Piloting DEC at speed: 2024 Annual Report

Did DEC have the luck of the Irish in today's results?

Dear reader,

Happy St Patricks. Four leaf clovers abound and markets fizzled, today, for sure.

OVERVIEW

DEC’s strapline is “Delivering Reliable Results” - and today its delivered reliable FY2024 results too.

Adj. Comprehensive Income $100.2m.

Adjusted to remove -$189m loss from unsettled hedges.

Adjusted to include $151.5m gain on settled hedges.

Full-year 2024 average production of 791 MMcfepd (132 Mboepd)

4Q24 average production of 843 MMcfepd (141 Mboepd)

December 2024 exit rate of 864 MMcfepd (144 Mboepd)

2024 Adjusted EBITDA of $472m

Free Cash Flow of $170.4m

2024 Adjusted EBITDA Margin of 50% and TTM Adjusted Free Cash Flow Yield of 33%

2024 Total Revenue, Inclusive of Settled Hedges per Unit(c) of $3.21/Mcfe ($19.28/Boe)

2024 Adjusted Operating Cost per Unit of $1.78/Mcfe ($10.71/Boe)

SHORTERS CAUGHT SHORT

Spare a thought for a lonely shorter. All their buddies have melted away.

Good to see they’ve released a document on responsible investing.

2025 GUIDANCE

174.4 KBoe/d, from today run rate of 191Kboe/d.

47.8Kbbls/d of Oil/NGLs + 143.3Kboe/d Nat Gas.

FCF $420m

Leverage 2X-2.5X

Synergies greater than $50m

Adj.EBITDA forward guidance of $825m-$875m implies a -$10 to +$40m EBITDA compared to the 12 months to September 2024. (which was $555m + $380m, since you would include 75% of Maverick for 2025).

This implies depletion of -10% is offset by synergies of +10%

For the detractors who used my numbers based on September 23 - 24 as justification that Maverick was a bad deal today’s results are a clear dismissal of their continual negiativity. Backwards numbers were based on very low prices. FCF combined based on historic numbers was $345m. Today the guidance is $420m, so $75m greater.

Or on a per share basis 19% higher per share than DEC prior to Maverick. Yes some of that would have happened anyway due to higher prices but that number includes synergies too.

Working Through The Operational Numbers

Production is up in 2H24 by 14%

Costs are slightly higher as a result, but gross profit improves too.

“Noise” from unsettled hedges makes DEC appear to make a loss. But it is the settled hedges that matter. Unsettled hedges are a theoretical future cost but accounting rules force them to be included even though it doesn’t make sense since future revenue isn’t also included, only the cost.

Improving average prices are offset by slightly lower hedge prices in 2H24. Overall fairly steady prices through 2024. Natural Gas is strong in 2025 and the outlook is strong.

A negative I see is unit costs higher in 2H24, particularly LOE (Lease Operating Expense) higher by 19.2%. These costs will be part of the synergy and rationalisation in 2025 driving the $50m of savings.

DEC point out adjusting for inflation these increases are actually decreases in real terms.

Other negatives are higher depletion and G&A (ignoring one-off costs). These are slightly above increases in production and were due to the DP Lion disposal decreasing the estimated proved reserves relative to the depreciable base.

NEW SYNERGIES

Let’s consider some new ACCRETIVE upsides revealed today.

The prior presentation spoke of land potentially being worth ~$1,100 an acre. We learn of recent sales at $1,300 an acre instead.

The Summit Pipeline opens up Zone 5 TransCo which is $1.80/BOE - $3.70/BOE higher than DomSouth. That’s huge news. Zone 5 links to North/South Carolina and the East Coast pipeline network too.

$42.6m of disposals included $32.7m of undeveloped leasehold in 2024 is just $4.4m in 2H24, but that’s another $42m which wasn’t held on the balance sheet either.

$8m of revenue from CMM (Coal Mine Methane) is forecast to triple to $24m EBITDA in 2026/2027.

The LNG Contract is a further potential positive too.

NextLVL expanded from 17 to 18 rigs. It gets further capex investment in 2025. DEC says “we will focus on realising the benefits of vertical integration by expanding our internal asset retirement capacity. This will help us reduce reliance on third-party contractors, mitigate outsource risks, improve process quality and responsiveness, and enhance control over environmental remediation and costs.”

Moreover the news reports are ignoring simple fact that NYMEX averaged $2.27 during 2024, and while the realised average was pulled up to $2.49/MMBtu by DEC’s hedges, that’s still $0.19 per MMBtu less than 2023 ($2.68/MMBtu average) and an eyewatering $3.84/MMBtu less than 2022 ($6.33/MMBtu average).

Natural Gas has averaged ~$4/mmbtu (HH price) so far in 2025.

Also consider the diminished “headroom” at US LNG supply terminals as of last month in 2025 compared with six months ago. The orange in the left-hand chart is diminished in the right hand chart.

