PRTC-e doesn't always make perfect - Puretech the OB Laggard Idea down 32%

Puretech Review of OB 25 Ideas for 25 - Idea #14

Dear reader,

Puretech Health (ticker PRTC) is giving life to new classes of medicine. Not just theoretically - in practice. It’s already got the T-Shirt. The sale of Karuna (and its drug Cobenfy) for $14bn is one heck of a T-Shirt. More on that later.

Meanwhile what happened when tapping the parrot on the beak didn’t shut up that talking Umbrella? Surely Mary Poppins must have had a really bad day now and again? Not every day was magical smiles? Did that mean that Parrot had a worse one? Worse than what a spoonful of sugar could fix. A spoonful of superglue helps that parrot stay quiet (for ever).

Detractors might squawk about Puretech too. Share price down -32% and the laggard of my 25 for 25. Which has actually been a surprise for me. I had high hopes.

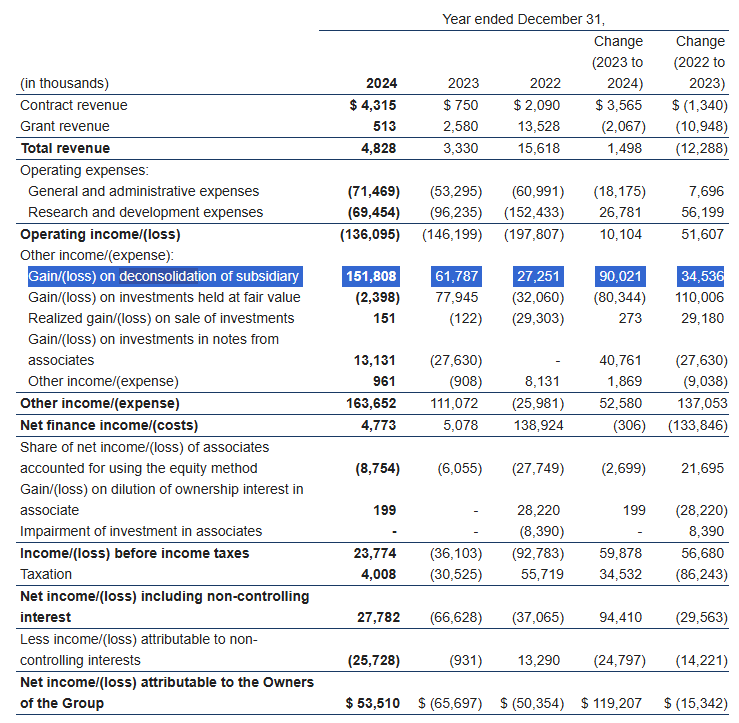

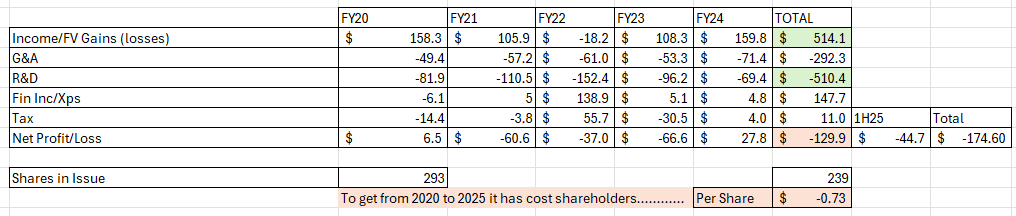

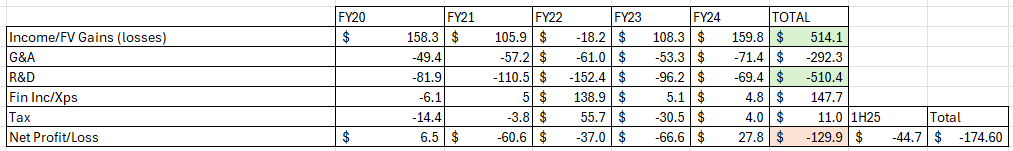

PRTC’s -$44.6m loss for the 6 months to June 2025 could be a reason for Mary’s ire. Although that’s less than a -$66m loss in 1H24, and Hmm wait a loss became a $53.5m overall gain in 2024 (i.e. 2H24 was a $119.5m net profit). Is a $119.5m 2H24 profit on a $380m market cap the sign of a loser? Annualised that period profit was a P/E of 1.6X.

Does having a laggard matter? The OB 25 for 25 is on an overall gain of 35.1% so I guess I could talk about how you break parrot eggs when making omelettes. I wonder what Parrot Eggs taste like? A colourful meal?

The question you have to think about is what if a business expenses what others capitalise? Imagine if you were accumulating Christmas cards in your warehouse ready to sell but expensed every one to your profit and loss as you printed them. Now imagine you live in Narnia and Christmas comes only once in a while.

