Dear reader,

People say AIM is doomed but consider the 696 companies on Australia’s ASX in metals and mining are down -12.6% YTD. In a year where friend-shoring and record prices, lower inflation, reasonable fuel costs should have been a bumper year. You’d imagine the Aussie’s BBQing fat steaks and Shrimp as they gorge on the rich rewards of being “the Lucky Country”.

Perhaps it’s a reflection of the woes of the Chinese economy. Perhaps the Chinese stimulus announcements signal better times down under too.

At A$0.16 or 8p a share, Strata Investment (ticker: SRT) probably isn’t a name you’ll have heard of. But SRT was listed in the UK until late 2022. Metal Tiger was one of Simon Thompson’s favourite stocks. He would speak of the hidden value that one day in the future the 2% NSR would generate returns. Judging by his list of articles at IC, he hasn’t spotted the hidden value announced by SRT in late August (or if he has he’s not saying) although I believe he has written about SRT in the past year.

I’ve been quietly keeping an eye on this from time to time and spotted a 24% leap in assets for 31/08/24. That warranted a closer look.

This is a £13.5m (A$27.1m) market cap, where the Royalty alone is now worth £17.6m. Adding cash and receivables then deducting all liabilities (-£1.2m) arrives to £16.3m which means there’s £2.8m worth of royalty in the price for free.

But that’s not all. There’s a further £11.2m of equity holdings too. For free. More on that later.

But let’s first consider the Royalty. The Royalty Receivable is based on 2% NSR - or net smelter return of all of Sandfire Resource's ~8,000km² area, excluding T3 but inclusive of the A4 and A1 Projects.

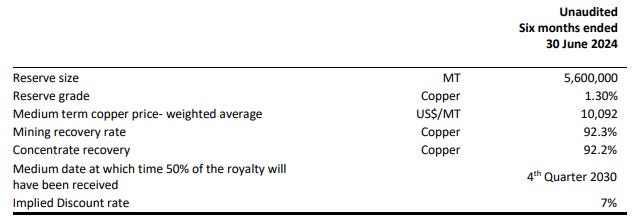

Let’s consider how that £17.5m arrived to the balance sheet.

If we consider the A4 royalty, 9.7m tonnes at an assumed $3k profit** at 92% recovery and 92% concentrate recovery converted to GBP returns is about £19m. But discounted by 6% reduces the income to about £12.5m net present value.

** the C1 cash cost is US$1.54/lb while copper is $4.5/lb so $3k per tonne is pretty conservative.

And the A1 reserve has a higher discount and its less-certain and smaller reserve contributes the other £5m. But eagle eyed readers will spot that if it’s reasonable to consider that commodities are inflation linked then a discount rate is a form of hidden value. Since the future returns will be higher since inflation causes everything including copper to go up then arguably a discount rate is countered by naturally rising prices for commodities.

The royalty has increased in August 2024 due to Sandfire’s results of the A1 deposit

But Sandfire are continuing other drilling programs so more upside will be announced, so the £17.5m royalty not only is flattered by a discount but is just what is known today. And once drilling results are known this can only go up further.

If you ignore T3 (not part of the NSR) the royalty only covers the Probable. Yet I&I at A4 is at least 100% upside. So potentially a further £12.5m or more - nearly another 100% of the market cap. And that’s just based on the known indicated and inferred. In 8000 Sq.Km2 more could be found too.

First ore at A4 occurred in September and first royalty is expected into SRT in early 2025.

Equity Investments

Now it’s fair to say that SRT’s shares have had a fair horrific performance in 2023. It left London to have the freedom of the ASX and bet heavily on battery metals like Lithium which then crashed to low prices in 2023 and 2024. A £4m loss last year and £0.8m loss in 1H24.

Is there grounds for any optimism here, or do SRT’s managers just have terrible judgment? Apart from the fact that the holdings are free, so theoretically there is no downside, a further fact is 90% of the £11.2m of equity holdings are publicly listed.

Let that sink in. So could be sold for cash - even at their current depressed rates. Furthermore £0.5m are warrants and derivatives and these are the very reason SRT left London due to restrictive rules (or at least that’s what they claimed). Typically warrants are “in the price for free” so are on the balance sheet at zero. If a company makes an exciting discovery and its share price shoots up the warrants suddenly become very valuable since they are an option - but not an obligation - to buy. In other words £0.5m of warranties could deliver many millions of upside. Meanwhile just £0.9m are private/unlisted and early stage explorers.

Let’s consider some of its largest holdings.

