Dear reader

I was pretty excited to see Tungsten make an appearance for KAV in Zimbabwe.

Although Tungsten in Zim is not altogether a surprise since my prior research unearthed (ha ha) other Zimbabwean Tungsten projects for example with Premier African Minerals which unfortunately (for them) is 51% owned by another party and they don’t want to party. Boo.

But KAV own 100% of Hillside. Party on!

Do the Fandango. Thunderbolts and Lightnings (and other military aircraft, use tungsten). China’s restrictions are very very frightening. Mamma mia! Mamma mia!

It’s not just Tungsten KAV have found in their samples.

Samples of 2,200ppm is 2.2% Tungsten. That’s a wow but they are just peak samples and it’s early days. At $390/tonne credit, and assuming the 100 tonnes per day being commissioned at KAV’s hillside that would sum to an added $0.3m per year from Tungsten credits alone. Selenium sells for $18,500 tonne, Bismuth $8,000, and Molybdenum for $44,300 a tonne so could add a further $0.1m-$0.2m.

$0.5m a year doesn’t sound very impressive, but that’s based on 100 tonnes per day on those sample levels. Consider that the Hillside project is the size of 1,100 football fields and if one day there were a 5Kt per day operation then you’re looking at $20m credits per year maybe more?

-

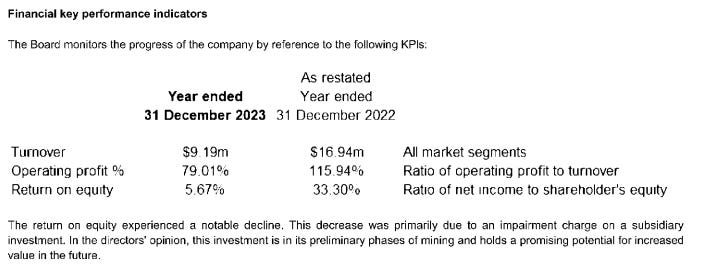

There is strong backing at KAV from a HNW party called PureBond who bought in to KAV and who own a controlling 52% interest but paid a 66% premium to the market price back when KAV looked ready to simply go bust. The share has dropped to 0.6p - would PureBond pull out? No. “We shook on 1p a share, so 1p it is” they apparently said. You don’t see that kind of honour very often. Perhaps they saw the crestfallen, slumped shoulders of the KAV crew, but reviewed their work, saw the quality and thought we need to incentivise these lads - after all Ben Turney had poured 6 figures of personal money into KAV. Who are PureBond? Their accounts tell us that they achieved 5.67% & 33.3% ROE over the past 2 years and operating profits of 79%-115%. That their investment in a subsidiary is “in its preliminary phases of mining and holds a promising potential for increased value in the future.” Who might they be speaking of there?

CEO Turney is now resident in Zim and has presided over what so far can be described as an exciting newsflow from its three projects, as well as moving from explorer to mine operator (albeit on a small scale for now) as well as continuing a 2nd work stream in Botswana for copper.

Nara is one of 3 claims in Zim(babwe). Hillside and Leopard, too, which you can read about in the KAV presentation. It augers well that there’s nearly a gram of gold in the tailings. The investment thesis is that in 1982 Zim produced as much gold as Oz. Then Mugabe happened. The Zim economy went to pieces and gold mining with it - apart from “Artisans” scraping the ground with picks - literally. (See my comment about scrape marks later but I’m leaving this description as is)

In 2024 the scrape marks show us exactly where to drill was a fascinating comment. 40 years later a post-Mugabe world ZIM is slowly re-opening to foreign investment. KAV reckon there could be 1Moz just at Nara, or possibly as much as 2.6Moz (see Page 16 of their deck). Other Zim mines like Caledonia historically have produced at circa $1,000 AISC and operated successfully, so the prospect of 1Moz at a $1,600 margin if it could happen would be an extremely tasty $1.6bn PBT. Theoretically.

Tax in ZIM appears to be 30% plus a government royalty of 5% for gold. So an undiscounted, $0.9bn lifetime net profit theoretically.

BOTS

Nothing to do with robots or agents I’m referring to Botswana where Kavango hold three separate areas. The near term one is the KCB where one neighbour recently paid $1.85bn to acquire 2/3rds of the land Kavango hold. What? Yes MMG. Who used to work for MMG and now works for Kavango? Lead geologist Dave Caterall.

