Dear reader

Netscientific has a holding called Martlet Capital. It is fund manager to Martlet and charges a fee to do so. This article looks at the final part of Martlet’s holdings.

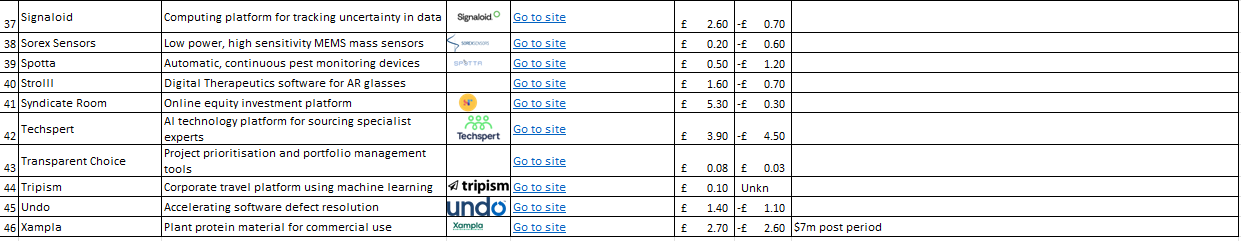

Signaloid

The real world is uncertain, ain’t it? So what about a service which provides an uncertainty API to accurately model the world and provide uncertainty. UaaS - uncertainty as a service. When you think about it it actually makes a lot of sense. Signaloid's computing platform lets you run your existing software and feed in probability distributions as regular data. Signaloid have 29 patents protecting what they do and how they do it, either via an API for cloud software or there is an Enterprise version for on premise code.

Think about financial services and things like swaptions. You need to calculate the distribution of possibilities to price something accurately. Signaloid can help.

Engineering and alloy strength modeling, BESS energy storage system modeling, are other examples.

Finally robotics and sensors are another example - for autonomous driving - but other similar use cases.

They lost money in their last accounts (£0.7m) and have £2.6m of assets but what impressed me was their client list:

Sorex Sensors

Anyone who watch Private Ryan remembers Fubar. Well Sorex have FBAR technology and readers will be pleased to know the acronym differs widely. FBAR stands for a film bulk acoustic resonator and a very small way to sense even a trillionth of a gram of “something”. Something for Sorex is indoor pollution. Dust, dirt, Carbon Monoxide, NOx and Sulphur Dioxide are common pollutants.

The global market for sensors will be $323.3 billion by 2024 their web site tells us but with Sorex claiming small business exemption in their latest (2022) accounts, we only know they lost -£0.6m and assets of £163k remain.

So the Jury is out on this one.

Spotta

It’s itch time reader. Bed bugs are a guaranteed itch fest. Spotta offer 24/7 monitoring for hotels and places of beds.

It’s a very news worthy topic, and Spotta have taken full advantage. Appearing on Sky News, in the Daily Telegraph, even that Extreme Left news organisation the BBC has featured them in 2024.

Spotta raised £3m back in December 2023 to expand their global growth and particularly their “Bed Pod Detector” product for Bed Bugs.

But they also offer an IoT solution for detecting insects in an agricultural setting.

They speak to a $570bn annual cost of insects and the benefit of detecting them. Also considering the 4m tonnes of pesticides used each year in the UK, alone. The accounts as at August 2023 meanwhile speak to a -£1.2m annual loss and £0.5m cash (plus £3m last December).

Spotta could well be one to monitor.

