#12 of the picks for 26 MMMpac

Do do do buy? Or don't don't don't buy?

Dear reader

“You have so many relationships in this life

Only one or two will last

You go through all the pain and strife

Then you turn your back and they’re gone so fast

Oh yeah

And they’re gone so fast, yeah

Oh, so hold on the ones who really care

In the end they’ll be the only ones there

And when you get old and start losing your hair

Can you tell me who will still care?

Can you tell me who will still care?

Oh care. Mmmbop, ba duba dop”

Lyrics from MMMBop, as sung by Hanson

The tune is more cheerful than the actual words don’t you think? I can’t help but hum that song when people mention Mpac to me. “It’s forming a bowl” Mr Rebel declared yesterday. Mr Rebel has a keen eye for bowls, I don’t.

I know MPAC because it’s the 6th worst idea of 2025 for fun runner Mr Hill, losing people who followed his idea on 1st January -47% year to date. Ouch! Is one person’s unfortunately-timed buy, another’s well-timed buy? Could October 2025 be the start of a turnaround in the fortunes of a share slated to increase from £5.72 per share at 31/12/24 to £8.00 per share according to two broker guesses?

Which instead fell to just £2.90 on Friday when I released the video to this idea. Are we now at the turning of the tide, as Gandalf once declared? Or was it Canute who said that?

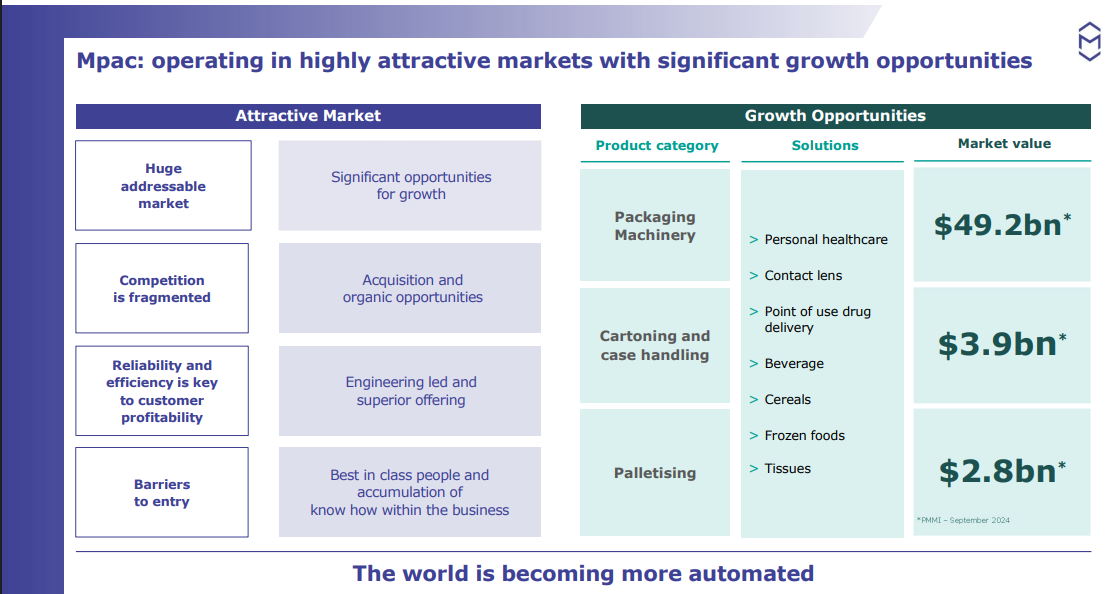

MPAC is a collection of six businesses involved in delivering product assembly, materials handling and packaging systems.

The world is becoming more automated, and MPAC is doing the automating.

