Dear reader,

Tom Price of Panmure Liberum set out a bearish picture for Uranium in the article “Uranium - output cuts of Kazakhstan” 29th August.

Yet the Oak Bloke found the opposite when he investigated Uranium in the article “leads to UUUU” 4th August.

So who got it wrong? Or are we both correct?

Price speaks to the spot price of uranium falling as the evidence that Uranium has ample supply. “….why’s the oxide price fading” he asks? It’s a good question.

He then answers it by offering three pieces of evidence:

KAP’s inventories

The production cut from Kazatomprom was expected

Growth from Cameco

I shall investigate these in reverse order:

3.Cameco

“The growth” forecast from Cameco appears to be unfounded. Price believes Cameco will produce 27m Lbs in 2024 (versus Cameco’s own estimates of 36m Lbs in 2024 of which their share is actually only 22.4m Lbs). He claims growth at Cigar Lake and McArthur will somehow hit ~45m Lbs by 2028, by his estimates.

Yet there’s no evidence to this. Looking at the above chart he believes this expansion will happen by Cigar Lake exceeding its licence (or obtaining an extended licence?), without any mention of this in Cameco’s reporting, and without any planned investment (beyond a life of mine extension). Meanwhile it’s true there’s evaluation work going one at Cameco’s other mine McArthur which would add 9m Lbs “when the time is right”. So this is not nailed down, not committed and would take time.

In fact it is furthermore the case that Cameco speak to disruption at its Inkai mine due to problems with a sulphuric acid shortage!! Production at Inkai is down from 4.5m Lbs to 3.6m Lbs.

What’s also interesting is that Cameco has committed to deliver 32 - 34 M Lbs to its customers and that’s 9.6m Lbs more than its 2024 production. So it is running down inventories (0.6m Lbs) and purchasing (9am Lbs) including from Inkai.

In other words Cameco is delivering ZERO to the spot market at least not in 2024. But taking 9.6m Lbs FROM (presumably) what would otherwise be sold on the spot market.

I also notice Cameco acquired Westinghouse and has lost $170m so far this year. I also notice Cameco’s cash has dropped from $1.25bn to just $0.36bn in the past 2 years. Would a huge capital project to boost production to 45M Lbs be undertaken when cash is low, and uranium prices are falling? Come on!

Is Cameco the Knight in Shining Armour ready to drive down the Uranium price further? Increasing production 10Mlbs/yr (>70%) in 2025. I struggle to understand how. If it is true then it had better get borrowing and get spending, and informing its investors, because 2025 is just 4 months away!

2.“The Cut Was expected”

KAP reported a cut to its 2025 production guidance (total managed interest) from 79-82Mlbs to 65-69Mlbs. That’s a 5,000 tonnes cut.

I’ve gone through all the previous Panmure Liberum notes and nowhere is a cut to Kazatomprom’s guidance mentioned. Now it is fair that previous research notes do speak to a fall in Uranium price.

But was the cut expected? I expected it through a blog from GoRozen but saw no mention of it elsewhere.

For example in this article February 2024 from Mining Technology they expect growth at KAP.

But it is also fair to say after an initial rise that the spot Uranium price has drifted down this week ending at $79.50/Lb. This does suggest the market is very sanguine about a 5Kt drop.

1.KAP Inventories

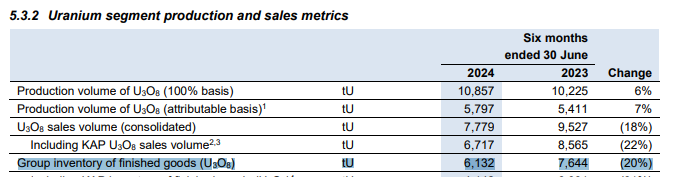

Price speaks to “sufficient inventories” but 6,132tU is just 4 months supply. By historic standards that’s far lower than the average. In 2022 for example, 9.3Kt vs 16.4Kt is just over 8 months supply.

When producers like to keep 6 months inventory and KAP is well below that. “Sufficient” is a moot point and while it’s extremely unclear what its commitments are (Price appears to believe it is an estimated 4,000 tU but doesn’t make it clear whether that’s 4Kt from inventory i.e. leaving around 6 weeks inventory by the end of 2024)

Demand

It remains the case and the OB is correct that primary supply does not cover demand. The WNA (World Nuclear Association) speaks to demand of 65.6 ktu (i.e. 77.4Mt of Uranium Oxide) in 2023 and this grows to an estimated 79.6Mt in 2024). It speaks to a 20% growth of nuclear power station capacity in the coming years.

This WNA estimate is in keeping with my IAEA estimates to 75Kt-93Kt of demand by 2030, because I realised my numbers were for tonnes of Uranium so that actually translates to 88.5Kt-109.7Kt of Uranium Oxide.

Price’s demand estimates go up to 2028 where 187.5 Mlbs translates to 85.1Kt which is 3.4Kt below my lower 2030 estimate. So we all appear to all be broadly in agreement on the demand picture. Which is good because both of us are using WNA data.

It’s also interesting to note that this 2022 report from the NEA speaks to “high” demand of 65,520 by 2025 whereas we are already exceeding that level of demand by 2KtU in 2024!

