MKANGO - Songwe and a Prayer? OB Idea#3

mine, refine, recycle - the OB Pick #3 for the OB Ideas 2025

Dear reader

Some companies are despised until suddenly they aren’t. Such as Mkango (ticker MKA) perhaps? Dismissed as a “sucker” stock or “speculative”. It has repelled its detractors but magnetised others.

And it’s true that in the past two years shareholders have been diluted by 27.5%. Shares in issue have grown from 215,206,548 → 297,078,761.

It’s furthermore true that Mkango has been pre-revenue for about 5 years so can’t point to growing profits (the clue in the words pre-revenue).

Nevertheless there is compelling value here, compelling and unique technology, compelling geopolitical reasons to believe that MKA will succeed no matter what. Despite many OB 2025 ideas being GARP I cannot wholly ignore what I believe will be a winning idea.

There are three parts to MKA’s story: Mine, refine, recycle

#1 Mine

Ask yourself, what price do you place on a mine? Not a lot until you know the details of said mine, I would hope. So let’s talk about the Songwe project, in Malawi. A mine which has a PFS, has a DFS, an ESSHIA, and an MDA. In other words it has been technically and commercially assessed and signed off, environmentally signed off, and finally the government (of Malawi) approved the building of a mine (and fiscal terms).

The AIM Market has quite a number of REE developers but MKA is different because it has progressed to FID. This s is a key differentiator.

The remaining step is a Final Investment Decision (FID) due in 2025.

Financing will need to be found to proceed. A backer would finance the $345m capital because the economics are there. The project economics are based on a 31.5% IRR, and a NPV of $559m. This is based on a 10% discount rate, with Malawi enjoying a 10% free carry. The mine has a planned 18 year life with 5,954 tonnes p.a. of rare earth oxides based on 18.1 MT grading 1.16% TREO and $32,816/tonne. Separately MKA plan to build a processing plant which would add further downstream value (this is part #2 “refine”).

Bear in mind that TREOs sell for much more today than $32k/tonne, and the 2027 basket price is $76. 516,000 CNY is $71k/tonne. So the IRR is in excess of 55% not 31.5% per the DFS which boosts the NPV above >$750m.

These are the mix of rare earths at Songwe. Who controls rare earths reader?

These are the sources of rare earths. 19% are in “friendly” countries. 81% of rare earths come from…. challenging places.

But more than just the raw material let’s also consider that 92% of all magnets made from REEs are manufactured in China - so TREO flows *TO* China for processing and downstream value adds. Magnets are a highly-effective pinch point for the Chinese given the ubiquity of high-performance magnets in EVs, turbines and other advanced applications like in aerospace.

Have you seen Chinese moves to dominate Electric Vehicles reader?

In any case demand is growing for magnets (including for EVs and Wind Turbines), catalysts, metallurgy, phosphors, ceramics, glass and polishing. By about 12.6% per year. What is the West’s Plan B if China restricts exports?

Currently there is no substitute for rare earths with the same performance/cost, although Tesla are trying to eliminate or minimise rare earths, using ferrite compounds for example. Demand is only set to increase and supply is constrained. Recycling will be a key technology and MKA seem well positioned to take advantage as we’ll see later on.

But considering the mine still.

Bear in mind, too, that today MKA has engaged a merchant banker reknown for successfully placing much larger rare earth supply chain projects than Songwe.

The FID should be the final piece of the Songwe jigsaw.

By the way there are 4 earlier stage Malawi exploration projects also owned by MKA too.