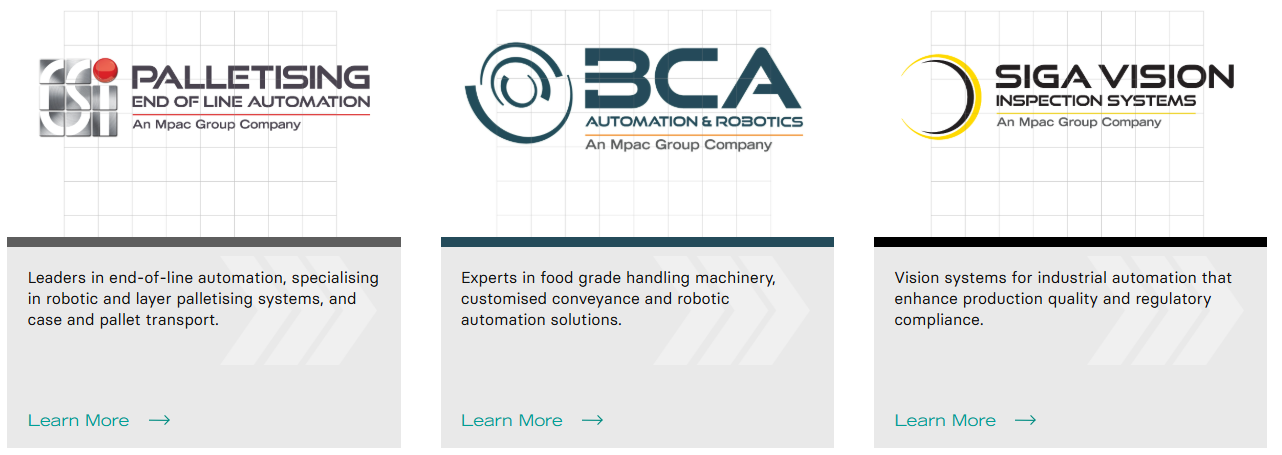

One business blends in so you might even miss its full name, but there are clues if you look carefully. Do you see it?

Keep looking….

Bottom left. Did you spot it? The clues were there. CSI, as in CSI palletising was a recent(ish) acquisition 1 year ago and “transformational” according to Mr Hill’s and the broker’s thesis. The six businesses offer complementary process stage machines and capabilities and know how as well as complementary customers where the classic cross sell and up sell can be pursued. But also Service offerings can be developed and provided.

MPAC is adding AI optimisation to improve performance and productivity. If you give a packing machine “eyes” (via MPAC’s SIGA vision acquisition) then it can detect that the alignment is ever so slightly off and realign itself automatically. The days of chucking away thousands of products because of a glitch are past if AI can detect and resolve glitches in the first nanosecond that they creep in. It is the case that MPAC won a Red Dot design award in 2025.

If we investigate CSI’s prior performance in 2022, 2023 and 1H24 it’s true there was double digit growth and a 10.2% EBITDA margin, but paying 8X EBITDA earnings wasn’t super cheap. It was ok cheap. The CSI deal (and the Boston and Siga Vision ones were also in 2024) diluted shareholders by 42.2% plus there is leverage of about 50% of equity - which wasn’t there before. Big ouch.

Quite how the brokers felt sales would nearly double in 2025 isn’t at all clear. Were I looking at this a year ago I’d be quite sceptical, and much lay in the continuing expansion of capital investment in both Europe and the Americas - far faster than before. It’s true Trump promised to cut red tape (and in fact has done so now) but Trump also promised to introduce tariffs. Mr Scott also reviewed MPAC a year back and described its performance as erratic. He further pointed out a high (and permanent) level of debtors. I agree, but observe a high (and permanent) level of creditors that offset that concern. I’m not sure I’d describe MPAC as erratic. It sells large capex products that are lumpy sales…. even before market uncertainty introduces delays to capex spend.

Huge synergies were expected and it was said cross selling would be achieved? Can we find any evidence to that? Not really. Not yet, and not in the numbers. The numbers are much better than they should be given the slow down is the best I can say. To evidence that consider that CSI completed 29th November 2024. There is only 1 month of CSI in 2H24, but a full 6 months in 1H25. Performance is as though it was not added. Based on the historic EUR44.4m (£37m) performance and 20% growth in 1H24 you’d expect an order intake of £44m in 1H25. Instead CSI and other 2024 acquisitions received £26.5m of orders in 1H25 between them). But MPAC tell us that 2024 acquisitions achieved £36.4m of revenue…. so on a par with 1H24 revenue at CSI - actually, but not so fast. BSA achieved $7m revenue in 6 months in 2024 so there’s circa -£5.5m or 15% fall in comparable revenue 1H24 to 1H25. (Siga Vision was de minimus)

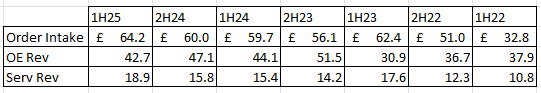

This chart provides further important clues. 1H25 order intake of £64.2m includes £25.2m of CSI. Of the £37.7m achieved by the pre-acquisitions businesses £31.3m was Europe/Asia while £6.4m was Americas. The historic split was about 60%/40% NA vs Europe.

