May the Fourth of closing discounts benefit you

Are we seeing closing discounts and growing NAVs?

Dear reader

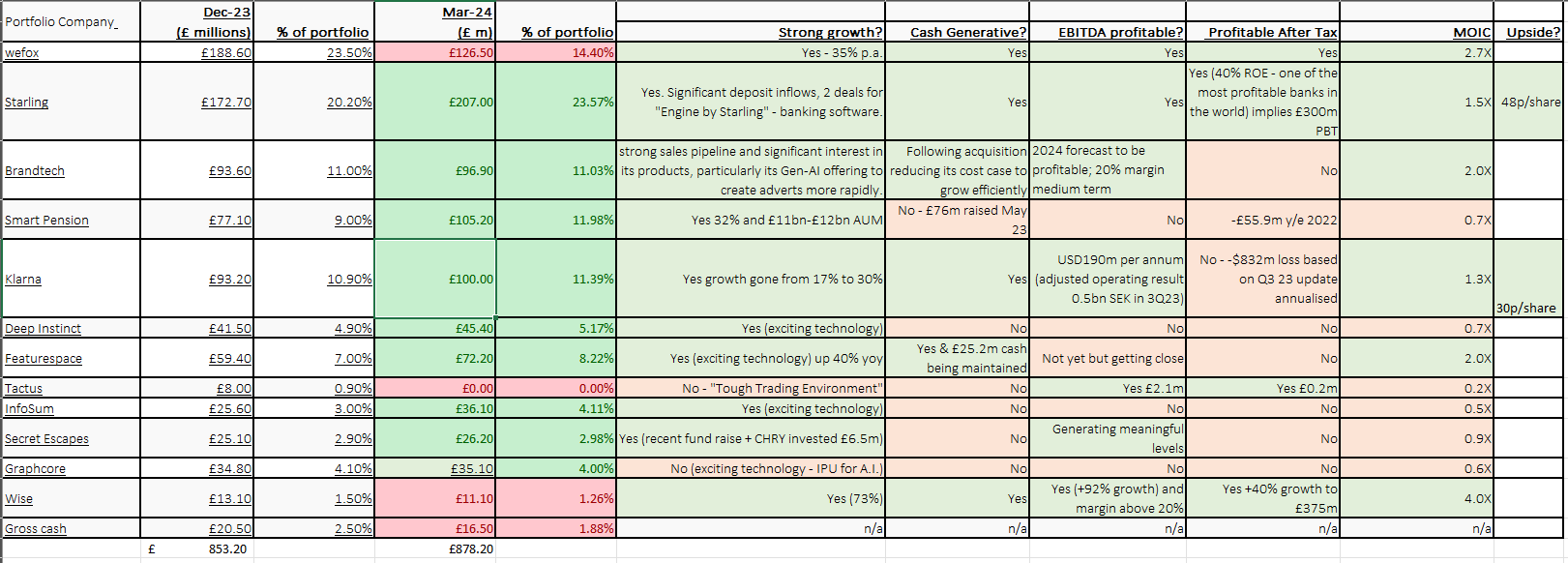

Chrysalis provided an update to its NAV. Its growing NAV mind you. Others have growing NAV too. Or at least we appear to have reached nadirs and M&A, trade sales and even prospectively IPOs are proving the NAV over and over.

I thought it would be an opportunity to review how the purportedly “doomed” world of Private Equity and Venture Capital was holding up in practice. The theory goes that higher interest rates makes growth capital unattractive.

Discounted cash flows and higher discounts mean the value of future cash is smaller. On top of this the difficulty and cost of raising capital is such that thriving investments wither on the vine.

But is that actually happening?

I’ve investigated a range of UK investment trusts. Some I’ve written about extensively. Others I have an eye on but have not invested and nor have I got deep knowledge.

I’ve set out the holding, their 12M low price, their current ask price, the maximum estimated discount to NAV (I’ve not built in forecast NAV or discounts to NAV that some like Molten themselves bring in). I’ve then looked at how much, if anything, the share price has bounced from a 12m low price, and then how much the discount has closed from the maximum point of discount.

The purpose is to look for value across many holdings and to look for patterns.

It is apparent that while some holdings have closed their discounts, others are lagging. An important component is how and whether NAVs are growing (or shrinking). CHRY has recently rebounded with quite strong NAV growth, and arguably has plenty to come with Klarna, Starling and others heading to IPO. TEK got its SALT IPO away against all odds and “proved” its NAV. For some like NSCI and IPO the NAV has been shrinking but this is on large publicly listed holdings of PDS (PDS Biotech) and ONT (Oxford Nanopore). GROW has shrunk until recently with the 6 months to 31/3/24 finally showing NAV growth of 7%. HGT has seen a 7% growth in its NAV over 12 months but is trading on virtually no discount to NAV.

Oakley have provided an impressive NAV growth even if that growth has slowed in the past year or so.

Next I was interested in understanding the current discount to latest known NAV.

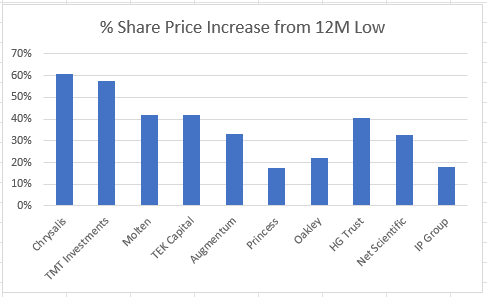

Next I was interested in the momentum from 12 month lows to see how much prices of Venture Capital and PE investment trusts had rebounded.

