Dear reader,

Have you ever watched those Marvel films where the weird black goo gets released and all of a sudden a super hero is born? I can’t speak of the status of any Super Heros (although nominations can be made for Paul Johnson, Sean Wade and Oliver Friesen), but I do know that this GSA new post didn’t merit an RNS nor any mention in the “news” page of POW’s or GSA’s web site. And it does involve some weird goo.

I was curious about the potential for GSA to become a POW super hero so investigated further.

This goo is funded by Innovate UK and is described as “game changing” in the social media post, and both government funding and “game changing” would be a good combination for Power Metals shareholders if they can deliver something:

Current Prices

Scandium $500k/tonne

Rare Earths ~$50k/tonne (depending on the REE)

Vanadium $12k/tonne

Niobium $45k/tonne

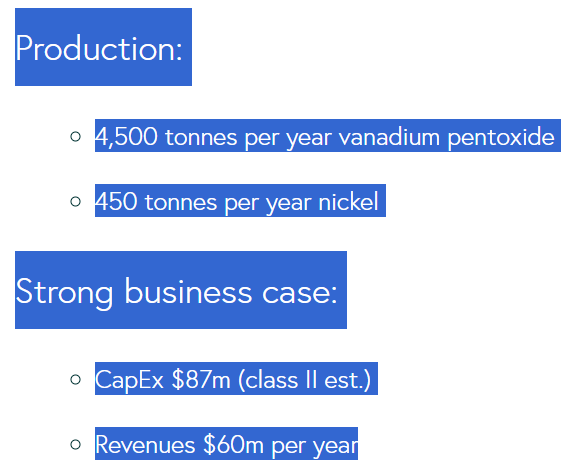

The Innovate UK grant details reveal some important clues for investors. Some of these details tie in to the “strong business case” achieved in Venezuela for a company called PDVSA. In their case study $60m annual revenues are generated from $87m capex.

The 2nd collaboration reveals extraction of Vanadium but specifically high-purity Vanadium suitable for use as an electrolyte for the growing VRFB market.

It is unclear how the 2nd collaboration ties in with the results achieved for PDVSA as we now see a $10m capex reduction described a vanadium recovery factor of >90% (worth $5m per annum per project), nickel recovery $4m, with zero apparent value for molybdenum extraction.

GSA environmental use a molecular imprinting technique that leaves cavities in the polymer matrix suitable for capturing a type of molecule. A material built to capture vanadium or nickel modules. You might say the black goo knows exactly what to do.

It came down the chimney on Christmas Eve for GSA

On Dec 24th GSAe entered into a commercial agreement with a third-party, Flyash Metal Recovery ("Flyash Metal Recovery Agreement"). As a result, the second part of the its Terms were executed, relating to £75,000 payable through the issue of 534,188 POW shares. The commercial agreement would have been over £160k in order to trigger the agreement.

I concluded the black goo X post and the Christmas Eve RNS must be connected. We don’t know the location of the contract but could it be Saudi Arabia (where they had an active conversation with a fly ash site?)

It’s all going on in the Kingdom of Saudi Arabia (the KSA)

This week was the Future Metals Forum in the KSA. GSA and POW were both in attendance. Saudi Arabia is undertaking a nationwide geophysical map of its entire country and makes this available for free to investors.

Saudi Arabia last year increased the valuation of its unexploited mineral resources from $1.3 trillion to $2.5 trillion, boosted by the discovery of rare earth elements and metals. The KSA announced new mineral investment projects valued at $100 billion, with $20 billion already in the final engineering phase or under construction.

Investment in critical minerals mining and processing must be happening “as fast and furious as possible” in Saudi Arabia, its energy minister said at the Future Minerals Forum in Riyadh.

One program the KSA operates is the EEP - the exploration enablement program. A SAR7m subsidy (£1.53m).

POW’s Balthaga project in the KSA found out this week that it has been accepted into that program!

POW’s partner AWAK in the Qatan project also has successfully won 3 bids for Jabal Al Klah North, South and Ad Dimah. Unfortunately (for POW) it doesn’t appear these bids relate to Qatan. Although I can’t be 100%. In my “POW Arabia” article I spoke of 21 other tenements so maybe, just maybe POW will announcement involvement at one of the below too?

