Dear reader

A reader asked me to look at Predator (AIM: PRD). Natural Gas in Morocco. Natural Gas in Trinidad. A junior O&G. What could possibly go wrong?!

I jest because I have written about other speculative O&G holdings (Chariot and Touchstone) which thus far have had mixed success. But the jury is out on such companies. This was Friday.

And such is the world of Junior O&G (and if you didn’t know that then you shouldn’t even be investing in Junior O&G, in my opinion). Plenty of harrumphers speaking ill of PRD in the chattersphere, I see.

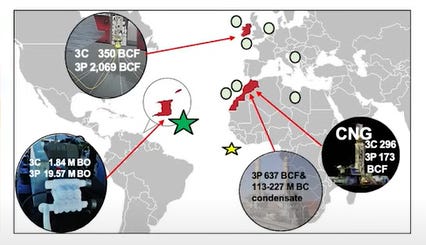

So Predator Oil & Gas has oil and gas activities in Trinidad, Morocco and Ireland.

Innis Trinity Project onshore, in SW Trinidad

Guercif Project onshore in Morocco.

Corrib South offshore Ireland

In fact some familiar faces then pop up - PRD partnered with Touchstone before acquiring the remainder of Cory Moruga by taking on £581k of debt plus taking on the future drilling commitment to the governmen. ONHYM is of course partner to Chariot in Morocco.

Fiscal

The £14.25m raised in 2023 raises an eyebrow.

In fact £5m was raised in 2022 also.

Much of this cash has gone into projects as a balance sheet intangible but is, in reality, spent.

In its 1H24 report as at June PRD says it is fully funded for 12 months on a going concern basis.

This is a very bullish presentation from PRD and well worth a watch:

Guercif - Morocco

The Fiscal terms for Morocco caught my eye (Energean and Chariot shareholders should take note) Tax is limited to a 5% royalty and 31% corporation tax after 10 years of 0% tax. Wow. With a $1m-$5m one off payment on production. Meanwhile gas sells for above average prices of $11-$12 per mcf.

The Moroccan government own 25% of Guercif through its ONHYM oil company. Morocco becoming a gas exporter (and equally not an importer) is one of its top political priorities.

The question is while there are “proven traps” the 3C means contingent and 3P means proved, probable and possible. Unless there’s a 1P value we can only really say it’s 100% possible. >$1bn as the example shows could equate to a 5% chance of success i.e. $1bn x 0.05 = $50m value x 75% ownership = $37.5m or £30m. Or 5p per PRD share.

Then consider that the Market Cap of PRD is £51.5m. 5% is my own assessment of the chance of success. I notice others including the house broker Oak Securities (no relation to the Oak Bloke) speaks to a much higher 12% chance of success and PRD speak to 50%.

On top of the Methane (which by the way is biogenic or pure) there is prospectively Helium. At an average 1.3% (which is over 6x that of its neighbour in Algeria) and assuming 30% recovery of 104.31 BCF at Helium’s current $550 per mcf, even with assumed $300 per mcf processing costs this could add a further $5.7bn upside x 75% interest is $4.3bn. Using a lower 0.5% (1 in 200) chance of success that is a risked £16.6m or 2.8p per PRD share.

Bear in mind that Charles Archer claims PRD believe their own analysis of the risk is only 50% which implies a multi bagger extraordinaire statistically speaking.

The drilling is extremely near term and the well is expected to spud in January 2025 so it just weeks away. The well is located just three kilometres from the Maghreb Europe Gas pipeline, so could be commercialised relatively quickly.

PRD also announced its other wells MOU-4 and MOU-5 will also undergo rigless testing to evaluate the presence of helium presence and PRD is conducting further reviews of the helium potential, integrating satellite spectroscopy analysis across the Guercif licence area.

Trinidad

Oil production from Cory Moruga has contingent and prospective P50 and P10 resources of 14.31 and 21.41 mmbbls.

I’ve not heard of Sandjets as a means to perforate, but the logic of their use makes a lot of sense.

At a forecast $19.61/bbl netback (Trinidad levies high taxes) and assuming a 5% chance of success here also using the lower 14.3 mmbbls number you arrive to a risked $14.3m or £11m. That’s 1.9p per PRD share. Accumulated tax losses should actually mean strong cash flow even at current $70/bbl prices.

An Independent Technical Report ("ITR") by Scorpion Geoscience Ltd. for the block and resource potential of the Snowcap Discovery determined that this tested oil reservoirs in a small new field, isolated from the Moruga field in an adjoining licence to the south and the Snowcap-1 field to the north. It also assessed the NPV10% to be US$85m.