mine, refine, recycle

#2 Refine

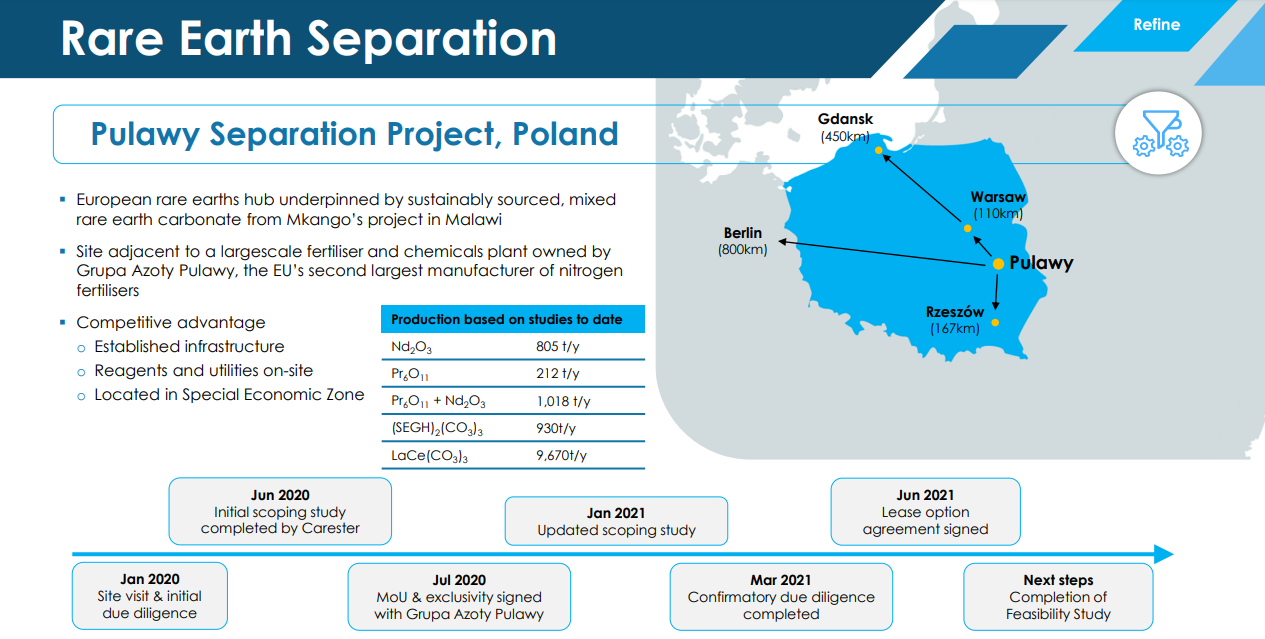

Pulawy, in Poland, would receive the TREO which would be a 55% concentrate. The idea would be to base itself next to a chemicals plant (needed for the reagents) and which also would be next to transportation, water and power.

The target is to achieve an opex of less than $3/kg of TREO with $120m capex. This is subject to further analysis in a DFS for Pulawy.

However the Songwe DFS contains a 27% discount to exclude the value of a rare earth oxide (REO) separation process. So removing that 27% discount thus improves the IRR of Songwe from 31.5% to above 45% (at $32,000/tonne REE prices).

Therefore the approximate NPV of Pulawy “should” be in excess of $200m NPV.

So if you’re already just a little bit excited by Mkango, reader, what if I’ve saved the best until last?

mine, refine, recycle

#3 Recycle - a complicated structure

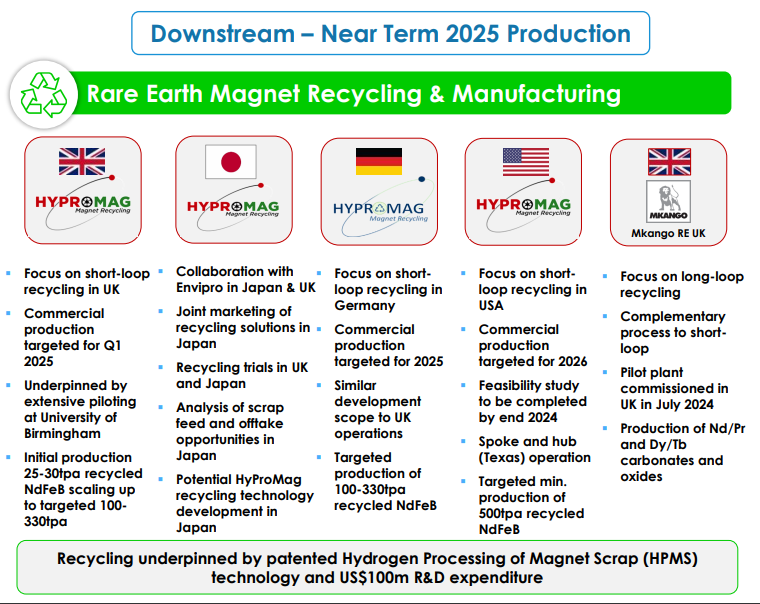

Before I speak of recycling let’s explain the complicated structure. MKA own Maginito. Maginito owns a UK recycling business 100%. It owns Hypromag 100%. This subsidiary owns 50% of a US recycling Entity and 80% of a German recycling entity. The other 20.6% of Maginito and 50% Hypromag USA is owned by Canada listed Cotec.