Also the 2040 “high” for East Asia (which includes China) is 41,296 but planned capacity ALREADY nearly accounts for that number (and Japan, South Korea adds to that number)

So clear evidence that actual demand is exceeding forecast demand, is that bearish for uranium price?

I would finally point out that another highly-secret source of demand for uranium is military. Whereas 5-35 years ago dismantling of nuclear weapons was occuring is that true today? Tensions over Taiwan, Ukraine, Kashmir, the China/India border, all contribute to militaries upgrading their weapons. At the very least military is now a form of diminished supply, and more likely a further form of actual demand.

Supply

The small print to Price’s report is that “secondary” means flows from inventories. Most people would think that is another way to say a deficit of supply. However “secondary” can also be the conversion of weapons grade material and reprocessing of spent materials (like Sellafield used to). But there’s no thought given to the economics or drivers of that secondary and no public sources of data at the World Nuclear Association. As I point out above, apart from the cost there’s the availability of fuel from military. For reprocessed fuel there’s the high cost and complexity.

The OECD however tells us secondary reprocessing volumes are negligible. A nuclear reactor must be adapted to use Mox, so the historic reprocessing of Mox is limited.

Therefore you have to decide to what extent you feel ongoing run down of stocks is a valid reason for prices to fall. This feels like a recipe for prices to rise not fall.

Reactor Retirement

It is also the case that a lot of work is going in to extending the life of reactors. This is the past additions and retirements of generators but going forwards retirements, at least for the next 3-5 years are likely to be lower. Plants taken offline may come back online - Japan notably has 21,475MW of mothballed reactors which would require 4,300 tonnes a year of uranium oxide if brought back online.

Conclusion

In a sense, Price is right. The price of Spot uranium is falling.

But there are a number of errors in his analysis, particularly around Cameco and its future production growth. I also question the ability of Ukraine to mine uranium and any assumption of production from a warzone is questionable. So I’ve amended supply in purple and tracked the resulting deficits in column 2 OB Estimate and retained his own decifit (leaving aside the secondary supply and supposed “surplus”).

It’s unclear where Price expects secondary supply to appear from and in what quantity as though it is possible to predict which stock pile may or may not sell in a given year.

Moreover his forecast of a $60 or lower uranium price in coming years also causes uranium to fall to around to even below the cost of production, at least for Cameco, and Cameco isn’t the highest cost producer.

So to summarise the OB has found 10 reasons why the price of Uranium will not remain low:

Rapidly declining stockpiles at producers (e.g. at KAP) - less than 4 months below the 6 month+ “norm”.

Higher taxes in Kakazhstan will apply to uranium. Generally costs are rising at KAP and at Cameco comparing their accounts across 2022 → 2Q2024

Ongoing issues with Sulphuric Acid where 55% of Uranium is mined by Leaching using Sulphuric Acid - driving up the cost for that form of mining (55% of world production).

Expectations of lower prices of Uranium. Is it realistic to imagine Cameco or others will ramp up production if prices are falling and if Liberum are correct. These producers are not stupid.

A structural deficit of at least 13,000 tonnes a year according to Liberum but upwards of 19,000 tonnes a year according to OB calculations.

Increasing demand from the pipeline of new reactors.

Delays to decommissioning and life extensions being made to existing reactors.

The prospect of mothballed Japanese reactors coming back online (+4.3Kt/year)

Small Modular Reactors from Rolls Royce, Bill Gates and China which might further boost demand for nuclear power generation by reducing the capex, capex uncertainty and build time.

Low levels of new contracts will eventually drive buyers to purchase from the market at spot prices.

While it’s true Uranium is now at $79.50 per Lb I just don’t buy the argument that the price will keep falling and the murky secondary sources will keep the market in surplus until at least 2028. Based on my analysis, that’s 105Kt of deficits between 2024-2028, and while, yes, there are potentially 250Kt of surpluses worldwide we are talking a global run down of 40% of all inventories with zero impact on price. It also assumes secondary sources are willing to sell.

One major source of secondary will likely be China. China holds vast supplies of most materials because a blockade would be a fairly simply way to bring it to heel in the future (assuming it couldn’t break a blockade). China produces far less Uranium than it consumes. Whilst it shares a border with Kazakhstan I would doubt China would run down its stockpile for strategic reasons.

About an eighth of that 250Kt stockpile for example is managed by John Ciampaglia who manages the 32Kt of Uranium at Sprott Uranium ETF. At 13 minutes in the below video he speaks to how people at Utilities assume he would loan or sell them their uranium - that it is “mobile”. He categorically says NO. That is not how the vehicle works. We (Sprott) have never sold or loaned a single pound.

So where is this magic porridge pot of secondary supply exactly? John Ciampaglia calls this out too.

All in all a recipe for pricier yellow cakes, and that’s no pork pie.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

What relevance does the spot price of U actually have. The volumes over the summer have been very low. There have been few RFPs or contracts, and little sport buying

Utilities are apparently holding off any spot purchases. That is different from no shortage or adequate supply.

Long term contract prices are the real cost of uranium.