Dear reader

Is it greed to dismiss a 44% discount as not enough?

This is a “95” super stock on stocko which sounds great. Come on Oak Bloke stop picking the suckers just pick the super ones. But before we do let’s look inside.

JZ Capital Partners ticker JZCP so presumably pronounced Jazz Cop, hence today’s picture as we get into the groove. A one, two, three, four….

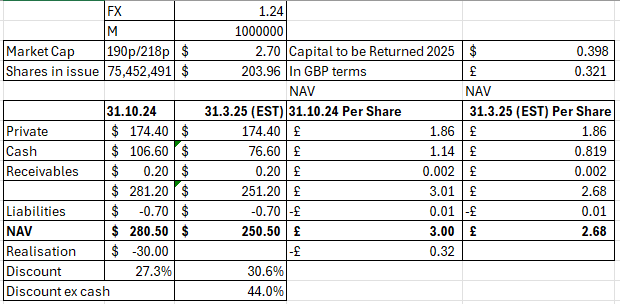

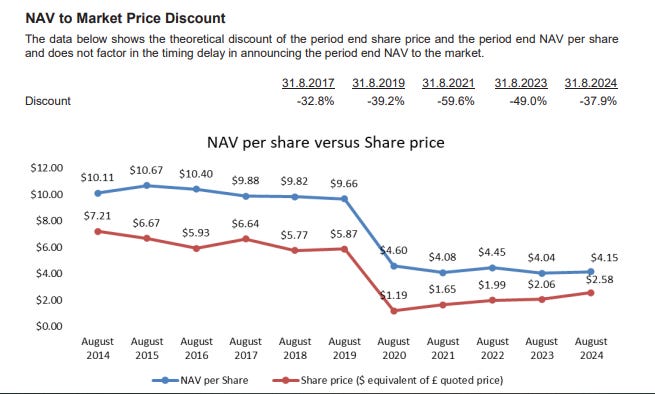

A(nother) fund in wind down, a $30m realisation planned for 1H25, a 26% discount growing to 29% post the $30m realisation and if you strip out all other cash it’s actually on a 44% discount to its last NAV.

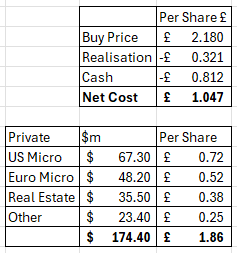

So a $207m purchase price less a $30m realisation less cash of $76.6m means you’re buying $174.4m of private holdings for about $100m. That’s your 44% discount.

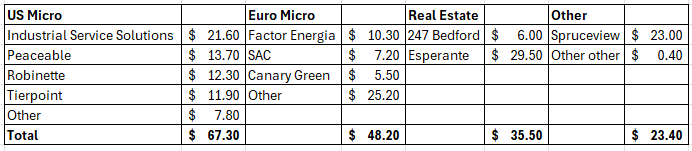

So what’s inside?

The portfolio is comprised of US, Euro, real estate and other.

Let’s start with the USA.

US Micro

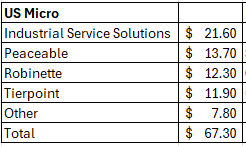

In the US Portfolio - there are four large holdings.

USA#1 Industrial Service Solutions

The first and largest ISS is having a busy time with the IRA and with re-shoring of industry into the USA, supporting and installing electrical equipment across a wide range of industries in the USA.

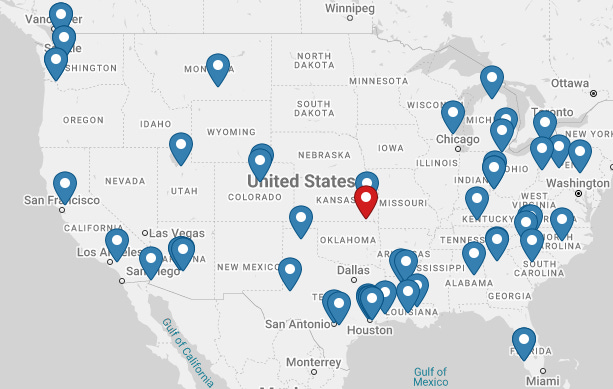

They are based all across the USA….

