Dear reader

Phoenix Spree Deutschland (PSDL) is a UK-based investment trust that offers investors a unique opportunity to gain exposure to Berlin’s residential real estate market. With a focus on mid-market residential properties, PSD aims to deliver long-term capital growth and income through a strategic blend of rental income and condominium sales.

Let’s explore PSD’s investment strategy, recent performance, and its outlook in the context of Berlin’s evolving property landscape.

Was ist der Phoenix Spree Deutschland?

PSDL concentrates its investments in Berlin, Germany—a city renowned for its vibrant culture, growing population, and its…… sclerotic housing market. PSDL’s objective is to generate value for shareholders by acquiring, managing, and selectively selling residential properties. Unlike many real estate investment trusts (REITs) that focus solely on rental income, PSD employs a dual strategy: Maintain a portfolio of income-generating rental units while converting others into condominiums for sale at a premium.

The problem for PSDL is its tenants. They don’t pay much rent. Things got decidedly worse a few years ago when the Berlin Red-Red-Green coalition capped and reduced rents for private non-subsidised rental properties aimed to prevent rents being set at free-market levels. This was later struck down by the Feds and after all Germany has some of the strongest tenant protections in the Western world.

Rent’n’flip.

Berlin’s appeal as an living/visiting destination lies in its relatively affordable property rental prices compared to other European capitals. This leads - of course - to strong demand driven by population growth and a chronic housing shortage. PSD targets the mid-market segment, striking a balance between affordability and growth potential, which “should” be a resilient niche in this competitive market.

However, PSD has not been immune to challenges. Berlin’s rental market has historically faced regulatory pressures, including rent control measures, though recent relaxations have provided some relief for property owners. Rising interest rates and refinancing difficulties have also posed headwinds, increasing the trust’s cost of capital and contributing to share price volatility—a common issue for real estate-focused investment trusts. The problem has been fair value losses due to valuations influenced by higher interest rates and mortgage availability has driven the valuation per SQ.M downwards.

Essentially cost of debt and the discount rate applied to the Fair Value of property has increased driving headline losses.

About €200m of losses since 2021…. above today’s market cap. Note we only have 1H24 results so I’m doubling up the 2024 results for comparison (i.e. annualised means double). I’m estimating the discount rate at 4.7% since it is not disclosed.

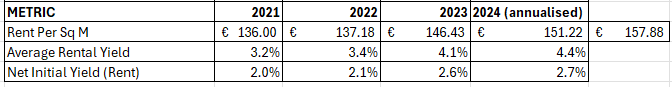

Meanwhile we see rents are growing, by about 4% a year each year. But net of costs rents can barely clear a 2% return for investors, and there’s a 60% cost of sale.

The average rent (i.e. REVENUE) per square metre is only 4.4% and the NIY is actually (incredibly) LOWER than the average. But in another breath PSDL reports a circa 26.8%-33% premium on new rents so I’m left a bit puzzled. I tend to believe the fact that a premium is being achieved since the rental yield is INCREASING year on year, although that is also reflecting a reduction in voids since 2021 from 3.1% to 1.4%.

Units available have reduced from 2707 to 2610 since 2021, while square metreage has reduced by 1% to 187,800sq.m suggesting smaller properties are being sold (the average increased from 70.1m to 71.4m so that makes sense. 71.4m suggests 2-3 bedroom condos. Debt has remained stubbornly high and above -€300m while the cost of debt has risen (albeit I see there’s hedging so the cost of debt is controlled to some extent for now). Refinancing would not be at attractive rates.

Unlocking Value Through Condominium Conversions

Conversions. That’s a weasel word. What that really means is unoccupy the condo and sell it.

As Genesis once sang: “Get ‘em out by Friday….. Helps you excel… sell… sell… sell…”

The problem of course, is you can’t send in the Winkler nor can you subject tenants to genetic halving in size surgery to fit in twice as many to the same building site - that remains just part of a Peter Gabriel song which you’ve probably never heard before. Respect to those who have.

So PSDL’s strategy is its focus on selling its multi-family residential buildings to reduce debt. A key tactic is the conversion of rental units into “condominiums” or Eigentumswohnungen. Try saying that after a Schnapps or two.

