Panthera

Is this a Dog? Or a beast?

Dear reader

Panthera. My first reaction was to think Thunder, Thunder, Thundercats….

But my memory of a character called Panthera was faulty. The character was Panthro and little did the Oak Bloke know that they rebooted the Franchise in 2011. Briefly.

My first reaction to Panthera Resources (ticker PAT) meanwhile was to think what garbage. A stinker. A real sucker stock. It loses money. Has few assets. Hardly any cash. Dilution year after year. Assets in risky countries. You’d be nuts to consider it.

But my 2nd reaction was to get a bit excited.

Digging into this more closely there’s a reason why I changed my mind.

They have a claim. This relates to a prospective mine in India with a JORC worth a net 1.2Moz to PAT.

This claim was effectively taken from PAT’s Australian company, and there happens to be a treaty between Australia and India for investment protections and to prevent expropriation. PAT has a right to damages.

"The September 2023 decision by the High Court of Rajasthan ("HCR") to dismiss the writ petition adds to the act of expropriation, and India has again breached its obligations to provide investment protections to Indo Gold Pty Ltd ("IGPL") and its investment under the Treaty.

After 12 months of due diligence Litigation Capital Management took on their claim.

LCM have a 93% win rate. These take on claims such as these after extensive due diligence and this is why their win rate is high.

Assessing the claim:

1.2Moz might be (roughly) $1,500 AISC and Price of Gold $2,450 so a $950/oz margin over 1.2Moz (after deducting capex of say $300m, and deducting LCM’s cut of 15% plus 4X costs of $13.2m contributed by LCM to the case leaves PAT with $661m ($1.14bn - $300m - $126m - $53m)

Realistically there has been a 50% dilution since 2020 in the number of shares and you could foresee further dilution before the claim is won. Let's say 50% more. = $330m

One difficulty I had was that PAT themselves are speaking of Bhukia a bit strangely. They say:

"The Company believes that the market value of Bhukia is substantial with the project ranking among the top undeveloped gold projects in the world."

Really? 1.74Moz gross (1.2Moz net) isn't among the top undeveloped projects in the world. Newmont & Barrick have reserves 100X greater than this.

But given that PAT is a titchy £9.6m market cap there is a heck of a margin of safety in the odds. In fact the $660m (£508m) would have to be diluted 53 times to reduce the value of the award to the value of the market cap. Or put another way if the value of 1.2 million ounces of gold at the fair value of the margin less capex would have to be reduced by 53 times. An award of less than $18 per ounce of gold for example. It’s difficult to see how such a small amount would be a fair award of damages.

Of course if they lose the case then the award is zero. Historically that’s happened 7% of the time on LCM cases.

-

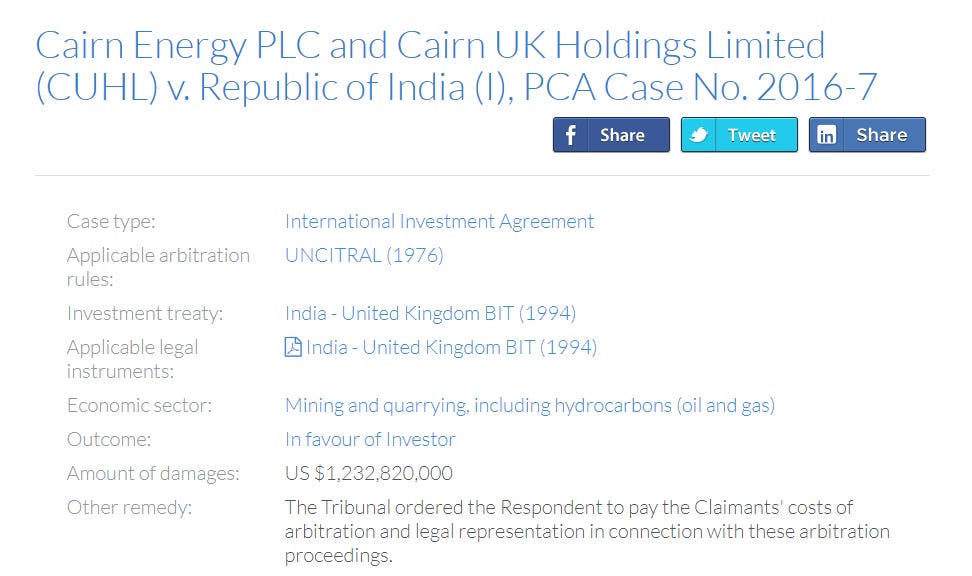

And if you’re still sceptical, perhaps I should add that when it comes to India expropriating investments and then paying out compensation there is precedent. I’m sure this was part of LCM’s reasoning to take this case.