The full year decommissioning was a little lower than anticipated at $19m in 2024 vs $21m, however for 85 wells vs 182 3rd party wells, so while revenue per 3rd party well appears to be significantly up in 2024 (up by around $108k per well), however gross profit of Next Level appears to have dropped to -$0.06/BOE in 2024 vs $0.16/BOE in 2023 - due to fewer third party wells.

Considering Derivative “Losses”

Let’s consider the -$67.4m loss of this $3.30 swap. As at 31/12/24 the price of Natural Gas was $3.57. This implies a $0.27 loss per mmbtu. 27 cents multiplied by 213,686 mmbtu is $57,695. So how do we arrive at a -$67.4m fair value loss?!

The answer is the volume is a daily volume (365 days), and so that sums to 77.99m mmbtus which means “fair value” is a -$0.86 loss per mmbtu. So that suggests “fair” is priced at $4.16/mmbtu (last Friday’s spot price).

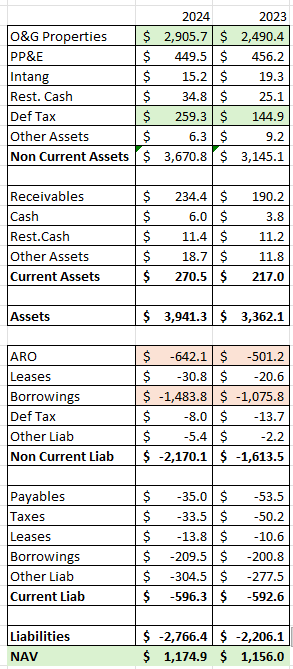

In other words I wondered what the balance sheet looks like if you strip out this derivative noise too (both from assets and liabilities). After all these liabilities are not liabilities from the perspective that they are REALLY a future cost of sale (or other revenue) depending on whether there’s a future high or low gas price. In that same future there will also be FUTURE REVENUE too.

So they are included as part of accounting’s rules - so let’s remove them to consider the underlying performance.

The answer is you see an underlying ~$20m NAV gain in the accounts. The items in green explain the main increases and items in red are the main detractors.

There is an important point here. IF you believe you can earn a larger ROCE (return on capital employed) and ROE by using borrowings (i.e. use leverage) then DEC has increased its Properties by over $400m net in 2024. These will generate higher revenue. These higher revenues are offset by a corresponding increase in borrowing, and borrowing cost. But if you earn more than you pay (DEC paid 7.37% interest costs as at 31/12/24) then this is ACCRETIVE.

Most people understand this, but a few really struggle to understand this simple point. They incessantly moan about the high borrowing, ignoring the benefit it also brings.

The deferred tax you see is what you see in the P&L where a -$224m pre-tax loss becomes an -$87m loss post tax. This asset can be offset against future tax liability so as long as you are happy DEC can generate profits in the future then this asset is “real”.

Conclusion

Overall, the outlook for US O&G in 2025 and beyond is improving.

As I write the shares are up 9.3% today. But this article and today’s results don’t really contain any or much new news. It only really repeats what was aleady known. It clarifies the position and validates my models. So the market is catching up with the realisation that DEC offers a great way to tap into Coal Mine Methane, LNG exports, powering Data Centres and the tipping point for vast natural gas not being unlimited natural gas. That and tariffs should ensure DEC has a bright 2025.

There are some negatives and DEC hasn’t played it perfectly. Costs are up slightly, its presentation today while very bullish ignored some investor concerns. DEC’s Maverick acquisition places it really quite suddenly in a much bigger league than before - with much bigger cashflows, development JV prospectivity, scope for land sales, and development of CMM, and Data Centre power agreements, along with synergies across the numerous acquisitions.

A final good news was the fact that buybacks will resume. Those plus getting debt to 2X adj.EBITDA remain objectives. Although I dare say a few tuck in acquistions may come along before too long too.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Great. So after the hundredth instructive DEC post, I still feel it would add so much value if you put that prodigious mind of yours into running an analysis of Harbour Energy. They have fallen after recent results. I see a good price; but then I'm your average nobody. What do you see?

Hi OB, great work as usual.

One thing (and apologies for the longer comment, but bear with me) that I just came across and that I found interesting:

The SEC form 20-F contains more/different information than the AR downloadable via the company website. The change pertains to the proven reserves and SEC disclosure rules I think. There are like 8 pages (8-16 in the SEC document) between "Outlook" and "Sustainability Review". (It seems information of this section is in part also in the US document page 145 onwards).

The crux of the matter is the reserve PV-10 valuation. In the US that is based on past year's average prices (and also the derived calculation of "standardized measure").

This way, the reserves are valued at pre-tax PV-10 of $1.6B.

In the call yesterday and in the AR downloadable via the website (pdf pages 2 and 31) the company provides a NYMEX strip derived PV-10 for their reserves of $3.3B. But I could not find too many details how this is calculated.

In other words: the impact of NYMEX strip is a cool difference of $1.7B. So based on last year's pricing the current EV ($2.5B as per YahooFinance) is significantly higher than the reserve value. Based on forward pricing the EV is significantly lower than the PV-10 of the reserves... (based on current yahoo finance numbers of ticker symbol DEC, I didn't bother to calculate net debt etc...).

Cheers