POS-ition open - Introducing Plexus

It's all about Seals!

Dear reader

About an O&G well

An O&G well is a series of pipes, inner and outer, like Russian dolls nesting one inside the other. These are called annuli (the plural of annulus) or also called strings. Around this is the casing which provides the structural integrity of the well. The top of the pipe with all its valve and arms going up, left and right is called the Christmas tree. A Christmas tree is an assembly of valves, spools, pressure gauges and chokes fitted to the wellhead of a completed well to control production. The go faster, go slower bit.

Below the Christmas Tree is a well head. This is a series of valves, adapters, tubing and casing that sits below the Christmas Tree. The thing which provides pressure control. Like the clutch in your car.

About Plugging a Well

The basics of Plugging and Abandoning (P&A) operations vary little, whether the well is on land or offshore, and the oil and gas industry has developed methods and materials designed to provide long term zonal isolation…. no leaks in other words!

The objective of all P&A operations is to achieve the following:

isolate and protect all fresh and near fresh water zones

isolate and protect all future commercial zones

prevent leaks in perpetuity from or into the well

remove surface equipment and cut the pipe to a mandated level below the surface

A traditional abandonment process begins with a well killing operation in which drilling fluids (drilling mud) is introduced where it is heavy enough to contain any open formation pressures.

The Xmas tree is removed and replaced by a blowout preventer, through which the production tubing can be removed. If you’ve watched the film “Deepwater horizon” the BOP is the thing they try to use and fails.

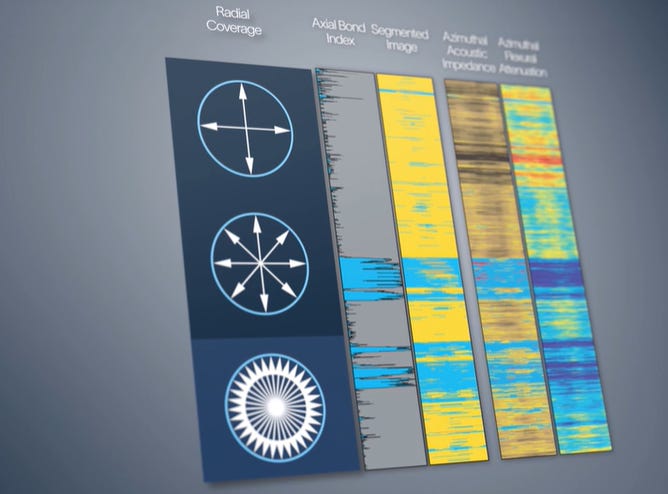

Now the reason the production tubing is removed (i.e. the A-annulus) is to check the outer ring - the B-annulus to ensure its integrity - remember no leaks. But did you know reader, that new technology from SLB does not always require this by providing multi-mode ultrasonic measurement, axial bond index, segmented imaging, and azimuthal acoustic imedence how can plug a well 20% cheaper using SLB technology.

(Off Topic: But did DEC use SLB tech to achieve approximately 20% cheaper P&A costs in 2023?!)

Cement is then pumped and placed across the open perforations and squeezed into the formation to seal off all productive layers.

Depending on the well configuration, a series of cement and wireline plugs in both the liner and production casing will be set to a depth level with the top of cement behind the production casing.

The production casing is cut and removed above the top of cement, and a cement plug positioned over the casing stub to isolate the annulus and any formation which may still be open below the intermediate casing shoe.

-

So where does Plexus come in?

As much as SLB provide generic wellheads and Christmas Trees, Plexus provide specialist/bespoke wellheads, Christmas Trees, actuators and something called POS GRIP. Think of this like an anti-wiggle methodology. Many leaks occur through wiggling. Subsidence, tremors, movement that puts stresses on pipes which can fracture or crack. POS GRIP is a way to handle this. But it’s not exactly a product it’s more a method of engineering. A patented one.

Plexus also has HG® technology, which is a simple scientific method of design for metal interface seals, used to permanently contain methane gas in wellheads, throughout the life of a producing well. The seal system comprises of multiple integral radiused bump rings, which interact directly with the wellhead bore, to halve the number of leak paths past the annulus, using a series of redundant gallery seals. A special technique is used to distribute perimeter stress, in compliance with the principles of Hertzian Stress Theory (HST). More anti-wiggle.

So SLB and POS are competitors, in a way. Or are they?

The reason I keep mentioning SLB is that POS did a deal with SLB.

On 2nd Jan SLB paid $5.2m cash for a perpetual royalty-free licence for POS-GRIP technology and HG® seal technology for Non-adjustable Surface Production Wellheads.

However SLB gets a royalty licence for Adjustable Surface Production Wellheads and HG Trees, so POS earns Royalties. Basically adjustable is an adjustable choke. The surface wellhead equipment is the second line of defence against a blowout. An adjustable choke is needed on higher pressure (more valuable) oil and gas wells.

The agreement does not extend to offshore (subsea and ultradeepwater) wellheads (POS’ traditional hunting ground).