Your profits would be terrible. At least in the short term. But when the Pevensey children arrive all those cards you sell would be pure profit. Because you’ve accounted for their cost already in previous years. Now, “best practice” is that you should usually “match” costs and revenues.

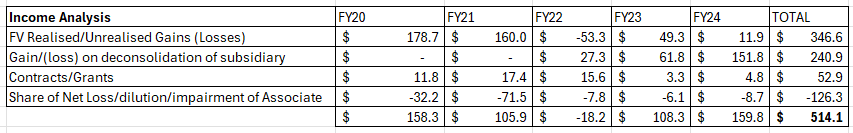

But the nature of Biotech is you spend money and one day in the future success arrives, you hope. Although once you “deconsolidate” your R&D into an entity where you own less than half you can recognise “fair value” - as is starting to happen at PRTC.

Christmas arrived with the sale of Karuna and the deconsolidation of Seaport in 2H24. Until then you expense it all and lose millions doing the equivalent of printing those Christmas Cards. PRTC have enough cash till 2028. So their “Christmas Cards” are nowhere to be seen on the balance sheet but imagine a warehouse piling up full of cards that are not on the balance sheet. The question is will Christmas arrive?

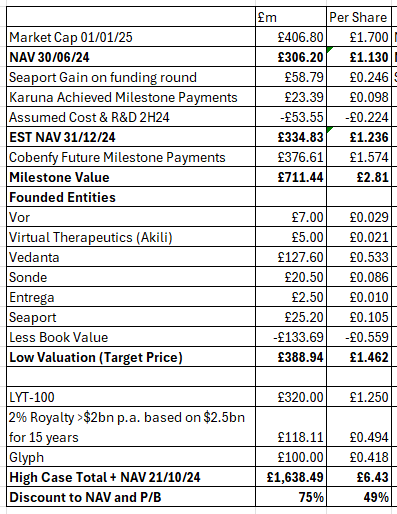

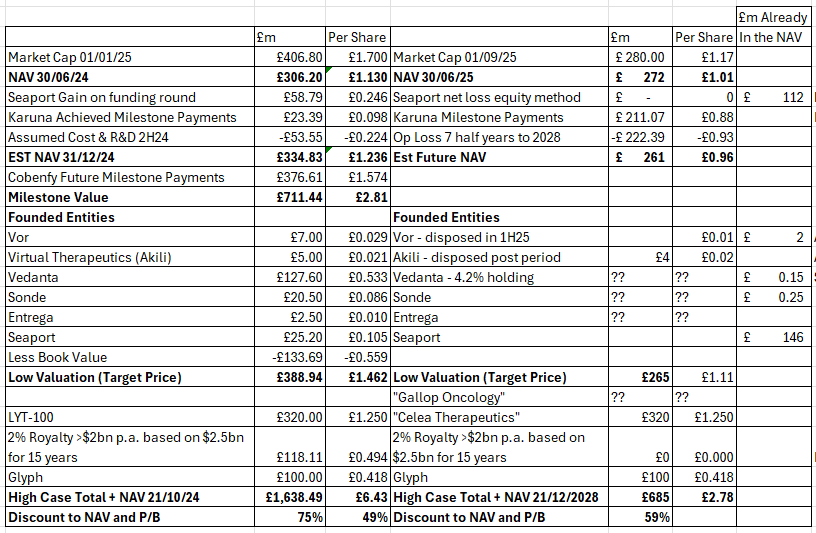

I previously made an assertion that PRTC could be worth between a low case £1.46 a share and high case £6.43 a share. So how has it not succeeded? To quote Jerry: Show me the money!

For the Founded Entities valuations I did follow broker estimates from Liberum. These weren’t my own estimates back then (since I felt I had no realistic way of valuing them and thought perhaps they did).

Brokers today have abandoned any coverage while Stocko at the start of 2025 had this on an algo score “21” and now its algos now say “47”. Their value score has leapt from “2/100” to “59/100”. Why’s that?

#1 Seaport Gain

In FY24 a $151.8m gain was obtained from deconsolidating Seaport. That’s a 63p per share gain in 2024. It is now held as an “arms length” investment rather than directly held assets. This also means PRTC doesn’t directly pay the ongoing R&D (although it could choose to participate in future funding rounds to maintain or increase its 35.1% ownership). Mainly thanks to Seaport PRTC made $53.5m net income in 2024.

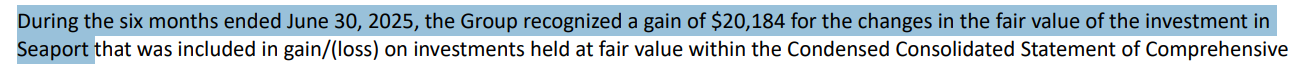

In 2025 PRTC recognised a further $20m gain. That’s a further 8p per PRTC share.

