Share price bid/ask 31.8p/32.3p. Mar Cap circa £275.1m Shares in issue 865.17m. Prior NAV £879m (£441m is Verne global so £438m net) but forecast NAV is £886m or 102.4p a share excluding).

NAV previously 101.6p/share now has holdings worth 102.4p/share - discount to forecast NAV was 57.8% now at a 69% discount, but with much lower leverage.

HOW IS THAT POSSIBLE??

Read on reader. The truth is out there.

The sale of “Verne Global” (book value £473m) which comprises of Verne Global London (previously Volta), Verne Global Finland (Ficolo Oy) and Verne Global Iceland has been agreed.

The sale is for £327m plus deferred income of £20m in 2024, and a further “up to” £107m by 2026 subject to Ebitda targets comes to up to £454m. So a 4% discount to NAV.

Bye bye Verne Global 38% of the portfolio.

Verne was a fast growing and profitable data centre asset and cash hungry growing so fast…. it was “too successful” they said! But also very ESG friendly. Data Centres usually burn a lot of CO2 through their energy use. Not Verne. Much like Iceland makes a lot of aluminium because energy is cheap now it’s providing data centres too….. because energy is cheap. It’s touted as a prize asset and has (had) bright prospects.

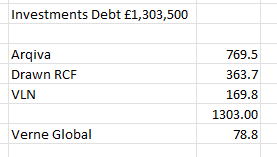

The current balance sheet (once you factor debt in) looks like this. “Investments - Debt” is “off the balance sheet” at TopCo i.e. the debit is held at portfolio company somewhere - mainly at Arqiva. So I’m factoring it in for visibility even though it’s technically not “shareholder funds”.

The DGI9 accounts are very confusing! It took a fair bit of analysis to tease out the state of affairs. But it feels like it was worth it.

The left hand side BS is the pre Verne sale make up of DGI9. As we can see if we include the “off balance sheet” liabilities there’s a lot of liability lurking.

The right hand side is what happens when Verne sells - however they have chosen to repay £300m of the RCF not £56.2m as I believed they would in a past article.

The “debt” assumes full realisation of profits in 2026. Arguably this may not happen but remember reader it’s a prize asset that would flourish “if only” it had cash so I’m sure there will clauses in the sale agremeent that the PE buyer must fully fund Verne (to the tune of over £600m) - so while it’s true the agreement is confidential DGI9 are not stupid - and didn’t accept the highest bid (apparently).

The various balance sheets I’ve produced assumes NO PROFITS MEANWHILE, even though 2024 free cash flow/profits appear to be above £40m/year and EBITDA is above £200m/year and growing. More on that later reader. (Keep reading it’s worth it!)

Investments - Debt reduces by £300m repayment of RCF plus Verne’s debt is no longer our problem. (£924.7m).

So notice reader “Equity” of £886m? That’s the remaining holdings and the “debt” (£127m) with some adjustments.

Cash £29m assumes the balance above £300m drops to cash.

The £1.303bn of “Investment Debt” previously was this.

Investments at FVTPL drops to £773m this is made up of these investments - notice Giggle is written off to zero post period and Verne drops away (£441m).

THE FUTURE

Scenario 1 - Unlocking Arqiva

DGI9 spoke to the priority that they needed to “unlock” Arqiva. Latterly they appear to have had a change of heart (rightly so) about a “small matter” of needing to refinance the RCF in 15 months. Meanwhile it’s also true that the cost of the RCF debt is 50% more expensive currently.

So why was Scenario 1 so important? Well it was all about covering the dividend.

Arqiva dividends would generate £20m or 0.4X of the dividend cover. Now the dividend is cancelled, that requirement no longer exists.

As can be seen, in the chart above the cancelled £50m/year dividend would have been covered 1.6X times by June 24. Obviously 0.4X is now gone with Verne being gone.

However with £300m of the RCF paid off, Interest Payments will reduce by some £27m too, which is over 0.5X the prior dividend cover too.

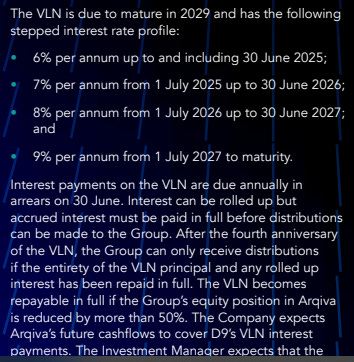

But the problem is Arqiva can’t pay dividends to DGI until the £163m Vendor Loan Note (VLN) i.e. the principal is repaid plus any interest (£7m so far). So £170m must be found to unlock Arqiva earnings. Disposing of Verne is a step in the right direction.

Scenario 2 - VLN is paid.