Recycling - two processes - Short and Long Loop

Long loop involves first breaking down and dissolving the magnets through various techniques and then recovering the rare-earth oxides from liquid-waste streams. These oxides then have to be converted into metals before being cast into alloys and broken down (again) into a fine alloy powder to make the magnets. Long-loop recycling is an important but energy intensive and expensive process.

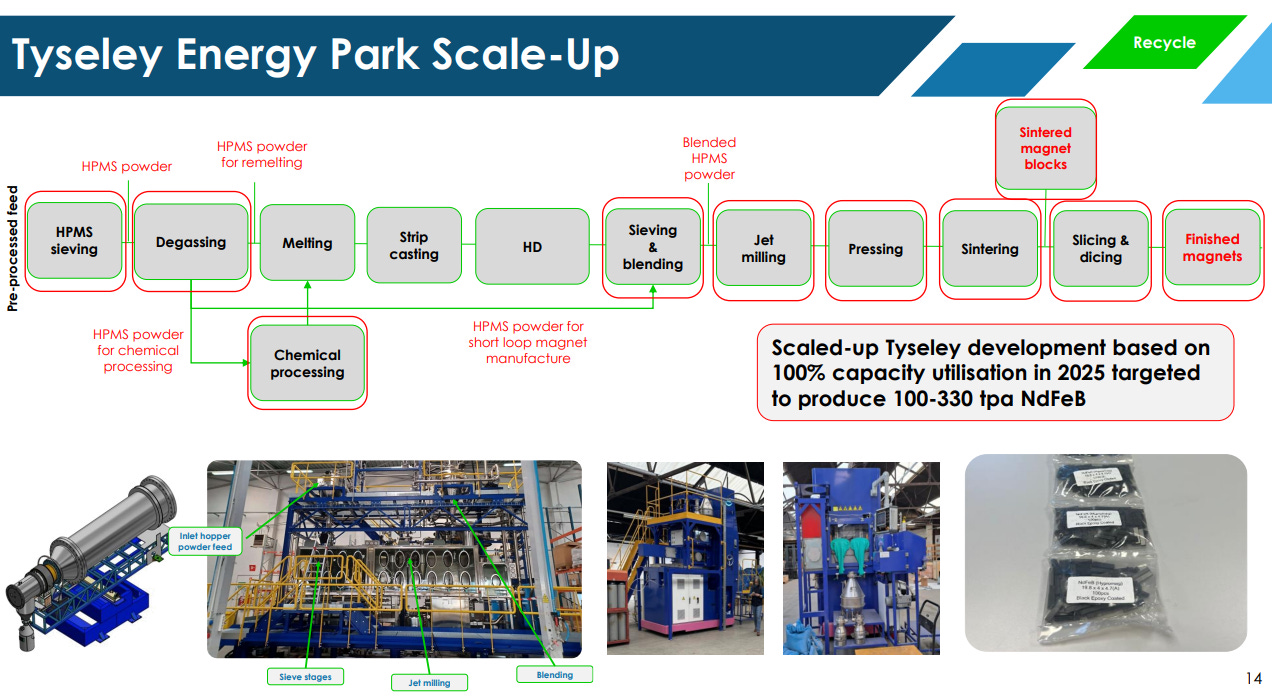

MKA’s “short loop” patented technology takes a different approach. Another UK success story. It is on the University of Birmingham’s patented Hydrogen Processing of Magnet Scrap (HPMS) technique. It uses hydrogen as a processing gas to separate magnets from waste streams as a magnet alloy powder, which can be compactified into “sintered” rare-earth magnets. Not requiring heat, it’s a relatively quick process dubbed “short-loop” recycling. It uses 88% less energy than virgin mined rare earths.

