Dear reader,

With a 2.26% net return so far and as the 2025 race leader as of 4th January (it’s early days!), I can’t help feeling bullish going into 2025. My 2024 ideas have risen over 1% this week too.

They do say hubris is not just pride, but pride that leads to a downfall. We shall see.

Commodities

My leans into UK, Japanese and commodity-related equities, as well as an arms-length nod into the US is supported in their 2025 outlook by investment experts like Schroders.

6X holding Serica is up 13%, while KAV +30% and MAFL +20% are leading the way. Other commodity ideas like UUUU are down -3.5%, THS down -4.6% and THX down -2%. Bottom of the heap is KDNC down -33%. Ouch.

Gold is a theme across 4 holdings in 2025. I did consider an even greater exposure but didn’t want to be reliant on gold. I find very, very little support for Gold among investment managers in their 2025 outlook. This comes as a surprise.

Oil only appears once in my portfolio (albeit weighted x6) although I considered more. Ideas ranging from minnows like Predator, Jadestone and Touchstone to giants like BP and EQT were considered.

The price of Uranium might not shoot out the lights in 2025 but strong indicators point to a shift in world energy and SMRs - small modular reactors - is probably one of the most popular new acronyms for 2024. Today’s Wall St Week on Bloomberg features a piece on SMRs.

Japan

HSBC agree that Japan’s undervaluation, EPS growth and potential for a multiple expansion presents an attractive entry point.

So far in 2025 BGJSC hasn’t been helped by the latest downwards move of the Yen. Japan’s Big Mac Meal at 195 yen to the pound is £3.33 making this a potentially great entry point - to buy Japanese Smaller Companies reader not Big Macs - delivery costs of a Big Mac might be a little prohibitive, although it will no doubt appear fit to eat no matter how long it takes to arrive.

Robotics

I was quite sceptical about NVidia being the largest holding of RBTX until I looked at NVidia’s earnings and the earnings outlook. The earnings comparison made by JP Morgan to Cisco in the Dotcom bubble and today is prescient. PSH gives me some GOOG exposure also.

US Exposure / Private Equity

Several of my other ideas come with large US exposure but are at bombed out prices due to being unloved UK-listed holdings like PRTC, GSF, MKA, WATR, SEIT, GSF, LIV, APAX, OCN, PSH, JPEL. All play into Blackrock’s observation to gain exposure indirectly.

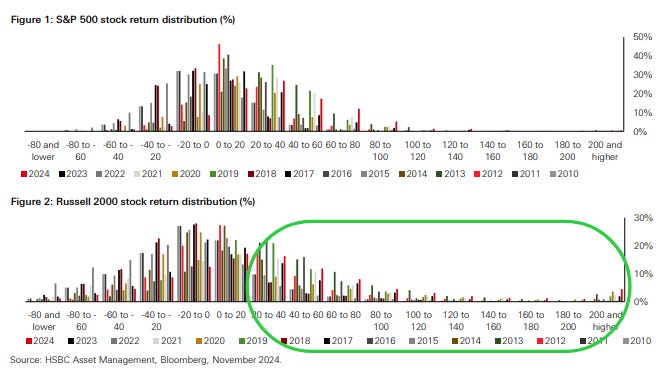

My 6X lean into “Private Equity” XLPE but which is as much a play on wealth management as it is Private Equity, and is also a large lean into the USA, although not exclusively so with European and Japanese exposure too. My aim with XLPE is to target into the 20%+ returns of US businesses like those enjoyed by a reasonable proportion of the Russell 2000 - without buying either the index of US equities directly. Perhaps I’ll get some of those “200% and higher” holdings we see in the chart below to deliver outsize returns in 2025.

NB Distressed Debt is not US focused but was a special situation where it appeared to offer near term upside.

Health

MERC, EMVC and PRTC I believe should offer some interesting health tech exposure (among other sectors) in 2025. All three are a form of special situation and offer large potential upside but are deeply unloved.

Mercia and EMVC should also benefit from an increase of interest in VC/EIS funds and perhaps government invested funds too.

PRTC is an interesting case study for investors who bump their gums about the UK market being the reason for a low valuation. It is interesting to see PRTC is UK AND Nasdaq listed but there is very little US interest, possibly because a “FTSE250” size company is too small for many in the US. Avacta shareholders for example, should seriously take note. A move to the US and to the Nasdaq is no panacea.

Fellow fun runner Paul Hill holds HVO which could be a huge beneficiary of what I’ve read around the government’s plans to encourage pharmaceuticals to base themselves in the UK. Other commentators dismiss HVO as “speculative” and “it hasn’t delivered an awful lot for its investors.” The past numbers don’t support that asessment and this share could merit a much closer look based on the 2025 outlook.