PRD plan to use several "new technology" options for improving well deliverability, including Sandjet rigless testing, and Wax treatments, using the Jacobin-1 technical data to deliver improved well deliverability and reservoir flow assurance. Initial indications are encouraging that the proposed treatments will achieve the desired objectives. If it does further wells Snowcap-1 and Snowcap-2ST1 can then have the same treatment.

Developing the potential for net revenues from production will provide the Company with a safety net to finance overheads and for organic investment in future discretionary work programmes.

Ireland

PRD is awaiting regulatory developments to proceed with exploration near the Corrib gas field. It expects this to happen in 2025 following the Ireland general election. PRD says it has a farmin proposal already on the table.

A 2 TCF gas holding near to Corrib whose gas will be exhausted in the coming year has supplied 1 TCF over the past 10 years. There is an existing onshore processing facility and subsea pipes which could be utilised to reduce capex.

The Irish government claim a tax yield of €1.7 billion and tax is 25% implying Corris delivered €6.8 billion of gas revenue.

Development of the 2 TCF Corrib implies €17 billion of gross revenue (assuming static prices).

2 TCF equates to 40 MCF per £1 of PRD. 40 MCF at £9.78 per Mcf is £391.2 gross revenue per £1 of PRD shares.

Assuming a netback of just £0.50 per Mcf and a 1 in 1000 chance of success that equates to a risked 2p per share of PRD

Valuation

On a (harshly) risked basis 5p for Morocco gas, 2.8p for Helium, 1.9p for Trinidad Oil and 2p for Irish gas. That’s 11.7p per share.

On an unrisked basis if we consider PRD’s BOE on a 3P basis then we are talking 500 million barrels equivalent. On a 3P+3C basis 600 million barrels equivalent.

That’s equivalent on a unrisked 8p-10p per barrel equivalent of oil - assuming it is there and assuming it is commercial. Some of that Boe is Gas but is in locations where the price of gas is equal or higher to the price of oil.

I don’t need to tell you buying something for 10p that you can sell for £55 (less production costs) is a path to vast riches.

If we further consider helium, there is theoretically $19bn assuming 76.5bcf at a conservative $250 per mcf profit margin. Theoretically for each £1 of PRD shares you hold 1.5 mcf worth £288, if those calculations are true. Even applying a 1 in 1000 chance to that value you are looking at a 28.8p risked valuation. Or a 1 in 10000 chance equals 2.9p per share. What I know I know is that the chance is not zero and that I’ve independently checked the Hassi-R’Mel Helium find exists does indeed provide helium at 0.19% - the article below links to ScienceDirect where you can read about it.

I also don’t need to say that the above is only what the company knows about. There is work progressing on assessing Helium at other Guercif wells (other than MOU-3).

I have been impressed by the thoroughness of the PRD Annual Report which goes into a level of engineering detail that neither Touchstone or Chariot approach. I have also been impressed by the CEO’s bullish albeit somewhat abrasive approach. The abrasiveness is borne out of frustration as well as character and perhaps if I were in his shoes I might be just as frustrated. He has plenty of skin in the game which is good to see.

It is fascinating to check out Paul Griffiths track record. To see at Fastnet it was turned to a £15m cash shell and reverse taken over by Amryt Pharma which went on to be sold for $1.4bn in 2023. As CEO of Island Oil it was successfully sold for £14m to San Leon Energy. The Amstel field has generated many millions of barrels of oil for Holland. Bit more challenging to check out his impact at Libyan National Oil and “Gulf Oil” is now Chevron of course. What is apparent the leader of PRD is a proven do-er over >40 years and not a discredited talker in my opinion. So when he talked in bullish and aggresive terms in the above presentation I take his words at face value and seriously.

It’s true that PRD’s projects have been developed over a number of years so I can understand a shareholder from 2019 harrumphing about the “lack of progress” and dilution. This slide embodies that journey and reasons for delay.

As a non-shareholder (for now), I’ve concluded PRD to be well worth a punt. Yes it has risk, and yes it could go back to market for more cash at some point and yes there is also a chance it could be taken private (due to frustration).

But even applying some pretty harsh valuation metrics and risked chances of success this share is statistically worth more than 9p. It could easily be worth many multiples of today’s share price.

A new 2024 shareholder can enjoy the disconnected value ahead of several pieces of near term potentially transformative news.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"