Large rebounds in CHRY and TMT are noticeable. But both appear to have plenty of upside left, partly because the NAV itself doesn’t reflect the value of the holdings (I believe and have sought to demonstrate through articles on those holdings).

Others like Molten, TEK and Augmentum have had more muted increases. For Molten that 40% increase is in the past couple of weeks, while TEK has dropped back from initial optimism about Microsalt’s IPO. IP Group is the clear laggard in share price recovery and noting the 55% discount to last NAV suggests the negative perception of IPO holds it back. It’s true that ONT has haunted it but ONT itself has bounced 20% from recent lows and I believe there are a number of realisations in IPO’s cleantech and healthtech holdings which make IPO an attractive option.

Finally we can see all VCs have closed their discounts to some extent. But some much more than others. Oakley and TEK stand out as laggards in this regard, and IP Group too.

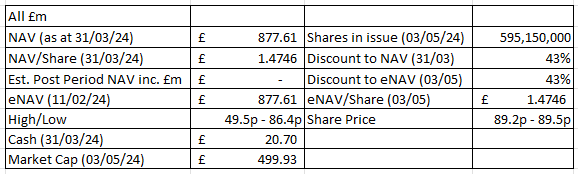

CHRY

This analysis was curiousity on the back of the revised NAV from CHRY.

CHRY announced that as at 31 March 2024 the unaudited net asset value ("NAV") per ordinary share was 147.46 pence. This represents a net 4.09 pence per share (2.9%) increase since 31 December 2023. Movement in the fair value of the portfolio accounted for approximately 5.15 pence per share, with foreign exchange generating an adverse movement of approximately 0.87 pence per share. Fees and expenses make up the balance. Positive uplifts at most holdings was severely offset by a 1/3 decrease at WeFox, and an apparent 100% write off of Tactus. Graphcore’s valuation slightly increases - Bloomberg tells us that Softbank is in talks to acquire.

CHRY also on 22/04 updated on its REVB claim which it says “note a claim of £39m, together with a claim for consequential losses of a further £6.2m. The Company considers that it has a strong case and is willing to pursue it.”

If it achieves that that’s £45.2m or an extra 7.5p per share; which would put the discount to NAV at 46%

CHRY comment that:

wefox continues on its road to profitability; while it achieved a full month of profitability in December 2023, the Company is aware that there are also seasonal factors that make extrapolation to a full year inadvisable. Revenues increased to $800 million in 2023 while the cost base fell year-on-year.

The company is continuing to invest in its technology platform, which uses AI, data analytics and automation to streamline insurance workstreams, and caters to insurance companies, brokers, partners and customers. The Company views further monetisation of the platform as a key future value driver and was encouraged by the announcement of the WindTre partnership towards the end of last year.

The company intends to continue its focus on profitability this year, which is likely to involve further cost base optimisation and concentration on its distribution proposition. The Company has previously highlighted the appointment of Mark Hartigan as Executive Chairman and CEO; Mark was previously CEO at LV= and Head of Operations for Europe, Middle East and Africa at Zurich Insurance Group.

The valuation of wefox fell in the period, reflecting a deterioration in the assessed multiple of the listed peer group against which wefox is marked, a fading of the calibrated premium to the last funding round reflecting passage of time, and strategic repositioning within the business.

So WeFox has been reduced by one third on no actual bad news!

Comparing WeFox with (for example) UK listed Sabre Insurance. Sabre is a £400m market cap. Turnover about 1/4 of that of WeFox. Sabre has 1/10 of the customers of WeFox. WeFox was valued at $4.5bn in 2023 which is £3.6bn. CHRY’s 1/3 mark down is to say it is now only worth £2.4bn. Which is 6X more than Sabre. Yet WeFox grew revenues by 35% from 2022 to 2023, it is heading towards profitability while Sabre has consistently made profits over 6 years but these have declined year after year.

Comparing WeFox with Direct Line Insurance, DLG is about 3-4X larger than WeFox (on customers and revenue) but has flat sales over 6 years and is a £2.4bn market cap. It lost money last year and halved in price (so was a £5bn market cap) but generally achieves a reasonable 9%-10% return on equity.

We do not know which peers were used to determine a 1/3 reduction in WeFox, presumably some German insurers, because I can’t see any UK insurers that explain the sudden drop. Comparatively, WeFox is at a fair price if it has exhausted its growth, but is incredibly cheap if it can continue to grow (i.e. achieve something 2 UK insurance competitors haven’t).

Sometimes patience is required with Venture Capital, but overall the winners in CHRY and in similar outweigh the losses and that is perhaps the lesson to take. Outsize gains pay for the losses and the costs.

I feel I will write more about this topic but is provides some food for thought. I welcome reader’s input on this too.

Regards, and may the fourth be with you all year round,

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings even those held in VC stocks might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Interesting article.

I note you took my advice re the disclaimer about small cap stocks ... Thanks. :)

There are some major private equity firms like Harbourvest Global Private equity and Pantheon International on big discounts that you don't seem to have considered in the above article. Is there any reason why you excluded them? Cheers

There's also a consideration imo which needs to be had with POW as to whether the model they are trying to implement could work in AIM. This could be a trap, or an opportunity, and could also be considered more broadly within the univeres of UK PE investment trusts.