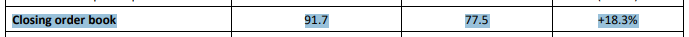

That implies about £40m of deferred order intake for the USA. The MPAC closing order book at 30/06/25 was £91.7m (vs £77.5m at 1H24 and £118.5m at 2H24), while we also learn in the 1H25 results that the order book has since grown to £93m as at 22/09/25 (the date of the report). If you factor in +£40m then the “true” order book going into 2026 is probably £133m.

Even if you say pah, cobblers Oak Bloke, half those deferred orders are toast then you get to a £113m order book. That supports a run rate of delivery at least 25% higher than that achieved in 1H25.

And that, reader, is nowhere in the price.

Performance 1H25

So underlying performance including its acquisitions for the whole business was about 7% stronger in 1H25 which is really -35% weaker when you consider that 42% dilution of shares. Or looked at another way the -15% weaker performance for 2024 acquisitions was better than a -36.9% weaker performance in the original MPAC businesses.

But then as a potential new shareholder (that’s me reader, and possibly you) then you’re buying this for -47% discount to where in stood in 2024, so in rough terms it’s achieving about 12% more revenue per £1 of MPAC shares than it did in 2024.

If we graph the numbers the underlying direction of order intake and recurring servce revenue is pleasing. Without the alteration to its enterprise value this would be an exciting chart.

Note, too, that the order book is at record levels of £91.7m so about 9 months of revenue at the current run rate.

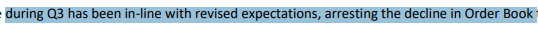

Declines have been arrested in 3Q25 we are told and order book is now “in line”. Aren’t those the words you’d desperately want to hear if you were sitting on a -47% loss? The decline has been arrested.

Considering that the reason for the fall in share price was a profit warning based on its customers delaying (but not cancelling) orders then that is actually a pretty good outcome - and indicates some synergies creeping through in the numbers in 1H25.

For example 42% of all OE orders having been won from new customers to the Group. Given the long-term nature of relationships and sales that’s a huge positive isn’t it?

Cost Reduction

MPAC has sliced through its costs during 2025 and relocated work to lower cost countries of Romania and Malaysia. This meant a restructuring cost of -£11.5m. There is a focus on improving utilisaton so we should see some improvement to margins in FY2026.

Overlooked Value

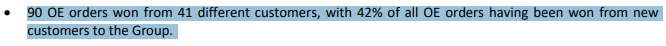

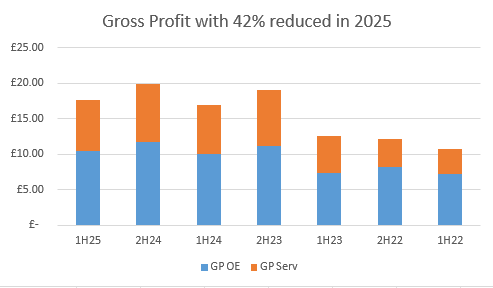

When I extracted out Gross Profit by period a couple of things caught my eye. Well like the obvious. Gross profit is growing… a lot.

Now it’s true that with 42% dilution then you could argue that shareholders should only include 58% of the gross profit in 2025 - for comparative purposes. If you do then gross profit is still pretty good. I mean they achieved the same as they did back in 2024 on an underlying basis, during Lib Day and all the stuff that slowed things down for MPAC.

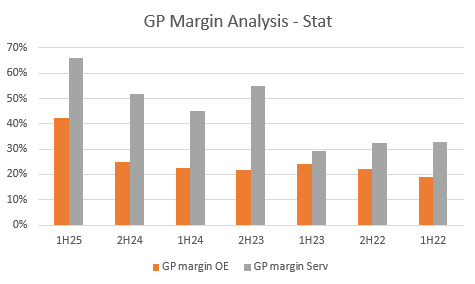

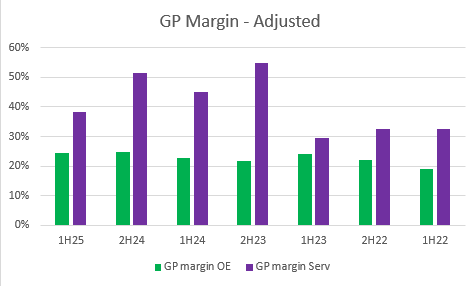

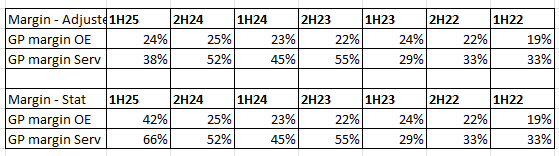

From a GP margin perspective we see both OE (original equipment) and Services are growing in terms of margin. So it’s higher prices, lower costs or a combination of the two driving the increased gross profit and not rising volumes.

