Dear reader

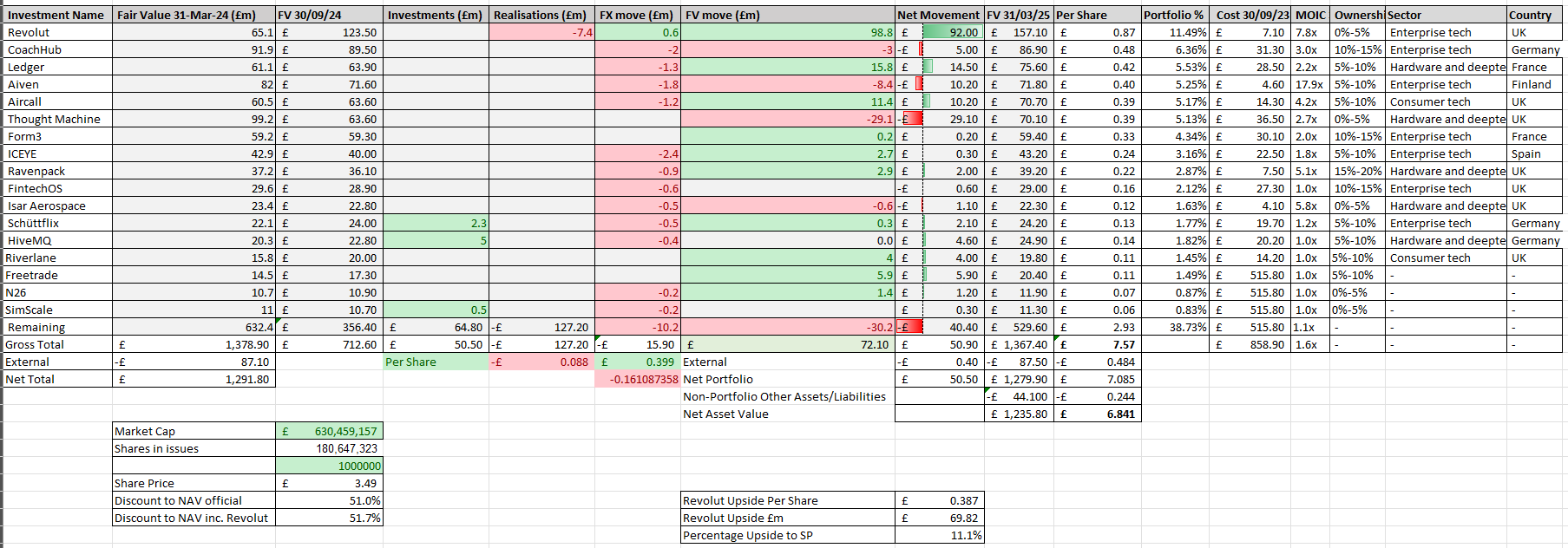

GROW reported a -£12m reduction to its portfolio. Boo!

But what if those apparently negative numbers hide the BEST RESULT since 2022?

Consider that in the 18 months to 31/3/22 the fund returned the equivalent of 80% of today’s (£3.49/share) market cap per year. The wheels fell off after that and Lettuces outlasted Prime Ministers, inflation then interest rates flew up, supply chains were disrupted and sentiment to European growth stocks became more wilted than the Lettuce (and the PM).

What’s changed? Well a £95.1m of increases in FV is more than triple the 2H22 result although still not back to the heady days of 2021/2022. It’s getting there. Decreases have to be considered too, and those reduced in the 2H25 results too.

£93.4m average on a £630m market cap implies a 15% per annum return net of set backs and adverse FX average over 4.5 years.

Considering the portfolio of 2020 (remember not all names and holdings are disclosed so we can’t do this for 100% of holdings) then a similar pattern emerges. £380m of realised and unrealised gains. This implies that the Core delivers the bulk of the increase to fair value. They are the ones to keep an eye on. They are the multi baggers doubling, tripling and decupling (i.e that’s a tenfold).

The same data presented slightly differently is that 54% deliver more than 1X, and only 15% delivered zero. Both the <1X and 3x+ are about 30% but the proceeds are 11.5X greater for 3x+ so if <1x averaged 0.5x then 3x+ actually meant a ~6x return.

The focus into some highly relevant areas of growth is also an important theme. AI native and AI enhanced sits alongside Fintech, Cybersecurity, Quantum, Space, Blockchain and Digital Health.

