These are producing ~1.85Mt/yr of 42% chrome concentrate.

These feed the Inyoni PGM flotation plant which produces around 40koz PGM/year.

On an average P/E basis then $90m is 5.1X average earnings, although it’s 7.1X FY2025 earnings. Given PGMs stronger outlook then the FY2024 result looks the outlier, and if FY2021 level profits return then the buyer is paying 2.5X earnings.

Of course the risk could be that the Miners who provide feed to JLP might decide to cancel the agreement and process the materials in house or renegotiate the arrangement. Somehow I think that unlikely. The industry has been capital starved and no one is in a position to do such a thing. But JLP are less sure.

Besides in a recent interview with the two Mr Roasts and Mr Archer, Coetzer mentions country risk several times.

So while the deal appears to offer poor value to JLP perhaps it’s a case of “as good as it gets”. Coetzer appears to believe so.

Sale of SA Assets - Balance Sheet

The segmental analysis also shows $110.9m of net assets as at 30/06/24 and $116.3m as at 31/12/24. So $90m might appear to be selling at a discount to book.

But Not so Fast!

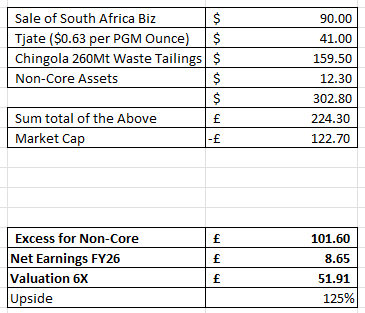

Jubilee keeps the rights to Tjate Platinum an early-stage mining project with an estimated 65Moz PGMs.

Jubilee’s exploration intangible asset comprises the Tjate Project, which is potentially the largest undeveloped platinum ore block globally, covering 5,140 hectares across three farms. Independent appraisals estimate the area could yield up to 65 million ounces of platinum group elements (PGEs) and gold. The project focuses on the Merensky and UG2 platinum reefs, located between 600 metres and 1 000 metres below the surface, for initial mining.

The Tjate mining right commenced on 1 March 2017 and, unless cancelled or suspended, will remain in force for 30 years, ending on 28 February 2047

Held at a cost of just $0.63 per ounce of PGM, 65Moz could be worth $110bn even at a $1,700 basket price. Of course you have to dig it out of the ground and the 65Moz is a guess and not a proven JORC resource…. yet.

In any case $116.3m of SA assets less -$41m of exploration assets (Tjate) retained is that $75.3m net assets are being sold.

So the SA operation is being sold at a $14.7m premium, paid over 3 years.

Zambia Copper

Of course the FY2023 segmented results for Copper showed just a $0.2m profit (with -$2.2m “Other”) and $5.1m profit in FY24 (with -$3.8m other) so there’s a degree of faith required that the Botswana Copper focus can yield profits.

Especially since segmented profits fell to a -$1m loss (with -$2.7m “Other”) in 1H25. That was during a period of disruption through power and water problems. Alternative power providers have now been sourced.

A potential use for some of the $90m will be further resilience and energy efficiency measures in Zambia. Solar panels would seem an obvious investment in sunny Zambia.

Sable is undergoing capital investment to build a second tank-house which will take a further up to 9 months, and mean an expansion of capacity to 14Ktpa

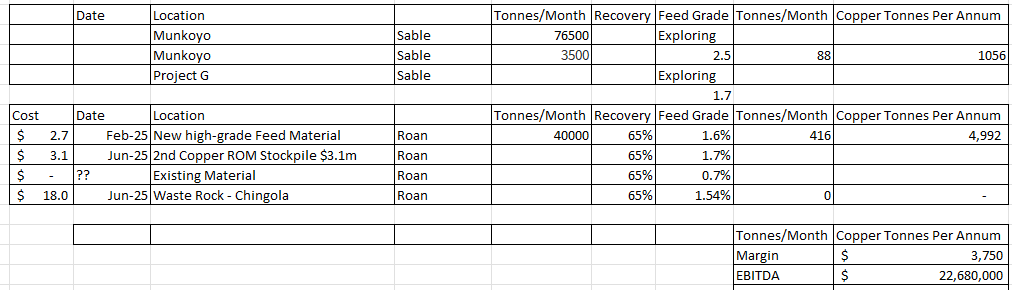

Based on JLP’s latest statements they appear to claim that 500 tpm of copper units is possible. These appear to relate to these assets and projects. At an assumed $3,750 margin per tonne the EBITDA of $22.7m approximately equates to the EBITDA of the Chrome/PGM business being sold.

But $22.7m isn’t the full picture. A further upside is possible via Chingola - the large Waste project. 10Mt of its 260Mt has been commercialised at $6.75m.

