Dear reader,

I’ve asked this question before and no one seemed to know. How is it that a share with a 30p/36p bid/ask that closes at 33p (the midway) nevertheless claims to be up 13.64% today?

The only explanation I can think of is that in the clearing session before 8am that it dropped 4.5p and rose up 4.5p to start the day at 30p/36p. So was “up” for the day.

Anyway it’s very misleading and if this were a supermarket that MoneySaving Martin fella would be wagging his finger and quoting the trade descriptions act. Or the riot act. But not when it comes to trading shares, it seems.

Anyway, should it have been up for the day? Was there good news to cause it to go up 13.64%? Read on reader, read on!

What the ‘eck is a Nubdug?

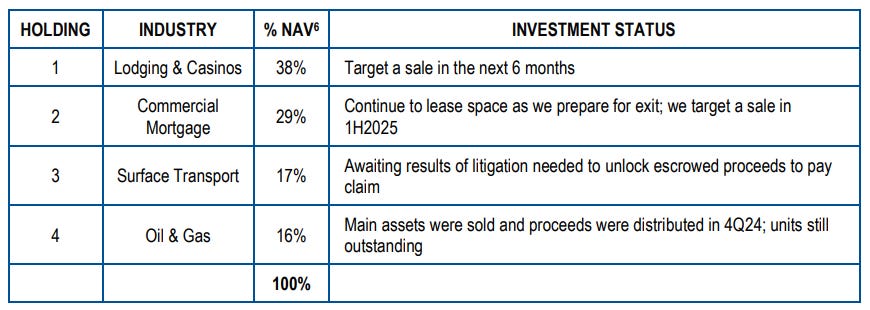

NBDG was a fairly boring idea of disconnected value. Four holdings that were once upon a time distressed holdings bought for a song in Lodging, Commercial Mortgage, Surface Transport and Oil&Gas. They were distressed 10 or more years ago when they were acquired, so turnaround stories. The fact they are living and breathing all the years later is a positive sign. The fund is in wind down and seeking to exit its holdings and return cash to shareholders.

Back when I included this idea it was 27p/33p bid/ask and shortly after the Company resolved to make a capital distribution totalling (before expenses) £1.5 million to NBDG shareholders as at 26th November 2024 (equivalent to approximately £0.0539 per NBDG share which is 9.7% of NAV) by way of a compulsory partial redemption of NBDG shares at a price equal to £0.5535 per NBDG share (being the last published NAV per NBDG share prior to this announcement).

So readers following this idea paid a net 27.61p per share net of that cash back, right?

And so the 55.35p NAV net of 5.39p redemption back then left us with around 90% of our shares remaining right?

The good news didn’t stop there.

So a further asset (the surface transport) has exited, while “further distributions” of O&G means more to follow.

It gets better. The Surface Transport was the asset without a clear timeline and was in litigation. So to see it actually become the 1st of the 4 assets to exit is very positive.

It still gets better. Back on the 27th February 2025 the NAV was 50.92p. So the Surface Transport Distribution of 20.7% of NAV is worth 10.54p per share.

While the O&G distribution is worth 1.32p per share.

So an 11.86p conversion to cash per share total, leaving assets of 39.06p per share since the RNS tells us the NAV was unaffected (i.e. the book value of an asset turned into cash and that’s why the NAV is unaffected).

So that leaves these two assets, plus whatever proportion of the Oil & Gas asset is left. Both of them are targeted for a sale in the coming months (the below chart was published in the September 2024 update)

New Global Share Class ("NBDG") Shares in Issue are 25,123,440 implying a £12,792,855 NAV.

So if you’re already a Nubdugger then the good news is another 10p “should” be coming as a partial compulsory redemption of circa 20% soon leaving you with a holding that you paid a net 17p for where the bulk of that should be realisable in the next few months.

If you’re an onlooker is it worth joining the party? Well the idea is 3p higher to buy (assuming you can’t get in lower than the 30p-36p spread - I paid 32.5p not 33p for example) plus I and other Nubduggers got 5.39p per share back already.

So 36p where you get the equivalent of 10p per share distribution “soon” and then potentially 34p “soon after”, with 7p some time later, means a 41% profit. It’s not enormous and of course not guaranteed, but so far so good and perhaps at the very least worth watching out for the promised further details in due course.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

It is based on the price vs the previous day auction.

Another general question for you:

Which companies have you found the most simple to value and that required the least assumptions? I note that in many PE and Renewable write-ups, you make assumptions about the values of the underlying assets, potential cash flows and power price forecasts.

However, it seems to me that the more assumptions you include, the more likelihood for error. Thanks in advance!