Let’s consider Cobre. Now, Sandfire’s Botswana mine, is where SRT has that amazing 2% Royalty, and where it’s mining lots and lots of copper. What could be a smart move in that scenario? How about buying part of the company literally next door?

SRT’s largest holding is Cobre and it own 22% of the green squares below where the orange is Sandfire. Neighbours….. everybody needs good neighbours….. with 1.3 percentage copper…… you can find yourself a beaut……

Hidden in the (free) price is the fact that Cobre also has a 2% NSR royalty with zero value on the balance sheet. If Cobre is the next Sandfire then the Royalty could be worth millions theoretically.

Of course most holdings (2/3) are sub £25m market cap explorers, with (1/6) £25m-£50m, (1/10) £50m-£100m and just (1/20) above £250m. That can mean some pretty bombed out and cash strapped juniors. But that can be an opportunty for SRT to increase its holdings along with options and warrants (in the price for free) where the Royalty cash funds these strategic follow ons.

If we consider SRT has been seeking to diversify its range of commodities after falling foul of chasing battery metals. Today, 8.3% is Lithium**, and 8.5% iron ore, while 27.4% are rare earth, 19.3% copper, and nearly a quarter oil & gas and 13.1% gold/silver.

So 83% of those commodities are actually NOT at bombed out prices are they. Just Lithium and Iron Ore.

Gold is at record prices, Rare Earths remain at decent prices (and could shoot up in China plays funny buggers with export controls), Copper at $10k, Oil and Aussie Gas at $80 per BOE.

** Lithium at 8.3% was about ~30% in past periods I think. I’m saying that off the cuff and haven’t checked the specifics but I know it was a large part so you could argue there’s a 25% potential rebound at some point since electrification and the need for Lithium hasn’t actually gone away.

GOLD

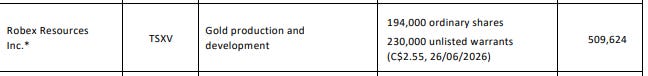

Take the #5th largest holding where £0.5m of shares are held in a £233m market cap called Robex, a gold miner, based in Mali (next door to Hummingbird’s Kouroussa actually).

With a DFS that at $2,300 has an IRR of 67%! An AISC of $1,026! First gold pour is 12 months away, construction is ongoing. The share price is C$2.65 so notice the warrants give an opportunity to more than double the holding for a fixed £330k.

SRT’s £0.5m is a 0.2% holding in Robex and of the $108m annual EBITDA infers a pro rata £0.18m EBITDA, for a share you buy for nothing.

RARE EARTHS

Or consider #4 Viridis. A holding worth £0.68m.

Consider the recent JORC of 201m tonnes at 2,590ppm is 520,000 tonnes of TREO. Given that SRT own 3%, that equates to a paltry valuation of £46 per tonne of rare earth to value 3% of those resources at £0.68m

OIL & Gas

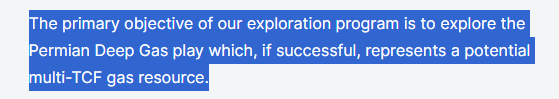

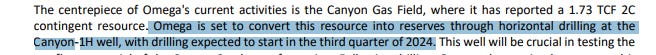

Who recently announced an actual multi-TCF gas resource, at least a contingent 2C one. SRT own 12m of 83.5m shares so 1/7th of the company. Success and 3 TCF and 233mmbbls of oil would translate into several £10m’s.

With permits, equipment and £12.5m of cash including an R&D incentive it’s drill baby drill! Canyon is proximate to Brisbane and 50km from a gas pipeline.

Conclusion

Despite what can only be described as a horrific past track record and a fairly ignominous exit from the UK for those of you like me, willing to go overseas and invest in places like the ASX Strata this appears to offer compelling value where the risk is baked in.

If you agree that Sandfire is a big beast which isn’t shutting up shop tomorrow (or ever) the market cap is more than covered. Then on top you get £12m of free stuff where the free price tag apppears to be a screaming blunder.

And a bunch of unloved holdings where at least some appear to be on the cusp of some very exciting progress.

NB before you go out to buy just be aware that there’s a temporary trading halt due to a major transaction. This could be nothing or could be major news (good or bad). I will update this article once there is clarity.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thank you for the extensive write up. Has been a dreadful investment to date. I (still) hold.

Thanks OB. But isn't this suspended until next year pending a business combination which could have a significant impact on value. See discussion on Hot Copper. I hold and hope for better days.