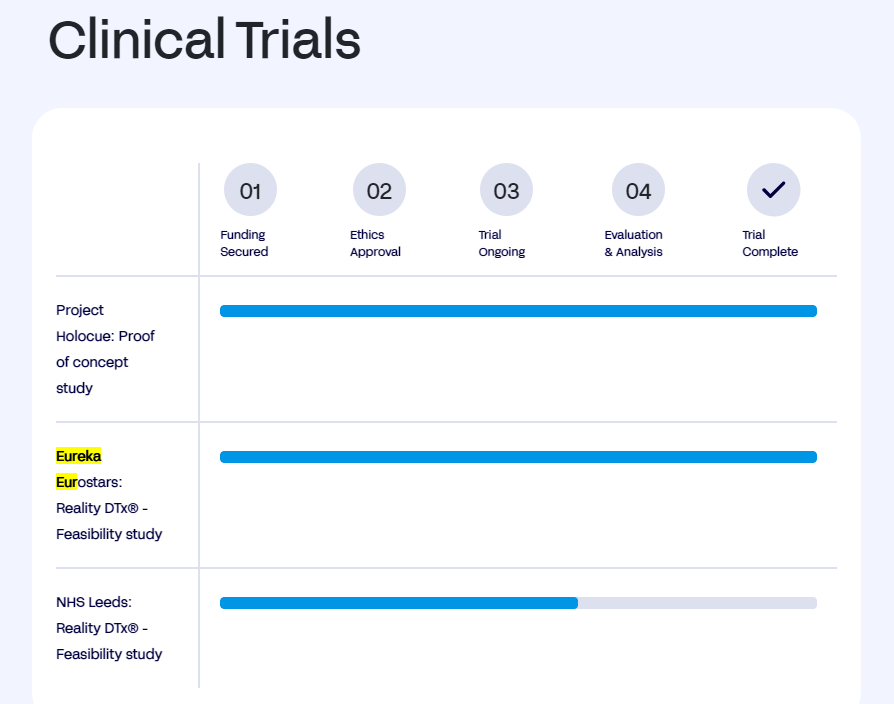

Strolll

A strolll is a regulated medical device and must be prescribed by a registered therapist.

10 (Private) UK clinics and 2 US clinics stock a strolll. That generates £297 a month per device for Strolll it would seem, and each clinic has a minimum of 2 devices. That’s Income of £88k per annum.

The clinic trials are very interesting. Two trials have found the device helps with rehabilitation of injury but also helps people with Parkinsons.

The third trial could be dynamite. This is with the NHS in Leeds (which is a large teaching hospital) and the trial is to determine whether Strolll’s AR Glasses can help with rehabilitation at home for adults with Parkinsons. Sadly there are 153,000 people in the UK with Parkinsons and it affects 1 in 37 people. 10m people worldwide.

The business at the end of 2023 had £1.6m assets and made a loss of -£0.8m for 2023.

Syndicate Room

This is an interesting idea. Get a group of business investors called “Angels” to give your web site credibility and get their business investment ideas and then wrap up an EIS/VCT. Kind of what Martlet do.

This is the list of the several dozen startups Syndicate Room have backed.

This is the top one of the list: Lemon

Examining companies house records it appears the £1.25m capital has been extended by a £0.4m investment via Syndicate Room (based on number of shares issued and assuming these to be £1 each). Lemon Financial Technologies Ltd offers an intriguing Factoring business for SaaS companies. Get the annual cash up front but the customer only pays monthly. Pretty good idea.

Could this grow and “become big”. Sure it could and it appears albeit based on a sample of one, to already have some traction. Could be a future vehicle for NetScientific to get involved in more directly also.

Techspert

Using AI to connect project with experts is a recruitment co by another name. Techspert focus on healthcare and pharma.

But these achieved 539th place in the FT 1000 Europe’s fastest growing companies and list Accenture among their client list.

A review of Trustpilot reviews reveal some instances of glitches around payments and “revenge reviews” from disgruntled folk who weaponise reviews for example when payment notifications hit their spam folder. But leaving these aside, there is a positive set of 5 star reviews for the service provided which is a positive.

Transparent Choice

This is a Project Management software and a SaaS offering backed with a wealth of videos and resources. It’s quite hard to see from the (2022) accounts any commercial progress but with names like RNLI and the US House of Representatives.

Tripism

Tripism targets corporate travel and making the travel experience better. They don’t offer a booking system nor travel services but instead work with existing platforms and service providers while provide a superior company intranet experience. So this is a portal for internal travel teams to offer superior travel experiences to their busy execs with better communication and engagement and a single platform experience. An emphasis on maximising the benefits of points programs and promotions, but also managing feedback to the travel team, to colleagues and to suppliers is also part of the proposition. It’s difficult to see any commercial progress in their 2022 accounts but the web site and client list appear impressive so another to keep an eye on.

Undo

Another company with a strong client list and a debugging tech for coders is Undo.

Something as simple as a screen recorder and a “bug database” being able to go back to the reason for the bug and the point of failure is hugely time saving. I can see how this platform would be hugely popular and the “50%-80% time savings” are achievable.