If I strip 42% out of the margin then 1H25 is still ahead of 2022 and 2023 for services and we see margin growth even versus 2024. NB the GP split is not revealed in interim results and only in the full year results so I have done a split at the half year based on the GP split the period before. So 1H25 is split the same way as 2H24 for example.

When orders do come storming back and if it can achieve 66% gross margin on services and 42% of OE then that will ratchet profits. Hugely. The broker’s model appears to rely on simply selling more stuff and achieving sales of over £230m in FY26 whereas the actual performance we are seeing at MPAC seems to be higher margins which are offsetting lower volumes.

In crude terms if MPAC can achieve £200m revenue or more (and the broker guess of revenue expansion is accurate) then even at a 42% GP margin (ignoring the higher 66% GP margin for services) then this is £84m GP. Even assuming distribution and admin costs of -£50m (underlying was -£23m in 1H25) then that’s £34m Operating Profit for the full year or £17m per half year.

Of course you also have to be happy that distribution/admin isn’t going to rise much more than that - but we are told of spare capacity and making better utilisation of that. So it’s not unreasonable to consider this shouldn’t rise too much in response to higher levels of activity. You do have the higher margin services in your back pocket too.

This is where I fell off my chair. (For a change)

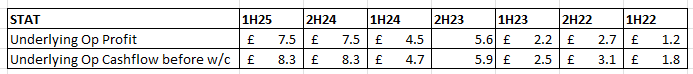

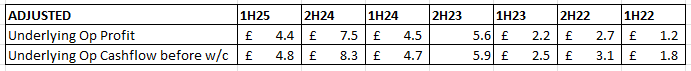

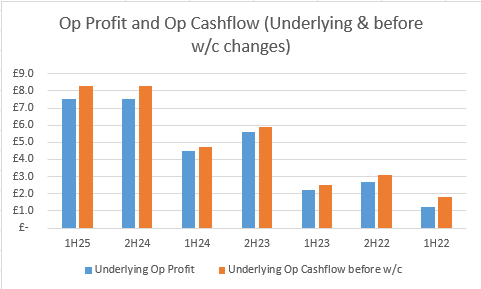

£17m would be a more than doubling of profit compared with the underlying £7.5m op profit in 1H25. Notice that the underlying op.profit in 1H25 is already a creditable performance compared with 2024. Also if you ignore working capital changes and pull out the underlying operating cash flow. MPAC performed no worse in 1H25 than in 2024.

Bet you didn’t see that coming did you? Hard-pressed shareholders who expected transformational performance for the past 10 months. The good news appears to be that it’s coming - finally.

Even if I once again strip out 42% of profit in 1H25 for comparison, then the performance is flat compared with 1H24 and while 2H24 stands out as better it’s quite hard to explain a -47% drop in price when underlying op profit even after stripping out the -42% dilution and only including 58% of operating profit looks quite good, actually.

Adding that potential future £17m Op Profit and Cashflow in this chart would be near parabolic compared with 2022. It would equate to a tripling of Net Profit to £11m (per 0.5 year).

But once again actual cash generation backs up the Op. profit more than 100%.

£22m net profit (if it can achieve this) on a £87m market cap nearly exactly equates to a 4X price earnings. If it can’t and instead growth of zero occurs - forever - then you can still get to a performance outcome of below 10X earnings (underlying).

Pension

In 2024 MPAC had the spectre of a pension liability but this is now in surplus, and MPAC have purchased a bulk annuity which means it is now insured, and is transferring this obligation over to Aviva (this will take a few years). There is £5m of proceeds which “should” become unrestricted funds when they do. I say should because I can’t think why it wouldn’t.