And in India, which has a common law based legal system inherited from the British, precedent matters. In other words once a case is settled a particular way it creates a precedent and a Lawyer can quote cases as part of their argument to the Judge or Jury.

Winner winner, what’s for dinner

Assuming a win what happens next. It’s fair to say a special dividend would be given. At least equal to the market cap and probably more.

But the plan would also be to progress its projects. These include:

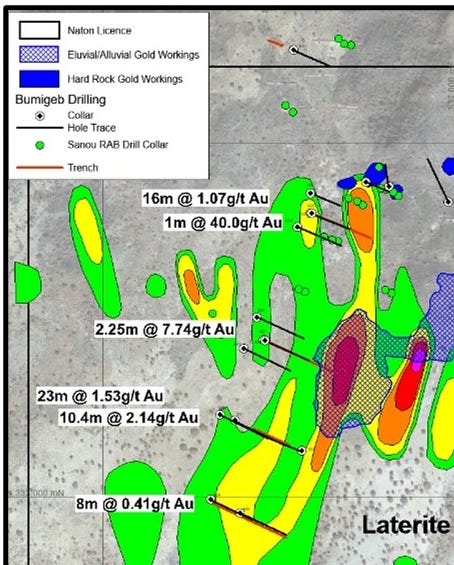

1. Bido, Burkina Faso a Gold/Zinc claim where in the Interim Results they’ve completed IP arrays, and nearby are various 1Moz and 3Moz JORCs. A small intercept of 40g/t Au is impressive.

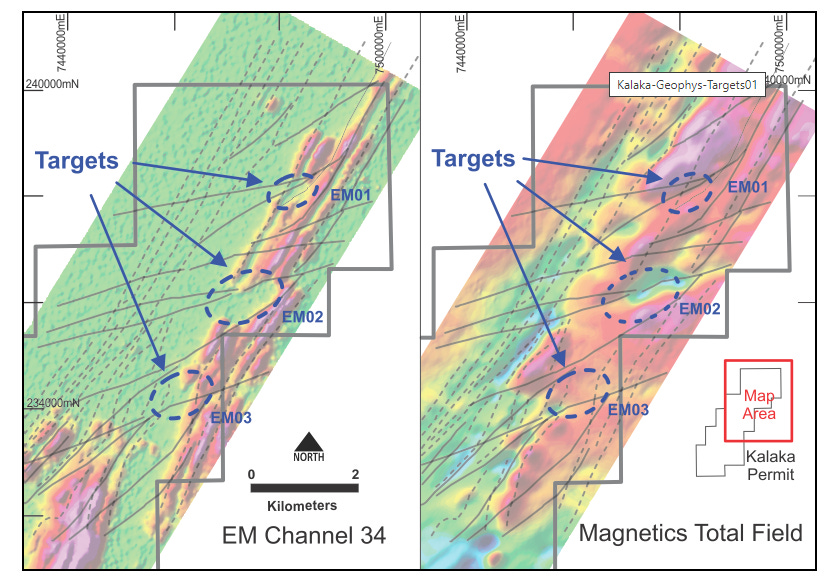

Kalaka, Mali where a 8 drill hole campaign revealed gold of 0.5g/t - 1.62g/t.

3.Bassala, Mali where a 2022 drill campaign found 3.7g/t - 5.6g/t.

Recent field work at Bassala in 2023 has identified the location of new artisanal gold diggings that highlight several zones of potential mineralisation that had not previously been drill tested by the Company. The Company intends to complete geological mapping and sampling of these new zones ahead of planning for further drilling.

Conclusion

Even without the prospective pay out, Panthera appears to be progressing its projects albeit they are early stage and are based in some difficult corners of the world, and - for now - doing so with limited cash. Places where there are already gold miners and gold.

If you are happy to tolerate that risk, along with the risk of the litigation then at today’s gold price this could be an interesting albeit speculative holding.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".