88% of the portfolio have a 12+ month cash runway and half of those (44% are cash generative and profitable).

The below list are known as the “Core” portfolio and make up 60% of the portfolio’s value.

Of course the portfolio gains/losses aren’t the final profit but once again the VCT/EIS business fees largely offset the cost of running GROW (75% of admin costs) and there were some one-off costs which meant a net loss of -£0.8m in the P&L.

Progress in the Top #10 Holdings:

#1 Revolut (at $45bn £0.87/share and +£0.39 if $65bn valuation)

Global financial services company that specialises in mobile banking, card payments, money remittance and foreign exchange with over 52.5m retail users growing fast and a 2024 implied $45bn valuation will prospectively rise to $65bn in an upcoming funding round (if it proceeds).

That Funding Round would add £69.8m to GROW’s holding worth 38.7p per GROW share!

Revenue of over £3bn, a 72% increase year-on-year, driven by their customer adoption growth and product offering diversification. Their technology-driven operating model allowed a translation of that growth into profitability, reporting a net profit margin of 26%, as net profit grew to £790 million.

Revolut Business continued to grow in 2024, generating 15% of total revenue, as more businesses join to use its multi-currency accounts, global payment services and smarter spending tools.

#2 CoachHub (+£0.48/share so £1.74 total)

Two holdings that equate to 50% of the share price.

A global digital coaching and talent development platform that offers personalised, measurable and scalable coaching programmes on a one-to-one basis for entire workforces and teams. Its platform integrates with HR systems to provide tailored coaching experiences, enhancing leadership development, employee engagement and organisational transformation. CoachHub serves over 1,000 clients worldwide, including leading companies across various industries. It connects employees with certified business coaches in over 90 countries, delivering sessions in more than 80 languages.

CoachHub launched a number of AI capability improvement including an AI coaching companion to enhance employee engagement and wellbeing, and, in September, launched a new Feedback Tool to measure behavioural impact from coaching. In 2025 AIMY™, an AI coach, developed in partnership with Microsoft will scale personalised coaching globally after obtaining a $40 million growth financing facility.

Previously, the predominant focus was on Executive level coaching and middle managers. CoachHub’s automation democratises and extends coaching to all organisational layers, opening up a much larger market to sell into while giving people a chance to really drive their career development. Allied Market Research estimates that the online coaching market will be a $11.7 billion market by 2032 at 14% CAGR.

#3 Ledger (+£0.42/share, £2.16 total)

Specialising in securing digital assets it is best known for its hardware wallets for Crypto. The Ledger Live app is a companion app that enables users to buy, sell, stake, and track digital assets from one interface. 8m devices sold in 180 countries, Ledger secures approximately 20% of the world’s crypto assets.

Ledger advanced its hardware product line and rolled out targeted promotions to boost adoption and user engagement. In April, the company launched the Ledger Flex™ Magnet Folio, a protective magnetic case for the upcoming Ledger Flex™ device – an accessory designed to enhance the physical security and usability of its hardware wallets.

The hardware wallet market is experiencing significant growth, with projections from Mordor Intelligence estimating it will reach $0.56 billion in 2025 and expand at a CAGR of 29.95% to $2.06 billion by 2030

#4 Aiven (+£0.40/share, £2.56 total)

An open source data platform that simplifies the deployment and management of cloud data infrastructure for streaming, storing and serving data across major cloud providers. 2024 saw the introduction of tiered storage for Aiven for ClickHouse®, enabling cost-effective data retention. In October 2024, Aiven achieved the AWS Retail Competency and hosted an AWS Immersion Day, empowering businesses with real-time data insights for better customer experiences.

2025 brought multi-version connector support for Apache Kafka®, allowing users to pin specific connector versions for increased flexibility and control. March 2025 saw the launch of Diskless Kafka, a feature that replicates topics directly in object storage, reducing TCO and enabling instant autoscaling and efficient geo-replication. In April 2025, Aiven won the 2025 Google Cloud Partner of the Year Award in Databases Category.

The global public cloud services market is projected to grow by 21.5% in 2025 (source: Gartner, 2024), reaching $723 billion. Aiven is positioned well to capitalise on this growth, as enterprises increasingly adopt hybrid and multicloud strategies. What’s more, according to IDC research, Aiven’s data cloud solutions offer a 340% three-year return on investment, driven by enhanced team efficiency, reduced infrastructure costs and improved scalability.