That implies a $175.5m-$18m profit = $159.5m net profit over the 260Mt.

We are told that:

The project has attracted keen interest from both metal offtake backed funding as well as large multi-national copper producing entities interested to partner on the potential project.

We are further told that non-core assets have been sold for $12.3m.

If we bring all of this together then we find that we have potential for assets above $300m. Converting that to GBP and deducting the market cap….

We have an “excess” of £101.6m. In other words it’s like you are getting paid £101.6m to own a profitable Copper production business in Zambia.

Going by the 550 tonnes per month at a $3,750 margin and a $22.7m EBITDA and deducting $11m of ITDA costs gets you to an £8.65m net profit in FY2026 (where that profit could go higher quite easily in FY2027 and beyond)

At 6X earnings that’s £52m suggesting a 133% upside to today’s 3.9p buy price

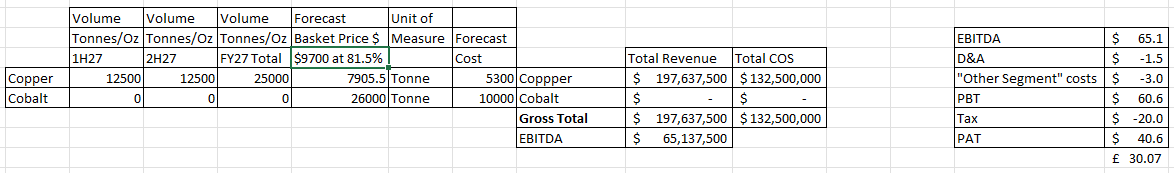

The above assumes Copper cannot reach capacity i.e. 25Ktpa

What if it can?

The answer is that £8.65m net profit grows to £30m based on a pretty demanding $9700 copper price and using a 18.5% deduction to account for non-Cathode production.

Modularising Zambia

JLP now have a proven capability of creating “modules”.

These are capable of processing 2Ktpa of copper oxide concentrate (+5% Cu) per 20Ktpm (thousand tonnes of ore per month) copper ore processing module (assuming a feed of 1.5% copper grade)

As depicted below for Project M Operating Costs are estimated at US$5,281 per tonne produced. Plus Capex for 20Ktpm copper processing module = US$3 million.

To extend Copper production beyond 25Ktpa (i.e. to build another Roan) would be in the order of around $50m.

The payback on that would be around 4 years.

Do you subscribe to my YouTube channel?

This was recorded 11th June and covers this article.

Conclusion

While monetising the South Africa operations appears a negative based on the direction of PGM prices, I do get the point around control. JLP are interested in project expansion and not in harvesting steady profits. Exiting South Africa might prove a wise move and it certainly monetises assets.

Monetising non-core assets, monetising Chingola and who knows perhaps it can monetise Tjate (given the rapidly rising PGM prices). That monetisation would get you to well above the current market cap price.

And all of that is before you consider the operational profits for Zambia which are nowhere in the price with Copper touching $10,000 my assumption of a $3,750 margin is pretty conservative. Longer term at higher Copper prices JLP is uniquely positioned to expand beyond Zambia, in time (Waste Copper exists worldwide)

At 6X forecast current year earnings you’re able to buy JLP for 3.9p when it appears good value at 10p.

If it pulls off expansion to 25Ktpa and grows to 38Ktpa then buying at 3.9p is the stuff of legend. 10p moves to a potential target price of 16p. But one step at a time.

Regards

The Oak Bloke.

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Safe to say that the income statement does not fully reflect the potential of the SA business given the large intangibles (which are amortised). As a result, EBITDA would be a good metric to use. Alternatively net cash flow generation can be used. In FY24, the SA business generated an EBITDA of $25 million. In FY25 performance is expected to be higher owing to increased chrome production (counter-acting price decline), increased PGM sales and margins.

Let's not forget that there's 5.5 kOz of PGMs that will be monetised (not reflected in the financials). Also lets not forget that chrome capacity is 2.1 million tonnes per year vs a guidance of 1.85 milion (so a 14% increase in revenue in FY26 is possible). Big question for management is why are do they want to sell the business? Recent disposal of resources in Zambia will generate $16 million over 12 months. We expect increased cash flow from the SA business given the rise in PGM prices. Given these, the company has sufficient funding options to complete projects in Zambia. In any case, on site leaching will only be scaled after 6 months of demonstrated performance

On the copper business, safe to say that they have failed to demonstrate that they scale the business. Roan which was said could do 10,000 tonnes per year in 2021 and 13,000 tonnes per year in 2024 post the front end - assuming 1.5% feed, can only do 4,300 tonnes per year at 1.6% feed. So there's already $100 million sunk into Zambia with minimal returns. Hoping that they can fruitfully use the $90 million from disposing the SA business is wishful thinking