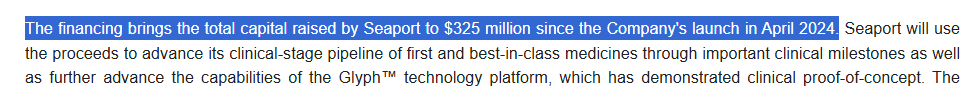

Seaport raised money last year at a $325m valuation:

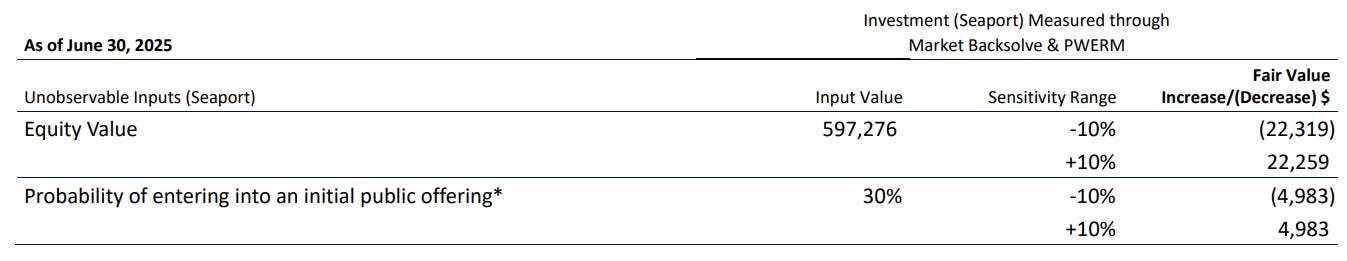

So a $597.3m 100% equity valuation shows how much progress its made in 14 months (to June 2025). Will it IPO in 2025 or beyond? A 30% chance of that according to PRTC.

Seaport is spending around -$70m per year of its money (not PRTC’s) and so Seaport has a 2028 runway also without a further funding round.

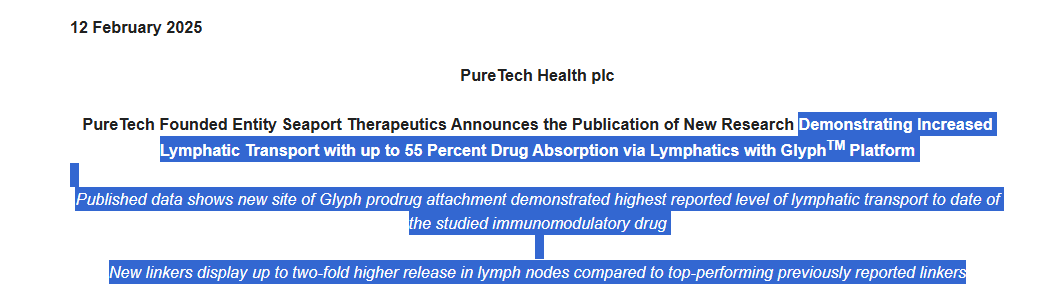

The programs in Seaport's pipeline use PRTC’s Glyph platform, which is designed to enable and enhance oral bioavailability, avoid first-pass metabolism and reduce liver enzyme elevations or hepatotoxicity and other side effects to advance clinically active drugs that were previously hindered by those limitations.

The most advanced therapeutic candidate in the pipeline is SPT-300, an oral prodrug of allopregnanolone that has now been dosed to its 1st patient in its Phase 2b study for major depressive disorder with or without anxious distress. Allopregnanolone is an endogenous neurosteroid with clinically validated rapid anti-depressant and anxiolytic activity, and SPT-300 retains this activity in an oral form.

"The development of important new neuropsychiatric medicines is often halted due to poor drug-like properties or unacceptable tolerability, challenges that our Glyph platform can now uniquely address," said Steve Paul, M.D., Founder and Board Chair at Seaport Therapeutics. "For instance, xanomeline was an effective drug that faced tolerability challenges, but once resolved, led to the FDA approval of Cobenfy™ (formerly KarXT) for schizophrenia.

Here’s the thing. If Seaport is the next Karuna/Cobenfy then can it “one day” sell for $14bn or more? If it did and if PRTC owned 35.1% still then that’s a valuation of over $4bn to PRTC isn’t it? There are lots of big IFs in that sentence and my own valuation is to keep it at fair value only. It is highly unlikely that PRTC would still own 35.1% by the time it gets to sell so $4bn is not my base case. But nor is zero - as the market appears to believe.

Seaport announced research 6 months ago where their approach of lympthatic system administation was shown to be 55% more effective than other “linkers”. Linkers are a means to transport drugs to the body without interception. Typically the liver will filter and destroy drugs you see. It also helps deal with tolerability and side effects. Seaport sneaks them past the liver by going via the lymphs. Clever. Groundbreaking? Could be.

PRTC transferred the following programmes to Seaport:

LYT-300 (oral allopregnanolone) is in development for the potential treatment of anxiety disorders and postpartum depression (PPD) where there is a need for safer and more effective treatments that work quickly, have more favorable tolerability and can be administered orally. A Phase 2a trial completed last year and achieved its primary endpoint. PureTech will be conducting additional studies into 2025.