If we ignore profits and solely pay the VLN out of balance sheet funds this would be possible in 2027. If new funding could be found then this could unlock sooner.

Unlocking Arqiva means accessing dividends. Until then they accumulate. I was interested in looking at EBITDA and EBITDA growth. I fell off my chair reader. WTF(udge).

What about the portfolio EBTIDA?

These numbers are from the June 23 Interims. The 3 Verne Globals refer to London, Finland and Iceland. £7.2m in H1 2023. So a run rate of £14.5m. So reader. Think about this and fall off your chair with me please. We sold an asset for £441m that generates £14.5m (3%) per annum EBITDA. Now I appreciate you’re probably thinking aha but what about the future? Yes you might have a point. But let’s reexamine the facts. Verne needs over £600m funding. So Would then be asset with £1.1bn poured in. So let’s be generous and say earnings increase 5X. £72.5m. So now you have an asset yielding 6% EBITDA. The D of EBITDA erodes that to maybe 4%. If DGI9 financed that at 9% that’s £54m “I” (interest) deducted. Rubbish!

Good riddance to Verne I say! What say you reader? What about the past? 2022, 2021 reports show Verne with flat earnings and falling NAV. Crown Jewels? Pah. Knock off diamante more like.

What about DGI9 remaining portfolio? A growing EBITDA - Arqiva is growing 10% a year 2021-2023. £98.8 for H1 23 doubles to over £200m for FY23. On shareholder funds of £886m reader. That’s 22.5% EBITDA yield, where the “I” of EBITDA has just shrunk by £27m a year (the RCF pay down) and will drop to zero potentially, and the “D” I guess takes us to 15% net (being pessimistic). There reader, are the crown jewels! So you now understand why you fell off the chair.

Scenario 3 - clear the RCF.

Assuming zero income/cash DGI9 can fully repay the RCF saving 9% a year (~£5m) out of the £20m deferred income from Verne. So the RCF “cliff” is no more!

Future Optionality

VLN - Vendor Loan Note - while the interest rate is quite lower at 6% for the next 18 months, the incentive to repay this is to unlock the dividends to the parent. Meanwhile these earnings don’t disappear they continue to accrue at the child level but just aren’t accessible.

An option would be to recommence a lower dividend. A £27m/year dividend would provide an 10% yield at current prices with FCF of £40m+.

Or the company speaks to beginning buy backs. At the current discount this generates a lot of value for shareholders.

Accretive Value

With Verne gone, there’s plenty of opportunities to grow its portfolio companies. Arqiva, for example, is the backbone to the UK’s internet. It has a bright future as the Internet of Things (“IoT”) unfurls. The Investment Manager views this part of Arqiva’s strategy as a huge NAV accretion opportunity and expects it to be a key driver of value in the future. Smart Utilities already contributes around a quarter of Arqiva’s revenues and it is expected to continue to grow.

The “swap” on Arqiva is a bit complicated to follow, but my take on it is the differential between the cost (of the swap) and the income (of the corresponding inflation linked revenues) will reduce in 2024 due to falling inflation and rates peaking and reversing. The effect stops altogether in 2027.

Conclusion

Stifel and others had a moan in Investment Week about “losing the crown jewels” in Investment Week and getting a bad deal. Are you kidding me?!

The share price has dropped it’s true. There is a risk of not getting the £107m or less than the full amount it’s true. But if we assume the NAV is £107m less than £886m then the share is still trading on a 64% discount (£779m vs £275.1m). And still generates £200m EBITDA. So I repeat - are you kidding me?!

Reader, this is an Investment Trust with some very interesting holdings and has been unfairly punished in my opinion. The drop following the news on Verne is a gift.

DGI9 is a defensive trust. Even if the future holds a nasty recession, these assets will continue to generate - and grow - income unless communications and internet were to somehow decline for the 1st time in history. And people stop watching TV.

This is my opinion and I do get excited in my optimistic opinion of what I believe is deep value missed by the market. I hope you enjoy reading my thoughts but this is not advice.

You know the mantra by now - if you need advice - go and get it - is my advice.

Have a good weekend!

Oak

I find the sell down unfathomable too, but still supremely comfortable in the long term. Not sure whether paying of Arviqa debt to unlock income is my preferred option, or not, after all the earnings are still there, accumulating. I think the Verne sell of is a good deal (particularly the earn out) - yes I think Verne will become a golden goose, but without the considerable long term funding was for DGI9, actually an albatross. That the sale now gives them options, is only a positive to me, in unlocking Arqvia, and a phoenix like rising for DGI9.

What EV would you assign to 100% of Arqiva and how FCF generative is this company?How does this compare to similar companies in the industry?