POS has the right to continue operating in the non-adjustable surface sector on a limited basis and to retain ownership of the original IP.

POS may quote SLB Valves and Trees combined with POS wellheads on a project basis, subject to SLB approval. So POS enjoys SLB’s quality by association, but also POS is not a volume manufacturer so being able to spec SLB’s kit on its projects is a massive advantage.

So it’s as much a co-operation - co-opetition - where POS is specialist in one thing and SLB quite another. But also a cross sell agreement, opening up POS to introductions from SLB. Remember reader, SLB’s turnover is $32bn a year and it’s one of the world's leading energy technology companies. An elephant. POS is a £16m market cap flea. It bodes well for POS in its "core" specialty application markets.

The US$5.2m cash lump sum, which will be used in part to build new inventory for the Company's historical core jack up exploration rental wellhead and associated mudline hanger sales business, which is a sector POS has re-entered in co-operation with SLB (a previous non-compete around rentals has finished).

SLB's best-in-class reputation benefits POS on many levels. As well as validating the additional assurance derived from the preventive Leak-Free technology delivered by its integral "HG®" metal seal solution, POS believes the expansion of its relationship with SLB will help to grow its own special surface production wellhead potential, and a further agreement provides POS with the potential to supply SLB's valves and trees on a project basis, enabling POS to supply and maintain package solutions, thereby enhancing its capabilities to be more responsive to customer requirements.

Looking to the future, POS' focus will be on the continuing development of its POS-GRIP friction-grip method of engineering for O&G applications and beyond. POS' engineering team holds a 20-year lead in unique proprietary patented "preventative" metal-to-metal seal technologies and its associated knowhow, making POS well suited to exploit many additional applications. For example, POS retains the rights to POS-GRIP adjustable surface production wellheads, tensioned hanger systems, HP/HT metal-to-metal tie-back solutions, subsea wellheads, subsea intervention systems, hydrogen drilling equipment, geothermal wellheads, plug & abandonment ('P&A') technologies, POS-GRIP Trees, bespoke HP/HT applications, and applications yet undefined.

With two major multi-national companies, SLB and TechnipFMC, championing POS' technology by incorporating the "Friction-Grip" method of wellhead engineering in their product mix, the Board believes that exploration & production ('E&P') operators will be encouraged to embrace Plexus' POS-GRIP technology in the future whilst the Company focuses its marketing efforts on the UK Continental Shelf ('UKCS'), the European Continental Shelf ('ECS'), and in additional growth regions including the Commonwealth of Independent States ('CIS'), the Far East, the Mexican Gulf of Mexico ('GOM'), and South America.

The Financials

I was quite dubious when I heard Paul Scott speak of POS. What made me pause was the drop in price due to the $5.2m IP sale, which was said to be unjustified. My deep value radar sought the truth of this. Once I understood the non-core nature of the sale, and how actually the co-opetition and quality by association as well as direct sales opportunities from SLB I started to get excited.

When I pored over the accounts the Gross margin of 73.1% caught my eye.

The OB FY24 (June 2024) forecast for POS:

The FY24 P&L estimate: (remember reader I’m including full year costs but there’s 5 months of sales (and COS) left to go. The £4.1m sale of IP is recorded in sales but not in revenue in my model.

If I apply a pro rata revenue and COS the FY24 out turn could be £5.6m (an FY24 PE of 2.85). This assumes the admin cost can remain static which isn’t clear - obviously they are selling time and expertise. The accumulated £24.5m tax losses I’m assuming will offset any tax liability.

Moving to the balance sheet I assume the £4.1m goes to build inventory as per the RNS, that there’s around £2m of operating cash flow (based on the 7 months sales P&L model), that fixed assets amortise/depreciate by the same as FY23, and I make no adjustment for debtors, creditors or other BS factors. My forecast NAV means this is 100% backed by net assets for my purchase price. (Price/Book of 1). Half of those assets are intangible so P/tB of 2, but I’m happy that their accumulated know how is worth £8m, or £1.3m a year over the next 6 years.

Conclusion:

Learning about POS wasn’t all that complicated after all.

It’s stuff for O&G wells, both to establish them and to abandon them. Both exploration and P&A is on the rise. Stuff is just stuff. Stuff to sell and stuff to rent. But the real value is not in the stuff it’s in how to apply the stuff - the design the engineering….. the lifetime ASSURANCE. This is where POS have expertise worth something. Backed now by 2 strong international brands opens doors, and makes sales cycles faster. POS has worked with an international blue-chip customer base which includes Apache, BP, ConocoPhillips, Equinor, Petro-Canada, Shell, Repsol Sinopec, Total, Tullow Oil and Wintershall, I can see how the next 5 months - and beyond - will be exciting for POS so I am glad to be POS-itioned here!

This is not advice

Oak

Crickey! The balance sheet now looks rock solid and with those gross margins the leverage on incremental sales is phenomenal...I can see why you opened a position here. Worse case this gets taken out by a big player IMO! Excellent analysis as always OB! Tempted even to cash in my CER for this!

Nice work 👍