3a - UK - LongLoop

Mkango Rare Earths UK ("Mkango UK") successfully commissioned a pilot plant designed to produce separated magnet rare earths (neodymium/praseodymium and dysprosium/terbium carbonates or oxides) via a long-loop recycling process, based on a chemical process (not a heat process). Long-loop can use NdFeB powder not suitable for short-loop processing.

The facility was 70% funded by UKRI a government quango focused on the automotive sector and the pilot plant is operational. A further scale up increase to 1000tpa and beyond is being considered.

3b - UK - Short Loop

This is delivered by Hypromag and full commissioning and then commercial production is imminent in 1Q25. Production will be 25-30tpa scaling to 100-330tpa later.

Recycling: The scale up of rare-earth magnet recycling initiatives in the USA, UK and Germany via its 90% owned tech subsidiary Maginito. The technology is called HyProMag where Mkango has developed a patented short-loop hydrogen-based process (the HPMS process) to extract, breakdown and demagnetise NdFeB magnets in scrap. HPMS is more energy-efficient compared with competing chemical-based recycling technologies (which face the challenge of having to first liberate magnets from end-of-life scrap components) and has a far smaller carbon footprint than prevailing primary supply production routes. Moreover, the ability to produce rare earth magnets or alloys directly from the recycled NdFeB powder is a key advantage versus competing recycling technologies.

Recycling UK: HyProMag is developing a £4.3m UK grant-funded demonstration plant in the UK with a minimum capacity of 100t pa of NdFeB products, and first production is expected in the next 3 months. In parallel, Maginito – via its Mkango UK subsidiary – is developing a pilot facility in the UK to chemically process recycled NdFeB powder and magnet swarf, complementing HyProMag’s short-loop HPMS recycling route.

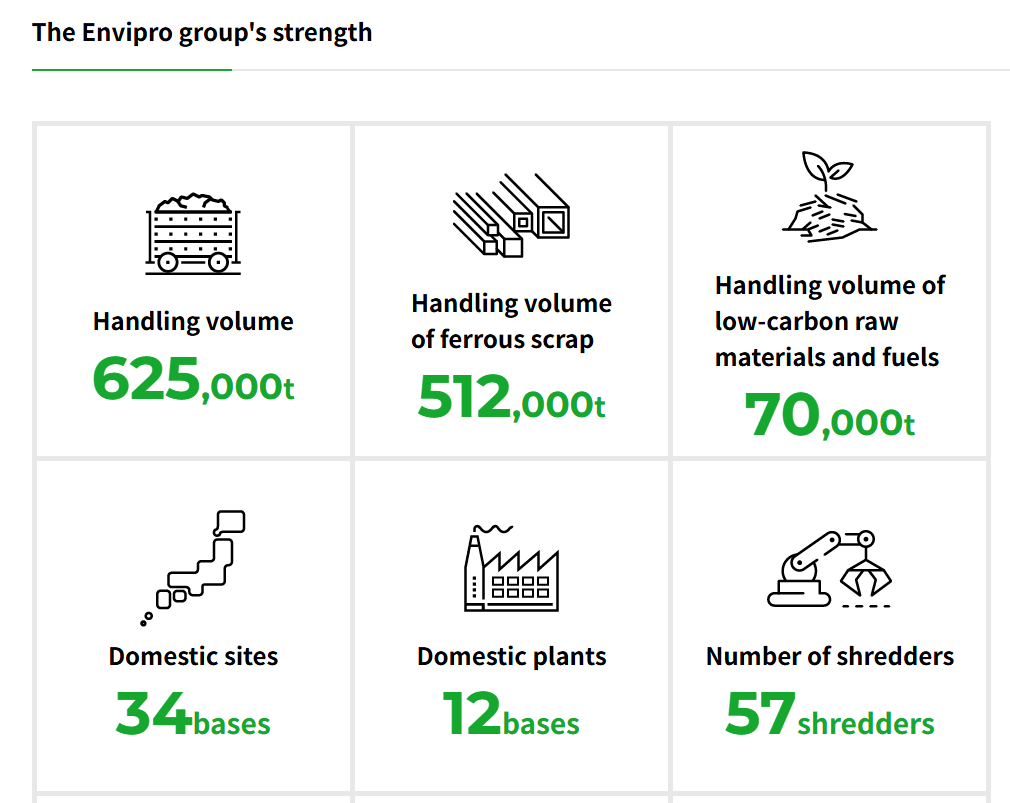

3c - Japan

Hypromag’s collaboration with Envipro is much newer and analysis, trials and development are underway. Japan is one of the countries within the MSP partners. Japan’s Envipro specialises in the handling of specialist waste and recycling.