#5 Aircall (£0.39/share, £2.95 total)

VOIP (Voice Over Internet Protocol) drives value to customers through actionable analytics, sentiment analysis and now AI applications. Its early adoption into the call centre market positions it as a pioneer in the space having deep longstanding customer relationships and expansion potential. It has scaled headcount, offices (NYC, London, Sydney, Madrid, Berlin, San Francisco), and funding (Series D) while surpassing $175 million ARR in 2025 and weaving AI into its core products.

Aircall has expanded its AI features to support French, German and Spanish languages, enabling SMBs to generate call summaries, key topics and talk-to-listen ratios to enhance customer interactions and team performance. New service-lines including Aircall Workspace provides a dynamic and intelligent hub designed to streamline customer communication and agent collaboration. In March 2025 it launched an AI Voice Agent, an intelligent virtual assistant that ensures businesses never miss a call.

#6 ThoughtMachine (£0.39/share, £3.34 total)

Cloud-native core banking infrastructure to both incumbent and challenger banks with a large existing library of products, its cloud-native offering – including Vault Core (core banking platform) and Vault Payments (payments processing platform) – is designed to give banks total flexibility in designing scalable products.

Leader in the 2025 Gartner® Magic Quadrant™ for Retail Core Banking, earning the highest position for Ability to Execute. In 2024 it partnered with SEB Embedded to drive Banking-as-a-Service (BaaS) innovation and with Afin Bank to launch a new digital bank aimed at serving the African community in the UK.

Banks are struggling with siloed information sources in on-premise technology stacks with leading neobanks paving the way towards a real-time world class customer experience. Banks have no choice but to adopt a cloud native core banking systems and build a single source of truth, which will help them build highly personalised products early in the journey of interacting with customers and be able to do so at lower costs.

#7 Form3 (£0.33/share, £3.67 total)

Payment-as-a-service cloud platform offering a fully managed, real-time account-to-account payment platform. Trusted by major clients such as Lloyds, Nationwide, Visa and Klarna, Form3 empowers organisations to streamline their payment operations and accelerate digital transformation.

It launched new products and enhancements including an industry-first Authorised Push Payment fraud prevention solution in the UK in April in partnership with Feedzai, enhancements to its Confirmation of Payee service, also aiming to reduce fraud in the UK, in collaboration with Currencycloud in May, and in March 2025, the company partnered with GoCardless to provide BACS payment connectivity.

It secured a $60 million Series C extension, with new investment from British Patient Capital and existing shareholders, to support growth and product development. In October 2024, the company was recognised with the Datos Insights 2024 Impact Award for Best Scam/APP Prevention Innovation, highlighting its commitment to combating financial crime.

Payment schemes and systems are largely regional and defined by currency, governed by a combination of governments, central and commercial banks. When payment scheme rules change, banks face difficulties in adapting. Form3’s technology, once implemented, applies these changes to all customers in real-time, seamlessly. All major payments schemes around the world are shifting into and/or are looking at building real-time schemes, which, by design, will require cloud-native software to support the implementation and continued maintenance.

#8 ICEYE (£0.24/share, £3.91 total)

Synthetic Aperture Radar (SAR) technology for Earth observation and operator of the world’s largest constellation of SAR satellites, providing real-time, all-weather imaging capabilities. The company’s services support various sectors, including defence, insurance, and government, offering insights into natural disasters, infrastructure monitoring, and environmental changes.

ICEYE’s data is used by organisations globally, including NATO and the European Space Agency, to enhance situational awareness and decision making. ICEYE raised $158 million in 2024 and launch 8 new satellites expanding its constellation and serving additional customer missions. It was selected by NASA to provide radar satellite imagery in support of Earth science and research and was named one of Via Satellite’s 10 Hottest Companies for 2025.

Satellite imagery is fast becoming a standardised tool to gain valuable insights across a variety of industries. With the global climate and international defence in focus, governments have leaned heavily on public-funded space programs, which, in more recent years, has sparked strong participation from the private sector. ICEYE has signed deals with the Centers for Disease Control and Prevention (CDC) in the US and the Australian government to detect natural disasters like floods and bushfires.

#9 RavenPack (£0.22/share, £4.13 total)

A leading provider of insights and technology for data-driven companies. AI tools and products allow financial institutions (including the most successful hedge funds, banks and asset managers in the world) to extract value and insights from large amounts of information, including news, regulatory filings and other textual data, to enhance returns, reduce risk and increase efficiency by systematically incorporating the effects of public information on their models and workflows.

