Dear reader

PDS Biotech’s Versamune and PDS01 phase 2 trials continue to progress. “Head and Neck Cancer” caused by Human Papilloma Virus (HPV) is contracted via skin-to-skin so typically via sex. So the virus manifests as a cancer in the head or the throat.

HPV is exacerbated by smoking and drinking - see:

https://www.mskcc.org/cancer-care/patient-education/hpv-and-head-neck-what-do-i-need-know

It kills an estimated 350k people each year and around 660,000 contract a HPV cancer each year. Survival is around 50% via surgery, radiotherapy and chemotherapy.

But Versamune is also being used in trials against other cancers too. Colorectal (bowel or rectum) cancer and cervical (the womb). It is at Phase 2 with pivotal news due in July and more news due in Q4 2024, and has a funding runway until the end of 2025.

PDS’ immunotherapy addresses a number of problems. First it helps T Cells recognise a tumour - i.e. spot the cancer. “immunogenicity” is that cancer evades detection. Second, it generates more T Cells and the right sort - ones that can infiltrate the tumour. “Suppressive cytokines and inhibitory factors” is what cancer uses to stop T Cells doing their job (i.e. to attack the cancer).

PDS uses a two-prong attack on tumours attacking from both outside AND inside.

The 3 key pieces of evidence so far appear to be good tolerance (4% had a serious adverse event Level 4), (much) longer survivability and a therapeutic response.

This slide shows Merck’s Keytruda on its own keeps 50% live for a year. Adding Chemo raises that to 55%. But the evidence so far appears adding PDS’ Versamune boosts that to 80% survive.

It also means average (median) survival more than doubles from a year to 2.5 years.

Comparing this graph to that of Avacta’s chart it would appear there are far more reductions in the tumour. Do T Cells offer a better chance than targeted chemo?

Intriguingly, what if you had a quadruple combo of Merck’s Keytruda + Chemo + Avacta + PDS? Would that be a dream team combo? Or do Avacta and PDS address different types of cancer? No mention of FAP at PDS.

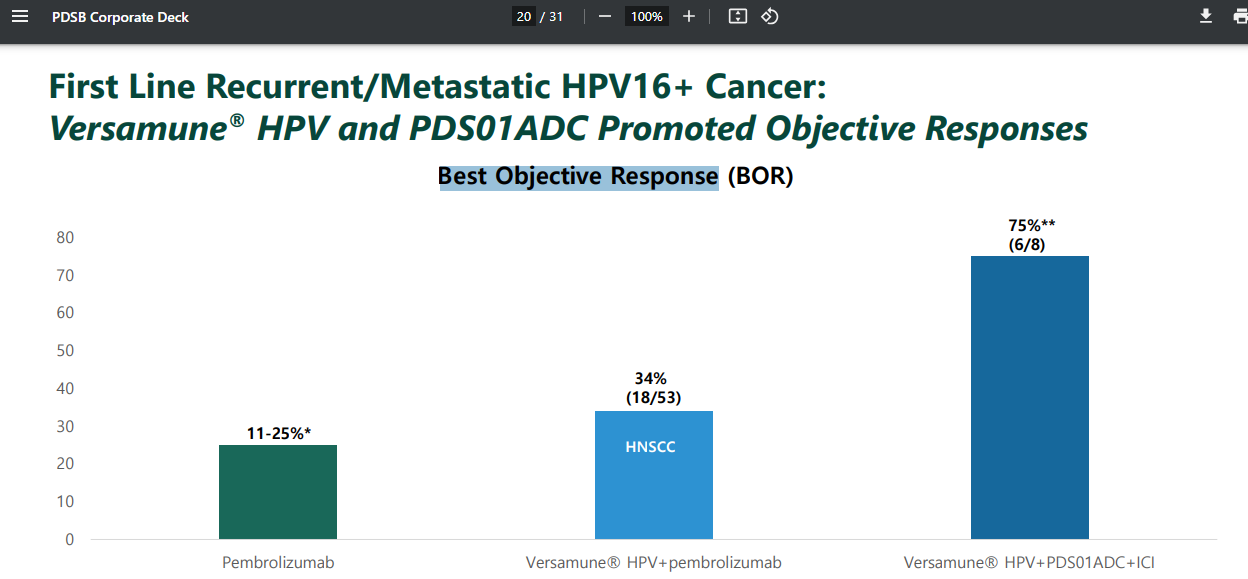

This chart also shows the difference between Merck’s keytruda on its own 25% response (i.e. reduction or stabilisation), versus 34% Keytruda plus Outside attack from Versamune, versus 75% with the triple anti-cancer whammy of Keytruda + PDS’ Outside + Inside attack components.

So 3X better than just Merck’s Keytruda - it would appear.

The “Objective Response” refers to the number of lesions in the place where you have cancer - e.g. the throat - as well as the places you don’t (yet). Non-target lesions are when cancer spreads. So the above 75% are where they are stable or responding - plus not seeing any spread of the cancer elsewhere in the body.