Travel

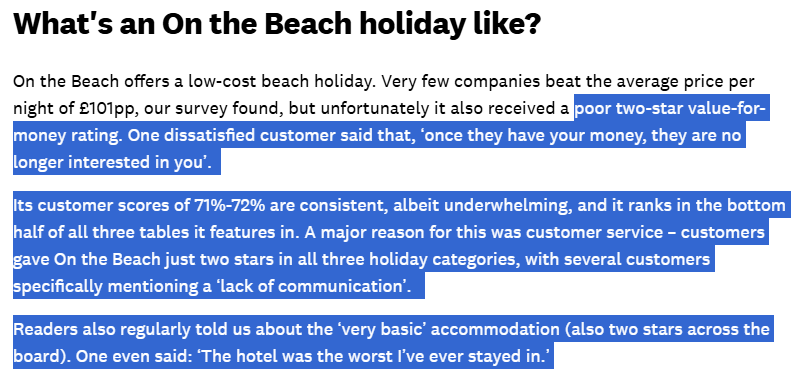

I did consider On The Beach based on some other commentators waxing lyrical but their TV advertising is so irritating I wonder quite how they intend to grow their sales. The swaggering characters in their airport lounge, chomping down buns, and leaping around in an anti-social manner on a beach is simply dreadful.

Which? isn’t complimentary either and the word bargepole comes to mind.

Instead I chose deep value at AVAP. The value stock that disguises a growth strategy.

If travel and airlines continue to do well we should see rising lease rates, and the large discount begin to close at Avation as has happened in other leasing ITs like Amadeo and Doric.

Housing

Watkins Jones stood out as a deeply unloved holding. I see continual comments about the cost of rectification yet the Building Safety Act 2022 and 2023 amendments appear to settle the matter. It’s true labour have accelerated the compliance but WJG appears to have the funds to cover that compliance. There doesn’t appear to be any evidence to substantiate the level of fear and “blood in the streets”.

Meanwhile it’s true that the forward order book is below trend, and this will constrain profits, there is growing evidence that both planning consents and its customers’ investment decisions will accelerate in 2025. If this happens WJG could see a substantial re-rate. When the government announced £3bn of loan guarantees in the budget it is hard to imagine that won’t happen… more on that later.

The One that got away?

Emerging markets were an area I didn’t include but gave serious consideration to. CGEO in 2024 was a clever play. Could I find a similar one for 25? No.

I considered Korea (WKOF), Vietnam (VOF, VMH and VEIL) and Taiwan (funds/ETFs) - and this chart shows they are major recent beneficiaries of US reductions of trade with China. But ultimately I decided there were too many risks.

I also considered IBZL and BRLA given the large fall of Brazil in 2024, but timing was against me and I am sat on the sidelines on that idea. Morningstar are very bullish on these regions for 2025 as the chart below shows.

UK Government Spending - I’ve spent some time going through the budget announcements

Anti-corruption: Rule of law is a cornerstone for a successful economy. Bribery and corruption undermines its operation (but makes for great telly programmes). Investment into a domestic corruption unit within the City of London could be money well spent.

£11.3bn in 2025 to reduce NHS waiting lists. While the numbers beggar belief the OBR suggest only 5% of treatments would result in a reduction of “unable to work”.

£1.5bn for A&E capital projects.

£4bn for Education including capital projects.

£0.5bn to fix potholes

£3bn for ENABLE build government loan guarantees for house builders (including PBSA - student accommodation - BTR - buy to rent and affordable homes)

Bed blocking: £3.7bn for social care could prove money well spent to reduce hospital bed blocking and reduce pressure on A&E. Above inflation awards to councils further supports delivery of local government services in England. £100m of extra funding for hospices will also boost the 1/3rd contribution taxpayers make to hospices - again a reason for NHS bed blocking.

Military housing re-nationalised: when 9,000 incidents of damp and mould at the UK’s 36,000 military houses were reported in 2022 it is - in my opinion - shameful and short sighted when 1/3rd of people leaving the military blame poor housing. John Major privatised military housing in 1996 and the NAO estimates it has cost taxpayers at least £2.2bn more since 1996.

Military veterans will be given prioritised access to social housing with additional funds for homeless veterans support.

32 new ‘Homebuilding Skills Hubs’ will be established around the country to create 5,000 construction apprenticeships. Good news for construction businesses.

New prison places. 14,000 new prison places will be built by 2031. Good news for Construction businesses involved in that space.