LYT-310 (oral cannabidiol [CBD]) is in development to expand the therapeutic application of CBD across a range of epilepsies and neurological disorders. LYT-310 is designed to enable oral administration of CBD in a capsule; expand the use of CBD into a broad range of therapeutic areas and patient populations (such as adolescents and adults) where higher doses are required to achieve a therapeutic effect; potentially improve safety and reduce gastrointestinal (GI) tract side effects that are associated with the currently approved CBD-based treatment by reducing GI and liver exposure; and allow for a readily scalable, consistent product in a cost-effective manner.

PRTC would get royalties for its glyph technology even if it held 0% of Seaport.

#2 A nice tickle not in the price

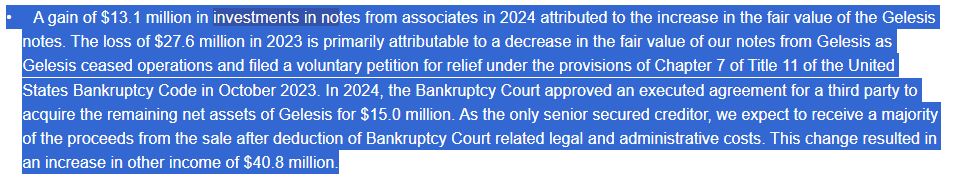

In 2024 a $13.1m gain was based on an old programme “Gelesis” which had been written off to zero. The assets of that company were sold and PRTC were the main beneficiary as Senior Creditor.

#3 Karuna Revenue Milestones

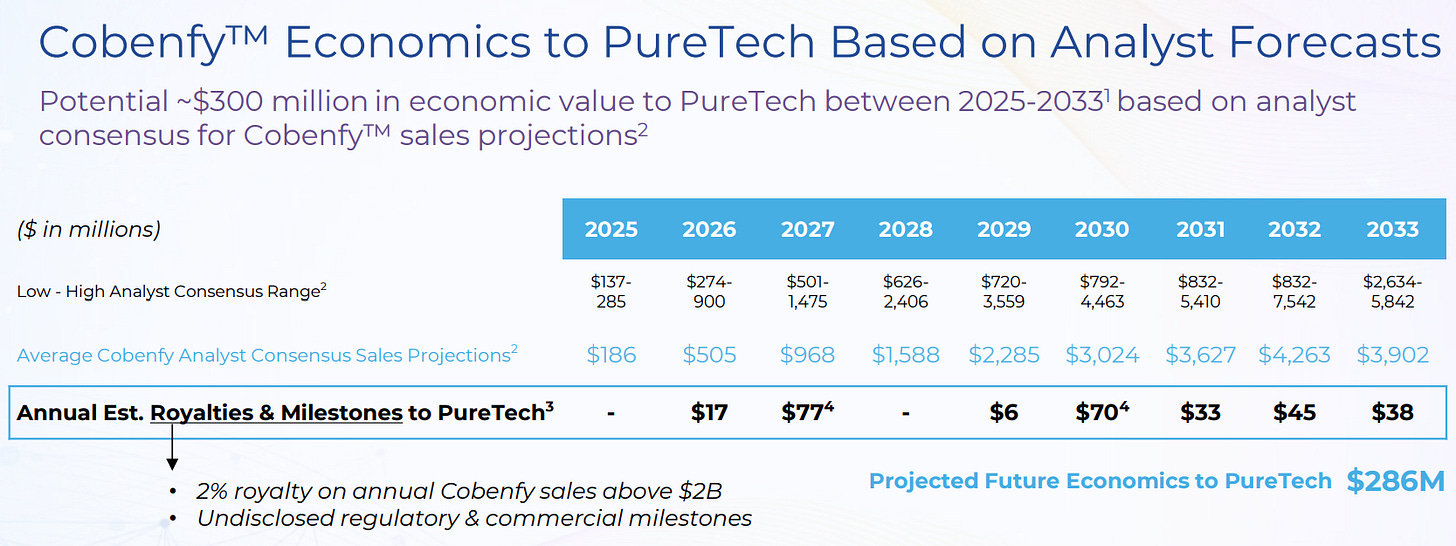

$1.9m income was recognised in 1H25, but was handed over to Royalty Pharma. Cost of Sales = -$1.9m you could say. That’s because PRTC sold some of the income in return for milestone payments (from Royalty Pharma). $1.9m was part of that.

So the £23.4m PRTC anticipated did not materialise in 1H25. However PRTC in its most recent presentation advise that based on Bristol Myers Squibb analyst forecasts/projections that the anticipated value from Karuna (now called Cobenfy) is $286m (£211m). This is over a period of years and of course are based on forecast performance at Cobenfy’s new owner. And that’s less than my prior up to £500m upside. But it’s much more than zero. That’s $1.19 per share of profit for PRTC-kers.

