More twists at SEIT?

Or is there no rollercoaster except the price? i.e. Nothing to fear except fear itself?

Dear reader,

SEIT is the ticker, SEEIT the company acronym and SDCL the company name - it’s confusing isn’t it? SEIT is focused on energy efficiency which involves the delivery of cheaper, cleaner and more reliable energy solutions at the point of use, reducing or eliminating reliance on the grid or subsidies.

This can be achieved for commercial, industrial and public buildings through on-site energy generation, such as combined heat and power units and roof-top solar installations, or through energy demand reduction measures, such as efficient lighting, heating and cooling solutions and also through effective use of energy storage solutions.

Save ‘em some dollar to earn some too

This is 65% USA about 30% Europe and about 5% Asia (Vietnam and Singapore)

Good to see that for the 6 months to 31/3/25:

“SEIT has delivered substantial income to the Company, in line with previous years. This stable performance ensures that we can cover the target dividend of 6.32p”

But in my prtior article SEIT like you mean it I said USA is in expansion… it still is… just. Looking at March readings vs February 2025: PMI at 50.2 (52.7), Confidence at 49 (50.3), Consumer Confidence at 57 (was 65). Trump Tariffs are hitting confidence perhaps.

We are further told:

“During the Period, SEIT's operational performance has been generally in line with expectations, delivering the expected distributions to the Company”.

Distributions were £48m in 1H25 and this was “in line with budget” so will we see a repeat performance so £96m for the full year maybe? That would be £4m ahead of FY24, and covering dividends 1.1X.

But I notice 2H25 was “generally in line” so not wholly in line. Let’s see if we can work out why.

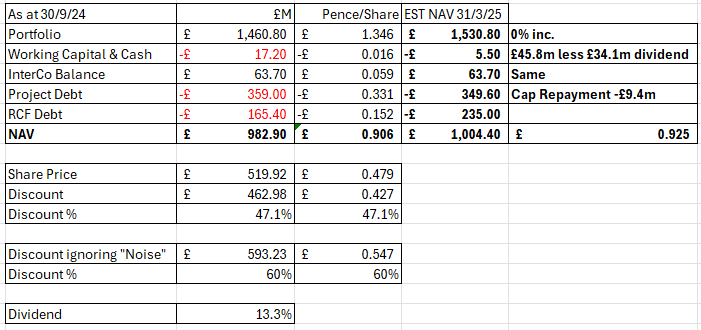

Just to remind you reader my own estimates were/are a NAV of £1004m or 92.5p vs today’s market cap of £520 or 48p a share. The below numbers are how I get there. The RCF debt is revealed in the update, which was £165m investment into opportunities in the portfolio - much of which was Onyx.

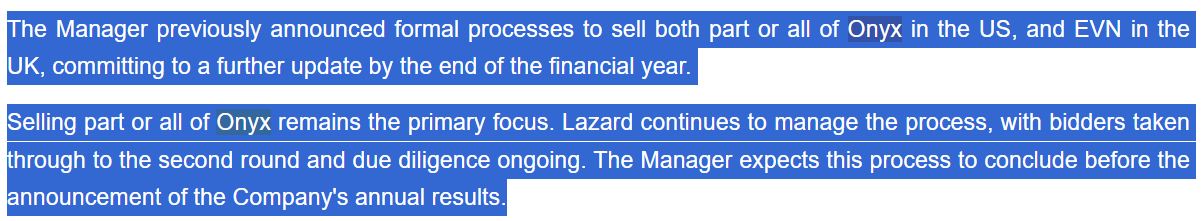

#1 Onyx 24% of Portfolio - Est. £350.6m or 67.4% of market cap

We learn Onyx hit or exceeded its targets. In FY24 the targets were 110% growth. It delivered $13.6m operational EBITDA in FY24 - so is a more than tripling unreasonable in FY25 based on a 14MW to 53MW? An EBITDA of $51.5m?

Of course the good news doesn’t end there. A sale could be imminent. Have a think. If it sells for NAV or close to NAV that’s circa £350m proceeds. That could wipe out the RCF entirely and puts money for buy backs or new opportunities…. or follow on into attractive holdings like EVN (see later).

That £350m is based on a $378m (£293m) with the £67m of 2H25 investment being “mostly” Onyx. Of course it depends on whether the buyer assumes the project debt of $51m, or whether that gets paid out of proceeds, so £350m could be less.

A wodge of cash most certainly supports the dividend meanwhile. A reader said he was uncertain that the dividend could be covered. Yes nothing is certain, but we’ll soon know whether the rollercoaster was just an illusion…. as proved to be the case for investors in HEIT battery storage where a nearly as large discount melted before competitive bids for attractive assets.

#2 Red Rochester £248.2m of portfolio or 47.7% of Market Cap (115% total)

A slightly cryptic update that is “above projections but below budget”. What does that mean?

Well performance was $8.3m EBITDA in 1H25 and that amount was 13% below budget implying the full year budget is $19.2m. So 2H25 EBITDA is somewhere between $8.4m-$10.9m based on what they are telling us.

The outlook is positive for Red Rochester going into FY2025 too “significant performance improvements” in what will move to be the largest asset post Onyx (assuming Onyx is sold):

#3 Primary 9% of Portfolio £131.4m or 25.2% of market cap (140% total)

Number 3 holding delivered on budget too, and may be a beneficiary to Trump Tariffs (well someone has to be a winner among the losers) since Primary recycles and uses waste heat and gas.

Other Updates - all on target, on budget, or ahead.

So we do not know what assets did NOT perform unfortunately but all the largest one did.

Investing into Growth

SEIT tell us that they intend to grow the Electric Vehicle Network. If you’ve visited one of those recharging places that charge upwards of 70p-75p a KW there’s money to be made in them there EVs! It’s like running a petrol station and being able to price gouge Diesel at £5 a litre.

SEIT build the facilities for operators to operate and earn a cut from operations. So it’s Capex intensive but offers strong returns too plus SEIT tell us “significant potential for further growth”. Yes please.

NOISE

The valuation applied to assets is heavily driven by the risk-free rate. Trump Tariffs, Stagflation Fears, the Rollercoaster exists for this, delivering noise to the performance of the assets.

The cryptic reference becomes even more cryptic when you consider there wasn’t really a reduction in discount rates in 1H25 - it was 9.4% unchanged from 9.4%. So what increase do we need to worry about?

The answer is they didn’t reduce risks in September 2024 so they are effectively signaling that there is no INCREASE to risk premium despite there being a perception of a rollercoaster, reflected in the share price.

A 9.4% discount rate is very, very high in my opinion for “boring” energy generation assets that are quasi essential services consumed on a daily basis.

Where the demand is growing and supply comes with challenges due to cost and regulation.

Yes Trump is rolling back aspects of regulation but at a Federal level. States still command their own power too. Of live assets Kansas and Florida are Republican and cover minor LED and BESS assets while the majority of SEIT assets are located in Democrat States.

So we await the full year report for more info but it would appear today’s share price offers a high yield fully covered dividend of 13.16%, near term realisations, and income growth too. All at a eyewatering 9.4% discount rate which (in my view) depresses the true value of its holdings which are tilted to the US but across a range of geographies, technologies, counter parties and opportunities for growth.

MAGA will need energy to power all that home-shoring of industry and the data/AI explosion; Europe needs energy to replace Russian gas. The Far East needs energy too.

The discount in SEIT’s share price is somewhat inexplicable.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings, even those held by a FTSE250 company like SEIT, might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Just tacking back to this article as SEIT appears to be at a 12m low today

inexplicable discount makes this a compelling investment case.