Dear reader

Eagle-eyed readers will recall a series of “Mano D’Oro” articles last year and lots of conversation around the smackdown comparisons to various gold companies along with lots of suggestions for other worthy candidates. One was PAF - Pan African Resources Plc from Zud Afrika.

I must admit I was intrigued and bought in, although not really written about it - so many other articles to write…. Anyway I top sliced recently (at a 45% gain) and timed that well since it has since declared a sharp fall in outlook, and now is down about 15% from recent highs - despite the gold price today of ~$2,900 an ounce.

Today’s interim results raise the question I’m going to seek to answer: Do I average up?

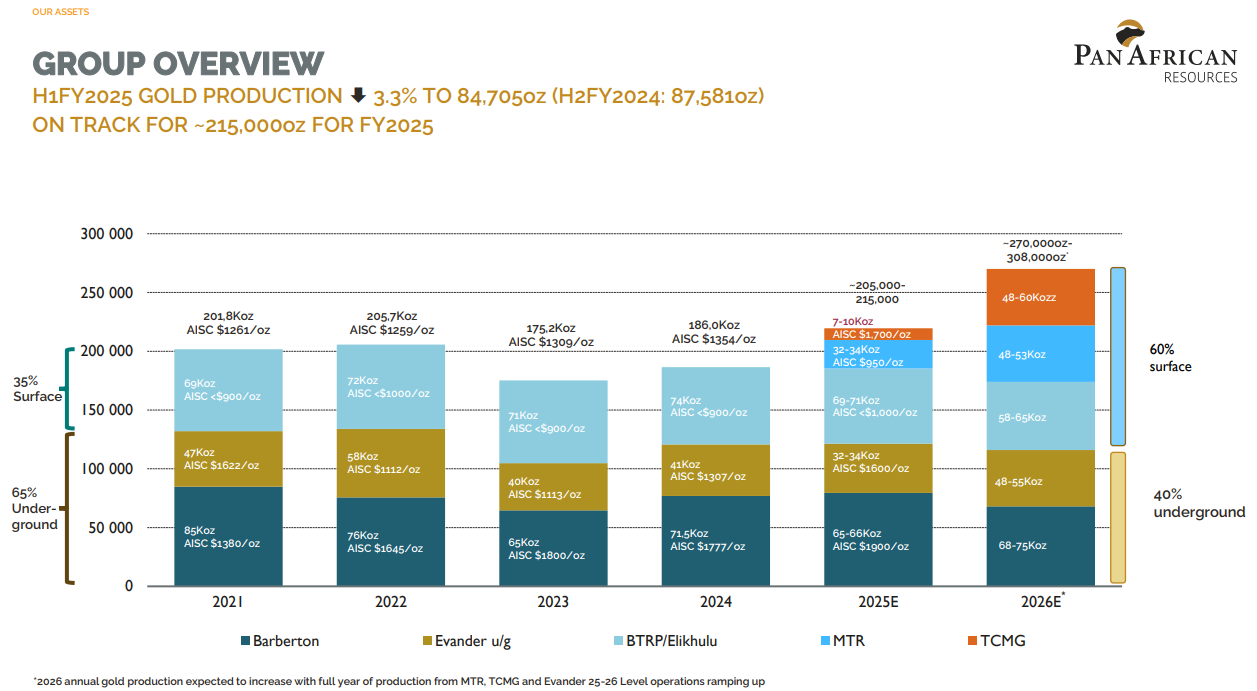

Stocko’s Roland Head thinks I shouldn’t. He gives it a lowly “amber” today in his review, saying the figures are “mixed” and “rising profits driven as much by the higher gold price as by any underlying growth”. This, of course, is incorrect since - as he later points out - “a hedging agreement locked the company into a lower price”. He thinks it’s worth considering the age and complexity of some of the deep mines which he thinks are (mostly) in South Africa. In fact they are all, not mostly in South Africa, and the proportion of open pit production is growing rapidly from 35% of gold mined in 2024 to 60% by open pit by next year. The StockRank has fallen as the final justification to take a neutral stance as he claims the easy money is already in the price.

In other news the trading update RNS stated a 38%-49% drop in earnings. Yikes!