Cobenfy has been well received by researchers and mental health thought leaders but has admittedly been slower than anticipated to actually commercialise out in the field. Could that be due to the overwhelmed mental health practitioners who don’t have the time/bandwidth to look at new drugs or attend conferences? Where practitioners are leaving the industry due to mental health issues (ironically)? There’s evidence to suggest that that is true. Anyone heard of “The Mental Health Crisis”?

So Cobenfy could be a victim to the very problem it’s able to help solve.

Cobenfy is the latest example of how PRTC claim to have a strong clinical track record of success “outperforming the biopharma industry by 6X”.

#3 VOR

Estimated by Liberum to be worth a risked £7m, but it got sold for £2m in 1H25. In the books for zero so it’s a £2m gain in 1H25.

#4 Akili

Estimated at a risked £5m, it was disposed post period for £4m, again it was a £4m gain on a book value of zero.

#5 Other existing Founded Entities - Vedanta, Songe, Entrega

These are valued at virtually zero in the balance sheet but are continuing with their programmes - at no or little direct cost to PRTC. Vedanta had a setback with its VE303 phase 2 result which is disappointing. It has cut costs and now is focused on its Phase 3 topline data which is due in 2026. Risk valued at £127m according to the broker. Who knows.

Sonde and Entrega are early stage. Risk valued by Liberum at £23m. Who knows.

Sonde is a 35.2% holding - valued at $3.1m but Liberum had a TP of $26m - voice-driven AI platform for health monitoring.

Entrega is a 73.8% holding - TP at $3m - hydrogels for improving capsule absorption.

