Part 2 of 3 - Considering ARCI

Ark Invest Robotics - part of the RIZE ETFs - ARK now in the UK!

Dear reader

How did Ark Invest anticipate I was investigating robotics exposure options?

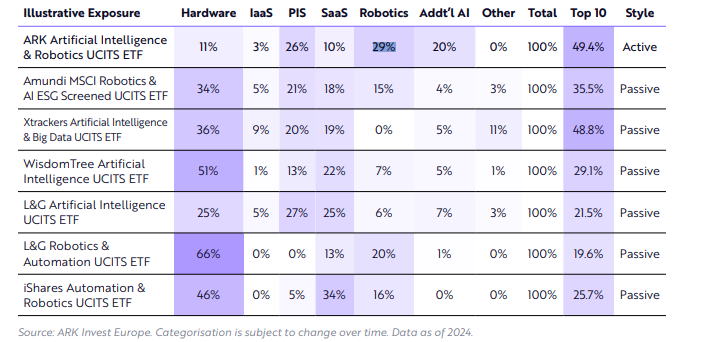

How helpful it was to find this “Know your AI and Robotics exposure” article. Inside it even gives a helpful guide to different Funds and ETFs. At 29% of the portfolio ARK says that ARKI offers the best exposure to Robotics. Hmmm. Let’s wait and see because 29% is less than the ETF featuring in Part 3. For whatever reason the ETF does not get included in Ark’s list for some strange reason.

In Part 1 we looked at the Top 10 of iShares Robotics ticker RBTX and found it was nearly no-botix.

Ark argue that focusing on and investing in robotics in industrial manufacturing is a mistake. Advanced applications is a more exciting opportunity over 5 years. It’s an interesting argument. I would be very interested in reader’s views on this assertion. I disagree.

The (unanswered) question is does a “pure play” humanoid robot developer stand a worse or better chance than an existing industrial manufacturing robot developer and supplier? Bearing in mind the latter have hundreds of patents, cashflow, experience, a customer base and thousands of highly-experienced engineers already working for them. Forgive my cynicism but this “leapfrog” mentality speaking to “advanced applications” feels misplaced. The winners in Robotics in my opinion are the engineers, the do-ers, not the dreamers. Not the software houses. Making stuff is very different to making software. A Robotics ETF with Satellites and Software, yet it will win the Robotics race? The exception to the Ark stable could be #2 pick Tesla. But Musk is an engineer, not a dreamer - so proves my point.

Let’s look at the Top Holdings anyway:

Palantir 9.87%

Palantir is the biggest single holding with an eye watering 107.2 P/E but an attractive growth rate. Its website certainly gives an impressive demonstration of building workflows and then having an AI agent assist you with your process once built. This looks suspicously like the Microstrategy AI+BI except Palantir’s looks far superior.

I’m struggling with paying 107x times earnings.

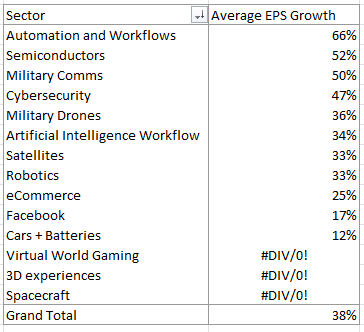

Look at the growth rates reader.

Tesla 9.5%

Tesla needs no introduction, and what is noticeable is that it is currently one of the slowest growing holdings. Ark have a strong thesis that Tesla will transform through its Robotaxi and the ubiquity of turning a major cost (transport) into an asset and an income (we’ll all be taxi firms in the future)

Tesla recently roadshowed its Cybercab and its Optimus robot. The argument Ark give is that the accumulated driving knowledge of the self driving exceeds 3m miles - more than every other car manufacturer combined. Rather than relying on sensors the AI has learnt every road but learned from watching many hours of driving, and continues to learn.

Ark believe the 5 year valuation of Tesla is between 8X and 12X today’s share price and publish research to set out their stall. It is impressive work and they make a number of good points.

Meta 5.26%

Meta is a mystery. Not Robotics, so not sure what Facebook is doing in a Robotics ETF?!

You can Like, comment or share.

Iridium 3.97%

Iridium offers global satellite and comms services and is growing rapidly but is a more reasonable valuation. But no robotics.