GMET

Moving on to GMET I was sorely tempted to buy GMET but have so far resisted. Various arguments go back in forth in the chattersphere of the merits of choosing one over the other… both paths offer upside.

The positive news around Garnet samples comprising 58%, exceeded everyone’s expectations. If that sample is representative 58.3% of 12.53Mt at $220 is $1.6bn revenue, where this would not add much marginal cost and would simplify capex since tailings are less than half of mined rock.

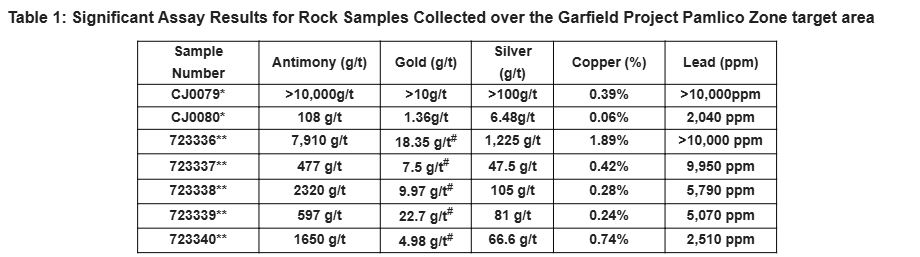

Of course the news wasn’t just about the Garnet. The antimony/gold/silver/copper/lead results are Garfield made me smile more broadly than err a Cheshire cat.

Of course the news wasn’t just about the Garnet, Antimony, Gold, Silver, Copper and lead. The site photos and terms of the Tempiute deal (assuming it goes ahead) made me smile more broadly than whatever exceeds a Cheshire cat.

Finalising the Tempiute deal is imminent. It offers incredibly good value (in my opinion):

150,000 GMET shares

$50k

$25k per 6 months until the NSR option is exercised.

1.5% NSR

$2m bonus based on an MRE of 62,000 ton contained WO3 (or higher)

There is a full brownfield operation at Tempiute complete with rusting machinery. But complete with water, power live at site. The equipment would need refurbishing or more probably replacing but what a head start! That’s all in the price for free.

Assuming a 62kt resource could be defined at $43,000 per tonne that’s $2.66bn revenue (plus silver, molybdenum, zinc and copper credits). Even at a lowly 5% net margin (including credits) that’s a $133m net profit.

Under that scenario the NSR equates to $40m + $2m bonus + $0.15m = $42.15m

If Tempiute is a vast disappointment and yields a paltry 5Kt of WO3 then the purchase cost would be $3.5m - delivering $0.22bn gross revenue

So the terms seem a very good deal to me!

POW - other

ACAM which changed to UCAM changes again to “Fermi Exploration” named after the nuclear physicist Enrico Fermi.

Work is continuing in the Athabasca and results awaited across numerous projects.

Disconnected Valuation

POW’s accounts show a gain from £14,589,000 to £ 19,772,000. Meanwhile at 13p each you can buy POW for £14.86m. (or just under £14m if you strip out cash).

POW hold 43.16% of GMET which at 31p is alone worth £16.74m! Then you have an 18.85% holding of FCM worth £0.4m plus £0.1m between RRR and AAJ.

So cash and listed holding exceed POW’s market cap by £3.3m.

Then you get GSA, Pow Arabia, and 49% of Fermi for free (plus other projects too)

Conclusion

POW’s share price remains completely anomolous.

Further validation from GSA on its mineral recovery results and capabilities as well as a first contract win is very good to see.

The FMF Conference attended by over 20,000 mining professionals and investors will no doubt have yielded results for POW - most directly for Balthaga - but is there more news to come next week?

GMET meanwhile enjoys its next trading day welcoming in a new US President and administration who are focused on MAGA. What will that mean for Guardian? Will they push the button on the 2nd Tungsten Mine - called Tempiute?

POW owns 43.16% of GMET worth £17.26m at a 31p bid price.

Fermi Uranium promises a long news flow in the months ahead too with its £10m warchest going into the ground. What could come out of the ground in 2025?

Don’t say black goo.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

The market is unhappy about something. My sense is it's the cash position. £870k at September. Are they going to have to unload some stuff at a large discount or do a equity raise?