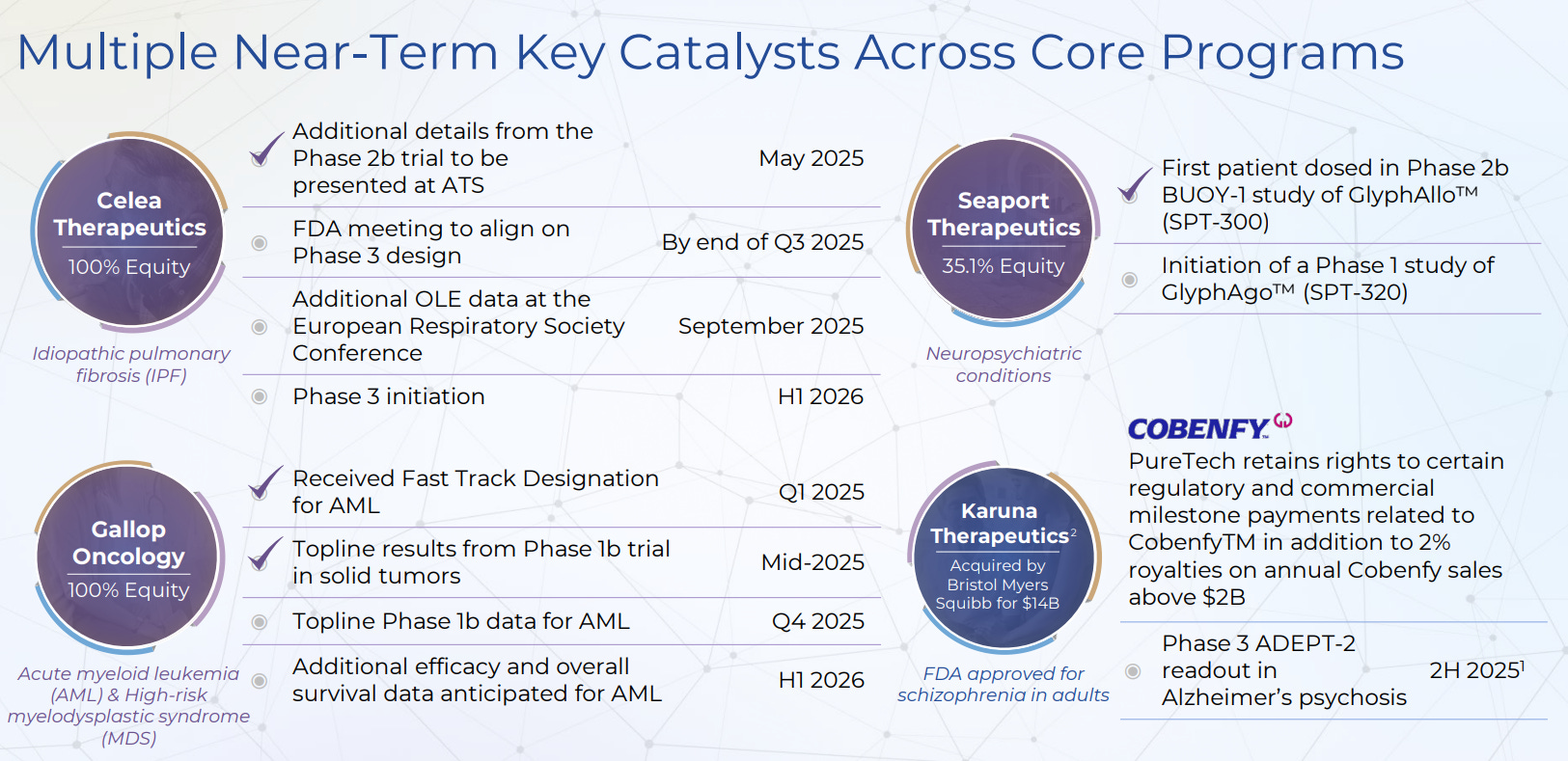

#6 New Founded Entity - Celea

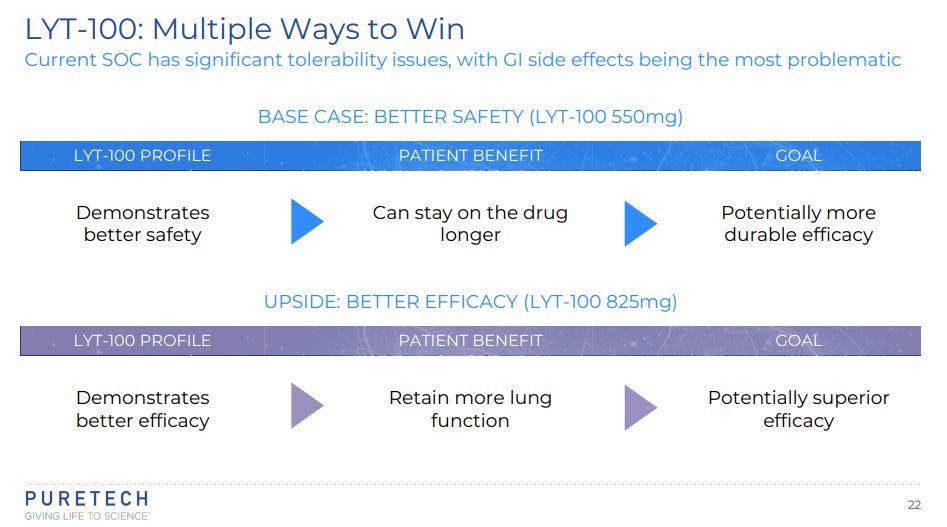

A new founded entity has been created for LYT-100. Today PRTC owns 100% and the next stage will be to raise funds. It also has a phase 3 programme in 2026.

It is my belief this is genuinely exciting.

LYT-100 (deupirfenidone) is in development for the potential treatment of conditions involving inflammation and fibrosis, including idiopathic fibrosis (IPF), for which current standards of care are associated with significant tolerability issues, resulting in approximately three out of four patients in the U.S. foregoing treatment with these otherwise efficacious medicines.[2] LYT-100 is a deuterated form of one of the two standard of care treatments, pirfenidone, which has proven efficacy and has been shown to improve survival in these patients by approximately three years, but its side effects cause patients to discontinue or dose reduce, thereby limiting its effectiveness.[3]

LYT-100 has shown a 50% reduction in gastrointestinal tolerability issues in a head-to-head study versus pirfenidone, and it can be dosed at a higher exposure level, but with a lower Cmax, than the FDA-approved dosage of pirfenidone, potentially enabling improved efficacy.

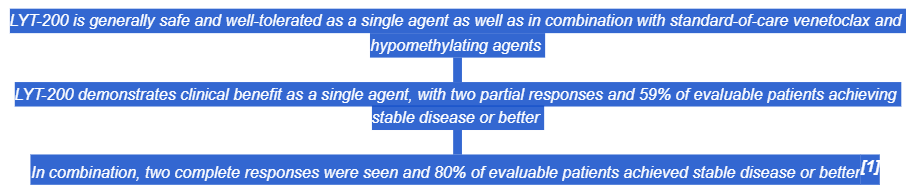

#7 New Founded Entity - Gallop

LYT-200 (anti-galectin-9 mAb) is in development for the potential treatment of metastatic solid tumors that have poor survival rates as well as hematological malignancies, such as acute myeloid leukemia (AML), where more than 50% of patients either don't respond to initial treatment or experience relapse after responding to initial treatment.[4].

PRTC announced positive results from its Phase 1b trials “generally safe” “well-tolerated” with “59% of evaluable patients achieving stable disease of better”, or in combination “80% or better". Wow! But it is early evidence, with just 18 patients. Next steps is to discuss a pivotal trial design with the FDA - the Phase 2.

About Deconsolidation and Hidden Value

Until they become “deconsolidated” i.e. until PRTC own less than 50% then 100% of the costs of R&D and expenses are 100% expensed to PRTC’s P&L and so a superficial analysis of P/E and P/FCF doesn’t show - that there is hidden value.

Deconsolidating Seaport unlocked a >$150m gain. What gain awaits Gallop and Celea?

The question is always what’s it worth? Go on Jerry, say it: Show me the money.