Sandfire is another neighbour to KAV. It extracted 44.7Kt of copper equivalent in 2024 generating an EBITDA of $179m at a 52% margin.

The land is contiguous to KAV’s land. See the colour-coded map below.

Sandfire’s FY24 presentation regarding their Botswana Mine next door. They generated US$179m at a 52% EBITDA margin in 2024. I’m not saying this is what Kavango one day will equally do, but if the land has a defined MRE which is as prospective as the contiguous neighbour what could they sell for? The answer is many times today’s market cap.

KAV meanwhile are halfway through their drilling 1st phase programme.

KAV is selecting targets to complete its drill program with further drilling planned in 2025. It will be exciting to see the outcome.

Valuation

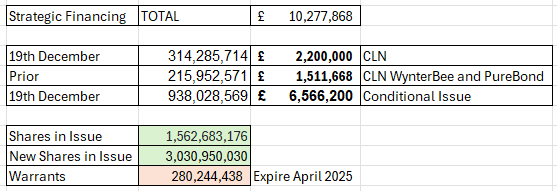

There’s been lots of harrumphing in the chattersphere about the recent “strategic” fundraise at a slight premium of 0.7p vs today’s 0.63p-0.65p bid/ask. Notice the word premium? Bold and Italics should hopefully highlight it for mole-eyed readers.

So what are the facts? £1.51m had been loaned earlier in 2024 and that is being converted to equity. A further £2.2m loan has been made which will be converted too once the prospectus is published. Finally a £6.56m raise. So 1.56bn shares becomes 3.03bn.

Plus there are 0.28bn warrants at 3p++. It’s very unlikely these will be converted…. it would be a wonderful problem to have if they were! They expire in 4 months, so best to ignore them.

The balance sheet moves to look like this. The dilution is quite theoretical really. As a shareholder you drop from 1.31p to 0.98p of assets per share, but that assumes you believe the Intangible Assets are worth anything. They are the past costs of drilling that have been capitalised but the reality is the money has been spent and their value is only what the claims might be worth if they could be sold. Are miners queueing up to mine in Zimbabwe? I don’t believe so. So fagedabouddit.

Tangible assets per share meanwhile have grown from 0.32p to 0.44p so your 0.63p share is now 66% covered by actual assets whereas before it was 50% covered. That’s a much more relevant way to look at the raise.

Moreover cash is the means to make things happen. 1% of something being more than 100% of nothing. Harrumphers take note.

I’ve laid out what we know of the Zimbabwe assets. Nara has not been purchased and would cost $4m to buy - deadline to decide is June 30th 2025. The known value is higher than this but not by much - yet. These could be worth anywhere from 5 figures to 9 figures, but there are tantalising glimpses of sample finds.

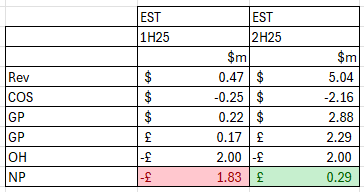

There is an existing cash-generating mining operation at Prospect 1 generating 30 ounces a month. Work is underway to expand that to 300 ounces a month in 1H25. I believe the valuation should start there, especially as that drives cash generation with then a theoretical upside.

1H25 is current run rate of 1Kg of gold per month which is 30 ounces a month at an assumed -$1,400 AISC. It provides useful cashflow but it doesn’t cover costs fully - for now.

But once the expansion is complete and based on a supposed $2,800 gold price in 2H25, and expansion in 1H25 this is forecast to produce a 300 ounces of gold per month operation by mid 2025* which at an assumed -$1200/Oz AISC and also supposing that overheads are £1m per 6 months, and £1m capex per 6 months of expenditure/depreciation should help this reach above break even in 2H25 - and going forwards - £0.29m estimated profit based on 300 Oz/month .

*in the Kavango documentary a 12-15Kg production rate is speculated on. This is higher than 300/month. The Capex was put at £0.7m but again I’ll leave my estimates where they are.

Development of Prospect 3 and 4 would raise this higher still. If expansion in 2H25 can raise this beyond 300 Oz/month.