USA#2 Peaceable

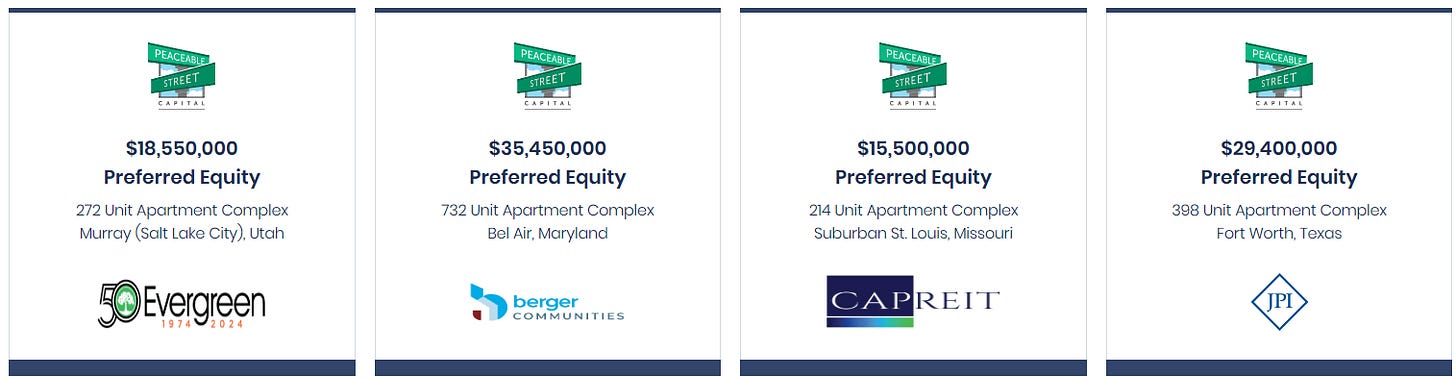

A real estate finance platform holding is the next one. A specialty finance platform focused on making structured investments in small and mid-sized income producing commercial real estate. Peaceable focuses on a diverse portfolio of property types including multi-family, office, self-storage, industrial, retail, RV parks, mobile home parks, parking health care and hotels.

It generates a 8%-10% return per annum, but also an up to 45% share of any upside on a sale too via its “Preferred Equity” aka Preference Shares. So that means it has some degree of protection in the event of a default too.

USA#3 Robinette

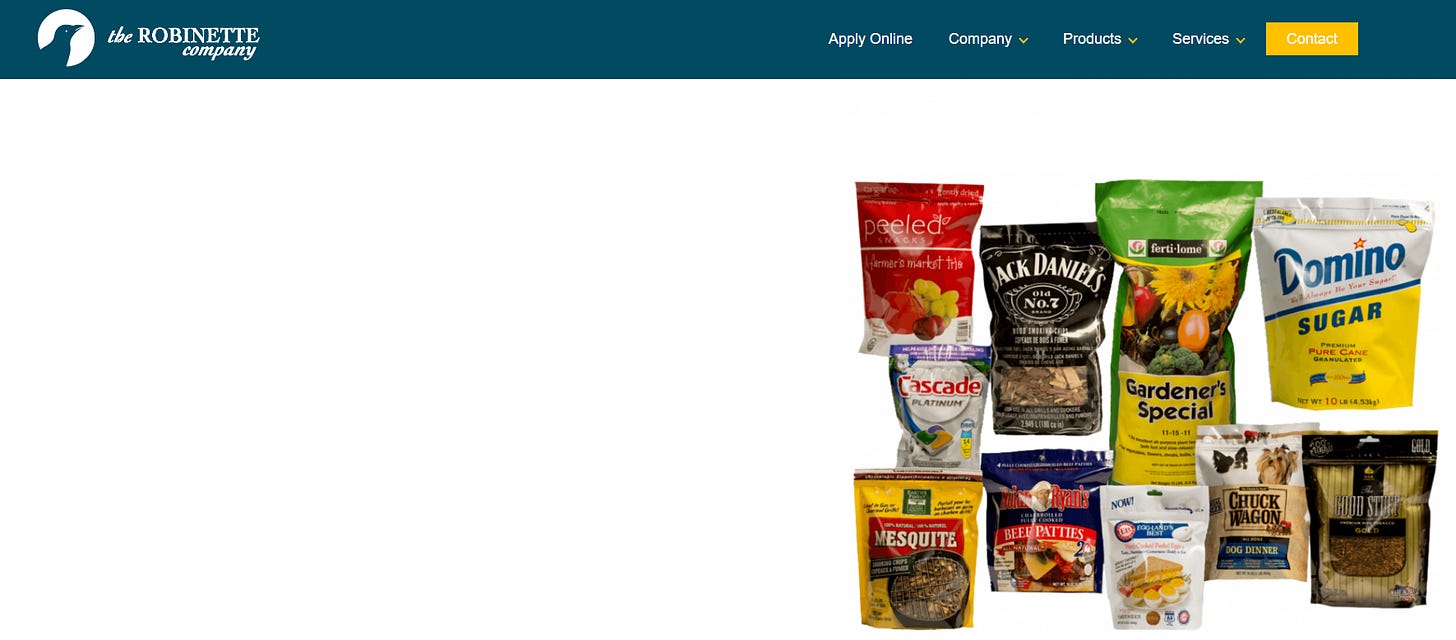

Next is a packaging company making packets for various food businesses, plastic films and that sort of thing.

USA#4 Tierpoint

Next is a US Data Center operator in operation with state coverage across most of the USA.

Has raised a further $1bn ABS earlier in 2024 to support its continued growth and operates 40 data centres across the USA. Customers include GSK and Bill & Melinda Gates Foundation (the mind boggles why the Gates Foundation wouldn’t be using Microsoft Azure for its hosting but there we go!)

-

Moving to Euro next.