The value is hidden in the sense that there is no “asset” recorded in the balance sheet and therefore in the NAV but arguably much of the P&L should actually be capitalised and then expensed if the the pharmaceutical fails to meet its goals. Unfortunately IAS38 prevents this. 2021-1H25 just under $0.5bn of R&D has been expensed! Effectively written off as worthless!

While it’s not fair to think 100% of that expense is an asset, if it were, then PureTech achieved profits of $64m a year, for each full year since 2021, on average. (£50m)

Or put another way that’s a P/E of 8 based on an average profit over three years, and at today’s market cap, it’s cheaper than GSK and Hikma which are at a 9.3 and 11.7 P/E respectively.

Profits are lumpy. Blockbusters take time. PRTC made a net profit in 2019 nearly equal to today’s market cap and made losses since. The question you must ask is can 2025 still deliver a Blockbuster?

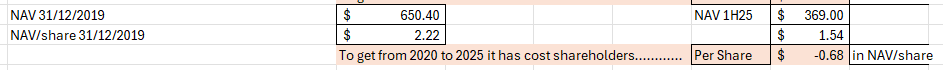

P/B - Price to Book. The latest 1H25 interim accounts show net assets of £2726m and this is currently a market cap of £298m. Paying 1.1X for Pharmaceuticals would typically be incredibly cheap. Hikma is 2.51X and GSK is 4.52X by comparison. Of course comparatively PRTC’s P/FCF is negative, and earnings too in the last four years, and such is the nature of drug development.

Net assets of which Cash and cash equivalent is £236m (at 30/06/25) down from £242.9m cash 12 months ago (as at 30/06/24). So with today’s market cap of £280m stripping out cash you are paying a net £44m for what exactly?

#8 Glyph

A final area of hidden value is that PureTech have a proprietary platform called Glyph which bypasses the liver and uses the lympthatic system to absorb drugs. This can improve bioavailability therefore effectiveness. A number of its drug candidates use Glyph as its delivery method.

£44m for buying PRTC at today’s market cap NET OF ITS CASH can buy Jerry what?

A historical strong clinical trial success rate

Cobenfy is a commercialised asset where the current outlook is £211m over 8 years but the potential is £500m+ including royalties. What if the analysts have got it wrong?

Seaport has delivered profits through deconsolidation and now via an increase in fair value. More to come? An IPO?

Active programmes and funding rounds for Gallop (100% owned) and Celea (100%) and Vedanta (4.2% owned)

Who knows for: Sonde and Entrega.

The value of Glyph - of sidestepping the liver and to go via the Lymph Nodes. It makes treatment more effective since it could increase pharmaceutic effect of many drugs. What’s that worth?

Show me that NAV today vs your prior article

I’ve added to the right today’s assessment. “In the NAV” is part of that NAV of £272m you see at the top (as at 30/06/25). What I’ve tried to do is show the movements that are now part of that £272m. But also how some elements are in the NAV for virtually zero.

The only elements of Liberum’s risked valuations I’ve left in is Celea which is called LYT-100 over to the left (£320m), and the Glyph technology (£100m). These are only factored in to my “High Case” valuation too. Once there is a funding round there will be a consolidation and we will know the truth of this number. Same for Gallop, too.

Liberum’s risked valuation was £5m for Akili, and post period it went for £4m. Vor was estimated at £7m and it was disposed for £2m. So there are clearly a range of potential outcomes - but the estimates were roughly right.

Notice I’ve included my estimate of total PRTC R&D and total Overhead costs for 3.5 years (to the end of 2028) in my low valuation. That’s the -£222.39m. That’s my timescale on which I’m prepared to back PRTC.

Notice too I’m including the Karuna/Cobenfy at £211m even though that income stretches further ahead than 2028. My thinking being that the value will remain a valuation consideration at the end of 2028 so I feel this is fair.

My low side is that failure equals a 4p a share loss to a NAV of 111p (assuming the share price and NAV are equal)

UPSIDE

Even if all programmes except Celea and Glyph are deemed worthless (i.e. so this is a very pessimistic upside!) and there’s no Cobenfy upside then we can see PRTC has a >100% upside of £2.78 a share.

PRTC see their shots on goal as being these:

Time Machine to 2020 - judge PRTC by 5 years performance:

If you travelled to 01/01/2020 what would you see in PRTC’s world? Many aspects would be familiar. Go and read the 2019 Annual Report. Karuna has just achieved its Phase 2 primary endpoint showing statistically siginificant and clinically meaningful results. There has just been an IPO for Karuna in NY and PRTC holds 20.3% of stock. Celea is pre-clinical, Gallop is pre-clinical, Seaport and SPT-300 and SPT-320 haven’t even been thought about.

Entities that are today sold or failed and are gone like Gelesis back then have got FDA clearance and $100m of funding. Things looks bright for Akili, Follica, Alivia. Now all sold and gone.

Other names are there Sonde, Vor, Entrega, and have not progressed much in 5 years.