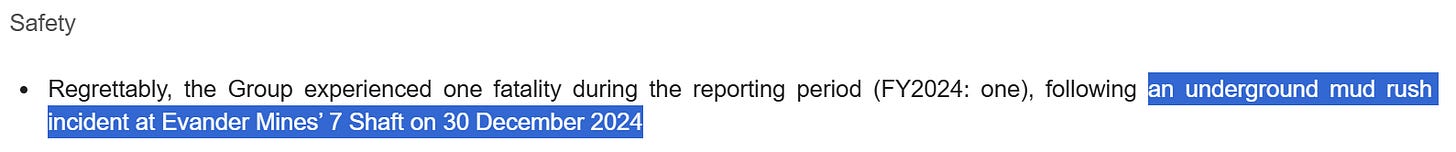

But before we explore the mine any further please spare a thought for the one fatality at PAF’s mine a few weeks back.

Ending your life as a mud rush descends on you is a horrible way to go. This appears to be a South African phenomenon described in this study.

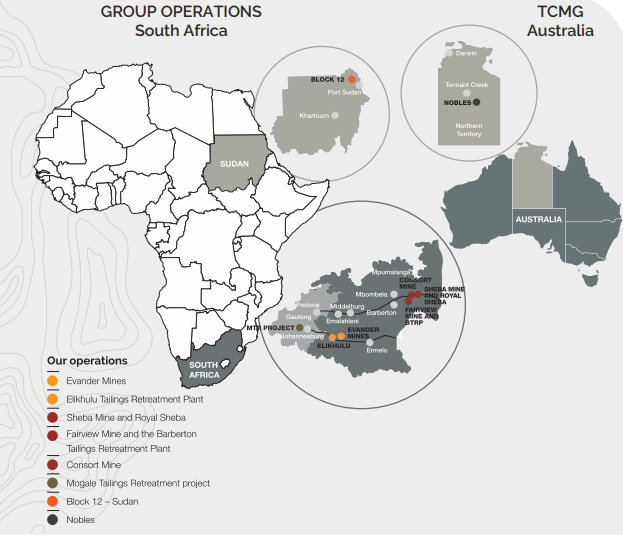

PAF is a collection of mines and tailing retreatment projects across South Africa and Australia with an early stage Sudan interest too.

The largest mines are South African underground: Barberton and Evander, both growing in cost and falling in yield. The open pit BTRP is the gift that keeps on giving, with MTR (tailings recovery) coming on stream and Australia’s TCMG too.

Why the sudden drop in Earnings?

The Hedge: A $17.4m penalty on 84,705 ounces is $205.42/ounce extra cost. A large reason the AISC jumped to $1675. Deduct that back out and you get to a much more reasonable $1,470/ounce. Guidance is for $1500 so this seems eminently achievable, although 2 months in 2025 will be hedged so 2/3rds of $205 gets us to ~$1530

Decrease in Gold Sold. If you were only getting $2,300 per ounce don’t you think it’s common sense to stockpile the gold until the hedge expires?!

Multiple Eskom transformer failures at Barberton Mines, negatively impacting production from the operation for 10 days - that’s a 6% increase to AISC straight away. PAF tell us a “a number of mitigation measures have been implemented to avoid a recurrence of this issue”. For example a solar plant at Barberton went live October 2024.

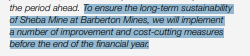

Barberton is getting older so improvements and cost-cutting measures are planning during 2H25 (to 30th June 2025). Even so it achieved a 20% NET margin post tax in 1H25 - that’s not bad!

-

Cost and Complexity?

There’s nothing I’ve found which is specifically costly or complex? Not sure why complexity was raised as an issue?

Easy Money is already in the price?

It’s true that the share price has tripled in the past 5 years while Gold has increased by 90% but if you put a, say, $1,400 AISC “floor” beneath the gold price of 5 years ago and today then Gold has gone from $170/ounce margin to $1500/ounce margin. A 9X increase. In that perspective, PAF is 67% below the “gold margin” - assuming production is the same…. and it was 170Koz in FY2020 and forecast to be 205Koz in FY2025….. so 75% below in that perspective.

Next year production is forecast to grow to 235Koz-250Koz, so 83% below in that perspective.

