Dear reader

It was interesting to see that since the last NAV update - as at 30/09/24 - by how much its public portfolio (aka strategic) of mostly gold stocks has increased in price.

Luca Mining particularly is off to the races, but Argentinian Cerrado too. Perhaps the Milei chainsaw cut through some red tape or simply that investors no longer see Argentina as persona non grata, and are buying again.

Its 660Oz of bullion was $2635 and is $2935 today, so has increased £160k (0.4p a share)

The increases mean even though this has nearly doubled in price that it remains at 35.9% below NAV and once you strip out cash, bullion and listed companies MAFL remains at an astonishing 62% to NAV!

But wait!

That’s before you consider the potential increase in value of MAFL Golden Sun holding which is a Gold Producer. The value of Terrasun, a Gold explorer.

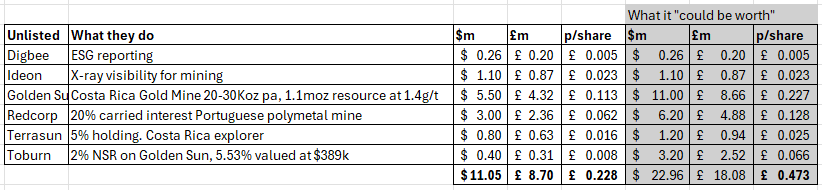

Increase? Yes, Gold remember? Now at record levels. As at 30/06/24 the unlisted portfolio looked like this:

Even if Golden Sun is only producing at 350 tonnes per day delivering 2,700/oz per year at a supposed $1500 AISC then that’s a PBT of nearly $4m. 5.56% ownership means pro rata $0.21m. Not huge numbers but once production is at 10X larger that then would be over $1.5m net profit pro-rata which then is a P/E of 3.3X - again assuming a chunky AISC of $1,500. Valuing that on 7X-10X would mean a 11p-22p per MAFL share upside based on a 2026-2026 Price Earnings.

It’s quite difficult to know what kind of upside could exist for Terrasun but you’d expect there to be robust levels of demand for mining equipment in Costa Rica and in neighbouring Nicaragua.

Toburn

Then there’s the 2% NSR (Net Smelter Royalty) over Golden Sun known as Toburn. MAFL own 5.53% of Toburn.

At current rates of 2,700 ounces a year at $2,900 per ounce that’s $7.83m revenue so worth $8,660 to MAFL per annum.

At a future rate of 30,000 Ounces per year, at $2,900/oz gold that would generate $87m of revenue for GSR and therefore $1.74m for Toburn. Therefore $96k for MAFL per annum.

The question is how much of the 1.11Moz is recoverable and exists - as 75% is proved, probable and measured while 25% is only indicated and inferred. If the overall number is 90%, then that translates to income of $3.2m for MAFL based on $2,900 gold.

Since MAFL apply a 12.5% discount rate at $2,650/ounce to value this asset at just $389k - eight times less.

If you believe (as I do) that gold will increase in price in line with the cost of capital then there’s an argument that discounting the future value of that gold is too pessimistic.

-

RedCorp (Lagoa Salgada)

Or RedCorp where the 20% carried interest is worth much more than the current $3m valuation.

Where each dollar of future income would be over one third precious metals at current prices.

If the Portuguese Empresa de Desenvolvimento Mineiro (EDM) take up their option to carry 15% of costs then MAFL will sell its remaining 5% to Cerrado/Ascendant at the NPV discounted at a DCF of 10.5%. Currently that calculation is $123.2m so 5% is $6.16m. So that’s $3.16m more than MAFL’s NAV.

Consider the NPV is based on Gold at $1,700/oz, Silver at $22/oz and other metals at similar below market prices. The NPV is being updated in 2025 through optimisation work on recoveries so potentially revised upwards on price assumptions too.

What it “could” be worth.

I fell off my chair when I added up what these 4 private holdings might be worth based on Golden Sun being worth double, based on a P/E of 7X, based on RedCorp being valued at its official $6.2m level (i.e. ZERO included for the revised NPV through optimisations we know are being worked through), and I’ve put 50% upside on Terrasun based on current prices, and Toburn I’ve considered at its undiscounted potential value at the current gold price.

You arrive to a 24.5p upside per MAFL share. There’s reasons why Digbee and Ideon could be worth more too.

It is astonishing to then realise that the NAV per MAFL share would increase to 61.1p per share and that when you strip out cash, gold and listed shares based on current prices then you arrive to an 85% discount.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

This was an inspired pick for 2025. Up 61% YTD!

Is this an investment trust? Not listed at https://www.theaic.co.uk and no discount / premium to NAV quoted at https://markets.ft.com/data/equities/tearsheet/summary?s=MAFL:LSE