Xampla

Xampla raised $7m in 2024 to expand its Morro product range. This is a plastic replacement using natural and biodegrable materials (plant proteins) to produce films and coatings for food products.

It has a pilot project with the European arm of Yili a top 5 global dairy brand from China.

Again it’s difficult to see any certain commercial progress but one to keep an eye on.

Conclusion

In Part 3 of 3 we’ve looked at the final components of Martlet’s investees and what their potential upside could be. There’s several which are worth keeping an eye on and have promising business models and several where the jury is out.

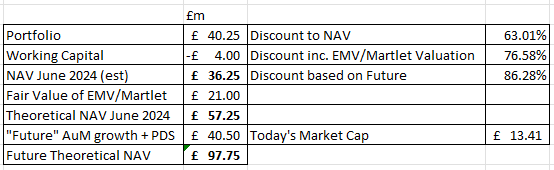

Netscientific stands to earn platform fees for managing the Martlet and EMV funds. It also can earn 10%-20% accretion fees (share of upside) on any uprounds and we can see several possible candidates for that in Martlet Part 3, as well as others from the reviews in Part 1 and Part 2.

Considering NSCI’s deal on the 13th May with Martlet didn’t cost NSCI shareholders a penny, and in fact generates income has not been appreciated by the market. In fact in a bizarre twist NSCI is down 10% since the news of the Martlet portfolio.

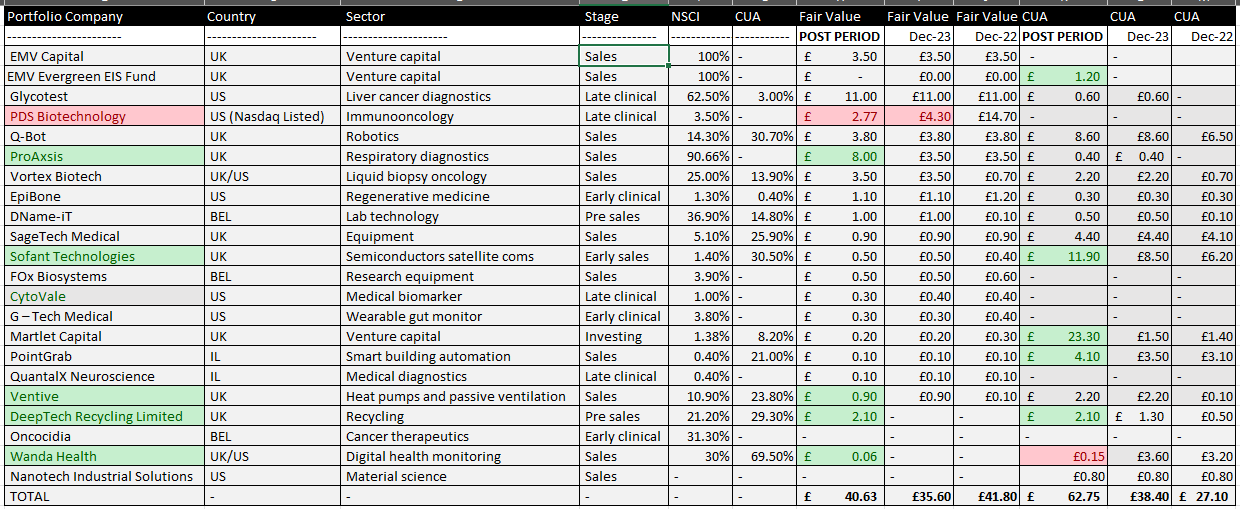

£13.4m buys you a core portfolio of £40.25m which dedecting other assets and liabilties nets to £36.25m. If you consider a 10X P/E on the £2.1m fees fair then that’s a £21m valuation upside, and future growth could add £40.5m based on a £200m AuM business and PDS returning to its target price alone.

The core discount is 63%, factor in EMV/Martlet’s fair value and that grows to 76.5%. Add in the fair value of £200m AuM and PDS Biotech’s target price and you are at an 86.3% discount.

That’s even before any other upsides, realisations and news flow in the core portfolio. Other VC funds are increasingly achieving realisations at or above book value. Will this thawing of the market pass NSCI by? I think it unlikely and remain positive about its holdings and business model. With just a £13.4m market cap even one modest realisation for NSCI would unlock value.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".