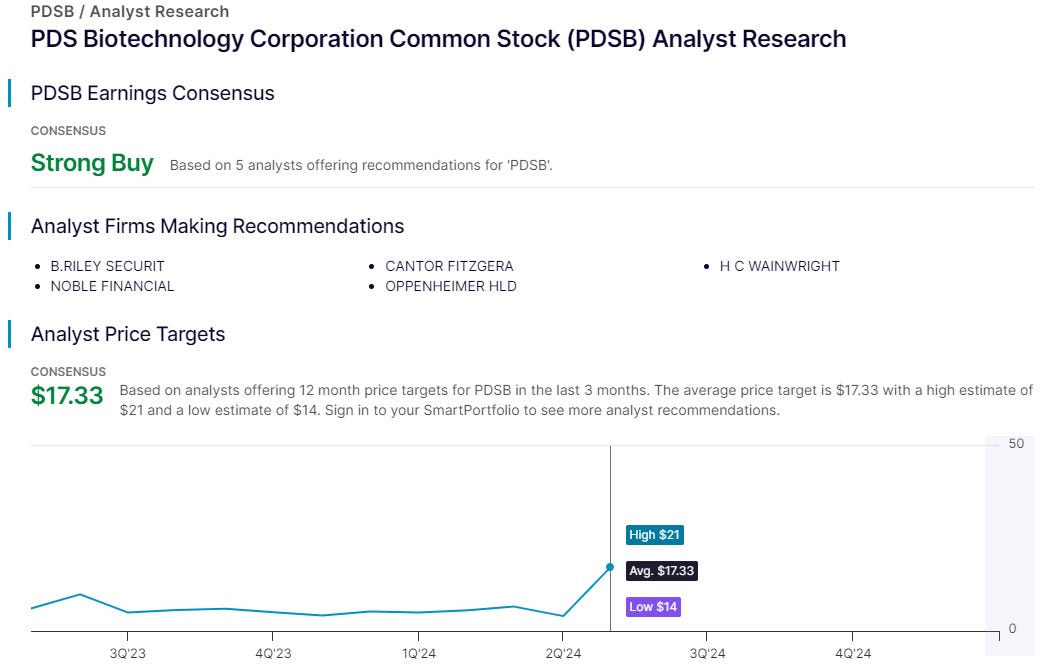

PDS is mooching at $3.51 so interesting to see 5 analysts see a median 5X upside. I wonder whether Merck might acquire PDS? At a $128m market cap 5X would be a mere $0.63bn. Merck have a $15bn warchest and are facing a PATENT CLIFF with Keytruda.

Moreover, Merck’s Keytruda was a 2009 acquisition from which they got FDA/EU approval in 2014. Keytruda is enormous for Merck. Merck sold $25bn of Keytruda in 2023.

Reuters thinks Merck is looking to boost Keytruda:

5 analysts think PDS is undervalued. Not just the Oak Bloke and his ever optimistic thoughts.

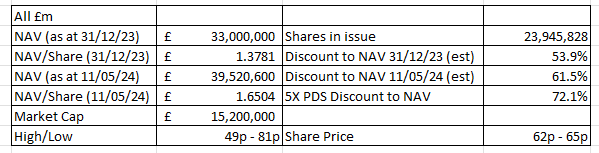

5X would only take PDS back to where it was in December 2022 but it would be equivalent to NSCI current market cap. From a NAV perspective it would boost the discount from 61% to over 72%. But more on that later! Read on, reader, read on!

PDS is just one of 4 Late Stage Clinicals.

Other “Late Clinical” shots:

Cytovale, despite being listed as late clinical, now appears to be at a Commercial stage. Its IntelliSep test is the only test of its kind that is U.S. Food and Drug Administration (FDA)-cleared for detecting sepsis in an adult population that presents with signs and symptoms of infection to the Emergency Department (A&E). The test provides critical new information about immune activation and sepsis risk stratification through a simple blood draw in about 8 minutes.

Recent research showed IntelliSep demonstrated impressive 'rule-out' performance related to sepsis, with a Negative Predictive Value of 97.5%. These findings spotlight how IntelliSep enables clinicians to detect sepsis earlier in patients for whom the condition wasn't otherwise suspected. Conversely, IntelliSep also provides an objective tool for clinicians to rule out sepsis and move onto an alternative diagnosis," said Dr. O'Neal.

Cytovale is currently working with early access partners to integrate the IntelliSep test into their A&E screening. Recent data from Our Lady of the Lake Regional Medical Center, a large academic medical center in Baton Rouge, La. found that when IntelliSep was integrated early in an ED sepsis diagnosis protocol it significantly reduces length of stay for IntelliSep tested patients, resulting in a savings of $1,429 per patient.

$1,429 saving and a million cases a year in the USA alone. That’s a $1.4bn of savings if the US healthcare adopted Cytovale. Is that a no brainer? Meanwhile in NSCI’s books Cytovale is valued at £40m ($50m) and NSCI own 1%. Do you think a $50m valuation might be a little on the cheap side, reader?

Proaxsis

In a final update, 2 days ago NSCI reported a cool £4.5m uplift to its NAV based on an upround at Proaxsis. That’s equivalent to 30% of the NSCI market cap. Is NSCI up 30% on the news? More like 0%. The market is blind to the blindingly obvious!

This is due to an upround of funding. The new investment is being used to turn what is now a Lateral Flow test (remember those reader) and as pictured below - called the NEATstik into a reusable device which can be used at home by those with elevated risk of Exacerbation - those with COPD, or Cystic Fibrosis (CF) etc. There are 11k sufferers in the UK with CF and 100k worldwide. CF is a northern European disease. A shocking fact is life expectancy for someone with CF in the 1950s was 6 months and today it’s 47 years. At home monitoring might help extend that 47 number higher - at least I hope so.

Conclusion:

NSCI’s NAV growth in 2024 alone has grown an estimated net £5m, and that’s despite its listed PDS holding dropping by £1.5m in the period - on no bad news.

So the discount to NAV has grown from an estimated 54% to an estimated 61% in a time period where discounts on Venture Capital are shrinking (at GROW, at CHRY and others).

If PDS gets bought out by Merck (and there are compelling arguments why they would) then the discount sits at 72% potentially - that’s if Merck only pay for what it traded for 18 months ago. $0.6bn to solve a $25bn per year revenue problem - seems exceptionally cheap.

The evidence shows NSCI’s discount is disconnected from reality - and in my opinion a rerate is overdue.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings including those held in VC stocks might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"