Selling condos and not whole buildings enables higher prices. Historically only about 1% of the portfolio has been sold but in 2025 a ramp up of effort is underway. It greatly surprises me that it took until 2025 to come up with this strategy. Seems so obvious as an outsider looking in.

Selling empty properties and not rented ones also enables higher prices. So a reduction in voids isn’t necessarily a positive. We can see an 18.3% premium to the sales price above NAV in 2021 but a 48.6% premium in 2023. So 166% higher. The premium exists regardless of the falling valuation, suggesting that the reduction of fair value isn’t actually all that fair. At least not when it comes to selling.

PSDL increased the number of units available for sale from 108 in late 2024 to 366 across 16 properties, with plans to bring an additional 576 units to market in the second and third quarters of 2025. This phased expansion aligns with that PSDL say is an “ambitious goal of achieving an annualised condominium sales rate of €50 million by the end of 2025.”

Ambitious?

Will the Plan Work? Or is it too slow.

Berlin’s residential real estate market should be a compelling story. The city’s population continues to grow, yet housing supply struggles to keep pace, creating sustained demand for both rentals and ownership properties. While the market has cooled slightly from its early 2020s peak, mid-market segments—where PSDL operates—continue to perform well, thanks to their accessibility and prime locations. Think buildings the equivalent of Acton and Nottinghill. Nice but not super premium.

PSDL’s focus on condominium conversions positions it to capitalise on this demand, particularly as more units hit the market. However, success hinges on the trust’s ability to manage its debt and refinance effectively in a rising interest rate environment.

When I ran the slide rule PSDL plan my reaction is is it “ambitious” to achieve only one sixth of the properties they plan to put up for sale by the end of 2025. €50m of €298.4m. Come on.

As at the end of March they are perhaps €10m through that €50m plan.

Saint’s Patience:

Yes, PSDL’s March update reported a remarkable 258% increase in year-to-date condominium reservations and notarisations compared to the previous year, fueled by robust tenant demand and an expanded sales pipeline. Also PSDL secured shareholder approval to continue operations, a vote of confidence in its strategy and future prospects. A bit surprising if you ask me.

Once they achieve their €298m sale plan and simply using their numbers they should wipe out their debt - or perhaps mostly. I’ve assumed €275m is paid down leaving €25m - which is manageable. Using their numbers for square metres I get to a rent roll worth €18.9m and I’m assuming a 4.4% increase in that number. The NAV would be €370m again simply based on their sale of €298m of property and X square metres - that’s the maths. I’m not adding or theorising - that’s what the numbers show - nothing more.

PSDL-holders would be left with a 120,000 sq.m portfolio of 1,633 units worth €411.3m, and a net asset number of €370m.

Running a little P&L assessment against that future world you get a 2% net profit. Not terribly exciting…. but it is a profit. And that assumes zero accretion in the value of those remaining properties.

If you assume a 4% increase in property values annually, then profits quintuple to a 10% yield.

Conclusion:

I don’t own PSDL but a reader asked me to look. One of many ideas in my backlog! :)

I think my conclusion is if you feel pretty confident in their ability to deliver their planned sales and if that can happen faster than €50m a year (i.e. 6 years!) then you could be on to the start of a winner.

I say the start of a winner because the sales program probably has to continue in order to make any decent money (beyond 2% a year) and so the trust is actually on borrowed time - at some point it will have to sell so much to not be viable.

I come back to the fact that this “should” be compelling yet the low rent and interfering rent controls makes this a good investment to dispose of properties but a bad (or at best altruistic) investment to actually rent anything. When you sell, selling an unrented property is vastly more profitable too. It’s unlikely we can return to a world of zero interest rates either, so the inability to profitably use leverage makes the future opportunity a bit of a non-starter too.

So get ‘em out by Friday….. and hopefully a Friday soon, and not some future Friday many years from now.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I also own this (regrettably). The share price discount to NAV plus the ability to sell properties above-NAV makes me hang on. But I suspect that waiting until 2027-2028 for any serious return of capital makes the IRR here underwhelming.

Thanks - excellent analysis. I own this but have been wondering what to do with it. I not convinced it’s worth owning. All decisions seem to be so slow and I suspect managers are just milking this as long as possible. Will probably sell