Named Best Alternative Data Provider at the 2024 WatersTechnology Asia Awards, recognising its innovative Factor Library, which delivers actionable sentiment and macroeconomic indicators to investors without requiring extensive infrastructure. RavenPack launched Bigdata.com, a platform aggregating diverse data sources – such as news, earnings call transcripts, and filings – accessible through a hybrid retrieval system powered by an embedded knowledge graph. This platform supports AI-driven workflows, including thematic screeners and risk models. It offers a truly differentiated data product focused on the financial services and buy side sector. Their high-quality client base of well-known investment banks and hedge funds have been using RavenPack data for many years to help optimise returns and understand market sentiment on companies around the world. With the rich nature of RavenPack’s underlying data, they are leading the AI charge with respect to financial services and will, undoubtedly, be bringing more interesting products to market.

#10 FintechOS (£0.16/share, £4.29 total)

Aims to simplify and accelerate the launch and service of innovative financial products for major banks and insurance companies. With a low code/no code approach, their product facilitates interaction across technical and nontechnical product teams and enables them to create, manage and distribute financial products without replacing existing core systems.

In 2024 a $60m Series B+ investment round enabled accelerated global expansion. In 2025 Evolv was launched. This is a major platform update introducing a powerful tool suite that facilitates interaction between financial institutions and AI in a secure, scalable environment. Recognised as a Challenger in the Gartner® Magic Quadrant™ for Retail Core Banking Systems, Europe with the third highest in Ability to Execute.

FintechOS’s product is designed to be all about speed to market. The repeal and replace legacy technology method works for certain types of banks, typically larger Tier 1 banks, where it takes many years and at high cost. However, for the vast majority of banks and insurance companies, their systems remain an amalgamation and accumulation of older infrastructure and require technology that can seamlessly integrate with their existing stack.

Other Holdings (£3.55/share)

There are seven other Core holdings below the top 10 worth £0.75 per share (so £4.30 total). Then £2.93 per share is made up of 96 other holdings, so worth about 3p a share each.

These span Consumer tech, Enterprise tech, Digital Health and Deeptech

Consumer technology

New consumer-facing products, innovative business models, and proven execution capabilities which bring exceptional opportunities that are enabled by technology.

Hardware & Deeptech

R&D-heavy technologies that emerge to become commercially dominant, upending industries and enabling entirely new ways of living and doing business.

Enterprise technology

The software infrastructure, applications and services that make enterprises more productive, cost-efficient, and smoother to run.

Digital health

Using data, software and hardware to create new products and services for the health and wellness market.

Buying the above at Huge Discounts

I’ve added a column that reflects how much you pay for all of the above based on a GROW share. Refer to the “Buy Price at MP (Market Price) discount” column below.

Revolut, for example, would be bought for 45p. So of the £3.49 price of a GROW share 45p of that is Revolut. At a $65bn valuation you are holding £0.87 + £0.39 = £1.26 of Revolut for a buy price of 45p!!!

Conclusion

FY26 began on 1st April 2025. As I write the £30m buy back program is nearing its completion and perhaps shall be extended. It drove an 8p NAV accretion in FY25 and GROW remains on a large discount of about 48.5% to its NAV - despite bouncing 50% from its recent lows.

News from holdings like Revolut’s $65bn upround, if that proceeds, will only increase the gap between the NAV and share price - to a 51.1% discount. The continuing buyback program nudges the discount up too.

Meanwhile funds have begun leaving the US and making their way to Europe. GROW is a European powerhouse for VC and primed for a re-rate in my opinion.

Regards

The Oak Bloke

Disclaimers:

This is not advice, you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

As your tips don't always have the company name in it ,I was wondering if you have delved into IP group?

Another growth capital company.

My biggest holding at the moment is tekcapital for the Guident listing. I don't see myself having a large long term holding in tekcapital.

I also have a decent holding in Augmentum slight loss.

GROW very nice timing better there.

I also have Chrysalis (small holding)again for an IPO namely Klarna.

IP group is a new holding and looks on the face the best but I haven't given it enough research yet. Hoping you have!?

Hi OB - Is MOLT still your preferred out of AUGM and CHRY? I feel all these trusts need more of a catalyst like a big float of Klarna or others to get the juices going as the fintech stocks are all their biggest and most profitable investments.

I took positions in AUGM and CHRY as preferred their top tens over MOLT but maybe the discount is too much to be ignored with this area of the market is still seemingly shunned.