POW! Introducing Power Metals

Digging through the cornucopia

Power Metals or POW(!) holds an array of holdings, projects, royalties and resource investments across three continents.

Looking at its last accounts its book value is 0.69p a share and its current bid ask is 0.75p/0.8p so is paying 15% over book value worth it?

To find hidden value one must go prospecting. You could study Power Metals as an A level subject there are so many moving parts.

There are several paths to value. One path is prospecting and drilling so making actual metal discoveries and the dilineation of those.

Another is the commercialisation of those discoveries. It’s fair to say POW is a discoverer and not in the commercialisation business, currently. It describes itself as a merchant bank for miners.

Another path is the sale of assets. A number of assets rub shoulders with the claims of majors. There’s a degree of strategic logic that POW could sell holdings to a major or could JV along the lines of a farm out where they don’t need to fund the exploration.

A final path to value is to get projects listed and that holding parts of those listed companies is a path to value. Not only does an IPO listing provide capital and a focused management team (with skin in the game), it also provides transparency of value in a way that privately held assets can’t. It also gives POW an opportunity to reduce its holding, realising cash, while still keeping skin in the game. It’s also true that the average POW interview contains so many holdings that it can become too complicated to explain (good luck to me, reader!)

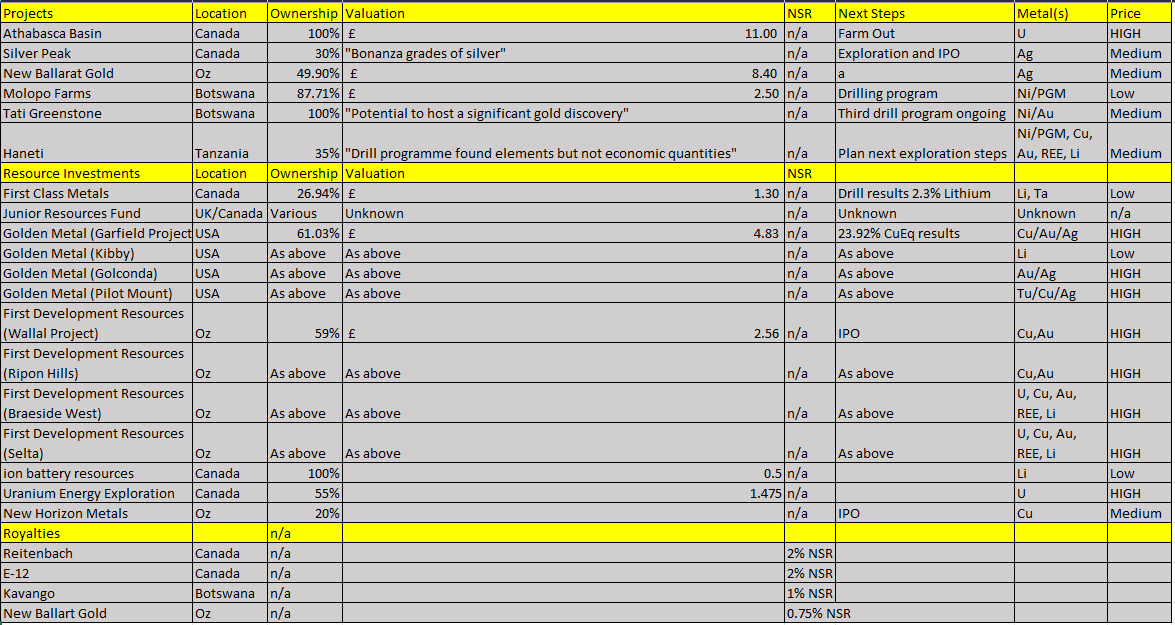

So here is the POW “estate” with valuations provided by the analysts, Resolve Research and First Equity as well as the latest presentation, interims and the annual report - I’m using this as a “Fair Value” estimate for NAV. Where there is no valuation, I’ve instead used words used by POW. In another column I’ve also listed next steps as set out by POW.

I’ve listed the metal(s) being prospected at each project and finally my assessment of the price attractiveness of the metal(s) in question. What can be seen is POW has a lot of projects which have attractively priced metals. Even the LOW price projects are going to be higher in the future. Right now, for example, Lithium is being battered by the market. That battering is opportunity. Demand for Lithium will 10X over the next 7 years and a surplus will turn to deficit.

Gold meanwhile is at around $2,100 and there’s talk of $3,000 gold in 2024. Uranium is over $91/pound - double year on year. Remember with mining resources when prices double, profits don’t double. They expand by many multiples.

Here’s a simple example: assuming an AISC $1500

Price of Gold $1600. Profit per ounce $100.