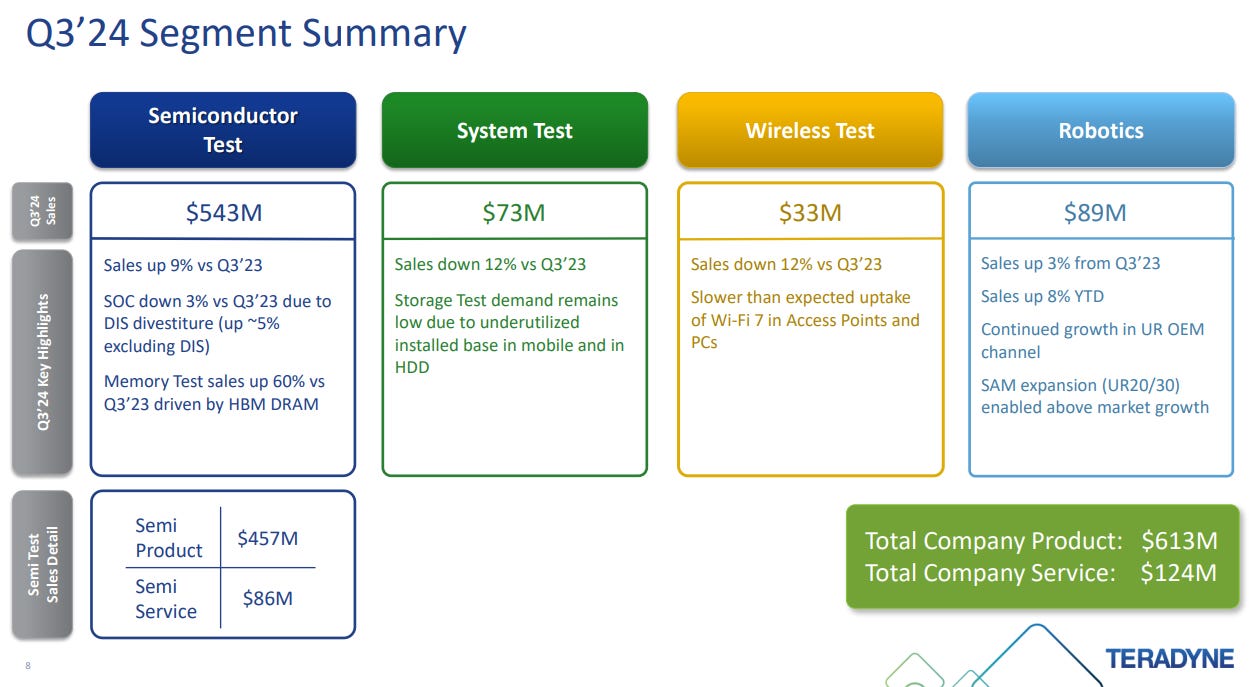

Teradyne 3.96%

offers material handling robots capable of handling heavy loads of several tons. It also sells “Co-bots” collaborate robots that work with a human in product assembly. But robotics is an acquired unit and only a small fraction of what really is a Semiconductor business.

Rocket Lab 3.75%

Yep. Rockets and Space Craft but no robots. No earnings either.

Taiwan Semi 3.33%

Semiconductors. Not robots.

Roblox 3.29%

This is that weird virtual world you can run around in and buy virtual real estate and “it’s the future” apparently. But there are no robots. Except people using a robot picture as their avatar in that game.

Kratos 3.08%

Military Comms and rapidly growing earnings but no robots.

Conclusion

So once again we find an ETF with a bit of a mixed bag. Quite a bit of variety and some holdings tenuous as to why they are connected to the theme.

But what catches my eye and impresses me is simply this. Look at the growth. That much is encouraging. An average of 38% growth over the past 12 months.

ARCI isn’t for me, but I can see how folks would be attracted to it. It is virtually all US stocks so that might be a key attraction for some. But for me I want Robots and I want value. I believe the US is an expensive market (the top picks are an average p/e of about 40 - excepting the 3 which had no earnings) and better opportunities lies elsewhere.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, you make your own investment decisions.

Micro cap and Nano cap holdings including those held in an ETF might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I've been looking for a robotic etf too and neither so far are appealing. Thanks for the write up as always.

I can't speak for finances but I'm an engineer for futurist tech and agree with the general ark view of humanoid robotics beating out industrial. It's definitely the next paradigm shift and an entirely new market as well as replacing existing.

General purpose robotics with specialised adaptations isn't as far out as people expect and industrial precision/repeatable robotics is more saturated. Lots of players in the space but I enjoy the design philosophy of x1 https://youtu.be/2ccPTpDq05A?si=OPKCP3nMkkKoM-Kv