The above estimate is based on a 360oz annual production in 1H25 growing to a 3,600oz annual production in 2H25 but let’s not forget that CEO Turney speaks of hitting a 14,000-15,000 ounces a year run rate by the end of 2025 - which is 4X my above estimate.

What could that look like?

My estimate is an annualised £5m net profit based on some pretty conservative overhead assumptions at say 6X earnings puts this at 3X today’s share price (0.65p → 2p). That’s factoring in zero for Tungsten or other mineral credits.

Beyond the above assumptions for Prospects 1+3+4 we must then consider the value of copper at the KCB, Hillside prospects 2,5,6, Nara and Leopard which all offer prospective upside.

And we haven’t even considered the other Botswana assets of Ditau and the Kalahari Suture Zone. Is there something of value ‘neath those 700m of sands at the KSZ?

Technology is moving forward and perhaps a new technology like Muon based tomography in fellow OB25 for 25 pick Ideon could one day peer downwards through the sands to the untold riches beneath?

Conclusion

I really like the fact that a decent slug of money has been raised. I’ve followed KAV over a number of years and they appear able to stretch money. I once commented if you gave them a decent slug of money the results would be something to behold.

So the raise gives me that opportunity to test that theory at a bargain basement £10m market cap. KAV offer a short-term path to being cash generative and self sufficient, with the ability to then scale that production, particularly if an open pit approach is possible.

This is not a low-risk idea and KAV disappointed in the past. But this time the hole is not 700m underground in the KSZ. The good stuff is much nearer at hand - even at surface in waste dumps. So in theory replace scraping sounds of a shovel at the hands of a bunch of eager and sweating Zimbabwean artisans, with the growl of a Cat(erpillar), apply modern methods, scale and watch the money roll in.

And if this article doesn’t convince you to the merits, then I invite you to spend some time watching this 2.5 hour deep dive into the lives of KAVangoers released two days ago and makes you realise - for example - that when the OB speaks of “scrapes in the ground” he was actually referring to deep, deep chasms where dudes with picks and shovels have dug deep down chasing gold so quite some metres of depth. The idea of doing that by hand is a mammoth task suggesting the effort was worth it for those past artisans.

If you watch the whole thing I think you could come away deeply impressed with the scale of the opportunity but also the earnest dedication of a highly-experienced team. Well done to Kavango for producing this documentary. I’d already written my article but have gone back and added two snippets of info (scrapes and 12kg-15kg) from watching it.

It will be interesting to see how £10m in the hands of these folks can turn a dream of gold to bars and ingots. I’m not allowed to have favourites among my 25 ideas but shhh I do like this idea for its potential for a re-rating. Don’t tell the others.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Elephant in the room is dilution & country risk. Was c450m shares early Jan 23, shortly over 3bn & that assumes no more raises or acquisitions in 2025. The jewel in the crown was Karakubis &that campaign like the last 4 in Botswana has been very poor, the hope was a commercial discovery worth $50-100m to KAV but even if that does materialise it’s now worth 50% less per share due to latest raise. You have to be deeply sceptical about Turney’s production forecasts as zero track record but assuming your retained earnings calcs then EPS is minuscule due to dilution. The PE ratio for a non dividend paying company in Zim has got to be 0.7-2.0, even Turney recognises this. Hence my analysis (despite the 0.7p fund raise) is that KAV is worth significantly less when valued like any other company. The balance sheet really is bollocks.

Country risk is real. Zim has no real currency other than USD & no access to debt funding hence all funding for the mine/production has been equity i.e. 3bn shares in issue. Zim govt announced it now wants 25% free carry for new mines, sketchy details & might not impact current plans but it’s the direction of travel. BT was named in an affidavit in Zim, the details are available in Zim press via Google, they are not flattering! Then you have everyday Zim issues like electric supply, draught, theft, machete gangs & endemic corruption.

Geological risk is significantly less in Zim than Bots but KAV have found a lot less gold than original estimates. Really can’t see 1m oz resource at Hillside from assay results, more likely 100k.

Investors could probably live with a lot of these issues if the risk reward ratio were sufficient & dilution was under control. But, given these issues can anyone point to a 5 or 10 bag upside?

Thank you for sharing your research, I invested in KAV a number of years ago, like you I think 2025 will be the start of the uptick despite the challenges