3d - Hypromag Germany

This is also delivered by Hypromag and full commissioning and then commercial production is later in 2025. Production will be 25-30tpa scaling to 100-330tpa later.

A key driver in Germany is the EU’s Critical Minerals legislation which mandates for 25% of all strategic minerals to be recycled - of course this includes NdPr.

Scale up will unlock €3.7m of previously announced German and European grants to develop a rare-earth magnet recycling facility in Germany’s Baden-Württemberg State.

3e - Hypromag USA (40% owned by MKA)

On Monday MKA announced its US Feasibility Study for a recycling and manufacturing operation in Dallas Fort Worth ("DFW"), supported by two pre-processing spoke sites in the eastern and western regions of the United States:

US$262 million post-tax Net Present Value (NPV) and 23% real internal rate of return (IRR) based on current market prices

US$503 million post-tax NPV7% and 31% real IRR based on forecast market Prices

Low all-in sustaining Cost (AISC) of US$19.6 per kg of NdFeB product which compares to current weighted average market prices of US$55 per kg of NdFeB products, the latter reflects underlying prevailing low rare earth prices with significant scope for price recovery

Expansion potential with the inclusion of a third HPMS vessel within three years following commissioning for an additional capital cost of approximately US$7 million

Production of 750 metric tons per annum of recycled sintered NdFeB magnets and 291 metric tons per annum of associated NdFeB co-products (total payable capacity - 1,041 metric tons NdFeB) over a 40 year operating life

Up-front capital cost of the Project is US$125 million (inclusive of a 10% contingency margin and Class 3 AACE estimated detailed design study and engineering costs) over a 1.7 year construction phase

Payback is achieved at current market prices in 3.9 years or in 3.1 years at forecast market prices

I think this table says it best. For every 3% increase in price the rate of return increases by 1%. During World War One Critical Minerals rose by 700% due to restrictions on trade. Were that to happen again the IRR for MKA would be 263%.

A business you can buy today for £24m would be worth many times that if its patented technology is a way to resolve the pinch point.

Next Steps - the USA is *not* messing around:

First Revenue targeted in just over 24 months during 1Q27 with a Notice to Proceed expected mid-2025 following completion of Detailed Engineering Design and Value Engineering phase, which includes:

Evaluation of optimisation efficiencies in construction and operations, to reduce capex and opex, and expand production

Parallel product and operational testing in the UK at the University of Birmingham Magnetic Materials Group ("MMG") pilot plant and in conjunction with HyProMag commercial developments in UK and Germany

Completion of commercial arrangements with potential feed supply and product off taker - discussions with several potential parties already underway

Continued discussions with federal, state and municipal governments, in relation to financing opportunities and other economic incentives including carbon price premiums which could improve economics

Minviro Limited has been commissioned to complete an ISO-14067 compliant "Product Carbon Footprint" analysis of sintered materials by the end of Q4 2024 using the results of the Feasibility Study

HyProMag USA is targeting 10% of U.S domestic demand for NdFeB magnets within five years of commissioning - design is modular, can be replicated and accelerated to facilities in eastern and western United States

The Feasibility Study was undertaken by a multidisciplinary team appointed by CoTec and Mkango and led by independent engineers, Canada-based BBA USA Inc. ("BBA") and U.S. based PegasusTSI Inc. ("PegasusTSI") with other independent experts and support from University of Birmingham, HyProMag Ltd and HyProMag GmbH

DEFICIT

According to Adamas Intelligence, even with zero…. difficulty with China, global demand for NdFeB permanent magnets is set to increase at a compound annual growth rate (CAGR) of almost 9% to 2035 (a tripling compared to current demand), driven by double-digit growth from the electric vehicle and wind power sectors. By contrast, Adamas forecasts that global supply will increasingly struggle to keep pace with demand over the same period owing to the long lead time of bringing new production online – it forecasts that production of Nd, Pr, Dy and Tb will grow by a CAGR of just over 5% to 2035 (a doubling compared with current supply).