Price of Gold $3200. Profit per ounce $1,700!

(When prices fall the opposite happens and they get battered!!)

Listings

IPOs in 2022 and 2023 were incredibly difficult, in fact close to impossible. No appetite in the market and the “running for the hills” has driven continued outflows.

This graph shows money raised on AIM in the years up to 2023. Click on the graph for an excellent analysis by Ryan Long of AIM’s dreadful performance in 2023.

But the question is now whether this will reverse in 2024? I think high prices in the US (PEs of 20 average) will drive interest. It already is. Where Rick Rule has led in Autumn 2023 many others will (and are) following.

Even based on the 2 holdings POW has managed to IPO, Golden Metal (GMET) and First Class (FCM) we are seeing hidden value for POW.

In fact if you deduct POW’s last reported cash, and its GMET and FCM holdings at their current NAV/market prices, from the “forecast NAV” value you arrive at a 67% discount…… that’s based on fair value . So that’s before discoveries, JORC delineation, further IPOs and news flow from its other portfolio.

Others like FDR are boiler plate “ready to IPO” including having an investor centre section on the web site and a December 2023 presentation. Very organised!!

Conclusion

There are a number of tailwinds assisting POW in 2024. The Rick Rule influence is a positive. The price of metals is a positive.

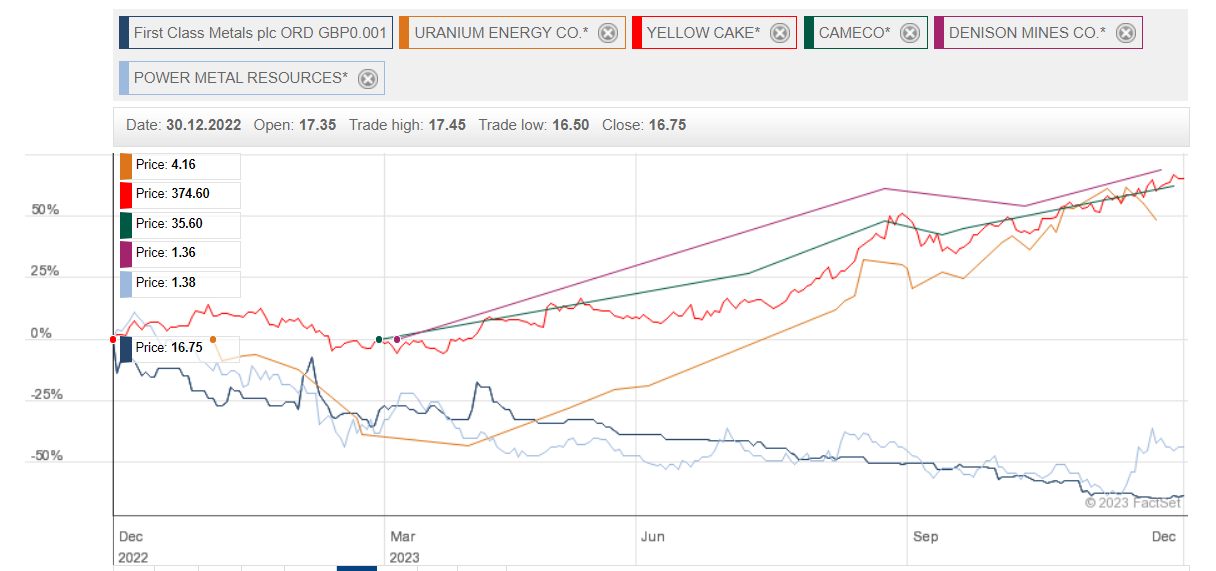

The newsflow at its key projects, especially the Athabasca basin (one third of fair value) and uranium is an enormous potential positive. Common sense tells you when I show you a 1 year comparison to POWs peers that POW is cheap.

Over 10 years POW is astonishingly cheap compared to its peers. Assuming a 400% uplift at Athabasca (which is what Resolve Research think) then that’s a £44m uplift or 2.5x today’s share price alone.

I also believe Molopo Farms could prove “prolific” too. Nearby, Sandfire discovered 60.2MT resources and Molopo is in the same Kalahari Copper Belt. Roughly 60.2MT is worth $156m if you make dig it out for $1 a pound and sell for $3.60. As 87.71% owner such a resource is £106m to POW or over 6x current market cap.

What strikes me, too, with POW is a success begets more success. More cash resources would flesh out and prove the portfolio - and even to IPO costs around £1m so to float 6-10 companies can need £10m.

I can see 2024 being very interesting for POW and I look forward to writing further articles focusing in on the value of its components.

This is not advice.

Oak

If Rick Rule likes it then there is deep value here. The portfolio is superb