Chosing MPAC

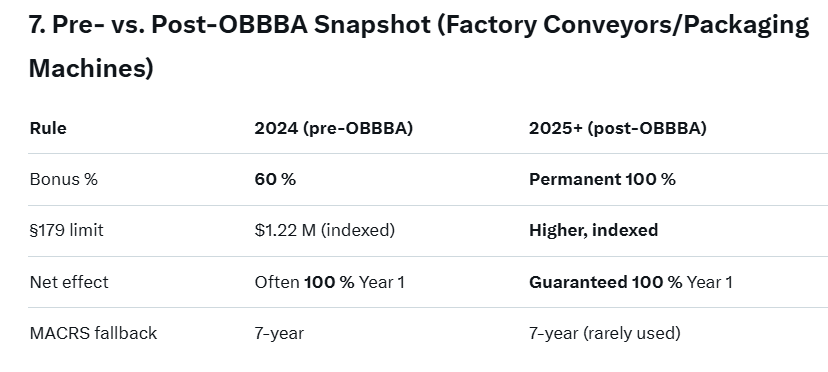

Apart from understanding the underlying performance, the reason I invested was the One Big Beautiful Bill Act (OBBBA)

2026 will be a bumper year for MPAC in my opinion. As its customers review their stalled projects will they not be tempted by the fact that pretty much everything MPAC sells is a guaranteed write off against tax?

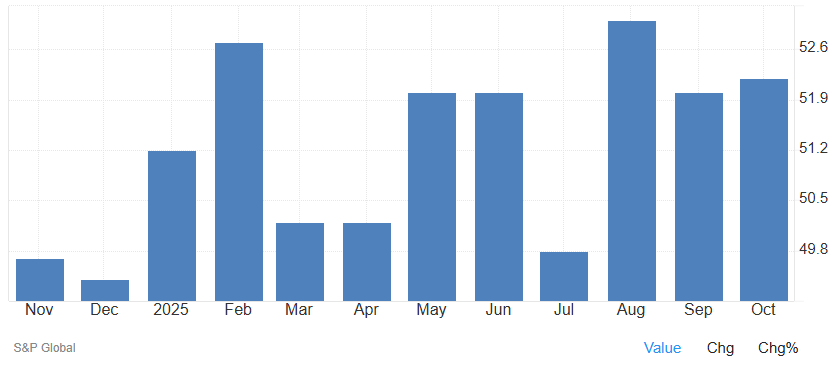

Despite the negative headlines the US Manufacturing PMI is in expansion at 52.2 in October 2025. Germany (much maligned as to be going to the dogs too) has a PMI of 50 (up from 45) in 2025.

Things are already accelerating for manufacturers. There is a buzz once again in the markets. Yes I could buy a US share at 20X-30X price earnings or buy MPAC with its large US footprint and valuation of below 10X P/E with prospects of that falling to 4X at today’s share price.

Value in its Valuation

Paxiom in Canada was acquired in 2024 for 12.5X P/E and Aluflexpack in Switzerland in 2025 at 15.2X P/E, so even if I’m utterly wrong then I’m buying at a discount even if mediocrity is permanent and growth is nil.

Growth is nil. Yeah, right.

I’ve deliberately not pointed out that its balance sheet contains £74.7m s/h equity mainly because I’ve used “underlying” metrics and a chunk of those adjustments is coughing slightly and considering that amortisation of assets is a “one off”. Intangibles remain at their same value forever….. not!

You would expect a business like this to not have large tangible assets. Yes, if it suddenly was unable to sell its products and services then MPAC would be worth zero. Even if there’s £74.7m on paper. Poof. Zero. That’s mainly because there’s £107.7m of intangible assets. Poof. Assume Zero.

People

Three NEDs joining MPAC with appointments at Senior Plc, Kier Group and De La Rue - between them have bought close on £100k of shares.

I notice Fidelity, Schroders and Gresham House are all buying shares in MPAC.

Have they done the same maths that I have? Or do they like bowls?

Bowl

I’m not a great believer in technicals or at least I believe technicals are the symptoms of the fundamentals. But it’s good to get a validation to what I’d noticed. Mr Rebel noticed the possibility of a bowl starting. I publish his X post here for illustration and with advance thanks.

Conclusion

Great margins, great prospects. One Big Beautiful Bill. Beautiful, it’ll be real beautiful.

Is this recovery play going to be an Oak Bloke 2026 idea?

Yes, I’ll MMMbop this in my portfolio and my Picks for 2026. This is idea #12.

Regards

The Oak Bloke

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”

Seems like your article may have moved the price up today!

Aways dazzle me with your analysis OB. Yes i hold and you’ve given me hope that my own cruder investing thesis was not completely rubbish! Thank you as ever.