So this idea is not reliant on Trump picking a fight with China (which could be just negotiation talk)

Valuation:

Previously the overall NAV was presented as an unrisked 221p.

But that unrisked NAV was before the US Maginito was formed, before today’s $55,000+ per tonne rare earth prices (using Neodymium as the proxy; other REEs are more pricey).

Rare earths are a strategic resource and this article argues may fall under the US Defense Production Act in the future. It appears increasingly likely that Maginito US would benefit from that Umbrella.

I was interested to see that Adamas intelligence have released current and future prices. ARC call these their estimates but the RNS shows the $55/kg and $95/kg by 2028 as forecasts from Adamas, so either there’s a coincidence or these prices come from Adamas too.

Interesting that the risked sum-of-the-parts from ARC appears to use $55 a tonne even though with lead times the 2024 prices are not going to be relevant by the time commercialisation begins 2027-2028. They appear to believe Germany will have a lower NPV than the UK despite having equal production planned (higher taxes maybe? But they don’t say). They believe Songwe + Pulawy only have an NPV of $94m despite the NPV quoted in the DFS even at a $33/Kg price point being far above that number. There are no explanations for how they arrive at their numbers, so it’s difficult to understand how they reach their valuation.

In their prior report ARC derived an NPV8% estimate of US$650m using a US$82/kg ‘basket’ price assumption to arrive at a 65p/share valuation and assumed a risk-adjustment of 0.3x NPV - which is like discounting it by NPV26%). So their new 25p valuation is a little strange, I feel. There’s no reconciliation why they now believe MKA is worth 40p less, and their $82/kg basket has been lowered to $55/kg despite the positive US feasibility study as well as higher forecast REE prices.

Oak Bloke Valuation

I’ve assumed a 10% cost of capital, 5% depreciation (20 year life), 25% tax.

I set out Capex costs, forecast price, opex, volume per year to calculate EBITDA and then Net. I use 40% of EBITDA to arrive to Net for the US (lower tax and higher chance of grant funding), and 50% for Germany and UK short loop with a 60% discount on long loop.

I then 20X to get a gross future cash flow - and assume static prices (i.e. future revenue and costs rise with inflation).

I believe 20X earnings for a PATENTED and UNIQUE means to recycle a critical commodity is pretty conservative. I then discount the 20X earnings by NPV10% to arrive at a NPV Gross.

I’ve kept the NPV at 10% but have adjusted to account for forecast basket prices in 2027-2028. I’ve used accurate attributable amounts and applied a harsher risk factor. I arrive at £0.48 per share (460% upside to today’s 7.7p bid / 8.20p ask)

I also further assume that we will see 100m more shares at an assumed 10p, which is a further 33% dilution, which will raise £10m. This means I arrive to 36p target which is a mere 350% upside.

Conclusion:

Only REE project ready to FID.

Compelling economics both for its mine, its refine and its recycling.

Only recycler able to use hydrogen and not heat to recover REE with 88% less energy.

Recycling projects in 3 countries including a major project announced for the US. Japan and Canada likely to follow.

Western government backed, and part government funded. Strategic, critical for the Western World and a likely area for Chinese trade retaliation.

These are the reasons this is pick #3 for the Oak Bloke Ideas 2025.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

A BIG THANK YOU TO THE 16 FOLKS WHO’VE DONATED SO FAR FOR 2025. FOR THE THOUSANDS READING THIS WHO’VE NOT PLEASE DO THE SAME.

IT’S COLD OUTSIDE. YOU’D BE SEARCHING FOR SOME RARE EARTH TO PLACE YOUR SLEEPING BAG IN THE BITTER COLD IF YOU WERE HOMELESS. LET’S SOLVE THE HOMELESSNESS PROBLEM TOGETHER BY INVESTING IN A HAND UP NOT A HAND OUT SUPPORTING EMMAUS’ WORK.

Excellent write up as akways. Have decided to make a regular donation to your charity each time I follow one of your ideas and another (larger one I hope) each exit!

BTW, did you ever look at pat.l. this is a pet stock of mine. They will have a 1bn usd+ litigation claim announced early next year and trade at 20m usd. Similar litigation claims made 4x before the court decision was even announced