So consider this is the net progress made in 5 years vs 31/12/2019:

Vedanta was at Phase 1 owned 61.8% → is now at Phase 3 topline data in 2026 PRTC own 4.2%

Karuna was working on Phase 2 → now Sold and delivered $1.1bn gross returns and now is worth $0.22bn is future royalty revenue estimated. No ownership today.

Celea Preclinical → Phase 3 initiation 100% owned still.

Gallop Preclinical → Phase 1b underway 100% owned still.

Seaport Nothing → Phase 2b underway and 35.1% owned.

It has cost shareholders $0.73 per share in that time given that there is a -$174.6m net loss over 4.5 years to 1H25.

But consider the NAV too. That’s a -$0.68 loss. I think the $0.05 difference is accretion of NAV due to the buybacks they did when they used $100m of the proceeds from the sales of Karuna/Cobenfy to do a tender offer.

During FY20 → FY24 PRTC generated over half a billion dollars of gains net of FV losses, impairments and dilutions…..

If you considered the “Christmas Card” analogy again how much of the below -$510.4m R&D is an intangible asset not on the balance sheet? A hidden asset. Go back to the 5 active programmes. You’re getting a share in:

Two phase 3s programmes (Celea & Vedanta)

One phase 2 programmes (Seaport)

One phase 1b programmes (Gallop)

A sale of Karuna that reduced shares in issue by 20%, and where there’s £211m (88p or $1.19 per share) of estimated future returns still to come from Cobenfy.

If £211m is “all there is” for Cobenfy. The milestones are $5bn, and the 2% royalty above $2bn annual sales based on stock analysts of Bristol Myers Squibb. Meanwhile the medical need is far higher and that translates to estimates above >£500m so the current estimates of £211m are extremely modest.

So 6 programmes for $0.68 per share with a $1.19 (or more) income…. think about that.

How does any of that progress explain why you can buy PRTC at -60% less than you could at 31/12/2019?

At today’s £280m market cap that’s a -£420m reduction in price from 31/12/19. Is that not mispriced?

Is it explained by a cliff edge of no cash? Nope. Runway until 2028 PRTC tell us. Any funding round for Celea and/or Gallop and that date extends into the 2030s albeit at some dilution on the current 100% holdings - but that’s part of how these risks get spread.

Conclusion

This is a complicated story. Well done if you’ve followed my article. It’s just as hard to read and understand as it is to write it!

Coming back to my Christmas Card analogy you’ve got to feel happy on the value of those cards stacking up in your imaginary warehouse. The bit I come back to in my own head is we see those cards selling at times: The Cobenfy deal is roughly equivalent to winning a 10 year Walmart Christmas cards agreement.

In 2025 Seaport is like having a website called “FunkyPigeon”. High hopes. Hopefully the Pigeon learned a lesson from that Parrot.

If this WERE a Christmas Cards business then it probably wouldn’t be on sale at £1.15 a share. Not with a “Walmart-esque deal” under its belt last year, and a couple of “Funky Pigeon” potential deals in its coop today!

It definitely is a DYOR idea and I hate using that cliche but it’s true. It’s also an idea that could require patience. Will it prove a OB25 for 25 winner? i.e. will the share re-rate in 4 months? Possibly not. Four months is not a long time. Not in the sloooooooow world of biotech. Personally, I’m giving it a 3 year window and I remain excited about what it can achieve by 2028. Could newsflow turn this around? The Seaport IPO, stronger news on Cobenfy (Brtistol Myers report quarterly), a funding upround of Celea and/or Gallop could all do that.

The final word of PRTC would go to Mary Poppin’s parrot but I’m told Mary Poppin’s Parrot is going to stick to its vow of silence like glue.

Regards

The Oak Bloke

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Hmm, apart from on 9 April 2025 where this went down to 103p, this one is at its 5 year low.

Hard to see how it goes much lower, though I suppose we should never say that!

Half year report was 28 August. Like you say, this is probably unlikely to be a fast burner.

I heard a podcast last weekend with the manager of the Orbis Balanced fund, Alec Cutler, who said they were buying Biotech. He said they would construct a narrative later (!) but that they were buying because the sector is just so bombed out compared with a couple of years ago and looked compelling. He was having a bit of a dig at the chap from Baillie Gifford's Scottish Mortgage who was also on the panel.

The chart of Biotech Growth Trust (BIOG) is forming a very marked bowl, as is RTW Biotech Opportunities (RTW) and International Biotechnology Trust (IBT). All these are on my watchlist but I hadn't noticed till I read your article just what a recovery they were making.

No such bowl for PRTC. Yet.

Interestingly, while researching the institutional ownership of Puretech Health, I discovered that RTW Investment Management LP (the same firm that manages RTW Biotech Opportunities Trust) is actually one of the largest institutional shareholders of Puretech Health directly. According to recent data, RTW Investment Management LP holds approximately 3,892,733 shares of Puretech Health.