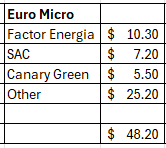

Euro Micro

Euro#1 Factor Energia

Factor is an alternative energy supplier to small and mid-sized companies in Spain, Factor Energia has developed into a fast growing energy broker, primarily targeting the highly fragmented small to mid-sized B2B market in Spain.

Euro#2 SAC

S.A.C offers the full value chain for leasing commercial vans. With two main offices (Copenhagen and Viborg) and its own mechanical workshops, S.A.C is able to provide flexible, shorter term leases at competitive prices. All van servicing is included as part of the lease and is done in-house with operating hours tailored to clients.

Euro#3 Canary Green

This business is focused on a niche build‐up of petrol stations in the Canary Islands (Spain), which benefits from high fuel margins and significant non‐fuel sales as a percentage of total sales in comparison to average petrol stations in mainland Spain.

There are additionally a large pool of “other” Euro holdings but no detail!

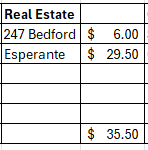

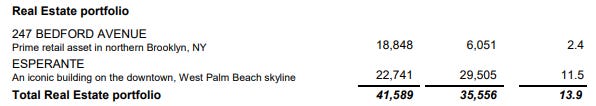

Real Estate

247 Bedford trades at a third of its cost price so appears to have been a dreadful investment, Esperante has performed better.

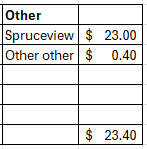

Other

Spruceview - $23m

Spruceview is a US asset management company focusing primarily on managing endowments and pension funds.

Sizing it up.

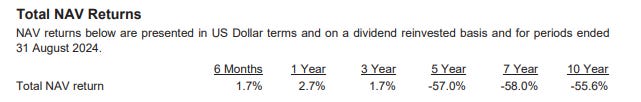

You have to realise that during covid JZCP investors were putting masks over their eyes as well as their mouths. On a ten year it has lost over half of its NAV.

Taking the nearer 3 year view 1.7% is hardly inspiring either. This was the reason I chose not to include it in my OB 25 for 25.

But did a broad brush view overlook something?

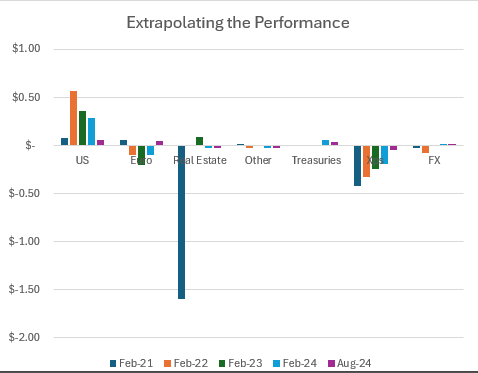

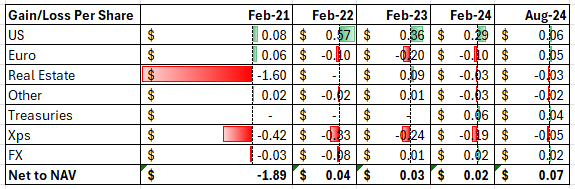

If we look at performance over 4 years the US has consistently delivered but the rest has been disappointing (ignoring that vast drop in real estate in 2020).

There are two aspects which caught my eye today. First is that the most recent performance (6 months to August 2024) shows a quadrupling of performance. Will we see that again in February 2025 - and going forwards until final realisation in 2028 or so?

It could be worth adding this to a watch list to see. Or if you’re feeling brave to take the plunge in the hope that the $0.07 gain in the interim is part of a broader improvement.

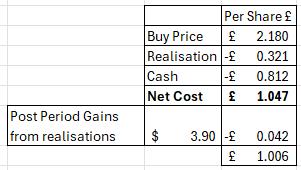

Second in any case, even if it continues a lack lustre performance, if you buy at today’s £2.18 ask price then you’re paying a net £1.05 for £1.86 of stuff (on the basis that £0.32 is being returned during 1Q25).

If you agree that the US based stuff is pretty solid (as it appears to be) then that covers £0.97 of the £1.05 - perhaps the full £1.05 if you consider possible US NAV growth since August 2024.

That then gives you £0.51 of European assets and £0.38 of US Real Estate in the price for free.

JZCP say the assets are going to be “substantially” realised over the next three years so you might get £0.05-£0.10 per year NAV growth for the next 3 years too. Perhaps more.

Moreover realisations could deliver some pleasant surprises. How can I know that?

Errr, I read the interim report dated from November 2024. $3.9m uplift post period. That’s another 4.2p.

Conclusion

Yours for just a quid - net - JZCP is a play on £1.86 of assets that might deliver £2 or so.

It’s certainly unloved but investors from a 2020 vintage who probably look like Zorro wannabes harrumphing and scowling ‘neath their covid masks at their misfortunes of 2020 US Real Estate losses. But that doesn’t mean a 2025 investor can’t make some money on this one, and probably shall.

Regards

The Oak Bloke

Disclaimers:

This is not advice. You make your own investment decision.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

yes, not a great track record of performance, but it does seem to have got (a bit) more shareholder friendly recently, and there's a big slug of cash should be returned (at NAV) soon