PAF would/should be 3X to 6X higher “by rights” but of course we must consider other aspects like risk. But today PAF’s risk is arguably lower than Fy2020. Back then PAF was South Africa only, today it has a growing Australian operation, it has Sudan too. Arguably the power outage problems of South Africa are abating through a mixture of privatising energy trading, “wheeling” power, building renewable power generation and Eskom simply rapidly increasing prices to pay to invest into its network.

PAF had s/h equity of $183m back then, today it’s $420m so $240m higher (despite shareholder distributions via buy backs and dividends). Finance costs of $23m are higher than 5 years back but appears manageable. PBT earnings cover finance costs 10X in FY25 and then 12.5X in FY26.

The forecast production and AISC all look reasonable to me.

Based on PAF’s 5 mines producing 205 Koz in FY25 and 270 Koz in FY26, assuming a $2,900 gold price from March 2025 to June 2027 and a steady AISC (which doesn’t factor in any cost savings) you are still looking at a P/E of 4.2X dropping to 3.3X.

Is the “easy money in the price”? I struggle to agree with that conclusion! The numbers appear to contain a large margin of safety too. The dividend is around $55m per year so about 20% of profits, suggesting the remaining $170m in FY25 and $230m in FY26 reduces the debt pile down to FY2020 levels or below. That’s not a recipe for risk and complexity either.

For those who want a longer-term story PAF also sets out how it will grow Australia to the same size as South Africa over the next 5 years too.

Conclusion

Having examined the evidence I’m now satisfied that an average up at PAF makes sense and the negative elements in the Interims are not reasons to abandon hope.

The yield is 2.65% based on 0.96p at the 36.25p share price, so the main reason to buy here is the cash generation and rising equity…. in other words in the next 18-24 months you go from own part of $420m of gold mines to $700m of mines simply via deleveraging or via further expansion capital.

Or if PAF juiced up the dividend, a 20% yield would be just about achievable based on a scale back of capex. £152m is $190m, which is within forecast profits over the next 2 years at least…. assuming gold remains at an average $2,900 per ounce of course.

A business capable of that based on forecasted earnings cannot be described as “the easy money is in the price”, can it?

Or looked at a final way you’d have to see a dramatic fall in the price of gold, or witness catastrophic difficulties in both South Africa and Australia in order to get to a point where you’d feel nervous about its current 36p valuation. So it has a margin of safety.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Fully agree with your analysis Oak Bloke …….I have held PAF for probably 15 years ……buying originally for 5p or thereabouts …….adding to it over the years ……it is now my second biggest holding ……I thought the comments on Stocko were a bit superficial and to be fair to Roland they do say they normally don’t cover miners etc and I am pretty sure this is their first time covering it.

As a play on gold ( which it is) and as part of a diversified portfolio I am struggling to find a better risk/reward play ……the timing of their financial update was a little unfortunate …….based on the gold price movement and the way PAF had moved since the start of the year I could very easily have seen it move to a mid 40’s price.

If the gold price stays at or around where it is now for the next two years then a 50p+ sp is a real possibility with the risk on the upside not only from PAF specific performance but from higher gold prices.

GerryOD

Great write up Oak and you cover the main points. As per Graham I also have been a LT holder, and if you look at the chart, PAF has tracked the Gold Price, all the while paying nice dividends.

Reading the tea leaves, the market reacted negatively for 2 main reasons: 1) the revenue miss, and 2) the large rise in AISCs.

The first, as you've demonstrated, is less of a worry. There's plenty of cash that will be coming in FY 25-7. Even with the hedging etc, the AISC jump however is a valid concern. This is bc management have been hammering cost containment and this sudden increase indicates that something is awry. The illiterate messaging also didn't help.

Now onto the plus point. The market seemed to like the Tennant acquisition bit something that needs to be added is that Aus miners trade at a significant premium to anywhere else in the world.

This then brings us onto management. Next year imo will be a major test of Cobus' capabilities. If costs continue to spiral, then this stock will shally along as a kind of a poor man's iamgold. However, if he can contain AISCs and ramp up Tennant smartly, then the value proposition is maintained.

A really bold move might be to divest all SA assets, and buy a major tier one mine (they're still going cheap) eg in PNG or another mining friendly jurisdiction. But I don't think that will happen.

Drills in the ground in Tennant with upsizing the Reserves would be a happy medium.

All told I think this is a buying opportunity, and a bet essentially on Cobus.