Dear reader,

Some shares give you G-force. From 4.4p to 75.6p in 2025 is a great result for lucky shareholders, although that share price has slipped and Mast is now 49p. Is it worth a look on the pull back?

I did a deep dive as the idea of the business appealed to me. Erm. Well, until I deep dived that is.

Let’s start with the “If I’d bought” 1 share 01/01/25 that would have cost me 8p in post consolidation prices (0.2p pre), so today that’s a 6X increase in share price.

WHOOPEE!

But congratulations particularly to those who jettisoned at 75.6p, and 49p looks like a good price to sell at also, whether you’re in profit or not.

Why’s that?

At the 31/12/24 there were 426,354,067 shares. Post Period there was a 40:1 consolidation. So 49p today is really 1.225p in old money. 40:1 creates 10,658,851 shares and 2,313,858 share holders were added so today there are just 12,972,709 shares at 49p each which is a £6.36m market cap.

I’m assuming the 96.5m warrants as at 31/12/24 have also converted at 40:1 and there are now 2.4m warrants remaining.

£5m of funds was raised in 2025 (Whoopee a 2nd time) and there was a complicated series of warrants added. The plain-English version is as below.

2.3m shares were added hardly diluting shareholders at all……

Until the warrants come along.

So a purchaser at 01/01/25 perhaps buying based on a tip would have paid 8p and bought the equivalent of 25p worth of assets (a 70% discount to NAV right?). The 2024 accounts show equity of £2.65m, and 10.65m shares.

The warrants (owned by the 2.3m shareholders who stumped up £4.65m and paid the equivalent of £2 a share) potentially add 401.1m shares (assuming they are all converted of course), and by converting 100% of warrants would add £10.4m further funds. (It’s £10.75m less costs of the fundraise is £10.4m)

The owner of 1 share post warrant (assuming they didn’t get to participate in the fundraise) would then own just 4.3p of assets per share, not 25p of assets per share due to dilution so would have lost over 5X the amount of NAV.

MEGA OUCH!

Does it matter?

Possibly not.

The question turns to what can the business do with the £15m of cash is raises?

What income can that generate?

After all it speaks of 300MW of power generation. That’s a lot right?

Let’s start with today.

MAST’s main site is Pyebridge. This site had three 2.7MW engines that needed overhauling. MAST borrowed to get them overhauled. You can see £1.64m of capex below.

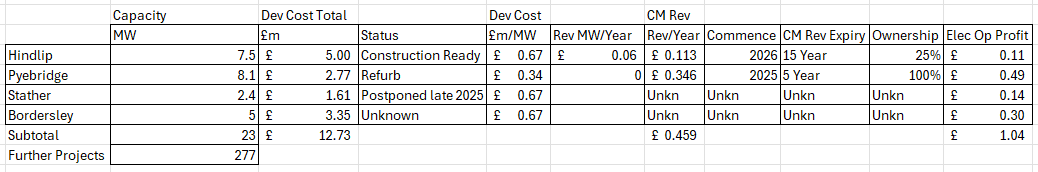

This will generate £1.73m profit by 2029 so that’s £0.346m per year. Hindlip meanwhile has a guaranteed £60k/MW/year so that’s £0.45m a year. That generates £0.8m.

Gas Peakers operate about 1500 hours a year and average prices are £80/MWh. I’m assuming a generous £40/MWh profit (beyond the cost of gas) and assuming zero for maintenance and all other costs. Yes, I do know occasionally there will be £600/MWh++ margins when the wind doesn’t blow etc etc but there will be plenty of below £80 per MWh hours also. Ember monitor this stuff for a living so if they say £80/MWh as the average then I’m happy that’s about right.

The below chart tells me that £80 is about right and I’m not even factoring in the potential for that £80 to drop over time, as more and more renewables, energy storage, interconnectors, and for that matter SMR nuclear join the grid. Arguing that we will see a return to 2022 peaks for peakers is dangerous wishful thinking in my opinion. It’s not impossible, but it’s not likely or if it happens it won’t be permanent.

The cost and revenue therefore looks like this.

If I work through the development of the four sites we get to a development cost of £12.7m just for the engines. Hindlip is described as “shovel ready” but we don’t know about Stather and Bordersley.

Even if we pretend there will be zero costs for two sites that are not shovel ready well it will require £12.73m to develop the four sites and get them operational.

MAST is giving up 75% of Hindlip for £0.5m and the Hindlip SPV is receiving a loan of £4.5m from Powertree, the lender and new co-owner. So the attributable to MAST is actually 1/4th of the profit.

Paying down the £4.5m debt back to Power tree will mean MAST won’t see income from Hindlip until 2032, prospectively.

Pyebridge should generate £0.8m operating profit (considering the CM revenue plus the power generation revenue) (and let’s say from around now, July 2025) so that will mean a reduced net loss of -£0.6m in 2025 and -£0.2m in 2026 for MAST.

That means the fully converted warrants cash pile will have dropped to £17.7m - £12.7m-£0.6m-£0.2m = £4.2m remaining by the end of 2026. How many more megawatts will that enable?

Let’s be really generous and assume Stather and Bordersley are both built in 2027. 2027 is a break even as a result.

Even if in a flash of brilliance you spot that Powertree paid the £5m dev cost not MAST and therefore the cash pile is £9.2m not £4.2m, the reality is that you are now faced with 277MW left to build, no sites (you have to buy or lease those, £9.2m in the bank, a business that generates £1.5m operating profit less -£1m admin cost and -£0.13m tax is a £0.37m net profit per annum.

That princely income would equate to 0.1p per year which after 548 years would equate to the 49p you paid for the share. Your NAV would be 4.7p of gas peaker plants and leased sites, plus about 2.2p per share of cash.

A 600% premium to NAV, for a P/E of 548X!

-

All of the above assumes 100% of warrants are converted.

Having paid £2 a share for those warrants you’d be a bit mental to not convert them unless the share price collapses by over 90% to below 4p of course.

I can’t see that the money raised will be sufficient to create these 300MW of generation. If they instead collaborate with Powertree or similar losing 75% of the SPV is a harsh price to pay. Perhaps they could achieve better terms than keeping 25% of an SPV and 90% of the money is a loan (£4.5m) in the future, but it doesn’t appear they would in a substantially stronger position to not worry about this.

It is not as easy to develop sites as the initial Pyebridge brownfield just recon the existing engines has been (and that’s not been all that easy either), and beyond the four sites, you’ve then got grid connections, planning permission, competing providers, the glib “we’ll build 300MW of capacity” isn’t as quick or as straightforward to do. Nor would the cash stretch that far. The engines alone would cost 20X more than the forecast remaining cash. So further dilution could be the only means to grow.

As I built out more and more MW of capacity I’d also worry whether there is a demand for that much peaker power. With competing and growing numbers of BESS power storage and LDES longer duration storage, the other danger and risk here is that Peaker plants don’t run for 1,500 hours per year. (That’s about 4 hours per day every day, by the way). At what point do you cannabalise the very scarcity of not enough peaker plants?

-

To conclude, I can’t see that the business has any basis as an investment. SELL.

Regards

The Oak Bloke

Disclaimers:

This is not advice; you make your own investment decisions

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".