The Dept of Science, Innovation and Technology’s own R&D budget is boosted to £13.9bn. Core research funding is boosted to £6.1bn. Good news for Universities and driving UK STEM skills - and for businesses who benefit from UK R&D - technology, life sciences and engineering. A £520m fund for Life Sciences Innovative Manufacturing is a further fillip for UK life sciences and intervenes on 10%-20% of project costs - so driving £2.5bn-£5bn of investment.

Commercial Research Delivery Centres (CRDCs) to enhance the speed and efficiency of commercial clinical research delivery, to support the UK’s status as one of the best places in the world for innovative companies to bring their portfolio of research. It will invest up to £300 million to bolster commercial clinical trial activity and help advance the delivery of new medicines and vaccines to patients. A total of 20 CRDCs are being established across the UK.

Project Gigabit delivers £0.5bn into fast broadband into underserved regions.

Business Tax Incentives - the UK will have the highest R&D tax relief in the G7. The government believes this will drive investment growth by over 20% over the next 5 years.

UK Market Prospects

I don’t think investors expected that in January 2025 popular sentiment would appear to contain so much uncertainty. Or do the British just continually want to have a moan? It never rains it pours. Or snows based on recent weather.

2024 - the year of elections - is over. Yet 2025 is shaping up to be the year of err elections. Varying levels of political chaos reign in South Korea, France, Germany, Brazil and possibly even the UK. 3m voted in an online poll for another election. Three million and one if you consider the world’s richest man agitating for change in the UK and elsewhere. This is not a political blog and never will be - I’m not the least bit interested in getting into politics with anyone, nor for readers to use this as a political platform. I merely say the investing environment isn’t as certain as was expected.

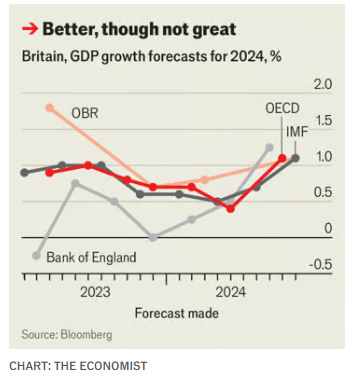

Yet depending on whose forecast you follow UK forecast 2025 GDP looks reasonable to strong, but not spectacular. Considering the double tax whallop from the prior government (frozen allowances) and current (October’s budget) it could be seen as a surprise that any GDP growth is forecast. Certainly there are negative sentiment signs here and there.

But is it a surprise to see growth? Not if you consider 2/3rds of that 2025 growth is government spending based on the OBR numbers.

As I covered in the section above a lot of investment is going into areas which could make Britain more competitive. A broken road network costs business money and creates a deeply negative perception on anyone visiting our country. Regardless of your politics, the “up to 8% hit” to business profits from taxes (which is my crude estimate) is offset by benefits through grants and incentives but also for businesses in construction, health, technology and finance there are new opportunities.

For the OB25 for 25 EMV Capital is a likely direct beneficiary (in fact the Spinout fund mentions Xampla which is one of the holdings where EMVC has capital under advisory). Also Mercia for the same reasons.

WatkinJones should benefit from both the planning reforms and the £3bn loan guarantees.

UK Net Savings

It is interesting to note that a wall of money is held by UK folks, well above that of the US or EU. So when will that money be spent? When will the flood gates open? Meanwhile the savings waters rise and rise.

Interesting that the UK earnings’ growth delta massively outstrips the growth deltas of the US and EU. Yet forward P/Es put the UK below both markets. Growth and growth in earnings at a reasonable price.

This chart can appear misleading “growth expected to slow” actually should be more accurately that the pace of growth decelerates in 2025 but according to KPMG the UK will deliver 1.5% annualised GDP growth backed as you can see by a growing strength of consumption….. lower incomes tend to save less and spend proportionately more so this consumption could suprise to the upside. This will be further reinforced by interest rate cuts, forecast to fall to around 3.5% in 2025.

Conclusion

So the UK economy in 2025 could be far stronger than many commentators believe. Oak Bloke optimism appears backed by the facts.

But more than this and as markets price 12-18 months ahead, the outlook going into 2026 looks reasonable too. This bodes well for investors too.

The 2025 wall of government money going into investment is notable. Roads, Housing, Health and Education are all big winners. Construction and Technology businesses including life sciences should benefit as a result.

It is also noticeable that there is a large wall of accrued savings, reducing interest rates and GDP growth should all provide support for UK business - and investors - in 2025.

Regards

The Oak Bloke

Disclaimers:

This is not advice. Make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

https://www.creomedical.com/en/

Wow, thanks a fascinating analysis a lot to digest. I am thinking Ithaca might be worth a punt it has a large tax loss position, Serica is a well managed company definitely worth holding